Lords Has Been Going Full-Throttle & There's Nothing But Open Highway In Front Of Them

(NASDAQ: LRDSF, CSE:LRDS, OTCQB:LRDSF, TCMKTS:LRDSF)

Lords is quickly making a name for itself in the apparel and wellness markets. With a strong global presence, impressive growth trajectory that's turning heads, and unparalleled client acquisition, Lords is poised for success on a massive scale.

They have set themselves apart from the competition with their exceptional products and innovative marketing strategies, building a loyal customer base and establishing themselves as a brand to watch.

LATEST NEWS

Lords & Company Worldwide Holdings Inc. Announces the Launch of 18 New SKU's with GVB Biopharma

So, Who Is Lords?

As a rapidly growing lifestyle brand, Lords is carving out its niche in the trendsetting sector.

With brands like FUBU and Harley Davidson as role models, who started out as grassroots lifestyle apparel and expanded into multi-billion dollar global successes, Lords is poised to capitalize on the growth of a properly managed lifestyle brand.

We are putting our marketing design and global manufacturing initiative into high gear and throttling down on all of our proven concepts.

When it comes to investing in a brand that's primed for success...

Lords Is The Top Choice.

7 Key Reasons To Have Lords On Your Radar Today...

This isn't just any brand - this is a company that's pushing the boundaries and setting the standard for what it means to be a leader in these industries.

IDENTIFYING THE OPPORTUNITY

Hyper-Responsive Low-Float Is Ready To Take Us For A Ride

This local compression has explosive potential for short-term profits, and long-term growth into valuation

TRADE CONFIRMATION

This stock loves to jump with very little volume, meaning there is likely going to be tremendous leverage over the bid-ask when the volume arrives. If price action can break above the $0.11 level, we will likely see an incredible run to the upside. Even a few thousand shares can send this flying, but we would like to see over 15,000 shares and a clean break above $0.11 for the higher potential runs. Until then, this is a beautiful range to trade for some quickly compounding gains.

TARGETS

Target 1: $0.1602 (+53%)

Target 2: $0.1880 (+79%)

Target 3: $0.3100 (+195%)

Bonus Target: $0.5400 (+414%)

Strong Support at $0.630

Where they were and where they’re headed…

Even more impressive, Lords (NASAD:LRDSF, CSE:LRDS, OTCQB:LRDSF, OTCMKTS:LRDSF) recently released their Q3 2022 results which showed remarkable growth with revenues of $1.98M, up from $400K in 2021, and projected to close out 2022 with over $2.6M.

Lords is projected to do over $9M in 2023, based on the current pipeline of commitments.

Lords' success is a testament to their ability to spot trends and make them their own.

With a team of individuals who are experts in multiple arenas, Lords has created a culture that's not just about fashion and health benefits.

It's about making money in multiple industries, and they know how to do it.

Lords: a powerhouse in the health and wellness market

Lords(NASDAQ:LRDSF, CSE:LRDS, OTCQB:LRDSF, OTCMKTS:LRDSF) is taking the health and wellness market by storm, with a focus on providing top-quality products that help their engaged audience achieve optimal physical fitness and overall wellness.

By rapidly expanding their online presence and focusing on natural health and premium branded apparel products, Lords is ready to emerge as a leading force in this sector.

Their proprietary technology platform powers an e-commerce ecosystem to scale their brands and drive profitability through strategic customer acquisition, efficient supply chain management, and data-driven analysis.

MARKET STATS - U.S. Wellness Industry

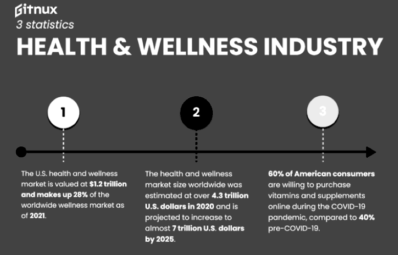

The global health and wellness market is on the verge of significant growth, with an estimated value of $4.3 trillion in 2020, projected to reach nearly $7 trillion by 2025.

The U.S. wellness industry alone is valued at $1.2 trillion and makes up 28% of the worldwide market.

Consumers are prioritizing wellness, with 79% believing it is important and 42% considering it a top priority. The COVID-19 pandemic has accelerated the shift towards online purchasing, with 60% of Americans now willing to purchase vitamins and supplements online. This trend is expected to continue, leading to increased demand for online health and wellness products and services. As a leading brand in the health and wellness market, Lords is well-positioned to capitalize on this growing trend and continue its strong growth trajectory.

With a laser focus on growth and expansion, Lords is set to disrupt the industry and take their place at the forefront of the market.

