Several Billion Dollars in Free Government support is going to Critical Mineral Companies and the Market has completely overlooked the impact it will have on specific stocks!

We highlight a $25 Million Dollar Market Cap that just completed a raise at a $50 Million level that is now elgible to receive over $200 Million dollars in government grants and credits.

Canada's Next High-Grade Low-Carbon Nickel Mine

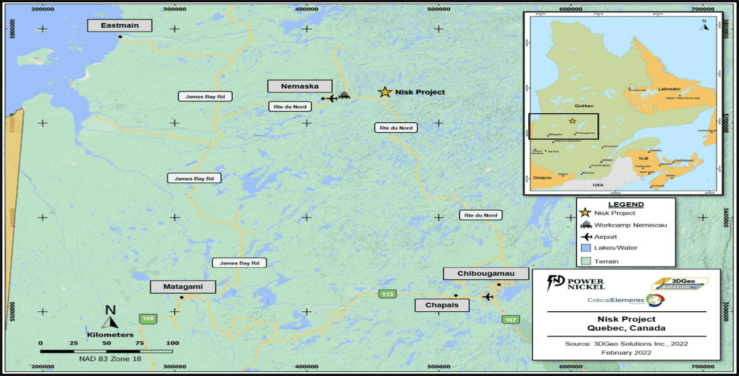

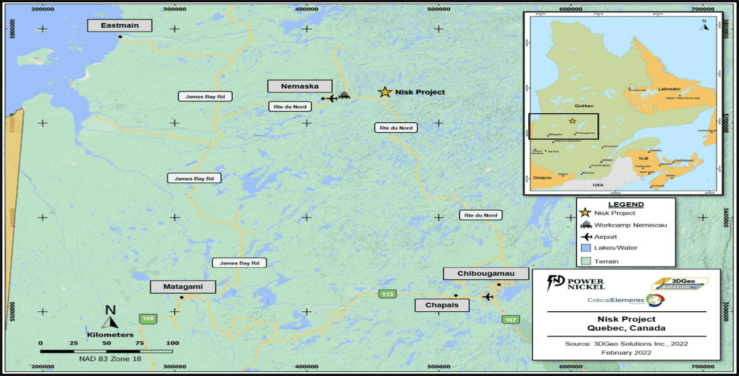

Located in Quebec, Canada the NISK project is a high-grade nickel-copper sulphide deposit with a clear path to commercial production.

NISK is positioned to be one of the lowest-cost and most environmentally-friendly sources of high-grade nickel and copper in the world.

8 Key Reasons Why Power Nickel (TSX.V:PNPN) Could Witness Unstoppable Growth Throughout 2023

IDENTIFYING THE OPPORTUNITY

The Trend Trade Of A Lifetime

With just over 100 million shares and almost no restricted shares, this moderate-float stock is a gold mine!

