LATEST NEWS

Remark Holdings Sets Third Quarter 2023 Financial Results Call for November 20, 2023, at 4:30 p.m. ET

6 Reasons Why Remark Holdings (NASDAQ: MARK) Could Be Poised For Significant Upside Potential in 2023 & 2024

IDENTIFYING THE OPPORTUNITY

INSTITUTIONAL SUPPORT IS IN PLACE AND READY TO RUN

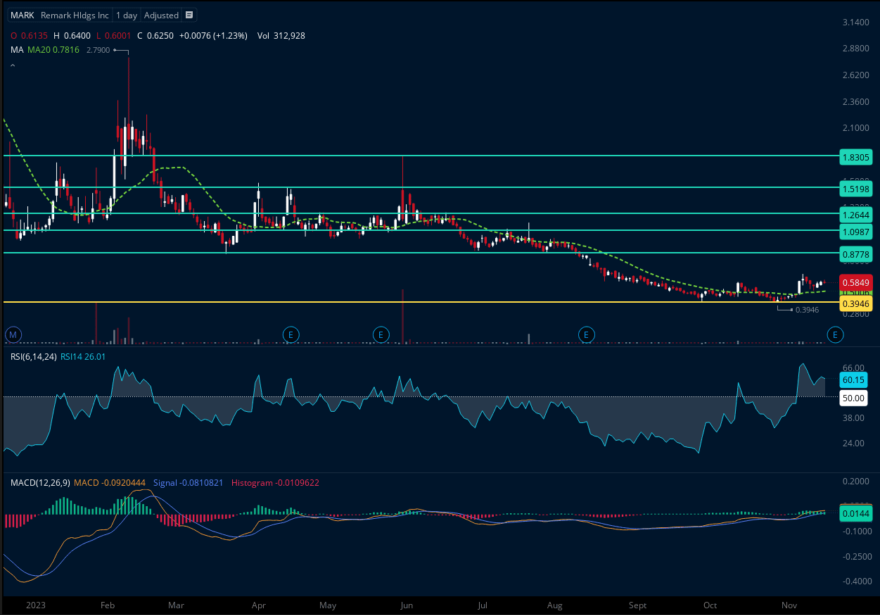

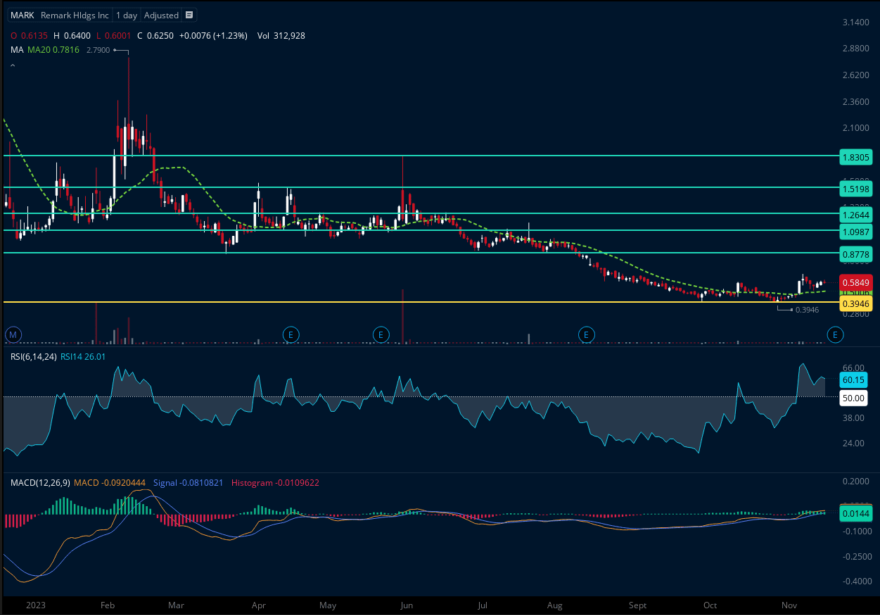

We are turning bearish and have confluence across multiple timeframes and systems

TARGETS

Target #1: $0.8778 (+50.10%)

Target #2: $1.09 (+86.39%)

Target #3: $1.26 (+115.46%)

Target #4: $1.52 (+159.92%)

Target #5: $1.83 (+212.93%)

Support: $0.3946

Remark Holdings, Inc.

