LATEST NEWS

Benuvia Operations, LLC and Chromocell Therapeutics Corp. Announce Strategic Partnership to Advance Healthcare Solutions

6 Reasons Why Chromocell Therapeutics (NYSEAMERICAN: CHRO) Could Be Poised For Significant Upside Potential in 2024

IDENTIFYING THE OPPORTUNITY

RECENT IPO MEANS WE HAVE BENCHMARK PRICE AND DISCOUNTS

With a valuation price of over $6 and evidence of strong post-IPO buy-up, we believe this is primed for a bullish rally!

TARGETS

Target #1: $3.96 (+13.47%)

Target #2: $4.29 (+22.92%)

Target #3: $4.60 (+31.81%)

Target #4: $4.81 (+37.82%)

Bonus Target: $5.47-$6+ (+56.73%)

Support: $3.20

Chromocell Therapeutics Corporation

(NYSEAMERICAN: CHRO)

Introducing the leading treatment innovator of the future TO THE MARKET

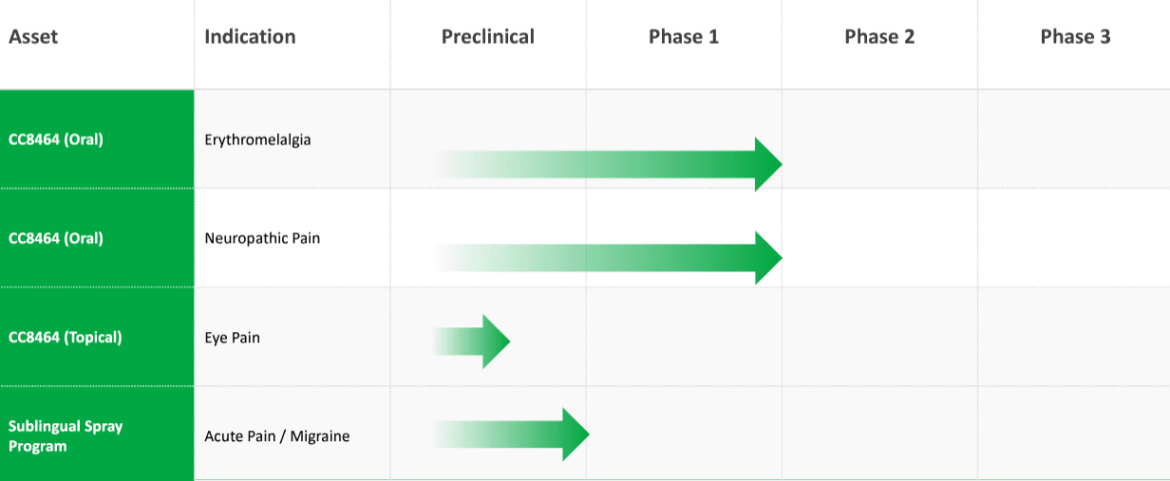

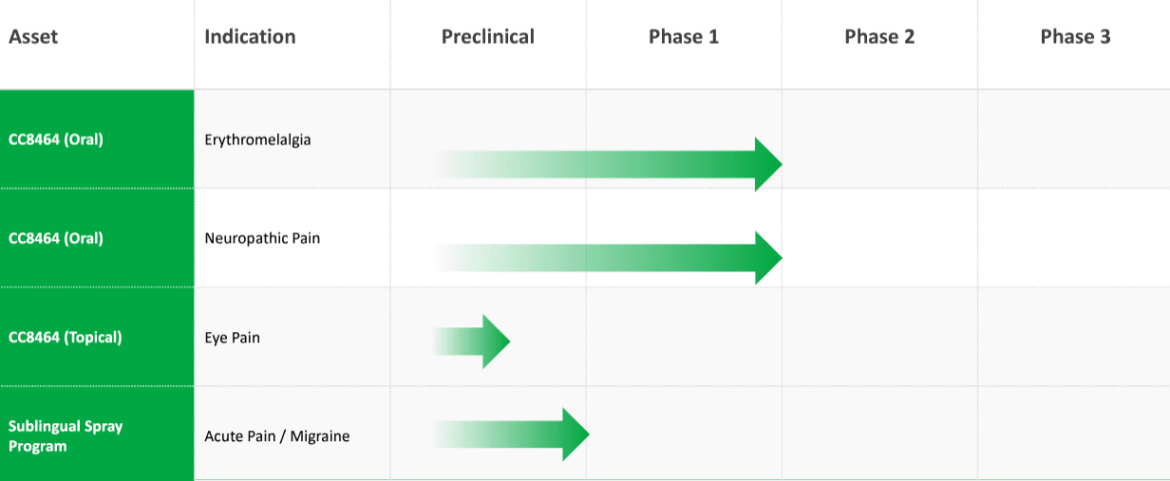

Chromocell Therapeutics Corporation (NYSEAMERICAN: CHRO) is a cutting-edge life sciences company dedicated to revolutionizing pain treatment through innovative approaches. The company's primary focus is on the development of CC8464, a patented non-opioid pain treatment compound designed to block sodium channels (NAV). By specifically targeting NAV1.7, Chromocell Therapeutics Corporation (NYSEAMERICAN: CHRO) aims to address various pain-related conditions, including Erythromelalgia, Neuropathic Pain, and Eye Pain. Their strategic pipeline also includes a sublingual spray program for Acute Pain/Migraine, showcasing the company's commitment to diverse and effective pain management solutions.

In its recent investor presentation, Chromocell Therapeutics Corporation (NYSEAMERICAN: CHRO) outlined a comprehensive development plan for Erythromelalgia, a rare neurovascular condition affecting thousands of patients worldwide. The company's Phase 1 trials for CC8464 have yielded positive results, with an emphasis on addressing a moderate drug-induced rash through a proposed gradual dose-escalation regime, reflecting the company's dedication to safety and efficacy. ChromoCell's proactive strategy involves seeking orphan drug designation and breakthrough status for CC8464, potentially providing regulatory advantages and accelerated development timelines.

