6 Reasons Why TAG Oil Ltd. (TSXV: TAO) (OTCQX: TAOIF)

Could Be Poised For Significant Upside Potential In The Near Future

These factors collectively underscore the company's potential for growth and profitability, making it an appealing choice for investors seeking exposure to the MENA region's energy sector.

IDENTIFYING THE OPPORTUNITY

DIGGING DEEP AND ARE UNEARTHING PROFITS

With a low float and high investor interest, a little bit of volume could send this soaring!

TARGETS

Target #1: $0.4788 (+29.41%)

Target #2: $0.5677 (+53.43%)

Target #3: $0.7105 (+92.03%)

Target #4: $1.01 (+172.97%)

Support: $0.2852

TAG Oil Ltd.

(TSXV: TAO) (OTCQX: TAOIF)

CORPORATE PROFILE: An E&P Powerhouse

TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF) is an internationally listed Canadian Exploration and Production (E&P) company, publicly traded as TAO on the TSX-V and TAOIF on OTCQX.

The company is actively focused on oil and gas exploration and development opportunities in the Middle East and North Africa ("MENA") region.

The company completed its first major transaction in Egypt in October 2022.

Completed a $25.3 million equity financing at $0.40/share in November 2022

Completed a $12.3 million equity financing at $0.58/share in September 2023

Basic shares o/s 184.2 million

Options o/s 11.5 million

Warrants o/s nil

Fully diluted shares o/s 195.7 million

Working capital

$15.5 million in cash with no debt

$17.9 million in working capital

Equity financing

Completed a $25.3 million financing in November 2022

Completed a $12.3 million financing in September 2023

New Zealand Royalty Revenue

2.5% on gross revenue produced from the New Zealand assets

$1.4 million royalty payments received in F2023

Applies to all current and future production

Australia

Three blocks sold in 2020 for a cash payment of ~A$2,500,000

TAG Oil to receive a 3.0% gross overriding royalty on potential future gas production

New Focus

Following return of capital to shareholders and retaining a strong balance sheet in 2019, TAG Oil embarks on a strategic initiative in September 2020 to acquire oil and gas assets in the MENA region.

Additional leadership team with proven track record join TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF) in September 2020.

TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF) completes the Badr Oil Field (“BED-1”) transaction in Egypt in October 2022.

In May 2023, TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF) announces first oil production from the successful re-entry of the BED 1-7 well in the BED-1 concession.

In August 2023, TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF) announces that it has commenced drilling the BED4-T100 well in the BED-1 concession.

Raised ~$37.6 million (from November 2022 to September 2023) to advance BED-1 operations and pursue potential strategic acquisition opportunities.

TAG Oil Ltd.

(TSXV: TAO) (OTCQX: TAOIF)

TAG Oil Ltd. (TSXV: TAO) (OTCQX: TAOIF) Is Strongly Positioned To Capitalize On Egypt's Regional Influence

Egypt's Influential Position

Egypt, a democratic republic with a rich history, stands as a highly influential country in the MENA region. Its strategic location at the crossroads of Africa and Asia, along with a population of over 100 million, provides a substantial consumer base and workforce. Egypt's pivotal role in the Arab world, both culturally and politically, makes it an attractive destination for investors looking to tap into the burgeoning regional markets. Its stable political climate and economic reforms also offer a favorable environment for businesses seeking growth opportunities.

As the largest Arab country, Egypt has been a central player in shaping the geopolitics of the Middle East in modern times. Its participation in regional initiatives, like the Arab League and various peace agreements, underlines its importance on the global stage. This influence creates an environment conducive to investment, as the country's policies and decisions often have a ripple effect across the entire region, presenting opportunities for those who choose to engage with its dynamic and ever-evolving economy.

Central Role in Middle Eastern Politics

Egypt's vastness, both in terms of landmass and population, has enabled it to play a central role in Middle Eastern politics. Its position as a bridge between Africa and Asia has made it a diplomatic and economic linchpin, contributing to regional stability and economic growth. Investors looking for stability and access to regional markets often find Egypt an attractive option.

Egypt's historical significance, including its pivotal role in the Arab-Israeli peace process and mediation efforts, has further solidified its place in Middle Eastern politics. Its continued participation in global initiatives ensures that it remains a central player in the region. For investors, this political centrality translates into a conducive and dependable investment climate.