(NASDAQ: MARK)

Introducing the future of artificial intelligence powered video analytics

Remark Holdings, Inc. (Nasdaq: MARK) is a leading provider of artificial intelligence (AI)-powered video analytics solutions, with headquarters in Las Vegas. The company specializes in leveraging cutting-edge AI technologies to enhance safety, security, and operational efficiency across various industries. Remark's innovative solutions are designed to analyze real-time video content, providing actionable insights that contribute to the protection of cities, employees, public spaces, and valuable assets.

The company has garnered attention for its Smart Safety Platform (SSP), a robust AI-driven system that rapidly analyzes video content at scale. This platform offers a range of features, including crowd density analysis, behavioral analytics, and anomaly detection within public spaces. What sets Remark apart is its ability to deliver real-time alerts, providing a proactive approach to security that can prevent incidents before they escalate. The integration of Remark AI's models into existing video infrastructure enhances the accuracy and speed of identifying assets, objects, and people.

Remark Holdings has strategically positioned itself in the market through key collaborations and partnerships. Notably, the company has initiated a sales and marketing collaboration with Arrow Electronics and Intel. This collaboration aims to expand Remark's market reach to Arrow's extensive customer base, providing Intel-powered AI servers that run the SSP. Arrow Electronics, in turn, supports the initiative through distribution, inventory management, and logistical sales support. Such collaborations underscore Remark's commitment to scaling its AI video analytics solutions across diverse sectors.

The company's industry recognition is highlighted by its acknowledgment as a representative vendor for Computer Vision Perceptive Systems by Gartner AI Analyst Erick Brethenoux. This recognition adds a layer of credibility to Remark's AI capabilities, showcasing its standing in the field of artificial intelligence. Erick Brethenoux's expertise in AI techniques and decision intelligence further emphasizes the company's commitment to technological innovation and operationalizing AI for growth.

Remark Holdings actively participates in major industry events, exemplified by its presence at the Gartner IT Symposium/XPO conference. These events provide Remark with a platform to engage with industry experts, showcase its AI-driven solutions, and explore collaborative opportunities. Beyond security applications, Remark's focus on practical solutions for waste management, as mentioned in the article, demonstrates its commitment to leveraging AI for environmental sustainability. Overall, Remark Holdings stands at the forefront of AI innovation, bridging the gap between technology and practical solutions that positively impact both businesses and communities.

REMARK HOLDINGS, INC.

(NASDAQ: MARK)