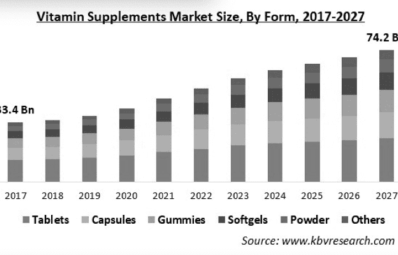

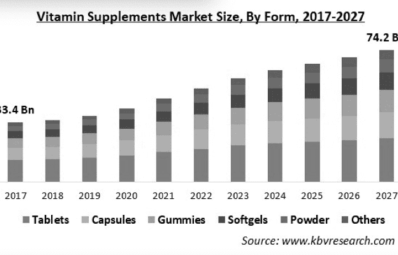

And with the global vitamin market projected to reach a whopping $74.2 billion by 2027, Lords is perfectly positioned to capture a significant slice of that pie. If you're looking for a brand that's committed to your health and wellness goals, Lords is the one to watch!

IN SECTOR CONTEXT

Lords Has The Supply To Meet The Growing Demand

As the demand for natural health products and supplements continues to grow, Lords (NASDAQ:LRDSF, CSE:LRDS, OTCQB:LRDSF, OTCMKTS:LRDSF) is quickly establishing itself as a top brand in the market.

With a focus on optimizing men's health through dietary supplements and natural health products, Lords offers high-quality products designed to help individuals achieve their wellness goals. The Lords Lean Up and Lords Man Up brands, in particular, have gained popularity for their proven ingredients and formulas that help boost metabolism, burn fat, and enhance male performance. With a commitment to quality and customer satisfaction, Lords is well-positioned to capitalize on the growing demand for natural health products and supplements.

Lords’ commitment to health and wellness continues with their strategic supply agreement with GVB Biopharma, a leading provider of hemp-derived active ingredients for pharmaceutical and consumer goods industries worldwide. With a diverse range of seven product lines and over fifty categories, GVB Biopharma's products complement and enhance Lords' existing lines. By combining forces with GVB Biopharma and expanding its product offerings in the health and wellness market, Lords has taken a key step in its growth strategy.

As part of this strategy, the recent acquisition of the iconic lifestyle brand Lords of Grasstown further broadens the company's product portfolio and expands its reach in the industry.

The brand, born from the vision of founder and director Tyler Hazelwood, is an established and recognized force in the Pacific Northwest's motorcycle culture. Through strategic partnerships and alliances, Lords of Grasstown has expanded to California and is well-received by its loyal following. This acquisition is not only significant in broadening Lords' product portfolio but also marks its entry into a lucrative industry. With the momentum gained from this acquisition and the support of its strategic partnerships and alliances, Lords is positioned to make a significant impact in the industry.

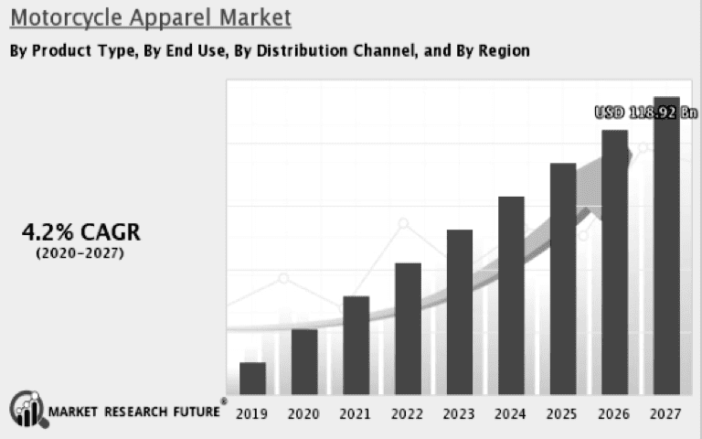

But that's not all. Lords is taking the motorcycle apparel market by storm with its high-quality products and innovative designs.

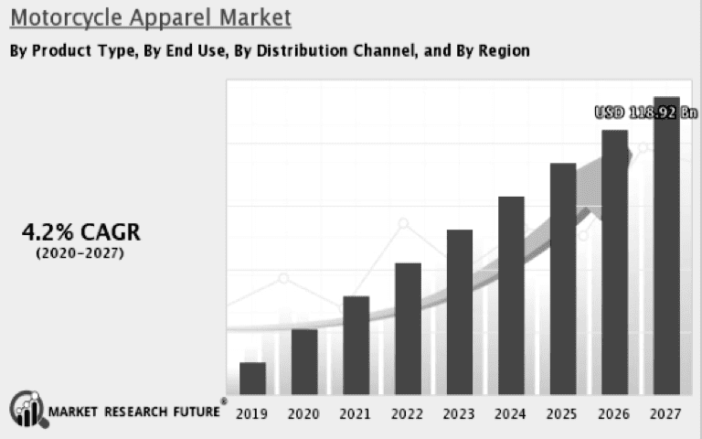

As the global motorcycle apparel market is projected to reach $118.92 billion by 2027, Lords (NASDAQ:LRDSF, CSE:LRDS, OTCQB:LRDSF, OTCMKTS:LRDSF) is set to capitalize on this trend and establish itself as a leading brand in the industry:

With its focus on quality products and trend-setting apparel, Lords is primed to become the next big thing in the industry.