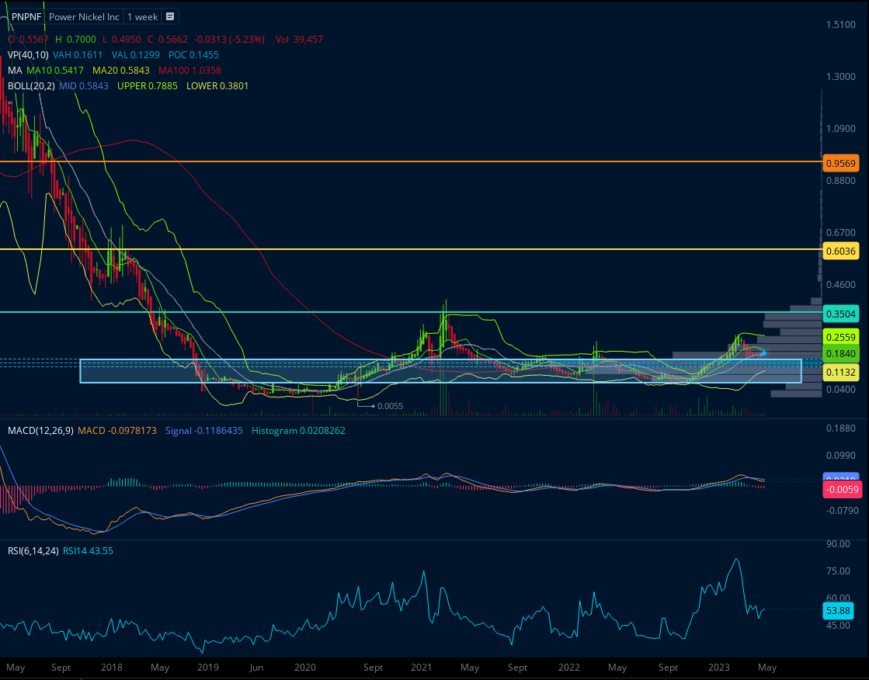

TRADE CONFIRMATION

We are watching the higher time frames for this one, but at these levels every cent cascades into larger percentages on your investment. The chart is currently validating a higher low after a higher high, so it could blast off at any time when the volume returns. A clean break over $0.35 would be ideal, but we can start building into our position at this level as soon as we're ready.

TARGETS

Target 1: $0.3504 (+90%)

Target 2: $0.6036 (+228%)

Target 3: $0.9569 (+420%)

BONUS: $1.34 (+628%)

6 MORE Reasons Why You Should Consider Power Nickel (TSXV:PNPN); (OTC:CMETF) Right Now...

72 New Nickel Mines Needed by 2030:

The electric vehicle boom has been an absolute game-changer for the so-called “battery metals” – and nickel in particular. BHP Group Ltd. – the world’s largest miner – recently projected that nickel demand will grow as much as fourfold over the next 30 years.

Battery Nickel Demand is Forecasting Major Growth by 2030. Power Nickel (TSXV: PNPN); (OTC: CMETF) is in an Excellent Position to Capitalize.

• Automakers to double EV battery spend to $1.2 trillion by 2030 – Nickel Demand Expected to Explode.

• Power Nickel’s (TSXV: PNPN); (OTC: CMETF) Nisk deposit has the lowest market cap per pound of NiEQ in ground – with Class 1 nickel.

• An “ultra mafic” deposit with comparables at Lynn Lake (22m tons) and Voisey’s Bay (50m tons), which sold for $4.5 billion.

• Located in Quebec – a top North American jurisdiction for mine development with financing incentives.

Drill Results Indicate a Potential Major Nickel Sulfide Discovery:

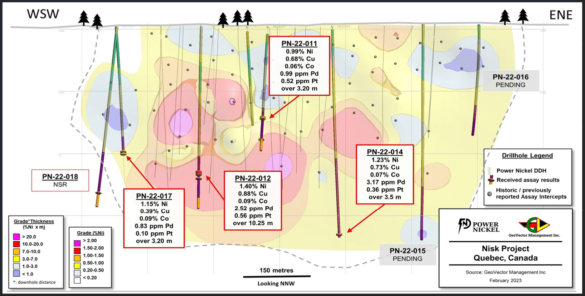

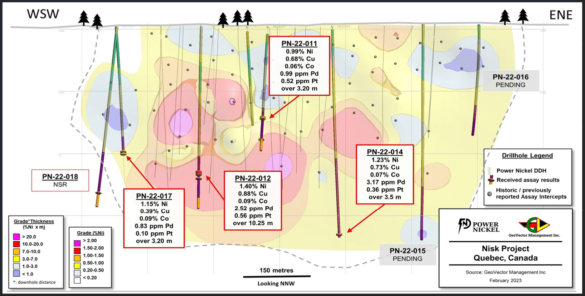

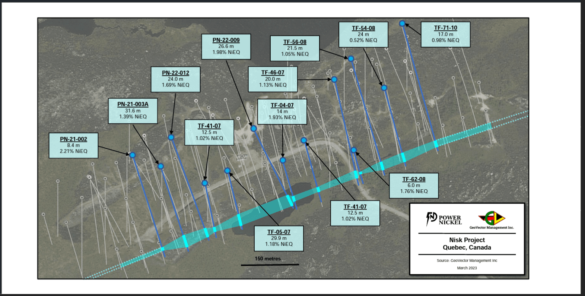

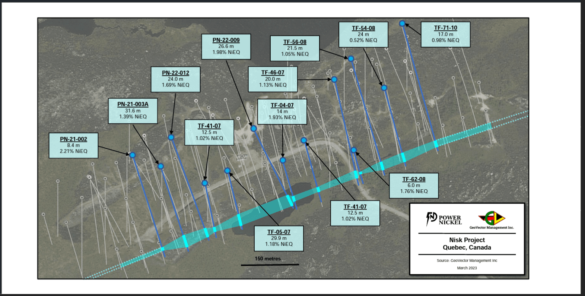

Power Nickel’s Nisk Project, located in Quebec, comprises a large land position (20 kilometers of strike length) with numerous high-grade Nickel intercepts. New drill results on the property show a continuation of the existing High Grade Nickel Sulfide discovery and make Power Nickel's ambition to be Canada's next Nickel mine more and more probable!