Remark's Vision Identify Recognition

Introduction

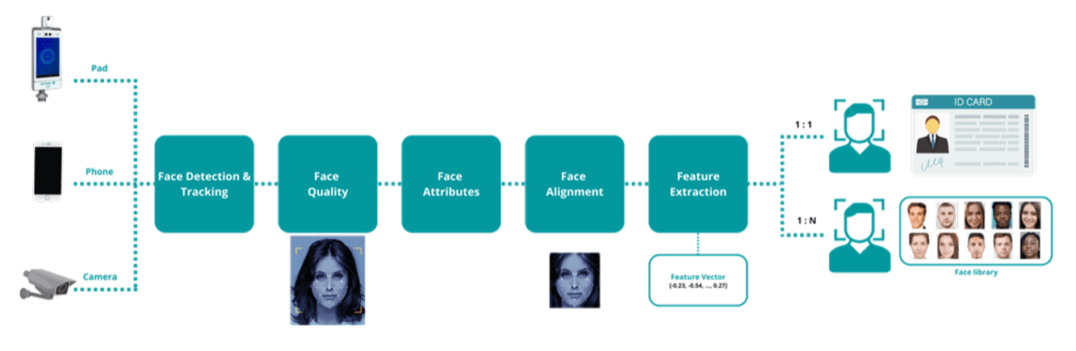

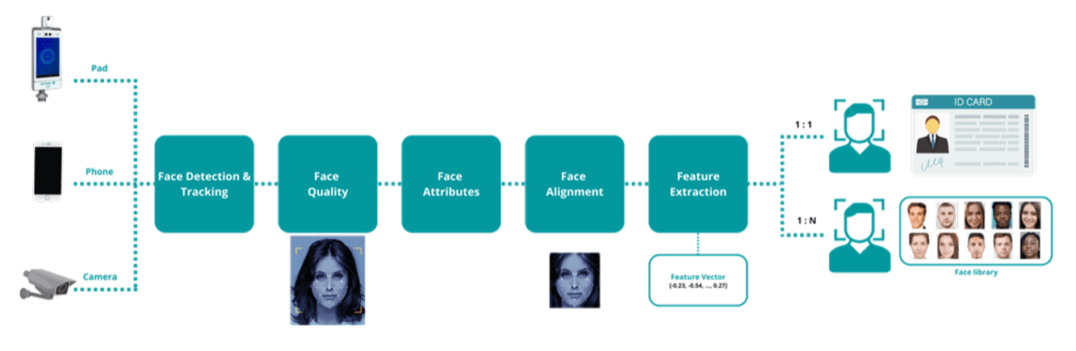

Efficient face recognition swiftly identifies individuals in real-time using digital imagery sourced from videos, portable device cameras, and external image files. Its applications span various aspects of daily life, encompassing tasks such as check-in, registration, payment, access control, security alerts, and police criminal investigations. Despite its widespread use, the accuracy of face recognition involves intricate engineering, influenced by factors like camera installation, resolution, video quality, lighting, image quality, camera type, and model parameters.

Remark Holdings, Inc. (NASDAQ: MARK) has high-potency facial products, their performance across diverse hardware platforms, software features for optimal functionality, and real-world use cases across multiple business applications. Key advantages of the Remark Vision SDK include top-ranking in Face Recognition and Tracking by NIST, GDPR certification ensuring adherence to strict privacy standards, robust security for data at rest and in motion, stellar performance in both speed and accuracy, a highly responsive design, rapid application development with low-code, no-code trainable models, an extensible and scalable microservices-based architecture, and versatile multi-platform support for Android, iOS, Windows, Linux (ARM), and Linux (x86).

Market Objective & Challenge

The primary business applications for face recognition revolve around 1:1 ID verification and 1:N ID matching. These mechanisms operate in two distinct environments - the "Prepared scenario" involves individuals consciously presenting their faces in controlled situations like kiosk check-ins or mobile registrations.

Conversely, the "Wild scenario" captures faces incidentally as individuals pass by and are unconsciously recorded by CCTV cameras. Access control, a key facet of face recognition, entails deciding whether to grant entry (access) to an individual in a specified area. In 1:1 face recognition for access control, each face is compared to a single image in a controlled setting, ensuring a high accuracy rate. This is often observed in scenarios like airport passport control, where a person's passport image is matched with a real-time scan. On the other hand, "In the wild" scenarios involve 1:N face recognition in non-controlled environments, where each face is compared to numerous faces in a dataset. This approach proves effective in identifying criminals or public offenders in diverse and uncontrolled settings.

Images may come from different angles, focal lengths of cameras, conditions, day and night, and indoor/outdoor environments. To achieve the best accuracy for face recognition, cameras should ideally be placed at eye level, with good lighting, and people should walk and look directly into the camera. However, for most of the scenarios that clients encounter, situations are much more complex, and cameras are not always positioned and configured in an ideal way for face recognition. We must figure out how to balance the variables to achieve the best possible results for these scenarios.