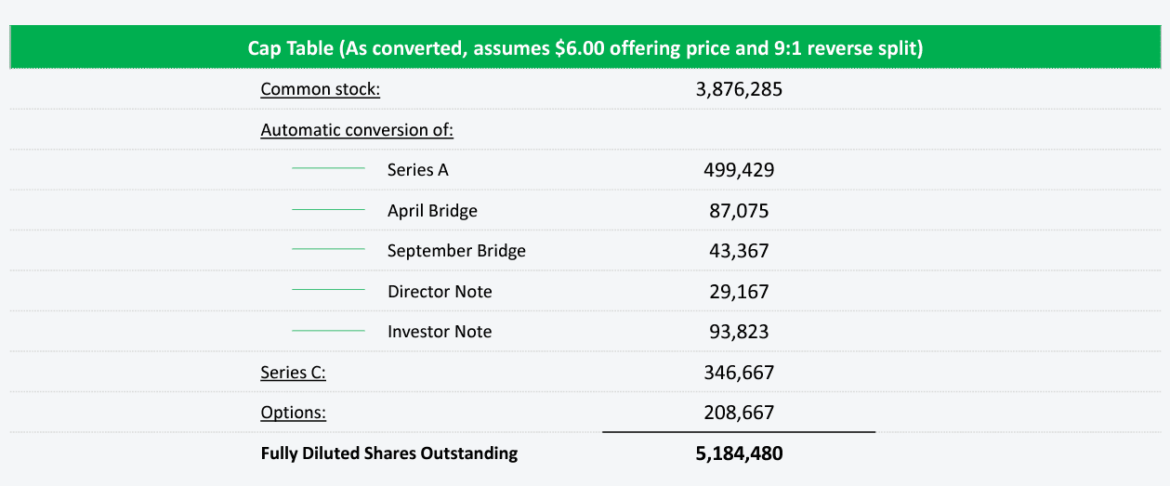

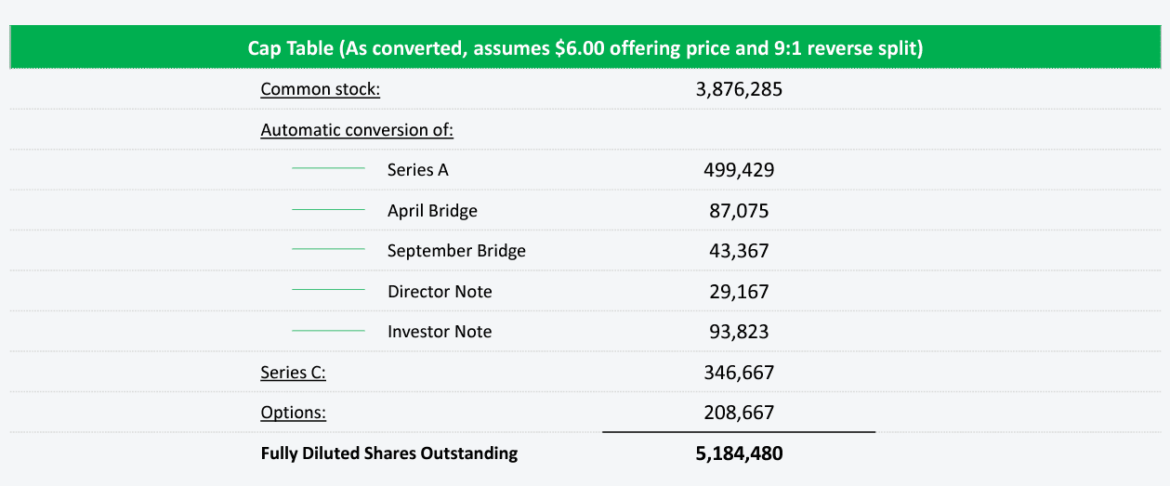

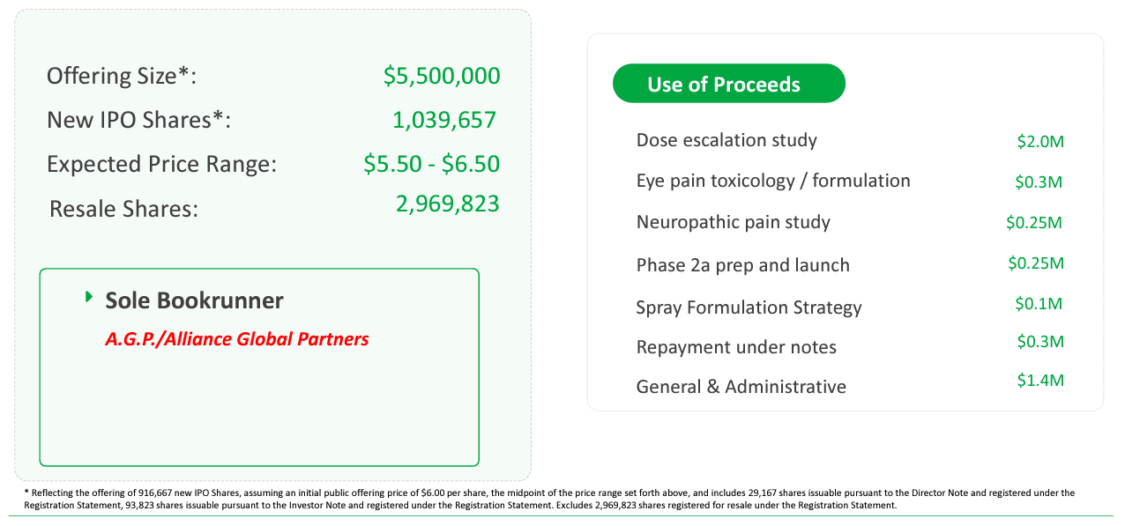

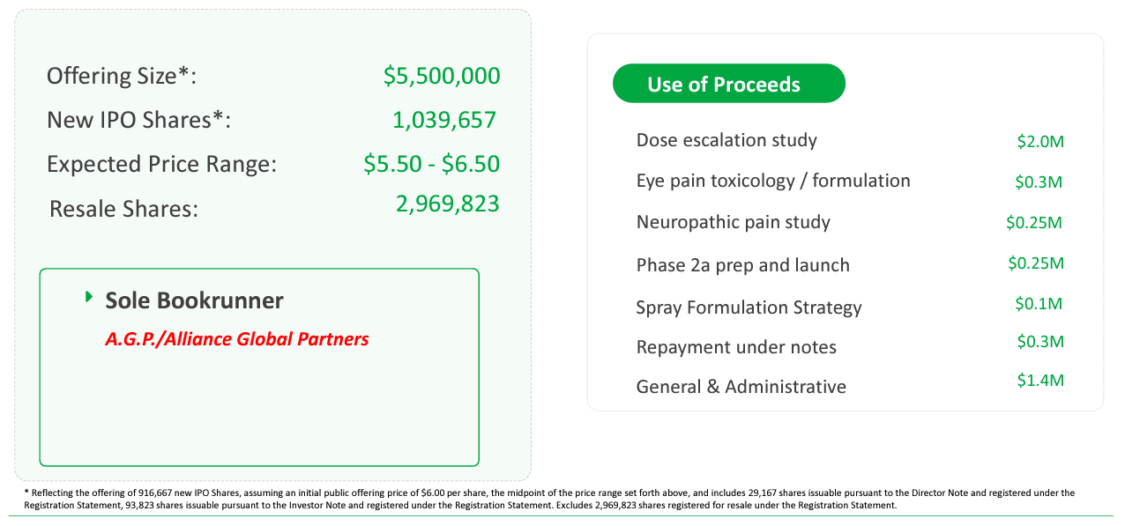

The company's robust financials and strategic utilization of funds were evident in its recent offering, where Chromocell Therapeutics Corporation (NYSEAMERICAN: CHRO) successfully raised $5.5 million. The capital raised is earmarked for critical initiatives, including a dose escalation study, in vivo studies for eye pain treatment, and the launch of a Phase II proof-of-concept study for CC8464. This allocation underscores the company's commitment to advancing its clinical programs and accelerating the path to commercialization.

ChromoCell's leadership team, led by CEO & Chief Financial Officer Frank Knuettel and Chief Medical Officer Dr. Eric Lang, brings a wealth of experience in both business management and pharmaceutical development. With a track record of raising over $300 million via various funding channels, Knuettel and his team have positioned Chromocell Therapeutics Corporation (NYSEAMERICAN: CHRO) for success in navigating the complexities of drug development and commercialization.

