LATEST NEWS

American Copper Initiates A 5,000m Drill Program At Its Flagship Lordsburg Project

5 Reasons Why American Copper Development Corp. (OTCMKTS: ACDXF) Could Be Poised For Significant Upside Potential in 2023

IDENTIFYING THE OPPORTUNITY

BULLISH CONFLUENCE LEADS THE WAY

We have bullish trendline support as well as historical structural support, with a healthy retracement to top it off!

TRADE CONFIRMATION

Ideally, we would see a strong open and sustain a volume push over 10k. We need to see it push away from this local support trendline and maintain this longer-term support in doing so. Once we see that, we should see some nice confirmations and can ride the wave.

TARGETS

Target #1: $0.24(+8.84%)

Target #2: $0.2653(+20.32%)

Target #3: $0.28(+26.98%)

Bonus: $0.32 (+45.12%)

Support: $0.2125

American Copper Development corp.

(OTCMKTS: acdxf)

With copper being so hot right now, ACDXF may be one of the arena’s biggest hidden gems.

Lithium has been having its moment in the sun, but copper is quickly pushing itself to the front of the stage. The metal is going to be crucial for the world’s transition to electric vehicles. 2022 was the biggest year for electric vehicles in the United States on record… Automakers are hustling to claim their position in the electric vehicle future. A copper shortage could send copper prices booming and copper-related companies like American Copper Development Corp. (OTCQB: ACDXF) may explode alongside!

American Copper Development Corp. (OTCMKTS: ACDXF) is embarking on taking full advantage if copper prices explode, as the company continues its hunt for a major copper discovery on its flagship property…. Nothing is early stage here…. Years of preparation have been spent on the company’s high-grade past-producing copper district property. Now it is time to drill, and this is one of the most exciting times for any exploration company. With plenty of cash on hand and drilling to commence soon, the results could quickly catapult this quietly trading company into the spotlight!

American Copper Development Corp.

(OTCMKTS: ACDXF)

Could ACDXF be the biggest copper play of 2023 going undetected?

The race for copper is intensifying as renewable energy continues to go mainstream. From electric vehicles to solar panels, copper is expected to be a big player. The lithium boom was the big story of 2022 but in 2023 it could be the copper boom. A copper shortage and a highly anticipated transition to a lower carbon economy make it an ideal time to add American Copper Development Corp. (OTCQB: ACDXF) to your radar!