Working Pipeline Flow

Picture Capture

The picture capture collects raw image data before feeding it into Remark Vision's face model pipeline. The capture section determines the prior quality of the whole process and final performance. Moreover, as the primary quality factor, they can hardly be modified or corrected by the post-processing algorithm within the pipeline. As a result, it plays a vital role in deployment before using in the actual application.

Camera Type

The type of cameras that are installed affect the performance of face recognition sufficiently. Surveillance (CCTV) cameras generally produce smaller and low-quality face images, resulting in poorer results for face recognition. Fish-eye/multi-sensor stitching cameras, combining multiple images from different sensors to provide 180 or 360 degree views of the scene, are designed for particular user scenarios and are not optimal for face recognition. Thermal cameras (infrared channels), which are helpful for temperature measurement and sight in poorly lit areas or at night, cannot be used for identity recognition. It is recommended that color cameras be used wherever possible.

Camera Installation

For face recognition, the camera shall ideally be placed in all entrances and exits with a vertical angle of approximately 45 degrees or more so that the occlusions are minimal. In addition, when possible, it's best to have the scene set up where the people are walking in and out individually and not in groups, such as through a turn style. In general, identity recognition can generate optimal performance under the circumstance below:

• The cameras are positioned at eye level.

• The lighting is sufficient, resulting in a quick shutter speed that produces a crisp image.

• The lighting gives good contrast, but the faces are not lit from behind.

• The camera focus on the area where you expect faces to appear.

• The camera is steady to prevent image smearing.

Framerate Per Second

Framerate Per Second (FPS) is how many images a camera produces consecutively during a second. Our AI models can work with high or low framerate, but higher than 8 FPS is recommended. A lower framerate may miss faces passing by quickly or faces of best angle timing.

Speed of Moving Object

The speed that a person is traveling affects the accuracy of face recognition. This is because the person may become blurred as the speed increases due to how cameras capture the image. Another factor is that when an object travels faster, it appears in fewer frames, affecting accuracy.

Bitrate

The bitrate is the data size that a camera generates during a second. Bitrate is directly related to pixels per frame (resolution), FPS, color depth, and encoding type, together as a combination. Bitrate can be used to control the video quality as an overall parameter as higher bitrate results in better quality. On the other hand, low bitrates save storage and transmission bandwidth. Two video streams of the exact resolution can be configured to a different bitrate, where the higher the bitrate, the higher the quality, given that other parameters are identical. Because the bitrate determines the quality of the video, the bitrate affects the performance of identity recognition. The better the quality of the video and images results in highly accurate the better identity recognition as more object features will be extracted accurately. Higher bitrates are necessary for more challenging scenes, such as partial occlusions or dark backgrounds, to achieve successful identity recognition. When the camera's field of view is wide, and objects look smaller, a higher resolution and bitrate are required for face recognition accuracy.

All Things Considered, They've Got It Taken Care Of

Quality Requirement & Modification

The cropped object image by Remark AI face detection model stage is processed into the object image quality stage. Identity or object quality indicators covering a wide range of dimensions are produced. On the contrary to the quality in the picture capture section as prior factors, indicators in this section are posterior output by models. Several modification processes are conducted to improve the condition. Moreover, various settings for these quality metrics in the SSP AI function manager can be adjusted by users in their business applications.