Investors considering Chromocell Therapeutics Corporation (NYSEAMERICAN: CHRO) may find reassurance in the company's commitment to addressing diverse pain indications, its positive Phase 1 results, and the strategic allocation of funds for upcoming milestones. As the company progresses through clinical trials and regulatory processes, it aims to solidify its position as a leader in non-opioid pain treatments, contributing to a paradigm shift in pain management strategies.

RECENT BREAKTHROUGH IPO

Chromocell Therapeutics Corporation (NYSEAMERICAN: CHRO) recently embarked on an exciting journey with its initial public offering (IPO), marking a significant milestone in the company's trajectory. The IPO, led by sole bookrunner A.G.P./Alliance Global Partners, aimed to raise $5.5 million through the issuance of 1,039,657 new shares at an expected price range of $5.50 to $6.50 per share. This strategic move signifies the company's confidence in its promising pipeline of innovative therapies, particularly the development of CC8464, a patented non-opioid pain treatment compound leveraging sodium channel blockade. The use of IPO proceeds includes funding critical studies such as the dose escalation study, eye pain toxicology/formulation, and the preparation and launch of a Phase 2a proof-of-concept study for CC8464.

Investor interest in ChromoCell's IPO can be attributed to the compelling investment highlights provided by the company. Chromocell Therapeutics Corporation (NYSEAMERICAN: CHRO) is a life sciences company dedicated to addressing the urgent need for non-opioid pain treatments. With a diverse clinical pipeline targeting rare diseases like Erythromelalgia, larger markets such as eye pain, and broader indications like neuropathic pain and acute pain/migraine, the company demonstrates a well-rounded approach. The positive results from Phase 1 trials and the strategic allocation of IPO funds for further clinical development and commercialization underscore ChromoCell's commitment to advancing innovative solutions in the pain management landscape.