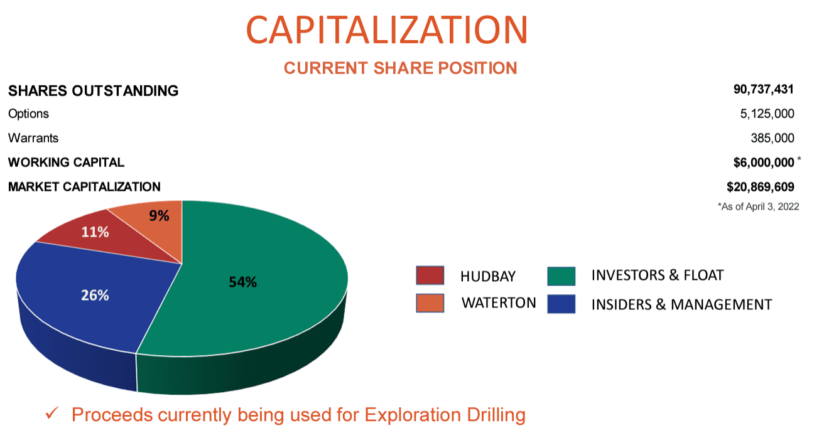

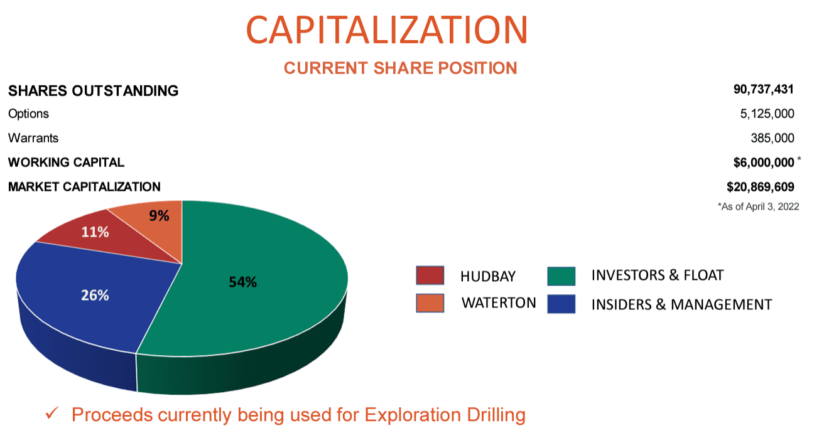

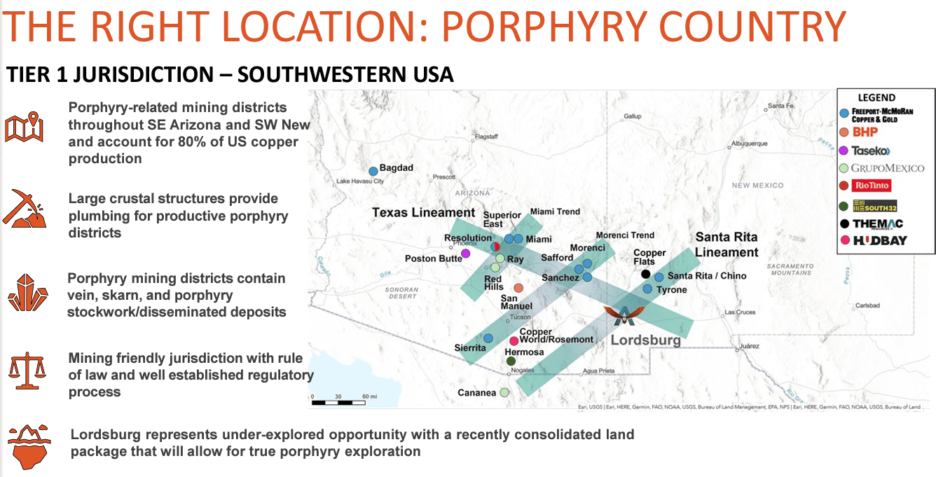

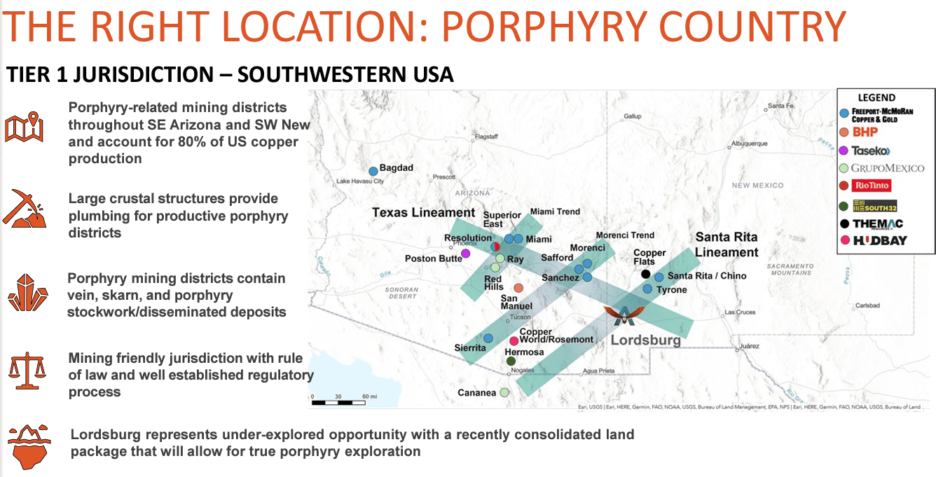

The company’s flagship asset is a staggering 18,700 acre land package that includes 100 patented claims totaling 1,900 acres. The claims are adjacent to the claims of industry giants Rio Tinto and BHP! Modern technology that has never been used before will be utilized on the company’s project. New Mexico offers American Copper an opportunity to grow a successful copper-focused company. Other mining legends in the area include Taseko, Freeport, and Hudbay Minerals. Hudbay is also the company’s largest shareholder…

Now is the time to see why insiders are loading up and how ACDXF’s flagship project could lead to sky-high shareholder growth.

American Copper Development Corp.

(OTCMKTS: ACDXF)

KEY TAKEAWAYS

RESOLUTION HAS HIGH-GRADE COPPER VEINS SIMILAR TO LORDSBURG VEINS AT BONNEY AND MISERS CHEST

PRESERVATION OF CRETACEOUS SEDIMENTS AT LORDSBURG SIMILAR TO MESOZOIC BASIC AT RESOLUTION

POTENTIAL FOR SKARN DEVELOPMENT AT LORDSBURG PROVIDING PALEOZOIC CARBONATES HAVE NOT BEEN ERODED

RESOLUTION IS A MAGNETIC AND MAGNETOTELLURIC HIGH - LORDSBURG HAS LARGE MAGNETIC HIGH OVER AND ADACENT TO BONNEY AND MISERS CHEST

RESOLUTION IS 1.9 BILLION TONNES GRADING 1.5% Cu1

Introducing the Management Team of American Copper Development Corp. (OTCMKTS: ACDXF)

Rick Van Nieuwenhuyse - Chairman

Mr. Van Nieuwenhuyse was appointed to serve as President & CEO of CONTANGO ORE in 2020. He previously served as President & CEO of Trilogy Metals Inc. from January 2012 until December 2019.