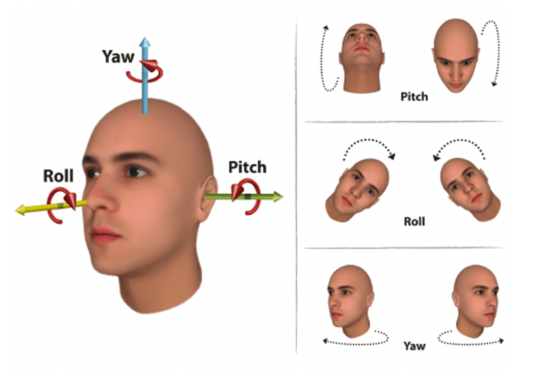

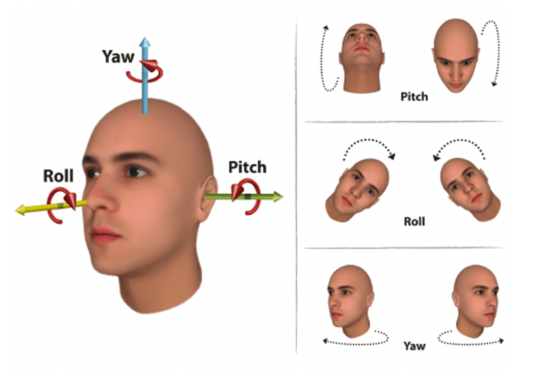

Identity/Object Pose

Real-world face pose for capture is recommended as yaw≤10°, pitch≤10°, roll≤10° The quality model also calculates identity/Object pose metrics as model object/identity pose. Object alignment is tried to get the best front face layout, e.g., rotation of the cropped object image to minimize the roll angle, but not perfect font object can always be restored for the pitch and yaw angle. Such model object pose is compared to the pre-set pose criteria to check whether processing the next section of face recognition or not. The user can adjust the criteria to optimize the performance.

Image Metrics: Size, Brightness, Contrast

Image quality metrics are also evaluated by the quality model and are compared with the pre-set criteria. Several modifications are conducted to adjust the image to boost the quality by algorithm, but it can only improve the situation to some degree.

Moreover, tolerance thresholds can be set up in the AI function manager to determine whether they are used for face recognition.

• Space between two eyes: minimum 60 pixels, suggested more than maximum 90 pixels

• Brightness: no shadow on the face, no over-exposure, and under-exposure

• Contrast: dynamic range of gray level on the face should be 85~200

Intact Quality Metrics: Blur, Distortion, Objectness

Some intact quality metrics about the completeness of the raw image are also evaluated by the quality model and are compared with the pre-set criteria. Because the low value of these metrics means the raw image data loses information in these aspects, they cannot be restored by internal algorithms. Still, the tolerance threshold can be set up in the AI function manager to determine whether they are used for face recognition.

Advantages Of Using Artificial Intelligence

Feature extraction is the most critical step in facial recognition. The feature extraction module will generate peculiar face features for each person. We have improved and optimized models, datasets, and processes. With a residual neural network (refer to the following diagram) and millions of training samples, the algorithm archives 9th place for face recognition with mask and 17th place for 1:1 face comparison (data collected on June 22, 2021) in FRVT (Face Recognition Vendor Test). It can meet the customer's needs in a variety of scenarios.

Face Detection Performance

The indicators of the face detection algorithm are described by the detection rate and the false detection rate, and the two indicators jointly evaluate the face detection algorithm. Detection rate (also called recall rate): The number of correctly detected (positive) face samples is higher than the total number of positive (including face) samples. The missed detection rate is the opposite of the detection rate, and the missed detection rate = 1 – the detection rate. False detection rate (false detection rate): The total number of samples that negative examples (not faces) are considered positive examples (faces) compared to negative examples (not faces). In large-scale tests, the performance of the face detection algorithm is as follows:

- Face detection rate 99%

- Face detection error rate 0.05%

Face Recognition Performance

The Face Recognition Vendor Test (FRVT), conducted by the U.S. National Institute of Standards and Technology (NIST), was a series of large-scale independent evaluations for face recognition systems. FRVT measures face recognition performance by FMR and FNMR. It is one of the world's most authoritative face recognition systems tests. Up to now, nearly 200 companies and research institutions worldwide have participated in this test, including all the major face recognition companies. We have achieved a Top 5 ranking among 189 tested systems and 249 entrants for the 1:1 verification wearing masks in the latest Face Recognition Vendor Test (FRVT). It also ranked top 15 on the test of the wild face in unconstrained scenarios in the FRVT test, performing strongly at the extreme view and angle in complex surveillance scenarios on various lighting, distortion, blur issues, etc. The June 25, 2021 test results established that Remark AI is the Top 1 solution in the western world, outperforming billion-dollar unicorns. The following table shows the test results submitted with the remarkai-003 model on June 22, 2021.