Power Nickel Appears on the Verge of an Important Next Step:

The biggest gains in Junior mining are when miners go from having a exploration play to when the market perceives them as having a commercial mine. This discovery phase as evidenced on the Lasonde Curve is often an optimal time.

The Company Appears Significantly Undervalued Compared to its Peers and it’s fully Funded:

The press release linked here details the funding just completed by the company in which the management team was largest investor. Other companies in the nickel exploration space – with similar potential tonnage and roughly equivalent grade nickel – now have market caps ranging from US$150 million to US$530 million...while Power Nickel currently has a market cap of just US$15 million.

Governments and Companies are in Desperate Need of Battery Metals:

The massive shift in the automobile market toward electric vehicles has not only driven the price of critical battery metals such as nickel higher...it has also sent governments and companies scrambling for new sources. Governments are handing out grants, incentives and tax breaks at breakneck speed and business leaders – such as Tesla’s Elon Musk – are aggressively looking to purchase these critical metals for their manufacturing.

How Big can Power Nickel’s Nisk deposit be? It is an Ultra Magic deposit. Similar to Lynn Lake (22 Million Tonnes of High Grade Nickel Ore) and Voiseys Bay with over 50 Million Tonnes of High Grade Nickel Ore:

With its location in northern Quebec Power Nickel has the added advantage of exploring for nickel at virtually half the exploration cost of alternative projects worldwide given the substantial tax incentives available. Given Nickel Sulfide mines are multi pod Power Nickel is in an excellent position to deliver a really big discovery.

Power Nickel’s Flagship Nisk Property Offers Game-Changing Potential

Power Nickel (TSXV: PNPN); (OTC: CMETF) is a Canadian junior exploration company focusing on high-potential copper, gold and battery metal prospects in Canada in Chile.

The company’s flagship Nisk property comprises a large land position (20 kilometers of strike length) with numerous high-grade intercepts for multiple battery metals, including copper, cobalt, palladium, platinum and class-1 nickel.

Located near James Bay in Quebec, Nisk enjoys the advantage of easy access to low-cost, low-carbon hydro power in order to help sustainably develop its resources.

Power Nickel is committed to developing Nisk into one of the most sustainable sources of battery metals and class-1 nickel in the world.