Chromocell Therapeutics Corporation

(NYSEAMERICAN: CHRO)

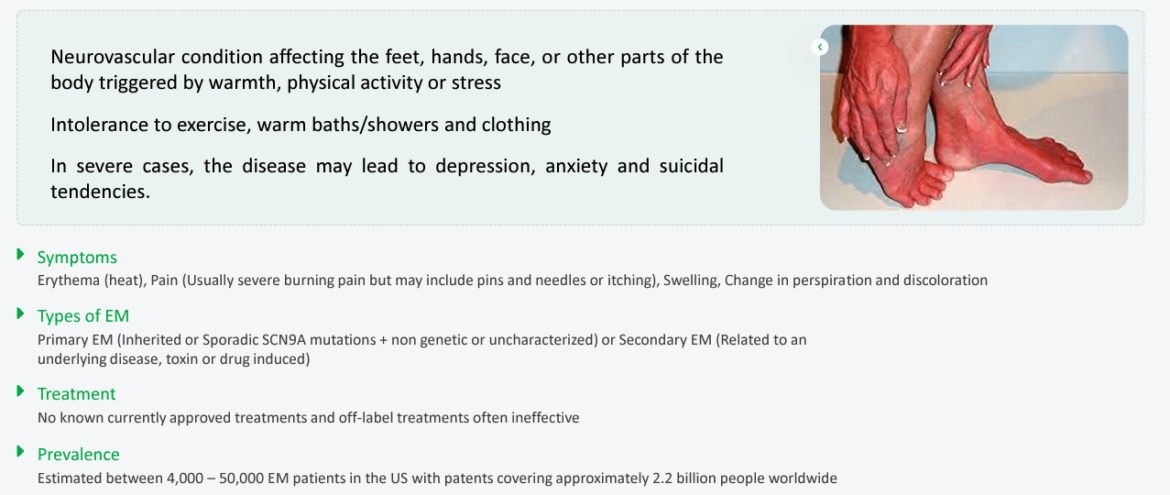

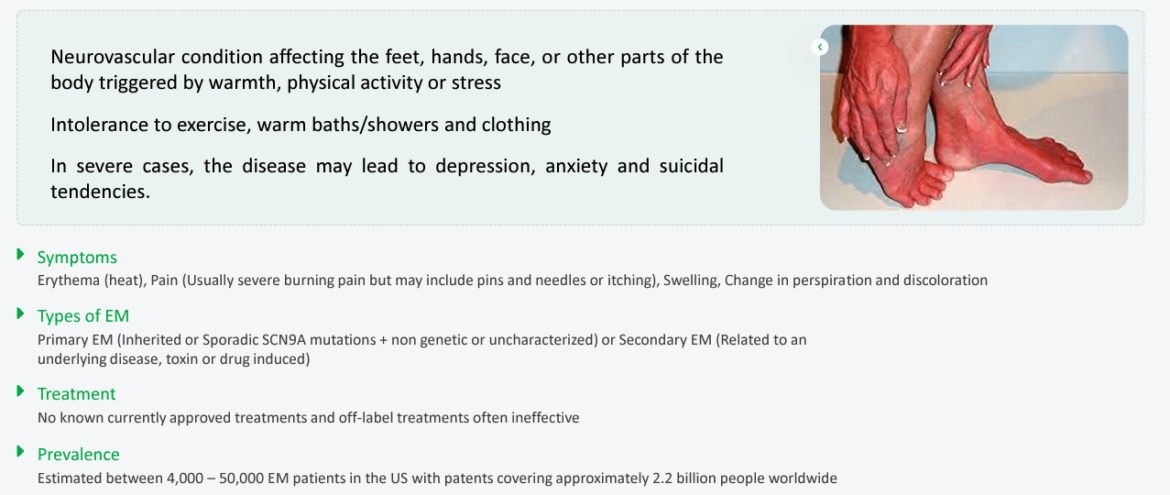

Erythromelalgia (EM) And Other Neurovascular Diseases, Their Impact, & The Future

The Problem

Erythromelalgia is a rare neurovascular condition that manifests as a severe and debilitating disorder, characterized by intense burning pain, erythema (redness), swelling, and increased temperature in affected extremities. The condition is triggered by warmth, physical activity, or stress and is often intolerable for those affected. Erythromelalgia can significantly impact the quality of life for patients, leading to functional limitations, emotional distress, and, in severe cases, contributing to depression, anxiety, and even suicidal tendencies. The rarity of the disease and the lack of effective clinical treatments highlight the critical need for innovative therapeutic solutions.

Neurovascular conditions, such as Erythromelalgia, represent a complex intersection of neurological and vascular components. The importance of finding effective treatments for these conditions lies in addressing not only the pain and discomfort experienced by patients but also in mitigating the potential long-term psychological and physiological consequences. In the case of Erythromelalgia, the neurovascular nature of the disorder underscores the need for targeted therapies that can modulate the intricate interplay between the nervous system and blood vessels. Such treatments not only alleviate symptoms but also aim to restore normal function and prevent the progression of the condition.

