LATEST NEWS

SoFi Invest Launches the SoFi Enhanced Yield ETF to Offer Investors a New Income Source

6 Reasons Why SoFi Enhanced Yield ETF (NYSE Arca: THTA) Could Be Poised For Significant Upside Potential in 2024

SEEING THE POTENTIAL

A STRONG UPTREND SINCE ITS INCEPTION

SoFi Enhanced Yield ETF

(NYSE Arca: THTA)

Alternative Income Strategy - THE COMPETITIVE EDGE

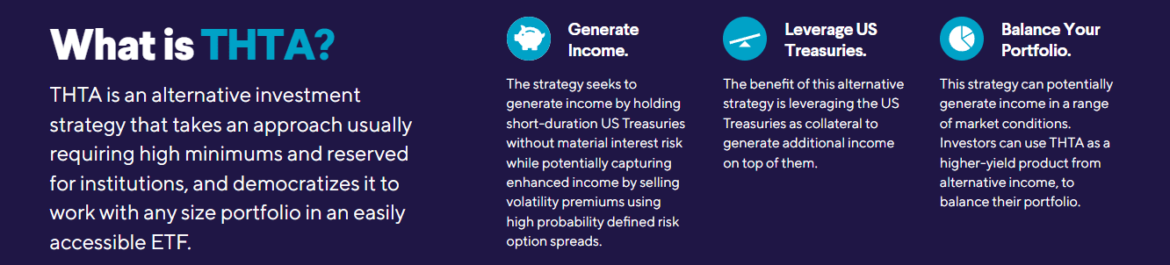

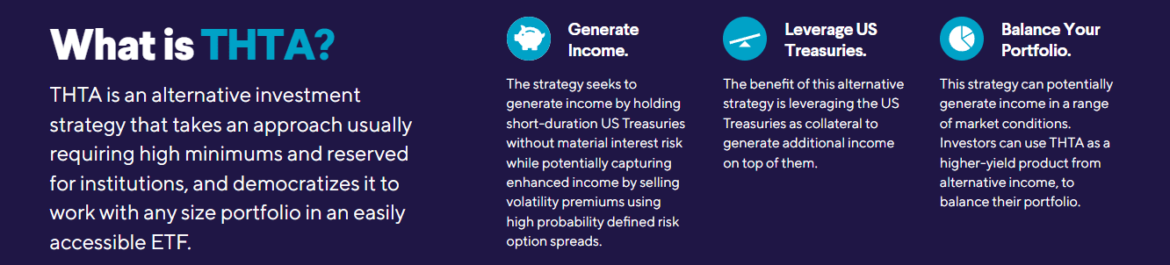

The SoFi Enhanced Yield ETF (NYSE Arca: THTA) is an innovative investment vehicle designed to provide investors with an alternative income strategy. Launched on November 15, 2023, The SoFi Enhanced Yield ETF (NYSE Arca: THTA) seeks to combine the stability of short-duration US Treasuries with the income-generating potential of selling volatility premiums using high probability defined risk option spreads. This unique approach sets THTA apart from traditional fixed-income investments, offering investors a diversified source of income beyond conventional strategies.

At the core of THTA's strategy is its focus on generating income while mitigating interest rate risk. The fund holds short-duration US Treasuries, providing a stable foundation for investors, and concurrently employs a credit spread option strategy to enhance yield. This disciplined approach, usually reserved for institutional investors, is democratized through the ETF structure, making it accessible to investors of varying portfolio sizes. By combining the reliability of US Treasuries with the income potential from option spreads, THTA aims to offer investors a distinctive and potentially lucrative alternative income solution.

The alternative income strategy implemented by The SoFi Enhanced Yield ETF (NYSE Arca: THTA) is designed to be both disciplined and opportunistic. The fund actively manages its exposure to volatility by utilizing option spreads, allowing it to capitalize on market conditions while remaining rooted in the stability of US Treasuries. THTA's approach is not bound by traditional indexes, giving the fund the flexibility to navigate diverse market environments. This combination of discipline and opportunism provides investors with a unique blend of stability and potential for enhanced income in a variety of market conditions.