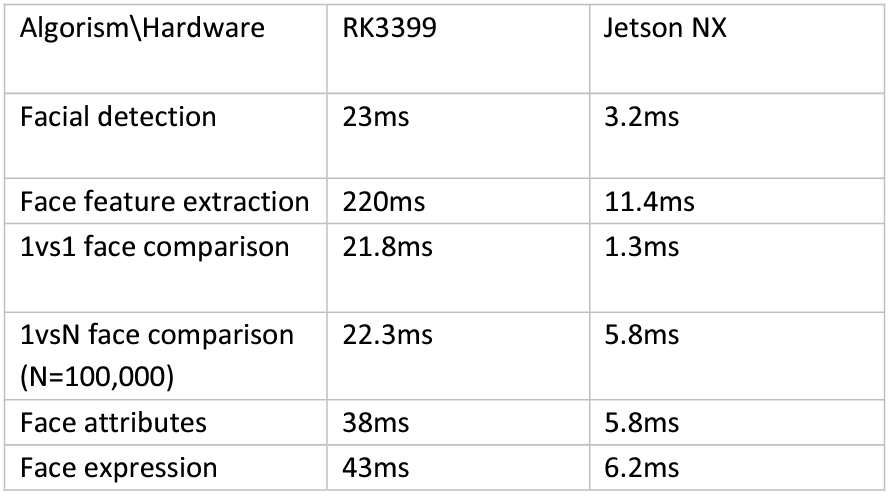

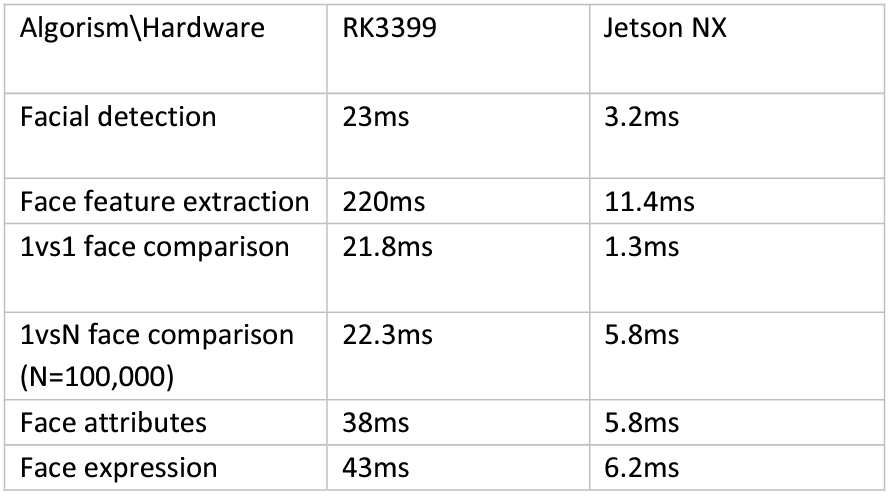

Speed Performance

REMARK HOLDINGS, INC.

(NASDAQ: MARK)

THE IMPACT OF AI DETECTION AND REAL-TIME ANALYSIS

Crime Prevention

Face recognition technology plays a pivotal role in preventing crime by enhancing law enforcement capabilities. Its ability to rapidly identify individuals in crowded public spaces aids in tracking and locating suspects. In scenarios such as criminal investigations, security forces can use facial recognition to match images captured on surveillance cameras with criminal databases, helping identify and apprehend individuals with outstanding warrants or connections to criminal activities. This proactive approach contributes significantly to crime prevention and public safety.