Diverse and Robust Economy

As the largest and most diversified economy in the Middle East, Egypt presents a wealth of opportunities for investors. Its diverse sectors, ranging from agriculture to manufacturing and services, provide a resilient foundation for economic growth. This diversity not only spreads risk but also offers investors a range of options for investment, ensuring adaptability in a changing global landscape.

Egypt's robust economy has been bolstered by comprehensive economic reforms, attractive investment incentives, and a young and growing workforce. These factors contribute to the country's overall stability and growth potential, making it an appealing destination for investors seeking to diversify their portfolios and participate in a vibrant, emerging market.

Key Economic Contributors

The Egyptian economy draws its strength from a variety of sectors. The oil and gas industry, along with mining, agriculture, the Suez Canal, tourism, and the textile industry, are the major contributors to Egypt's economic prosperity. The oil and gas sector's resource wealth, combined with a well-developed infrastructure, opens doors for investors seeking exposure to the energy market, while the textile industry provides opportunities in manufacturing and exports. The Suez Canal, a critical global trade route, ensures consistent revenue and offers potential for investment in logistics and shipping.

Egypt's tourism sector, boasting historical treasures, natural beauty, and a rich cultural heritage, is a growing industry with vast potential. In addition, the agriculture sector, with fertile lands along the Nile, provides investment opportunities in food production and export. With the government's commitment to economic reform and investment-friendly policies, these sectors continue to attract investors from around the world, promising a rewarding and diversified investment landscape.

TAG Oil Ltd.

(TSXV: TAO) (OTCQX: TAOIF)