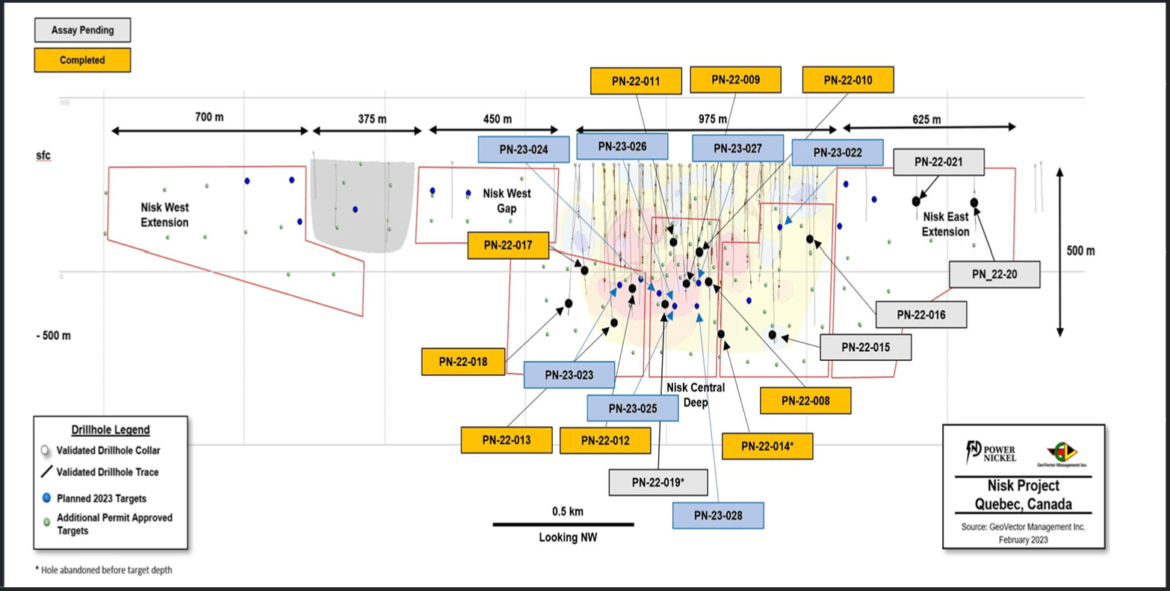

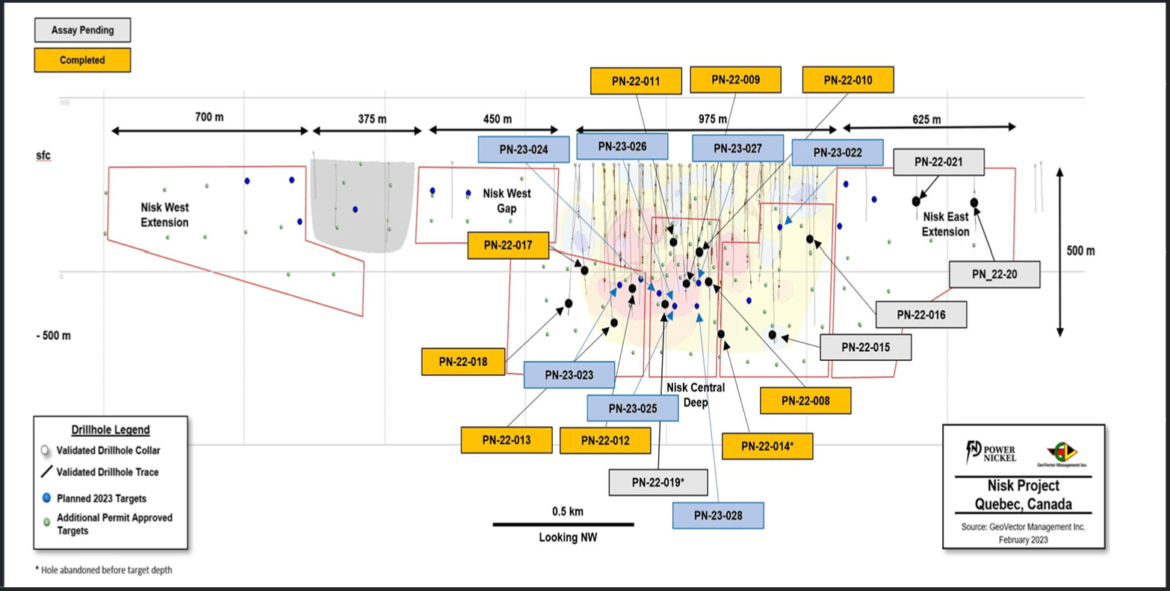

Evidence from historic drilling – along with more recent drilling programs – has shown that Nisk has four distinct target areas covering over 7 kilometers of strike length.

Here’s what is important to know about Power Nickel’s Nisk property: Nisk is an Ultramacific ore body.

Other ore bodies of this type in Canada include the Lynn Lake Mine in Manitoba, which produced 22 million tons of high grade nickel ore…and the famous Voisey’s Bay Mine in Newfoundland, which contains over 50 million tons of high grade nickel ore.

Given that all Nickel sulfate mines are multi-pod – and that Nisk Main, which is the pod Power Nickel is currently drilling – leads the company to expect that it could get to a commercial tonnage on the one pod while also exploring opportunities at Nisk West and other additional targets.

This would make it seem likely that the Nisk property – and Power Nickel as a whole – is not only highly undervalued today but has excellent potential for growth via the discovery of nearby pods.

While the existing resource estimates at the Nisk project are of historic nature and the company’s geology team has not yet completed work to confirm a NI 43-101 compliant mineral resource, for informational purposes only these historic estimates show Nickel, Copper, Cobalt and Palladium on the property.

Results from the company’s 2021 and 2022 drilling program appear to confirm what was represented in the historic work and successfully demonstrated the existence of Nisk’s main mineralized lense. The company does look at the property as having the potential for multiple pods and believes like other Ultramafic deposits like Lynn Lake and Voiseys Bay that Nisk has the potential to not only be a commercial mine but a sizeable one!

Assay Results from the drill program at Nisk are expected every two weeks for the next 3-4 months!