Chromocell Is The Solution

Chromocell Therapeutics Corporation (NYSEAMERICAN: CHRO) recognizes the urgency of addressing the unmet medical needs associated with Erythromelalgia. The company's dedication to developing CC8464, a patented non-opioid pain treatment compound through sodium channel blockade (NAV), reflects a commitment to finding innovative solutions for neurovascular conditions. The completion of Phase 1 trials and the proposed dose escalation regime, which addresses common side effects like drug-induced rashes, are significant steps toward advancing CC8464 as a viable therapeutic option.

The pipeline expansion to include other neurovascular indications, such as eye pain and neuropathic pain, further highlights ChromoCell's comprehensive approach to addressing diverse aspects of neurovascular health. These initiatives not only contribute to the development of potentially groundbreaking therapies but also signify the company's broader mission to enhance the understanding and treatment of neurovascular conditions, extending beyond the confines of Erythromelalgia.

In summary, the pursuit of effective treatments for neurovascular conditions, exemplified by Erythromelalgia, is crucial for improving the lives of individuals affected by these disorders. Chromocell Therapeutics Corporation (NYSEAMERICAN: CHRO)'s focus on innovative approaches and commitment to developing targeted therapies position the company at the forefront of addressing the complex challenges posed by neurovascular conditions, offering hope for patients and contributing to advancements in the broader field of pain management and neurological health.

Chromocell Therapeutics Corporation

(NYSEAMERICAN: CHRO)

Chromocell's Strategic Positioning in the Market

Pipeline & Partnerships

ChromoCell Therapeutics boasts a dynamic pipeline that underscores its commitment to addressing diverse medical needs through innovative solutions. At the forefront is CC8464, a patented non-opioid pain treatment compound designed to modulate sodium channel activity. The pipeline includes three active clinical/pre-clinical programs, each targeting specific indications. CC8464 is being developed in oral and topical formulations for Erythromelalgia, Neuropathic Pain, and Eye Pain. The company's strategic expansion into different therapeutic areas ensures a well-rounded portfolio that mitigates risks and maximizes potential impact in the pain management landscape.

Particularly noteworthy is the inclusion of a Sublingual Spray Program designed for Acute Pain/Migraine. This program signifies ChromoCell's commitment to addressing immediate and severe pain conditions, offering a potential alternative to traditional oral medications. The diversification of the pipeline not only broadens the company's reach across various pain-related disorders but also positions ChromoCell as a key player in the development of novel treatments for a spectrum of neurological conditions.

In addition to its robust pipeline, ChromoCell Therapeutics has strategically secured exclusive worldwide licenses for key formulations. The licenses include sublingual diclofenac and rizatriptan/ondansetron, showcasing the company's focus on expanding its portfolio through partnerships. These formulations, targeting acute pain and migraine treatment, align with ChromoCell's vision to offer a comprehensive suite of therapeutic options for patients suffering from a wide range of pain-related disorders.

The partnerships established by ChromoCell exemplify a collaborative approach to drug development. Through agreements with entities like Benuvia Operations, LLC, the company has gained exclusive licenses for formulations crucial to its pipeline expansion. This collaborative model enhances ChromoCell's capabilities, providing access to specialized expertise and accelerating the development of potential breakthrough therapies.

As ChromoCell Therapeutics advances its pipeline, the company's dedication to rigorous research and development is complemented by strategic partnerships that amplify its impact. By securing exclusive licenses and collaborating with industry experts, ChromoCell not only expands its technological arsenal but also strengthens its position as a leader in the evolving landscape of pain management and neurological therapeutics. These partnerships reinforce the company's commitment to delivering cutting-edge solutions to patients in need, ultimately contributing to advancements in the broader field of healthcare.