Exploring The Riches of Egypt's oil and gas fields

BED-1 PETROLEUM SERVICES AGREEMENT

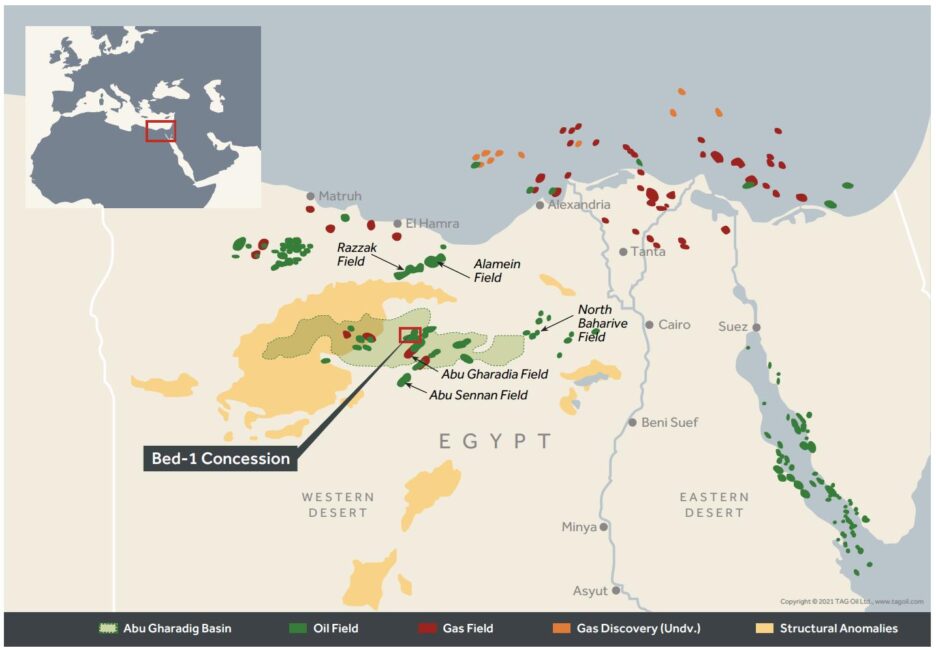

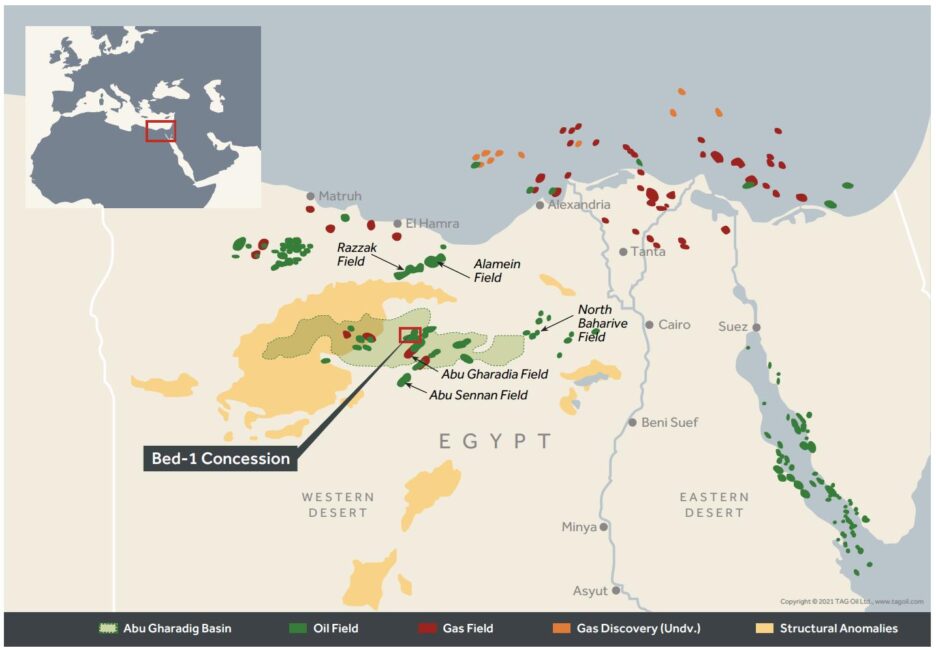

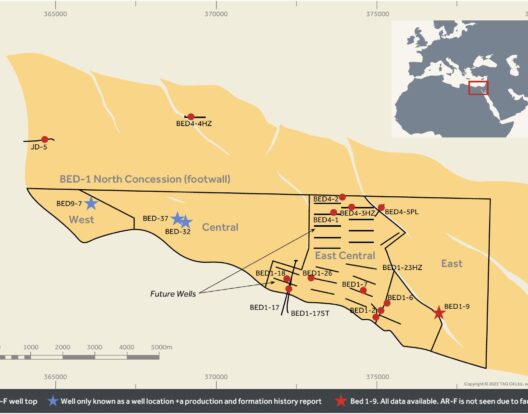

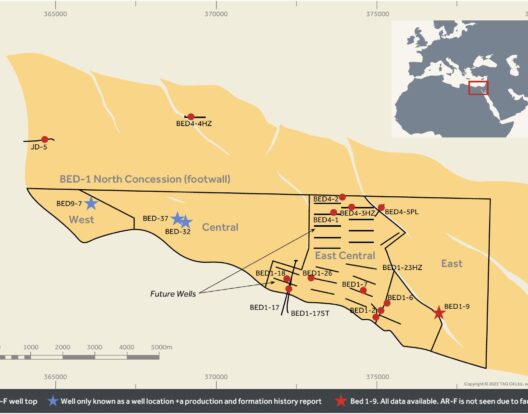

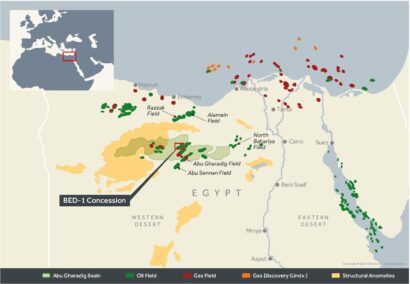

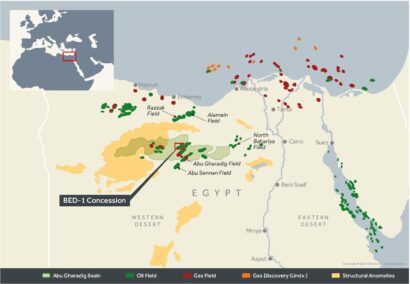

TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF) signed a Petroleum Services Agreement with Badr Petroleum Company (“BPCO”), a wholly owned subsidiary of EGPC, on October 13, 2022, to develop Abu Roash“F” (“ARF”) formation in BED-1, a 107 km2 (26,000 acres) concession located in the Western Desert, Egypt

Concession History: The BED-1 concession holds a rich history, having previously been under the ownership of Shell. During Shell's tenure, it yielded over 90 million barrels of light oil from formations below the ARF. In 2012, Shell relinquished the concession, and it has since been managed by Badr Petroleum Company (BPCO), a wholly owned subsidiary of the Egyptian General Petroleum Corporation (EGPC). Currently, the concession boasts a robust production capacity, with approximately 5,000 barrels of oil per day (bopd) from its deeper zones, supported by a capable 25,000-barrel processing facility.