Public Safety

Ensuring public safety is a paramount benefit of face recognition technology. In crowded events, transportation hubs, and urban centers, it serves as a valuable tool for monitoring and responding to potential threats in real-time. The technology can be employed to detect individuals on watchlists, enhancing security measures and allowing for swift intervention. Additionally, face recognition aids in the quick identification of missing persons, ensuring a rapid and coordinated response in emergencies. By bolstering situational awareness, this technology fosters an environment where individuals can feel secure and protected.

Economic Impact

Face recognition's positive influence on public safety has direct implications for the economy. A safer environment encourages economic activities by fostering public confidence, attracting investments, and promoting tourism. Businesses thrive in secure surroundings, leading to increased foot traffic, consumer spending, and economic growth. Moreover, the technology's applications in access control and fraud prevention contribute to safeguarding financial transactions and protecting businesses from illicit activities, thereby fostering a more robust and resilient economic landscape.

Fraud Prevention and Cybersecurity

In the digital age, face recognition serves as a formidable tool in preventing fraud and bolstering cybersecurity. Industries such as finance and e-commerce leverage facial recognition for secure authentication processes, reducing the risk of unauthorized access or identity theft. This not only protects individuals but also fortifies the overall digital infrastructure, safeguarding critical systems and sensitive information from malicious actors.

Efficient Law Enforcement

Face recognition expedites law enforcement processes by automating the identification of individuals involved in criminal activities. This efficiency allows law enforcement agencies to allocate resources more effectively, respond promptly to incidents, and streamline investigations. The technology's ability to analyze vast amounts of data quickly enables law enforcement to connect disparate pieces of information, uncover patterns, and solve cases faster, contributing to a safer society.

Privacy Considerations and Ethical Implementation

While recognizing the significant benefits of face recognition, it is crucial to address privacy concerns and ensure ethical implementation. Striking a balance between security and privacy is essential to build public trust in the technology. Implementing robust data protection measures, obtaining consent where necessary, and adhering to ethical guidelines are essential components of ensuring that face recognition technologies are used responsibly and respect individuals' rights. A thoughtful and transparent approach in deployment ensures that the benefits of face recognition are realized without compromising privacy and civil liberties. Remark Holdings, Inc. (NASDAQ: MARK) is paving the way to an effective, responsible future.

DIGGING DEEP

REMARK HOLDINGS, INC.

(NASDAQ: MARK)

Strategic Partnerships

REMARK HOLDINGS, INC. (NASDAQ: MARK) has strategically positioned itself in the market through key partnerships, enhancing its capabilities and market reach. The collaboration with Arrow Electronics and Intel signifies a notable milestone, enabling Remark to extend its Smart Safety Platform (SSP) to over 200,000 customers through Arrow's distribution network. This partnership facilitates the integration of Remark's AI-powered video analytics with Intel's high-performance processors, creating a comprehensive solution for real-time video analysis in various sectors, including public safety, security, and smart city initiatives.

Market Expansion and Collaboration

The partnership with NVIDIA, where REMARK HOLDINGS, INC. (NASDAQ: MARK) joined forces with PNY to present at the Smart City Expo World Congress, illustrates the company's commitment to market expansion and cutting-edge technology. By participating in events of global significance, Remark not only showcases its products but also fosters collaboration with industry leaders, positioning itself as a key player in the smart city ecosystem. Such collaborations contribute to the company's growth and strengthen its presence in emerging markets.

Financial Stability and Resilience

REMARK HOLDINGS, INC. (NASDAQ: MARK) has demonstrated financial stability and resilience, as evidenced by its positive net income in the fiscal year ending December 31, 2021. The ability to weather economic challenges and generate positive net income reflects the company's sound financial management and effective business strategies. This financial strength positions Remark to pursue growth opportunities, invest in research and development, and navigate market fluctuations with confidence.