You have the opportunity to join the ranks of early supporters and benefit from the company's potential for exponential growth. Don't miss out on this exciting opportunity to be a part of the next generation of lifestyle brands with Lords.

And Lords Flexible Manufacturing Allows for Product Expansion…

Lords is well positioned to capitalize on the growing trend in the apparel market with their flexible manufacturing capabilities.

Lords’ contractor in Nicaragua has over 30 years of experience in every aspect of the manufacturing process and has grown to over 4,500 employees producing over 150,000 garments a week.

With 7 buildings and over 350,000 square feet of combined production space, Lords has the capacity to meet the demands of their growing customer base.

Their ability to adapt to new production processes has solidified their close relationships with clients and allowed them to stay current in the ever-changing apparel industry.

With expertise in design, development, cutting, sewing, laundry, pressing, and finishing facilities, as well as a vertically integrated circular knitting facility, Lords is confident in their ability to continue expanding their product lines and delivering quality products to their customers.

Lords (NASDAQ:LRDSF, CSE:LRDS, OTCQB:LRDSF, OTCMKTS:LRDSF)

Lords has established itself as a multifaceted brand with a strong presence in several high-growth industries. From premium branded apparel to natural health and wellness products, they are well-positioned to capture a significant market share in each of these sectors.

Overall, Lords’ strong diversification and positioning in multiple high-growth sectors make them an attractive option for those looking to capitalize on the future growth potential of these industries.

The Powerhouse Behind Lords Brand: Meet the Visionary Team

The Lords brand is driven by a team of highly experienced executives who bring their expertise to the table to take the brand to new heights. With a combined 100 years of experience in business management and corporate finance, the Lords management team knows what it takes to thrive in the public and private markets.

At the helm is Chris Farnworth, the CEO and Director, with over 35 years of experience in high-level business development and financing structures. Chris has extensive worldwide experience, particularly in Europe, MENA, and Asia, and has a proven track record of success in strategic planning, project management, and partnership development.

Joining Chris is Business Development Director, Chad Clelland, who has been in the industry since 2009. Chad is a versatile executive with experience in operations, security, and alternate master grower. He is also the co-founder of Folium Life Science, an approved Canadian Licensed Producer, and has a wealth of experience in consulting, design, and government applications under the MMPR and ACMPR.

The team also includes Director Matt McGill, a seasoned professional with a strong background in both commercial and residential real estate. Matt has played a major role in many development projects and is skilled at crafting strategic financing options for corporations and the Lords brand.

Rounding out the Lords management team is Branding Director Tyler Hazelwood, an entrepreneur and creative visionary. Tyler's forward-thinking approach to brand development and his expertise in wellness and motorcycle cultures make him a key player in the success of the Lords brand.

Lords management team is well versed on turning opportunity into profits, and therefore has become a larger asset than the sum of its parts. Tying lifestyle and health and wellness together, Lords understands that it is imperative to not only look good, but to feel good, all the time. Their upward trajectory into 2024 is a testament to their ability to spot trends and make their own, making Lords (NASDAQ:LRDSF, CSE:LRDS, OTCQB:LRDSF, OTCMKTS:LRDSF) one to watch in the coming years.

Sources

- https://finance.yahoo.com/news/lords-company-worldwide-holdings-inc-004000413.html

- https://www.thecse.com/en/listings/life-sciences/lords-company-worldwide-holdings-inc

- https://webfiles.thecse.com/CSE_Form_11_-_Notice_of_Option_Grant_1.pdf?xA2Mx2rQCp37IpHrSh6BDehGbKsXzqQT

- https://ca.finance.yahoo.com/quote/LRDS.CN/

- https://www.lordsofgastown.com/

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Virtus Media business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company's website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers' works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer's communications regarding the profiled company(s). You should assume all information in all of our communications in incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation: Pursuant to an agreement between Virtus Media LLC and Third party , Virtus Media has been hired for a period beginning on 2023-04-24 and ending after 2023-05-01 to publicly disseminate information about OTCMKTS: LRDSF . We have been paid fifteen thousand dollars USD via ACH Bank Transfer.