Concession Term: The BED-1 concession holds a substantial term, extending until 2032, with the option for a further 10-year extension, effectively reaching until 2042. This extended term provides stability and the opportunity for continued development, making it an attractive prospect for investment and long-term ventures.

Service Fee: In an agreement with BPCO, TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF) is entitled to a service fee based on a percentage of the gross Production Revenue Entitlement. This service fee is designed to compensate TAG Oil for assuming full responsibility for the capital and operating expenditures. The fee structure is dynamic, with the percentage dependent on production levels and the Brent Oil price. In cases where production reaches up to 10,000 bopd and the Brent Oil price falls within the range of $70 to $90, the fee is set at 62% of production revenue, ensuring a fair and incentive-driven arrangement. Notably, taxes and royalties are to be borne by BPCO, enhancing the attractiveness of this collaboration.

Phase 1 and Phase 2: The BED-1 concession's development is structured into two distinct phases. Phase 1, referred to as the Evaluation Period, serves as a pivotal pilot development stage, with a committed investment of $6 million. It aims to assess the potential and performance of the concession, setting the stage for future growth. Following a successful evaluation period, Phase 2, the Commercial Development stage, is set to commence, backed by an additional $6 million in investment. This approach allows for a systematic and prudent progression, ensuring that investment decisions are based on sound assessment and paving the way for the profitable development of this valuable asset.

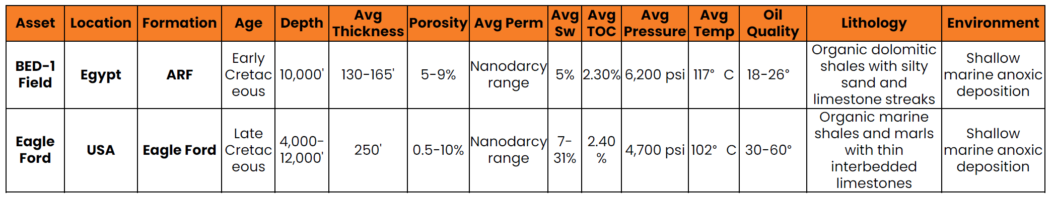

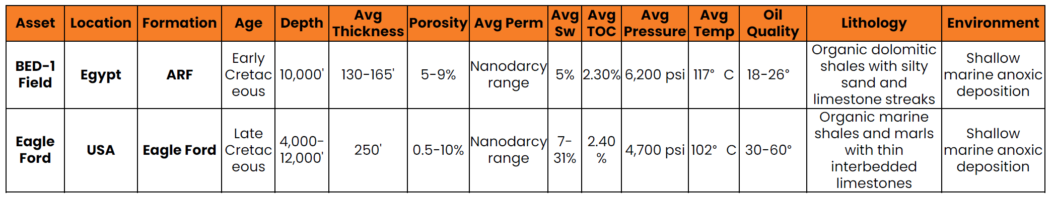

Comparison summary of bed-1 arf egypt and eagle ford in texas

Water Saturation and Hydrocarbon Potential: The BED-1 Field showcases a notably lower water saturation in its ARF formation compared to the Eagle Ford, a characteristic that bodes well for hydrocarbon exploration. This lower water saturation enhances the reservoir's potential for oil and gas extraction, making it an attractive prospect for investors and energy companies seeking promising exploration opportunities.

Total Organic Content: The Total Organic Content (TOC) in the BED-1 ARF formation closely resembles that of the Eagle Ford, indicating the presence of ample organic material conducive to hydrocarbon generation. This similarity in TOC underscores the BED-1 concession's potential for hydrocarbon reserves, providing a strong foundation for prospective investors interested in its development.

Oil Quality and Viscosity: Comparatively, the Eagle Ford exhibits slightly superior oil quality and lower viscosity when contrasted with the BED-1 ARF formation. The slightly better oil quality and lower viscosity in the Eagle Ford suggest easier flow characteristics and potentially enhanced refining capabilities, which can influence investment considerations based on oil quality preferences and production efficiency.

