The Tobacco Revolution Is Happening

Plant Biotech Disruptor, 22nd Century Group, Inc. (NASDAQ: XXII), Is Shocking the Tobacco Market with the Newest FDA Approval

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

Biotech Stocks Have Seen Explosive Growth Recently

When one thinks of explosive biotech stocks, they usually think of medical breakthroughs, and for a good reason. We’ve seen unknown biotech stocks like Moderna and BioNTech morph from overnight experiments into giants in recent history.

With more and more people paying attention to a multitude of health treatments for countless conditions, many investors have seen biotech stock shares skyrocket year-to-date in 2021 as of Oct 19, 2021:(2)

- KemPharm, Inc. 1,190.28%

- Novan, Inc. 902.46%

- Cassava Sciences, Inc. 787.39%

- Onconova Therapeutics, Inc. 685.74%

- Acorda Therapeutics, Inc. 572.37%

What if I told you, though, that a little-known biotech company is itching to potentially break out in a way you wouldn’t typically think- with breakthrough plant sciences.

Now before you tilt your head sideways in skepticism, let me break it down for you. Not only does this company have the explosive breakout potential of biotech upstarts. It’s disruptively positioned itself in potentially $1.3 trillion worth of addressable markets with some of the world’s hottest in-demand industries craving innovation.(1)

That company would be 22nd Century Group, Inc. (NASDAQ: XXII).

How 22nd Century Group Is Transforming Billion Dollar Industries

22nd Century Group, Inc. (NASDAQ: XXII) leads the world with cutting-edge agricultural biotechnology and intellectual property. It is leveraging modern plant breeding, gene-editing, and molecular breeding technologies. It has created new, proprietary tobacco, hemp/cannabis, and hop plants with optimized alkaloid and flavonoid profiles. Moreover, it has improved yields and valuable agronomic traits for customers in the life science and consumer products industries.

In layman’s terms, it’s like this.

It could turn a potential $817 billion global tobacco industry upside down with a proprietary product containing approximately 95% fewer toxins than conventional cigarettes.

It could transform a potential $100 billion hemp and cannabis space by disrupting every segment of the green leaf value chain by using its technology to help commercial-scale growers to improve crop yield, stability, and expression of key traits in high-volume production.

Even a potential $500 billion hops industry could be disrupted by 22nd Century Group, Inc. (NASDAQ: XXII). The company is leveraging its experience with tobacco and hemp/cannabis to accelerate the development of proprietary specialty hop varieties or valuable traits. After all, those plants are close relative to hops.

Judging by what confident analysts have said and the stock’s 790% run from earlier in the year before uplisting to the Nasdaq, watch out.

This is a company to keep your eyes on ASAP as it aims to become the latest biotech break-out candidate.

Upending an Estimated $817 Billion Global Tobacco Industry

22nd Century Group, Inc. (NASDAQ: XXII) is a revolutionary biotech disruptor with a historic chance to truly upend a global tobacco industry that has been a lucrative juggernaut for generations

As of 2018, the global tobacco market was worth approximately $817B, with cigarettes consisting of roughly $714B of this market- or about 90%.

This industry, though, is undergoing some shape-shifting changes, and XXII is right at the forefront.

Reports in the media claim that the government is actively considering moving forward with the Advance Notice of Proposed Rulemaking (ANPRM). Under this regulation, Big Tobacco firms will be required to reduce the number of toxins in all combustible cigarettes sold in the United States to be “minimally or non-addictive.”

Fortunately, long before the ANPRM proposal was even a thing, 22nd Century had the foresight to think outside the box and realize how lucrative and underserved a market for non-addictive smokes was. It wasn’t just the government demanding “something new.” It was the people.

Of the approximately 1 billion adult smokers in the world today, and roughly 34M U.S. adult smokers, about two-thirds, want to quit, with less than an estimated 10% successfully doing so.

That’s why the company developed its proprietary VLN product- a unique and roughly 95% reduced toxin combustible smoke alternative. All while having a familiar combustible product format that replicates the conventional cigarette experience, including the sensory and experiential elements of taste, scent, smell, and “hand-to-mouth” behavior.

The best part? VLN contains 0.5 mg of nicotine per gram of tobacco, an amount cited by FDA, based on clinical studies, to be “minimally or non-addictive.”