Investors considering The SoFi Enhanced Yield ETF (NYSE Arca: THTA) should be mindful of its potential benefits in terms of diversifying income streams and the non-correlated nature of its strategy. While the fund's performance is subject to market conditions, the alternative income strategy aims to provide investors with potential monthly income regardless of interest rate fluctuations, making The SoFi Enhanced Yield ETF (NYSE Arca: THTA) a compelling option for those seeking a dynamic and potentially rewarding addition to their investment portfolio.

THE STRATEGY BREAKDOWN

The SoFi Enhanced Yield ETF (NYSE Arca: THTA) employs a unique alternative income strategy aimed at providing investors with stable yet enhanced yields. At its core, the fund holds short-duration US Treasuries, providing a foundation of stability and security. These Treasuries act as collateral, allowing the fund to implement a credit spread option strategy. Through this strategy, The SoFi Enhanced Yield ETF (NYSE Arca: THTA) seeks to sell volatility premiums using high probability defined risk option spreads. This approach is typically associated with institutional investors but has been adapted to work with portfolios of any size through the ETF structure. The combination of short-duration US Treasuries and the credit spread option strategy forms the basis of THTA's disciplined approach, aiming to generate income while minimizing interest rate risk.

The fund's alternative income strategy is characterized by its focus on disciplined risk management and opportunistic income generation. By holding short-duration US Treasuries, The SoFi Enhanced Yield ETF (NYSE Arca: THTA) aims to avoid material interest rate risk while leveraging these Treasuries as collateral for additional income. The credit spread option strategy allows the fund to capture enhanced income by selling volatility premiums without exposing investors to unlimited risk. THTA's approach is rooted in the belief that it can generate income in various market conditions, providing investors with a potentially higher yield compared to traditional fixed-income investments. This disciplined yet opportunistic strategy is actively managed to adapt to changing market conditions and aims to offer investors a dynamic income-generating solution.

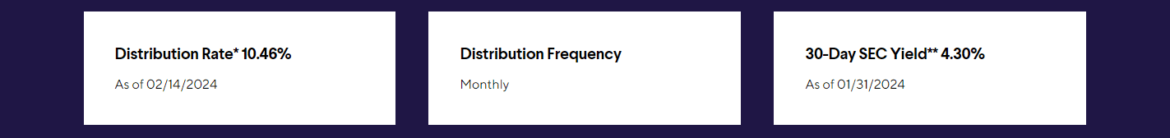

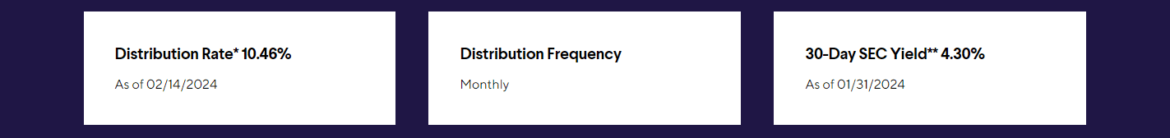

THIS YIELDS RESULTS

The SoFi Enhanced Yield ETF (THTA) stands out for its high potential yield, making it an attractive option for investors seeking robust income-generation strategies. The SoFi Enhanced Yield ETF (THTA) achieves this by leveraging US Treasuries as collateral, allowing the fund to enhance yields beyond traditional fixed-income investments. This non-correlated strategy aims to strike a balance between stability and income generation, offering investors the potential for higher yields in comparison to more conventional income sources. The fund's emphasis on achieving a high potential yield is rooted in its alternative income strategy, which combines the reliability of short-duration US Treasuries with the income-generating potential of selling volatility premiums through defined risk option spreads.

Investors considering The SoFi Enhanced Yield ETF (THTA) for their portfolios may find its high potential yield particularly appealing in the current low-interest-rate environment. The fund's disciplined yet opportunistic approach positions it to generate income in various market conditions, providing a potential source of higher yields that can complement a diversified investment portfolio. By actively managing risk and capitalizing on opportunities presented by market volatility, The SoFi Enhanced Yield ETF (THTA) aims to offer investors a compelling avenue for achieving a high potential yield while maintaining a focus on the stability provided by its core holdings in US Treasuries.