Chromocell Therapeutics Corporation

(NYSEAMERICAN: CHRO)

Chromocell's Expert leadership

Management team

FRANK KNUETTEL II - INTERIM CEO AND CFO

Knuettel has 30 years of management experience, growing early-stage and smallcap public companies. He has spent most of his career as a Chief Financial or Chief Strategic Officer at early-stage companies. He has raised more than $300 million via venture, public equity and debt offerings. He has managed more than 15 mergers and acquisition and has handled large-scale licensing transactions with fortune 50 companies. Mr. Knuettel also holds numerous board positions, at both public and private companies, including 180 Life Sciences (ATNF), ECOM Medical, Murphy Canyon Acquisition Corp. (MURF) and Relativity Acquisition Corp. (RACY). He holds an MBA from The Wharton School and a BA from Tufts University.

ERIC LANG - CMO

Dr. Lang is an Anesthesiologist and Pain Management Specialist with over 26 years of experience in the pharmaceutical industry. During his pharmaceutical career, he has had both broad-based drug and device development expertise in a variety of therapeutic areas. Dr. Lang has experience in designing development programs from early translational stages through phase III including the successful filing of several recent INDs and NDAs. Dr. Lang began his career with J&J and later worked for Novartis, Javelin Pharmaceuticals, Grunenthal USA, Covance, EnteraBio and Nevakar Inc. Dr. Lang earned his MD from Ben Gurion University, Israel and completed post graduate training at Emory University in Atlanta.

Board of directors

TODD DAVIS - CHAIRMAN, BOARD OF DIRECTORS

Todd Davis is Chief Executive Officer and a member of the Board of Directors of Ligand. Mr. Davis has nearly 30 years of experience in biopharmaceutical and life sciences operations and investing. He has been involved in over $3 billion of healthcare financings including growth equity, public equity turnarounds, structured debt and royalty acquisitions. He has led, structured and closed more than 40 intellectual property licenses, as well as royalty and hybrid royalty-debt transactions. Prior to founding RoyaltyRx Capital, Mr. Davis was a founder and Managing Partner at HealthCare Royalty Partners (formerly Cowen HealthCare Royalty Partners), a global healthcare investment firm. Previously, he was a partner responsible for biopharmaceutical growth equity investments at Apax Partners. Mr. Davis began his career at Abbott Laboratories, where he held multiple sales and marketing positions of increasing responsibility. Subsequently he led corporate development and held strategic planning and general management responsibilities at Elan Pharmaceuticals. Mr. Davis is a navy veteran and holds a B.S. from the U.S. Naval Academy and an M.B.A. from Harvard University. He also serves on the boards of Palvella Therapeutics, a privately held biopharmaceutical company, Vaxart, a publicly traded biotechnology company, and ViroCell Biologics, Ltd., a privately held biotechnology company.

EZRA FRIEDBERG - BOARD OF DIRECTORS

Ezra Friedberg has served as a member of our Board since May 2021. Ezra is a seasoned investor with more than twenty years of investing experience in both public and private companies. He invests actively in the biotech space and has served on the board of directors of Humanigen (HGEN), a clinical-stage biopharmaceutical company which develops monoclonal antibodies. Mr. Friedberg is a graduate of Johns Hopkins University.

RICK MALAMUT - BOARD OF DIRECTORS

Dr. Malamut is currently Chief Medical Officer at MedinCell Inc. He was most recently Chief Medical Officer and Executive Vice President at Collegium Pharmaceuticals and has also served as Chief Medical Officer for Braeburn Pharmaceuticals, Inc. where he was responsible for the company’s medical affairs, non-clinical and clinical development, clinical operations, research and development quality assurance, and pharmacovigilance functions. Prior to that, Dr. Malamut had similar responsibilities as Chief Medical Officer at Avanir Pharmaceuticals and was Senior Vice President of Global Clinical Development at Teva Pharmaceutical Industries Ltd where he was responsible for Pain, Neuropsychiatry, Oncology, and New Therapeutic Entities. His experience also includes roles of increasing responsibility focusing on early clinical development and translational medicine in Neurology, Psychiatry and Analgesia at Bristol-Myers Squibb and AstraZeneca.

Dr. Malamut earned his medical degree from Hahnemann University in Philadelphia and completed both a residency in Neurology and a fellowship in Neuromuscular disease. He worked as a board-certified academic and clinical neurologist for 17 years and has more than 50 publications in the fields of pain medicine, neuromuscular disease, autonomic disease, and neurodegenerative disease.