Investment in Research and Development

Financial strength is often coupled with a commitment to innovation. Remark's consistent investment in research and development is a testament to its forward-thinking approach. By allocating resources to enhance its AI-powered video analytics solutions, the company stays at the forefront of technological advancements. This commitment not only ensures the competitiveness of its current offerings but also positions Remark to adapt to evolving market demands.

Stock Performance and Investor Confidence

The financial health of REMARK HOLDINGS, INC. (NASDAQ: MARK) is reflected in its stock performance and investor confidence. Positive financial results, coupled with strategic partnerships and technological advancements, contribute to a favorable perception among investors. The company's stock performance is an important indicator of its market standing and the trust it garners from the investment community.

Sustainability and Long-Term Viability

Beyond short-term financial metrics, Remark's partnerships and financial strength contribute to its long-term viability. Sustainability in the business landscape involves not only profitability but also adaptability to changing market dynamics. Remark's ability to form strategic partnerships, maintain positive cash flows, and invest in innovation positions it as a company with the potential for sustained growth and longevity in the competitive landscape.

Sources

- Source 1: https://finance.yahoo.com/quote/MARK?p=MARK

- Source 2: https://finance.yahoo.com/news/remark-holdings-sets-third-quarter-140100332.html

- Source 3: https://finance.yahoo.com/news/remark-announces-sales-marketing-collaboration-130100928.html

- Source 4: https://finance.yahoo.com/news/remark-holdings-recognized-representative-vendor-130100969.html

- Source 5: https://finance.yahoo.com/news/remark-holdings-inc-joins-nvidia-130100674.html

- Source 6: https://finance.yahoo.com/news/remark-holdings-inc-nasdaq-mark-163623603.html

- Source 7: https://www.nasdaq.com/market-activity/stocks/mark/financials

- Source 8: https://www.nasdaq.com/market-activity/stocks/mark/sec-filings

- Source 9: https://www.nasdaq.com/market-activity/stocks/mark/press-releases

- Source 10: https://www.nasdaq.com/press-release/remark-holdings-sets-third-quarter-2023-financial-results-call-for-november-20-2023

- Source 11: https://www.nasdaq.com/press-release/remark-announces-sales-and-marketing-collaboration-with-arrow-electronics-and-intel

- Source 12: https://www.nasdaq.com/press-release/remark-holdings-is-recognized-as-a-representative-vendor-for-computer-vision

- Source 13: https://www.nasdaq.com/press-release/remark-holdings-inc.-joins-nvidia-as-a-partner-of-pny-to-present-at-the-smart-city

- Source 14: https://www.remarkholdings.com/

- Source 15: https://www.remarkholdings.com/docs/Remark%20Vision%20Platform%20White%20Paper.pdf

- Source 16: https://www.remarkholdings.com/docs/Remark%20Vision%20-%20Identity%20Recognition%20White%20paper.pdf

- Source 17: https://www.remarkholdings.com/docs/Remark%20Vision%20Public%20Security.pptx

- Source 18: https://remarkvision.com/

- Source 19: https://www.remark-entertainment.cn/

- Source 20: https://www.bikini.com/

- Source 21: https://www.remarkholdings.com/ir.html

- Source 22: https://www.remarkholdings.com/sustainability/

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and Lifewater Media, Virtus Media Group LLC has been hired by Lifewater Media LLC for a period beginning on 11/15/2023 and ending 11/16/2023 to publicly disseminate information about NASDAQ: MARK via digital communications. We have been paid seven thousand five hundred dollars USD. Virtus media agrees to pay Social media influencer 1. two hundred dollars USD,Social media influencer 2. two hundred dollars USD, Social media influencer 3. three hundred fifty dollars USD, Social media influencer 4. five hundred dollars USD, Social media influencer 5. two hundred fifty dollars USD.