SoFi Enhanced Yield ETF

(NYSE Arca: THTA)

It's Time For A Disciplined And Opportunistic Approach

The SoFi Enhanced Yield ETF (THTA) distinguishes itself through a disciplined and opportunistic investment approach, blending stability with flexibility. At its core, The SoFi Enhanced Yield ETF (THTA) employs a disciplined strategy by holding short-duration US Treasuries. This foundational position serves as a stable anchor for the fund, providing investors with a secure base while mitigating interest rate risk. The disciplined nature of The SoFi Enhanced Yield ETF (THTA)'s strategy is crucial for risk management, emphasizing the preservation of capital even in changing market conditions.

In addition to its disciplined core, The SoFi Enhanced Yield ETF (THTA) embraces an opportunistic approach to income generation. The fund seeks to capitalize on market volatility by selling volatility premiums through high probability defined risk option spreads. This actively managed strategy allows The SoFi Enhanced Yield ETF (THTA) to identify and seize income-generating opportunities across different market scenarios. By remaining opportunistic, the fund can adapt to changing market conditions, potentially enhancing overall returns for investors. This combination of discipline and opportunism positions The SoFi Enhanced Yield ETF (THTA) as a dynamic investment option, providing the benefits of stability while actively pursuing income opportunities.

The SoFi Enhanced Yield ETF (THTA)'s strategy is not constrained by following traditional market indexes. Instead, the fund takes an independent approach, allowing it to extract income from alternative sources and providing investors with a non-correlated strategy. The disciplined risk management coupled with the ability to capitalize on volatility sets The SoFi Enhanced Yield ETF (THTA) apart, offering a unique blend of stability and income potential. Investors looking for a balanced approach that combines a steadfast commitment to risk management with the flexibility to capture opportunities may find The SoFi Enhanced Yield ETF (THTA)'s disciplined and opportunistic strategy a compelling choice for their investment portfolios.

Exploration Strategy

Being prepared for every market direction is crucial for investors to navigate the dynamic and unpredictable nature of financial markets. Market conditions are subject to constant change, influenced by economic factors, geopolitical events, and other variables. By having a well-prepared and diversified investment portfolio, investors can position themselves to weather different market directions, whether it be periods of growth, volatility, or downturns.

Preparing for every market direction is a risk management strategy that helps investors mitigate potential losses during challenging times and capitalize on opportunities during favorable market conditions. Diversification, a key component of preparation, involves spreading investments across various asset classes, sectors, and geographic regions. This approach helps to minimize the impact of poor performance in any single investment or market segment. Additionally, having a mix of assets that respond differently to market conditions can provide a hedge against unforeseen events. By being prepared for various market directions, investors are better equipped to adapt their portfolios to changing circumstances, potentially enhancing long-term financial resilience and performance.

The SoFi Enhanced Yield ETF (THTA) provides investors with that advantage by offering potential monthly income irrespective of market conditions, providing investors with a consistent income stream. THTA's unique investment strategy, rooted in short-duration US Treasuries and the sale of volatility premiums through defined risk option spreads, allows the fund to generate income in various market environments. Unlike traditional income strategies that may be influenced by interest rate fluctuations or market trends, The SoFi Enhanced Yield ETF (THTA)'s approach is actively managed to extract income regardless of the prevailing market conditions, offering investors a dependable source of monthly income.

The fund's commitment to providing potential monthly income in diverse market scenarios aligns with investors' needs for stable and predictable returns. The SoFi Enhanced Yield ETF (THTA)'s ability to navigate different interest rate environments and capitalize on market opportunities makes it a versatile option for income-focused investors. By offering a non-correlated strategy that is not tethered to market indexes, The SoFi Enhanced Yield ETF (THTA) provides investors with the potential for monthly income that is resilient to the ups and downs of the broader market, adding a layer of consistency to income generation within their investment portfolios.