Benefits from VLN can potentially include:

- Reduced nicotine exposure and dependence

- Smoking fewer cigarettes per day

- Experiencing reduced withdrawal symptoms

- Minimal or no compensatory smoking

- Increased number of smoke-free days

- No increase in adverse effects in persons with mental health disorders

There’s been blue-sky potential for some time with VLN. But now, with demand reaching a fever pitch, government regulations promoting its potential growth, and even more subsequent tailwinds, we could be at the start of a tobacco revolution of biblical proportions.

Funding, clinical efficacy, and more

With nearly $100M in funding, mainly from U.S. government agencies, since 2011, 22nd Century’s reduced nicotine content cigarettes have been used in more than 50 independent scientific clinical studies conducted by universities and institutions.

Back in 2019, an FDA PMTA press release stated, “Authorizing these reduced nicotine products for sale in the U.S. is appropriate for the protection of public health.”

The future is now, and significant moves are being made in the U.S. and overseas to fully commercialize.

The company already has FDA authorization to sell VLN in America. However, VLN could soon become the first and only combustible tobacco product with FDA MRTP authorization. This would permit it to carry a headline claim of “95% less nicotine” on VLN’s packaging.

The second XXII receives MRTP authorization, they could be launch-ready for commercial sales within 90 days. Already, the company has identified both initial pilot and subsequent markets for launch. It is also in advanced discussions with multiple trade and retail partners. It is advancing marketing materials and other vital aspects of the launch.

The company keeps on making moves and preparing for what could be imminent approval. In May 2021, for example, 22nd Century Group announced the installation of state-of-the-art nicotine testing equipment to enhance VLN production. Investment in these new lab capabilities is expected to reduce testing costs by 90% and improve turnaround time from weeks to hours.

Beyond this, as potential regulations and crackdowns start, 22nd Century has a massive opportunity to license its reduced toxin technology to “Big Tobacco” firms such as Philip Morris.

After all, Philip Morris just announced an earnings beat on Oct 19, 2021, thanks to its smokeless non-tobacco product sales. In fact, Philip Morris said that cigarette and heated tobacco unit shipment volume reflected a 0.4% drop in shipment volumes. In comparison, non-heated shipment volume was up by 23.8%, driven mainly by the company’s smokeless IQOS product.

Beyond this, 22nd Century Group is also fully prepared to expand internationally and initiate the launch process of VLN countries with lower regulatory hurdles. It is entirely focused on multiple markets with premium tobacco products and proven distribution partners. It targets international market sales to begin in Q1 ‘22, fully funded by proceeds from the June 2021 capital raise.

Right off the bat, the company may have an easy opportunity to support New Zealand in becoming a smoke-free nation by 2025. The New Zealand Medical Journal years ago already published a letter recommending 22nd Century’s products as an “important smoking reduction tool.”

So with all of these potential catalysts from multiple angles, 22nd Century Group, Inc. (NASDAQ: XXII) is preparing to be the face of this possibly very lucrative revolution.

Should it be a shock to anyone that, based on the company’s latest earnings report, first sales are planned by Q1 2022?

Even without a full VLN commercial launch, the company saw record second quarter and H1 sales. James A. Mish, chief executive officer of 22nd Century Group said, “Our record second quarter and first half net sales were a result of the investments to scale-up our tobacco contract manufacturing capabilities and confirms our ability to generate new business and operate at scale ahead of VLN launches in the U.S. and internationally.”

In Thick Of The Potential $100 Billion “Green Rush”

Don’t think for a second that 22nd Century Group, Inc. (NASDAQ: XXII) is limiting itself to a smokeless tobacco revolution. It’s also positioning itself right in the thick of a potential $100 Billion+ “Green Rush.”

You’re already probably well aware of how the hemp/cannabis space has seen unprecedented momentum over the last few years. Canada was the first domino to fall when it became the first G20 country in the world to fully legalize it almost exactly three years ago.

In the U.S., 36 states & D.C. have now legalized medical cannabis use, while 18 states & D.C. have approved recreational use.

Now that New York has fully legalized green leaf, this could be the start of imminent full federal legalization. California legalized adult use in 2016, and Illinois legalized adult use in 2019. This means that three of the five most populous U.S. states have now fully legalized green leaf!

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

In Thick Of The Potential $100 Billion “Green Rush”

On top of the various potential health benefits of green leaf and the multitude of consumer products now available, this appears to be one of the only topics of conversation with widespread American support.

For instance, have Montana legalized green leaf at about the same time New York did. Had they ever agreed on anything politically before? South Dakota, another deep red state, is in the process of exploring scrapping its medical green leaf program for outright legalization.