Between May 1999 and January of 2012, he served as the President & CEO of NOVAGOLD, INC., a company that he founded. He served as the Vice President of Exploration for Placer Dome from 1990 to 1997. Mr. Van Nieuwenhuyse holds a Candidature degree in Science from Universite de Louvain, Belgium, and a Master of Science degree in Geology from the University of Arizona. Mr. Van Nieuwenhuyse currently serves on the board of directors for Valhalla Metals Inc. Mr. Van Nieuwenhuyse has over forty years of experience.

Daniel Schieber - President & CEO

Mr. Schieber established his career in metals and mining finance as an analyst for the Stabilitas Group of Funds in 2005. During this time the fund grew from 3M EUR under management to 240M EUR becoming the best performing Gold/Silver fund in Germany.

In 2009, he co-founded Euroscandic International Group where he raised upwards of $350M in project financing for specific development projects in the mining sector. In 2011-2015, he pivoted to Canadian-based farmland investments, where he became Chief Investment Officer at Dynamic Capital Corp., which focused on long-term, recession-proof investments with emphasis on gold and silver.

Blaine Bailey - CFO

Mr. Bailey is a CPA, CGA working with public and private companies over the past 20 years. Mr. Bailey brings complementary skills to the team in areas of finance, administration, and financial reporting. Mr. Bailey is currently the CFO of GR Silver.

Mr. Bailey received his Bachelor of Commerce degree (Honors) from the University of Manitoba in 1977, and qualified for the CPA, CGA designation in British Columbia in 1983. Mr. Bailey has served in the capacity of accountant for Molson Brewery B.C. Ltd. and controller for Nabob Coffee Co. with head office in Zurich, Switzerland.

Board of directors

Curt Freeman

Mr. Freeman is a U.S. Certified Professional Geologist and a licensed geologist in the State of Alaska. Since forming Avalon Development in 1985, Curt and his crews have conducted mineral exploration all over Alaska as well as in the Yukon, the western United States, Central America, South America, New Zealand, and Africa. He has consulted for numerous major and junior mining companies and he and his team of professionals have been credited with a number of gold, copper, silver, nickel, platinum group, and rare metal discoveries in Alaska and other parts of the world. Currently Director and Founder of Tectonic Metals Inc.

Tom Peregoodoff

Mr. Peregoodoff has over 30 years of resource industry experience, much of it in Greenfield and Brownfield exploration and resource development. He is currently President, CEO, and Director of Apollo Silver Corp and a Director of American West Minerals Ltd. Prior to this he was President & CEO of Peregrine Diamonds where he led the company from the resource development phase through to the eventual sale to DeBeers Canada in 2018. Prior to Peregrine, Mr. Peregoodoff spent 18 years in several positions with the mining multinational BHP, culminating in his role as Vice President of Early State Exploration, with global responsibility for all early stage exploration across their commodity groups.

Stuart R. Ross

Mr. Ross has had a distinguished career as a senior officer and director of several public companies, including companies listed on the NASDAQ and TSX Venture exchanges. His sector experience includes mining, beverage production and distribution, medical services, gaming, and merchant banking, including 17 years as a senior officer and director of Clearly Canadian Beverage Corp (1986 to (2003). Most recently, Stuart was President & CEO of El Tigre Silver Corporation, a TSX Venture listed silver exploration company (2007 to 2015).

Andy Bowering

Mr. Bowering is a venture capitalist with 30 years of operational experience and leadership in mineral exploration and development metals from early exploration through to production. Mr. Bowering has held senior management positions in a variety of capacities. He has been responsible for the acquisition and sale of several assets and the raising of upwards of $250 million in development capital. He has operated and managed programs through North and South America and abroad. He is a founder, shareholder of Millennial Lithium Corp, and other publicly traded companies focused in the battery metals and precious metals space including Prime Mining Corp.

Sources

- https://american-copper.com/

- https://american-copper.com/wp-content/uploads/2023/04/ACDC-Fact-Sheet_Q2-2023.pdf

- https://american-copper.com/wp-content/uploads/2023/04/American-Copper-Q2_APR-2023.pdf

- https://american-copper.com/investors/

- https://american-copper.com/wp-content/uploads/2023/03/E14-ACDC-Initiates-5000m-Drill-Program_FINAL.pdf

- https://american-copper.com/projects/

- https://american-copper.com/corporate-leadership/

- https://american-copper.com/media/

- https://finance.yahoo.com/news/american-copper-initiates-5-000m-123000739.html

- https://finance.yahoo.com/quote/ACDXF/

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media for a period beginning on 2023-05-22 and ending 2023-05-22 to publicly disseminate information about OTCMKTS: ACDXF via digital communications. We have been paid three thousand dollars USD.