SoFi Enhanced Yield ETF

(NYSE Arca: THTA)

Transparency and accessibility

Empowering holders with confidence and information

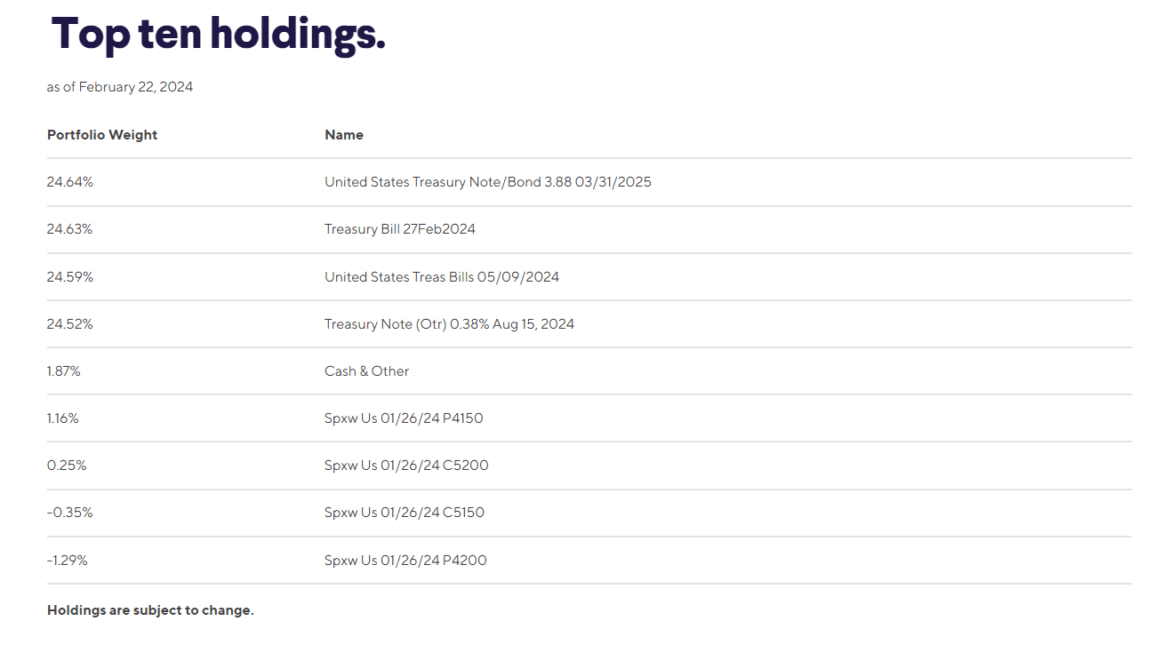

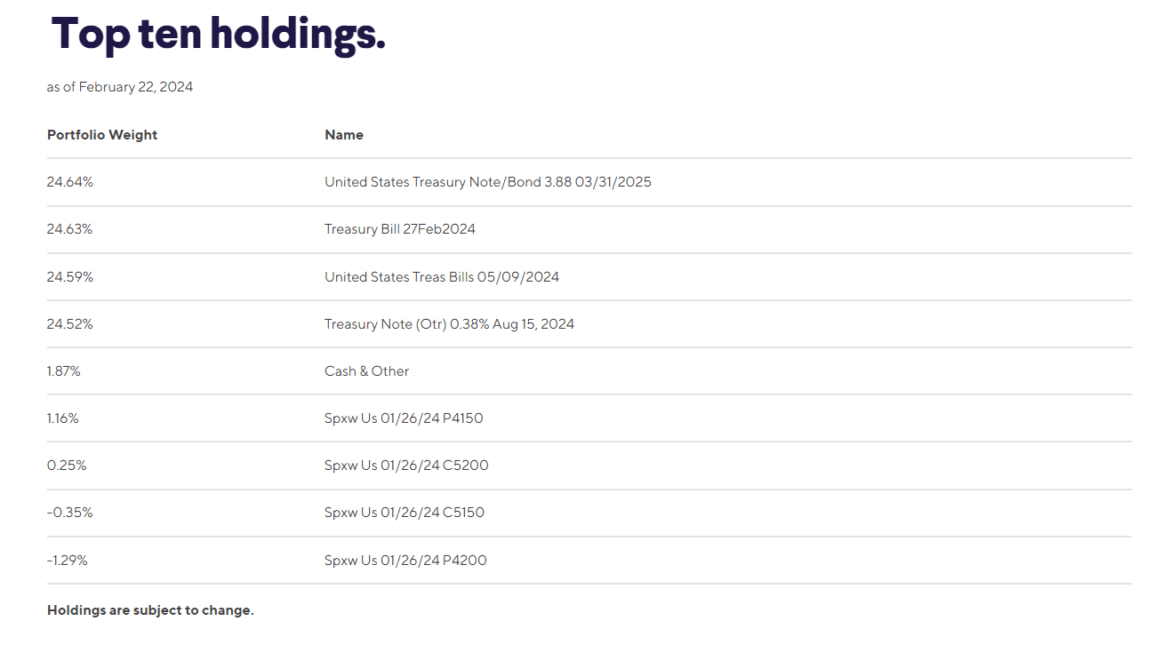

At SoFi Invest, the importance of transparency and accessibility in empowering investors to make informed decisions is of the utmost importance. The SoFi Enhanced Yield ETF (THTA) is crafted with a commitment to providing investors with a clear and transparent investment vehicle. The SoFi Enhanced Yield ETF (THTA)'s goal is to ensure that investors have access to comprehensive information about the fund's strategy, holdings, and performance.

The SoFi Enhanced Yield ETF (THTA)'s transparency begins with its unique alternative income strategy, which is detailed and easily accessible to all investors. Through their investor relations page, they offer in-depth insights into the fund's approach, including its focus on short-duration US Treasuries and the sale of volatility premiums using defined risk option spreads. This clear and detailed information empowers investors to understand how The SoFi Enhanced Yield ETF (THTA) aims to generate income and navigate various market conditions.

Accessibility is a cornerstone of the SoFi philosophy, and The SoFi Enhanced Yield ETF (THTA) exemplifies this by providing investors of all sizes with access to a strategy typically associated with institutional investors. The ETF structure democratizes the alternative income strategy, allowing investors to participate in a disciplined and opportunistic approach that may enhance yields. Our