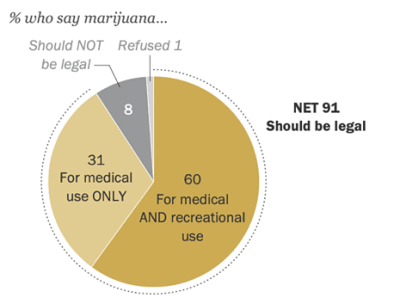

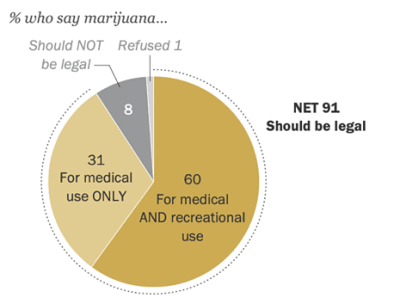

Results from an April 5-11, 2021 survey by Pew Research Center shouldn’t come as a shock then. According to Pew, “An overwhelming share of U.S. adults (91%) say either that MJ should be legal for medical and recreational use (60%) or that it should be legal for medical use only (31%). Fewer than one-in-ten (8%) say MJ should not be legal for use by adults.”

The green era has arrived, the game has changed, and 22nd Century is leveraging its plant science expertise to revolutionize it.

First and foremost, 22nd Century Group may have a solution to a severe industry problem- existing plant genetics result in low quality and unreliable yield for large-scale commercial production.

The company can potentially create disruptive, proprietary plant lines showing stability and higher crop yields for commercial use. How? Thanks to decades of experience and expertise in plant biotechnology and genetic engineering, a strong track record in developing disruptive valuable plant lines, and the ability to increase crops’ value by improving genetics to optimize desired traits.

22nd Century plans to accomplish the following:

- Plant lines with optimized genetics for commercial farming methodologies.

- Option to grow at scale indoors and outdoors Improved disease and pest resistance.

- The ability to control the expression of CBD, THC, CBG, CBN, terpenes, and other cannabinoids is critical to financial returns and quality metrics.

Because this market is growing so explosively, monetizing key plant lines is a significant priority for the company. 22nd Century has established a leadership position in genetic IP critical to hemp/cannabis achieving its full commercial potential. Moving to monetization in 2H ‘21 is looking more and more realistic because of:

- Off-take commitments for first high CBD and high CBG optimized plant lines growing now in Colorado.

- IP revenue from both proprietary and Anandia technologies.

- Readying multiple next-generation plant lines and IP to expand plant lines available in 2022 and 2023.

- Pipeline and line of sight to global monetization across medical, recreational, and consumer product applications.

Judging by the company’s expertise, transforming the entire industry could happen sooner than anyone thinks.

Hops Have $500 Billion Potential and 22nd Century Group, Inc. (NASDAQ:XXII) Is Bringing Transformative Global Value

On Aug. 30, 2021, 22nd Century Group, Inc. (Nasdaq: XXII) announced its formal entry into the global specialty hops market, its third and newest plant franchise.

The global hops industry could be a $500 billion opportunity. This is a sizable global growth market with well-established hops providers and consumer brands. 95% percent of global hop flowers are used in the brewery industry.

The remainder is a small but rapidly growing segment for active ingredients used in the flavor and fragrance, dietary supplement, and pharmaceutical markets.

What’s really causing rising demand for hops is the surge in the popularity of microbrew and craft beers. There’s also major demand for yield optimization to reduce brewers’ input costs, increase active ingredients for dietary supplements/pharmaceutical companies, and to improve disease and pest resistance.

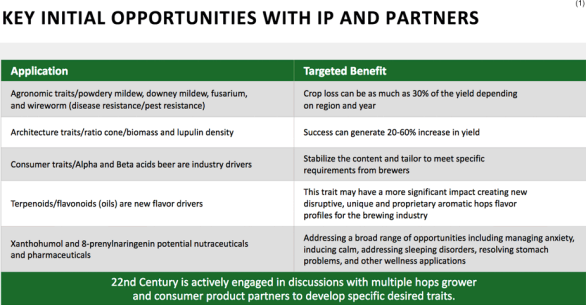

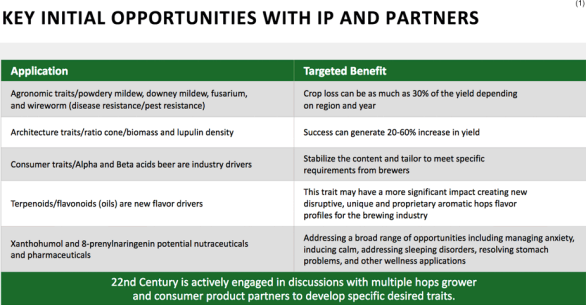

So here’s where 22nd Century is coming into play. It intends to leverage its experience with tobacco and hemp/cannabis. After all, hops are a close relative. By doing this, the company aims to accelerate the development of proprietary specialty hop varieties or valuable traits.