Power Nickel releases its complete drill data enabling modelers to model the deposit as Power Nickel does.

This is because the company strongly believes that transparency is confidence. Confident investors will realize the value proposition associated with the company and make the right investment decision.

Additional data on the Nisk property, including a database of drill holes and other information on the property’s potential is available for review on the companies website.

The company expects to take the results from the historic drilling programs, its initial program in late 2021, the current drill program, and a new metallurgical study and prepare a new 43-101 which it expects to deliver in early 2023.

Potential confirmation of 7 to 8 million metric tons of nickel at Nisk could be an absolute game-changer for Power Nickel (TSXV: PNPN); (OTC: CMETF), vaulting it from a speculative exploration opportunity to a company that the market would view as a commercial opportunity to develop a significant source of nickel.

IN SECTOR CONTEXT

Power Nickel Offers Investors Smart Access to the Red-Hot Nickel Market…at Precisely the Right Time

The timing for Power Nickel appears to be just right.

The company is moving forward with its drilling program at Nisk – designed to offer confirmation of a commercial development opportunity – just as demand for nickel is soaring.

According to BHP Group Ltd. – the world’s largest miner – global demand for nickel will grow fourfold over the next 30 years thanks to the electric vehicle boom.

“We anticipate demand for nickel in the next 30 years will be 200% to 300% of the demand in the previous 30 years,” said Jess Farrell, BHP’s asset president of Nickel West.

In fact, at this very moment governments and companies are scrambling for control of sources of all battery metals – including nickel.

In August, Tesla CEO Elon Musk signed a deal to buy $5 billion worth of nickelfrom the Indonesian government[i]…but that’s only a small portion of the nickel Tesla and other EV manufacturers will need going forward to hit production targets.

Governments all over the globe are also supporting the development of mines for battery metals such as nickel.

In the U.S., the Inflation Reduction Act – signed into law by President Biden in summer 2022 – offers hundreds of millions in grants, incentives and tax breaks to help facilitate more rapid mining development.

One example is Talon Metals Corp., which saw its shares surge on news recently that its subsidiary was chosen to receive a $114 million grant from the U.S. Department of Energy – which works out to 27% of the total project cost for building a new battery mine in Minnesota.

Similar opportunities are also likely to be given to companies throughout North America as the U.S. looks to lock down supplies of nickel to help reduce its dependence on foreign imports as electric vehicle demand continues to soar.

MARKET PEER COMPARISO

Severely Undervalued Opportunity: How Power Nickel’s Market Cap Compares to its Peers

One of the most compelling angles of the Power Nickel story for investors is the upside potential that exists for shareholders.

Other nickel companies – with similar tonnage on their properties and comparable grade nickel – have market caps that are significantly higher than Power Nickel (TSXV: PNPN); (OTC: CMETF).

While the historic drill results on the Nisk property are still yet to be confirmed by an updated 43-101 (expected in early 2023), the company believes the promising results from the fall drill program make it highly likely that they have discovered a commercial nickel ore body.

That type of potential – along with grades comparable to the others on the chart above – would suggest that with a market cap of just US$15 million, Power Nickel could present an extremely undervalued growth opportunity for early investors.

Should results from the company’s ongoing drilling program continue to line up with those historic estimates – and Power Nickel moves closer to becoming a truly viable commercial development opportunity – its market cap could potentially more closely resemble some of the others on the chart above. And that would represent significant upside opportunity for investors who were in on Power Nickel (TSXV: PNPN); (OTC: CMETF) ahead of the curve.

Well-Connected, Experienced Leadership Team is Guiding Power Nickel (TSXV: PNPN); (OTC: CMETF) on a Path to Success

Terry Lynch

CHIEF EXECUTIVE OFFICER

Mr. Lynch is currently CEO of Power Nickel Inc. a publicly held mining company with the advanced stage Nisk Nickel project south of James Bay Quebec. It also has projects in BC’s Golden Triangle and Chile. Mr. Lynch is also the Founder and Managing Director of Save Canadian Mining.

Save Canadian Mining was launched in November2019 to unify Canada’s junior mining sector in requesting regulatory changes in Canada’s capital markets. The organization is supported by the TSX Venture Exchange, the Ontario Mining Association, the Ontario Prospectors Association, as well as mining industry leaders like Eric Sprott (Sprott Mining) Sean Roosen (Osisko Mining), Keith Neumeyer (First Majestic Silver Corp), and Rod McEwan (McEwan Mining Inc) and over 25 junior mining companies and over 3,000 members.