commitment to accessibility extends to the investor relations page, where users can easily navigate and find the information they need to make well-informed investment decisions. By prioritizing transparency and accessibility, SoFi Invest aims to foster a sense of confidence and trust among their investors.

Sources

- Source 1: https://www.sofi.com/invest/etfs/thta

- Source 2: https://finance.yahoo.com/news/sofi-invest-launches-sofi-enhanced-140000705.html

- Source 3: https://finance.yahoo.com/quote/THTA/

- Source 4: https://www.sofi.com/wealth/backend/jwt/api/v1/sofi-etf/holdings-file?symbol=THTA

- Source 5: https://cta-service-cms2.hubspot.com/ctas/v2/public/cs/c/?cta_guid=4b58e411-b27c-43ae-b191-102410c1b8a3&signature=AAH58kFLO68Nlr8KjEKbD3TvP9U8AoXnog&placement_guid=d996bcad-470c-4f8b-b0da-5373a0a366bd&click=499ce67f-9b70-4b66-8e72-f5655461c4ee&hsutk=&canon=https%3A%2F%2Fwww.sofi.com%2Finvest%2Fetfs%2Fthta&portal_id=8096772&redirect_url=APefjpFGWwYrYmFPM-NygNkQbN_t2CHLIsfxdq6K408lBI7vM3cQ-ASy9vxkf7XULQ6_y7tfTKWeDXaC29zDUKl6LafxF7BnNvFAHXCz8cttiI8hpBanEdgPRxiigMVuWITDZYUXPMsbjNPZsyMJ2-O9Blk2g4AnznCBr5QS7Cj-VasygTL1t2HmFtd_3NFlF0b4-_XANQXqefX6CxFAeIsxk-8bj40lKQsddhyhXEXuQ9Dqlq6Mi_E

- Source 6: https://www.sofi.com/invest/etfs/

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and Wolf Financial LLC, Virtus Media Group LLC has been hired by Wolf Financial LLC for a period beginning on 03/04/2023 and ending 03/08/2023 to publicly disseminate information about NYSEARCA: THTA via digital communications. We have been paid one thousand five hundred dollars USD.