Leveraging research findings from closely related hemp/cannabis plants supports the development of specialty hop varieties with:

- Distinctive aroma, flavor, nutraceutical, and medicinal properties.

- Enhanced yield, disease resistance, and other advantageous agronomic traits.

The hops market is ripe for disruptive new plant technologies, especially new accelerated molecular breeding technologies and gene-editing tools that only 22nd Century can potentially provide. Hops also has lower regulatory barriers than the tobacco and hemp/cannabis markets.

Therefore, this is what the company intends to do about it:

- Introduce new technologies based on molecular breeding, flowering time, and double haploid to accelerate stabilization or creation of new lines.

- Introduce new agronomic traits to improve disease/pest resistance and plant architecture. This could increase crop yields in leading hop strains that are already well-accepted by the brewing industry.

- Increase hops content of hops active molecules that drive the beer industry, such as alpha and beta acids. Additional new compounds like terpenoids and flavonoids not generally associated with hops may also produce new, disruptive, unique, and proprietary aromatic hop flavor profiles.

- Increase hops content of active molecules with health and wellness applications as extracts/distillates in functional foods and beverages, nutraceuticals, and pharmaceuticals (xanthohumol and 8-prenylnaringenin).

Because many of the critical hops market participants are located in Europe, 22nd Century is targeting many commercial partnerships in that continent. A new subsidiary in the Netherlands, 22nd Century Group Europe B.V., was established to open new revenue opportunities in hops. At the same time, it’s still serving its tobacco and hemp/cannabis plant franchises and reinforcing its presence through an expanded global footprint.

In addition to this new subsidiary, 22nd Century is actively engaged in discussions with multiple hops growers and consumer product partners to develop specific desired traits and strategic partnerships.

Strategic partnerships could enable 22nd Century to deliver valuable, commercial-scale plant lines and IP in way less time than the traditional 10+ years in the Hops industry. It could very well transform a booming hops industry by accelerating the commercialization of new disruptive hops plants.

By applying its 5-step technique identifying the Plant Profile/Roadmap, Plant Biotechnology, Plant Breeding & Trials, Plant Cultivation, and Ingredient Extraction & Purification, 22nd Century’s innovative upstream alkaloid plant value chain is critical to unlocking new disruptive hop plant lines and IP at large-scale.

The Company’s Financials Demonstrate Stability, Strength, and Growth

The upside potential for this company is extremely atypical. It has disruptive exposure to three multi-hundred billion dollar sectors that in total give the company a potentially addressable market of $1.3 trillion.

Its latest Q2 earnings highlights show eye-popping stability, strength, and growth to accomplish its mission.

All signs indicate the potential for financial strength and an efficient operating structure with a strong balance sheet supporting current operations and strategy. The company saw an astounding +30% increase in YOY net sales and a +390 basis points increase in YOY gross profit margin. The company also has a dramatically improving cash situation, with cash and cash equivalents also skyrocketing from $22.3M to $62.3M YOY.

Earlier, we mentioned that even without a full VLN launch, the company saw record second quarter and H1 sales.(15) That’s because 22nd Century Group currently generates revenue from tobacco contract manufacturing operations (CMO), self-funding the cost of facilities needed to manufacture research cigarettes and its reduced nicotine tobacco products ahead of U.S. and global launch.

Beyond this, the company has other powerful-looking fundamentals. The company’s Altman Z-Score of roughly 26.8 as of Oct 19, 2021, looks potentially outstanding. Why? The Altman Z-Score is usually a solid gauge for illustrating financial health and bankruptcy risk. A company ideally wants a score of around 3.0 or higher and no lower than roughly 1.8. The fact that 22nd Century Group has a score almost 9x more elevated than the ideal figure speaks volumes.

Furthermore, 22nd Century Group could be under-leveraged and more than capable of meeting its short-term obligations. Its current ratio of approximately 7.7x and quick ratio of around 7.0x as of Oct 19, 2021, reflect its strong cash position. It also shows that the company has more cash than debt on its balance sheet and could indicate that 22nd Century has over 7 times more current assets than current liabilities.