Reservoir Pressure and Temperature: The BED-1 ARF formation stands out with both higher reservoir pressure and temperature compared to the Eagle Ford. These elevated pressure and temperature conditions can positively impact hydrocarbon recovery rates and reservoir productivity. Investors may find the favorable thermal and pressure conditions of the BED-1 ARF attractive for energy exploration.

Depositional Environments and Age: The BED-1 ARF formation and the Eagle Ford share similar depositional environments and an approximately equivalent age of deposition. These geological resemblances suggest that the BED-1 ARF could offer similar resource potential to the well-established Eagle Ford, making it an appealing investment proposition for those looking to capitalize on familiar geological settings.

Shale Content and Hydraulic Fracturing: The BED-1 ARF boasts less shale content in comparison to the Eagle Ford, indicating a more brittle and potentially fracture-prone reservoir. This lower shale content enhances the formation's amenability to hydraulic fracturing, a technique that can be pivotal in optimizing hydrocarbon recovery. For investors, the increased brittleness of the BED-1 ARF can signify efficient extraction processes and higher yields.

Reservoir Depth and Oil Window: The BED-1 ARF's reservoir depth aligns closely with the depth of the oil window observed in the Eagle Ford. This alignment indicates that the BED-1 ARF is well-positioned within the optimal depth range for oil generation and accumulation, offering investors an opportunity to tap into hydrocarbon resources within a geologically favorable stratum.

Permeability and Fracturing Potential: The permeabilities of both the BED-1 ARF and Eagle Ford reservoirs exist on the nano-darcy scale prior to fracturing. This similarity in permeability highlights the potential for effective hydraulic fracturing techniques in both formations, showcasing the viability of efficient extraction methods and making these reservoirs attractive investment prospects in the energy sector.

BED-1 CONCESSION - PHASE 1 DEVELOPMENT WELLS

The BED-1 concession's Phase 1 Development Wells represent a crucial stage in the overall development plan. These wells are pivotal in the assessment and initial development of the concession's hydrocarbon potential. As the cornerstone of Phase 1, these wells serve as the testing ground for extracting oil and gas from the BED-1 ARF formation. The results and performance of these wells provide vital insights for optimizing production techniques, guiding investment decisions, and setting the stage for further development. This phase represents a significant milestone, demonstrating the commitment to unlocking the concession's resource wealth.

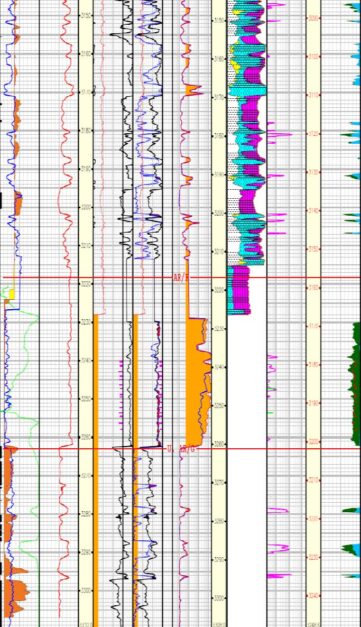

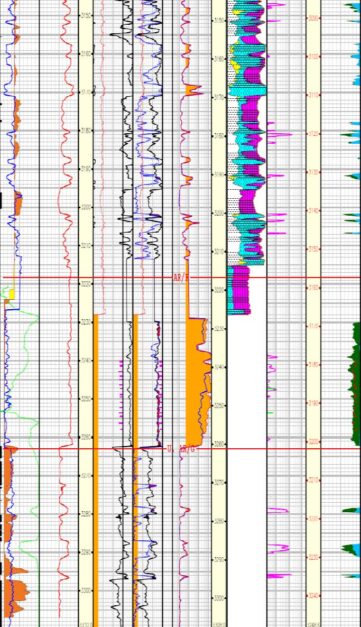

BED 1-7 Vertical Recompletion: In May 2023, the BED 1-7 Vertical Recompletion marked a critical achievement in the BED-1 concession's development journey. This operation involved the re-entry and recompletion of an existing vertical well, with the primary aim of establishing oil production from the ARF formation. It included essential activities such as perforation, Diagnostic Fracture Injectivity Tests (DFIT), and hydraulic fracturing. The successful installation of an Electric Submersible Pump (ESP pump) and the stabilization of well production at approximately 140 barrels of oil per day (bopd) confirmed the reservoir's responsiveness and validated the reservoir model. These outcomes are instrumental in guiding future development plans and encouraging investor confidence.