Mr. Lynch graduated in 1981 from St. Francis Xavier University with a joint honours degree in Economics and BBA. Prior to becoming a director with International PBX Ventures in 2012, Mr. Lynch had been CEO of privately held Nevada-focused Relief Gold. He also had been a director and later CEO of TSX-listed Firstgold Corp. He assumed the CEO position after the company had run into financial difficulty bringing its Relief Canyon mine into production. He arranged a sale of 51% of the company for a total capital injection of $26.5 million from Northwest Non-Ferrous Metals, one of China’s largest mining engineering and consulting groups.

From 2005 to 2008 Mr. Lynch was a partner with Kingsmill Capital Partners, a financial advisory firm specializing in advising public and private early stage growth companies. Prior to joining Kingsmill Capital he spent 15 years operating start-up companies in industrial products, oil and gas and media. Mr. Lynch was also the Cofounder of TSX and NASDAQ listed Cardiol Therapeutics. A leader in producing Pharmaceutical CBD and developer of ground breaking therapies for heart disease.

Peter Kent

CHAIRMAN

Fomerly with the TecSyn Group of Companies where he was Vice President general Counsel and Corporate Secretary. Peter brings over 25 years of business experience regarding complex business and legal affairs.

In addition to his time at Tecsyn Peter also was a corporate commercial lawyer at Bassel Sullivan a Toronto based boutique law firm.

Ximena Perez

MD CHILE

Ms. Perex has 13 years of experience in Chile as an exploration and production geologist.

The first 5 years as a production geologist in underground mining in Cu.

Then, she developed a career as an Exploration Geologist with extensive experience in drilling program supervision, data management and geological modeling.

She participated in the exploration for the expansion of Skarn Las Cenizas (Cu-Ag), Talcuna (stratabound and veins Cu-Au) deposits; Punitaqui (stratabound and veins Cu-Ag-Au) and Dayton (epithermal of Au), in these last two as Chief Exploration Geologist.

Greg McKenzie

LL.B, MBA – Director

Greg is a senior investment banker with 20 years of experience in financing, M&A, financial advisory, valuation, and strategic advice primarily to mid-cap companies.

His transactions are valued in excess of $18 billion.

Mr. McKenzie has worked in New York and Toronto and has held positions with Morgan Stanley, CIBC World Markets, Haywood Securities and Salman Partners.

While at these firms, Greg advised managements and boards of companies in various sectors including: metals & mining, industrials, consumer products, technology and healthcare.

Les Mallard

DIRECTOR

Mr. Mallard has spent 30+ years in the Canadian Produce Industry employed in various capacities with Chiquita Canada and Chiquita Brands North America.

Retiring from Chiquita in 2017, he has started Mallard Produce Solutions, a produce consulting company focused on providing North American and Latin American clients business solutions to expand their market potential.

Les is on the Board of Directors for the Canadian Produce Marketing Association.

Sources

- https://www.bnnbloomberg.ca/bhp-sees-nickel-demand-rising-fourfold-by-2050-on-ev-boom-1.1840872

- https://www.iea.org/data-and-statistics/charts/total-nickel-demand-by-sector-and-scenario-2020-2040

- https://electrek.co/2022/08/08/tesla-tsla-secures-deal-5-billion-worth-nickel-indonesia-official/

- https://www.reuters.com/article/us-tesla-nickel/please-mine-more-nickel-musk-urges-as-tesla-boosts-production-idUSKCN24O0RV

- https://www.bnnbloomberg.ca/bhp-sees-nickel-demand-rising-fourfold-by-2050-on-ev-boom-1.1840872

- https://powernickel.com/

- https://powernickel.com/pdf/Corporate%20Presentation.pdf

- https://finance.yahoo.com/quote/PNPN.V/

- https://finance.yahoo.com/news/power-nickel-announces-closing-1st-080000582.html

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Virtus Media business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company's website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers' works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer's communications regarding the profiled company(s). You should assume all information in all of our communications in incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation: Pursuant to an agreement between Virtus Media LLC and Social media outlet, Virtus Media has been hired for a period beginning on 2023-04-26 and ending after 2023-05-26 to publicly disseminate information about OTC: PNPNF. We have been paid forty thousand dollars USD via ACH Bank Transfer.