Not to mention, the company shows impressive growth potential. Its 5-year revenue CAGR forecast could be around 27%, while its net income growth forecast is expected to be approximately 8.5%.

Is it any wonder why the company uplisted to the NASDAQ back in August with numbers like this?

Analysts like Dawson James Securities appear to be wildly bullish on the company. On Aug 6, 2021, Dawson James gave the company a $7 price target based on better-than-expected Q2 revenue and multiple catalysts, including the FDA’s approval of the company’s MRTP application, along with “monetization of the legacy Anandia IP, revenue from the Colorado farm crop, and VLN launches in international markets.” Dawson James also expects additional license revenues, proceeds from additional crop harvests, and a low-nicotine mandate in the coming quarters.

After 22nd Century announced its foray into Hops, Dawson James doubled down on its $7 target on Aug 31, 2021. The firm said that the company is six months into its expected two-year development cycle and believes upfront license fees can begin in 12 to 18 months. It also added that the addition of Hops as another revenue source gives the company a major positive potential catalyst in a market with less regulation than tobacco. Most importantly, the company could have significant potential upside with less dependency on favorable regulatory rulings.

Do the math. That would give the company a tremendous 142.21% potential upside from its Oct 18, 2021 closing price of $2.89.

Does its pullback still seem like something to worry about? Or something to take advantage of?

Sources

Source 1: https://d1io3yog0oux5.cloudfront.net/xxiicentury/files/pages/xxiicentury/db/328/description/XXII_Investor_Overview_Website_100621.pdf

Source 2: https://fknol.com/list/best-performing/biotech-stocks.php

Source 3: https://finance.yahoo.com/news/22nd-century-fully-prepared-deliver-200000882.html

Source 4: https://bit.ly/3jfwV3g

Source 5: https://www.thestreet.com/investing/earnings/philip-morris-ekes-out-third-quarter-earnings-beat

Source 6: https://finance.yahoo.com/news/22nd-century-stands-fully-prepared-215600267.html

Source 7: https://bit.ly/3voRHSC

Source 8: https://nyti.ms/3poMuZY

Source 9: https://bit.ly/3urd1Wb

Source 10: https://bit.ly/2Pu9veu

Source 11: https://www.census.gov/newsroom/press-releases/2015/cb15-215.html

Source 12: https://bit.ly/2WBfpO6

Source 13: https://bit.ly/3B74KJX

Source 14: https://pewrsr.ch/3DoOvu1

Source 15: https://www.globenewswire.com/news-release/2021/08/05/2275328/0/en/22nd-Century-Group-Reports-Business-Highlights-and-Financial-Results-for-the-Second-Quarter-2021.html

Source 16: https://www.xxiicentury.com/investors/news/press-releases/detail/447/22nd-century-group-to-begin-trading-on-nasdaq-on-august-16

Source 17: https://d1io3yog0oux5.cloudfront.net/xxiicentury/files/pages/xxiicentury/db/328/description/XXII+Hops+Overview+Website+082921.pdf

Source 18: https://www.xxiicentury.com/investors/news/press-releases/detail/447/22nd-century-group-to-begin-trading-on-nasdaq-on-august-16

Source 19: https://finbox.com/NASDAQCM:XXII/explorer/altman_z_score

Source 20: https://www.investopedia.com/terms/a/altman.asp

Source 21: https://finbox.com/NASDAQCM:XXII/explorer/current_ratio

Source 22: https://finbox.com/NASDAQCM:XXII/explorer/quick_ratio

Source 23: https://finbox.com/NASDAQCM:XXII/explorer/total_rev_cagr_5y

Source 24: https://schrts.co/rxHaisDW

Source 25: https://finbox.com/NASDAQCM:XXII/explorer/analyst_target_upside

Source 26: Dawson James Report August 6

Source 27: Dawson James Report August 31

Disclaimer

Stock Research Today is a project of Alan & Company Marketing LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Alan & Company Marketing LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Alan & Co” refers to Alan & Company Marketing LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Alan & Co business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Alan & Co. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation - Pursuant to an agreement between Alan & Company Marketing LLC and TD Media LLC, Alan & Company Marketing LLC has been hired for a period beginning on 12/27/21 and ending after 2 business days to publicly disseminate information about (NASDAQ: XXII) via digital communications. We have been paid seven thousand five hundred USD via ACH Bank Transfer.