CHIA-LIN SIMMONS - BOARD OF DIRECTORS

Ms. Simmons is the CEO of LogicMark, Inc. (Nasdaq: LGMK), the former CEO at LookyLoo and a former executive at Google, Harman International and Amazon. She is a current Board Member of New Energy Nexus, an international NGO that support clean energy entrepreneurs. Ms. Simmons graduated Magna cum Laude and Phi Beta Kappa from U.C. San Diego. She received her MBA from Cornell University, where she was a Park Leadership Fellow and her JD from George Mason University School of Law.

Scientific advisors

STEVE WAXMAN - CHAIR OF SCIENTIFIC ADVISORY BOARD

Stephen Waxman is the Bridget Flaherty Professor of Neurology, Neurobiology, and Pharmacology at Yale University, and served as Chairman of Neurology at Yale from 1986 until 2009. He founded the Neuroscience & Regeneration Research Center at Yale in 1988 and is its Director. Prior to moving to Yale, he worked at Harvard, MIT, and Stanford. He is a Visiting Professor at University College London. Dr. Waxman received his BA from Harvard, and his MD and PhD degrees from Albert Einstein College of Medicine. He is tightly involved in our clinical development and arguably the leading expert in NaV1.7/Erythromelalgia, resulting from his work in leading an international coalition that identified sodium channel mutations as causes of peripheral neuropathy (PNAS, 2012). He has used atomic-level modeling to advance pharmacogenomics, first in the laboratory (Nature Comm., 2012), and then in the clinic in a paper (JAMA Neurology, 2016). His work is the basis for the new class of medications for neuropathic pain, underlying the development of CC8464.

ROBERT DWORKIN - CHAIR OF SCIENTIFIC ADVISORY BOARD

Robert H. Dworkin received his BA from the University of Pennsylvania and his PhD from Harvard University. He is a Professor of Anesthesiology and Perioperative Medicine, Neurology, and Psychiatry and Professor in the Center for Health + Technology at the University of Rochester School of Medicine and Dentistry. Dr. Dworkin is Director of the Analgesic, Anesthetic, and Addiction Clinical Trial Translations, Innovations, Opportunities, and Networks (ACTTION) public-private partnership with the U.S. Food and Drug Administration (FDA) and a Special Government Employee of the FDA Center for Drug Evaluation and Research. He is an Associate Editor of Pain and a member of the Editorial Boards of the Canadian Journal of Pain and the Journal of Pain. Dr. Dworkin’s major research interests are (1) methodologic aspects of analgesic clinical trials and (2) treatment and prevention of chronic and acute neuropathic and musculoskeletal pain. The primary focus of his current research involves the identification of factors that increase the assay sensitivity of clinical trials to detect differences between an active and a placebo control or comparison treatment. In ongoing studies, he and his colleagues are examining the relationships between clinical trial results and their research designs, patient characteristics, statistical methods, and outcome measures.

Sources

- Source 1: https://chromocell.com/

- Source 2: https://chromocell.com/erythromelalgia/

- Source 3: https://chromocell.com/pipeline/

- Source 4: https://chromocell.com/management-team/

- Source 5: https://chromocell.com/eye-pain/

- Source 6: https://ir.chromocell.com/

- Source 7: https://ir.chromocell.com/news-events/presentations

- Source 8: https://ir.chromocell.com/company-information

- Source 9: https://ir.chromocell.com/financial-information

- Source 10: https://ir.chromocell.com/stock-data

- Source 11: https://ir.chromocell.com/sec-filings

- Source 12: https://ir.chromocell.com/corporate-governance

- Source 13: https://www.nasdaq.com/market-activity/stocks/chro/historical

- Source 14: https://finance.yahoo.com/quote/CHRO/

- Source 15: https://finance.yahoo.com/news/benuvia-operations-llc-chromocell-therapeutics-130000545.html

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and JRZ Capital LLC, Virtus Media LLC has been hired by JRZ Capital LLC for a period beginning on 03/06/2024 and ending 03/31/2024 to publicly disseminate information about NYSEAMERICAN: CHRO via digital communications. We have been paid fifty thousand dollars USD. Social media influencer 1. fifteen hundred dollars USD, Social media influencer 2. six hundred dollars USD, Social media influencer 3. seven hundred dollars USD, Social media influencer 4. six hundred dollars USD, Social media influencer 5. five hundred dollars USD.