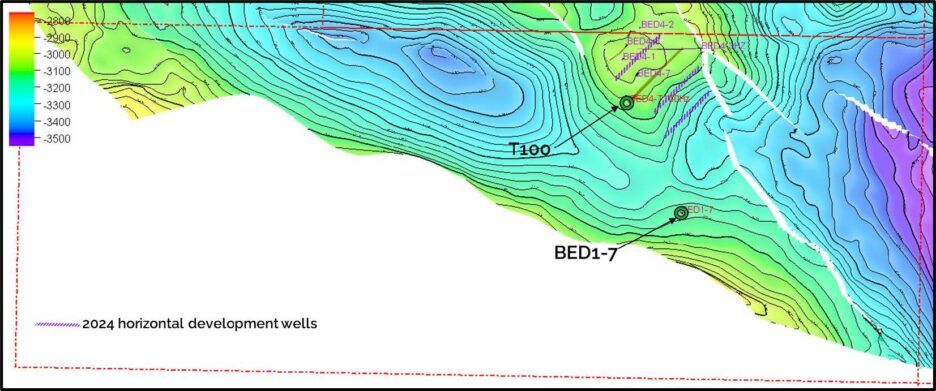

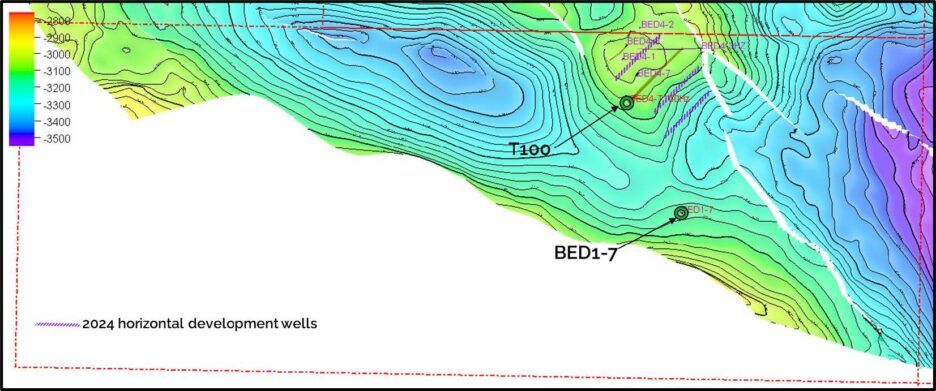

BED4-T100 Horizontal Well Drilling: The commencement of the BED4-T100 Horizontal Well drilling in August 2023 heralds a promising phase in the BED-1 concession's development timeline. This horizontal well, anticipated to yield results in the fourth quarter of 2023, is a significant endeavor in the pursuit of enhanced hydrocarbon extraction. It builds upon the success of the vertical recompletion, aiming to tap into the ARF formation's potential through horizontal drilling and fracturing techniques. The BED4-T100 well is poised to be a key contributor to the concession's production capacity and, by extension, to the investment prospects, presenting investors with a glimpse of the potential returns from this venture.

Future Horizontal Well Expansion: Looking ahead, the BED-1 concession demonstrates a proactive approach to development, with plans for three to four additional horizontal wells in the 2024 drilling program. These forthcoming wells represent a tangible commitment to harnessing the full hydrocarbon potential of the concession. By extending the reach of horizontal drilling, the concession aims to capitalize on its promising reservoir characteristics and favorable geology. This strategic expansion not only positions the BED-1 concession for sustainable production but also provides investors with a clear vision of the ongoing growth potential and the incremental returns that additional horizontal wells can deliver. The plans for 2024 underscore the long-term commitment to resource development and investor value creation in this dynamic energy venture.

BED 1-7 RE-ENTRY – PROOF OF CONCEPT

- Successful re-entry of an existing vertical well.

- First step to establish oil production from the ARF formation.

- Perforated and conducted Diagnostic Fracture Injectivity Test (DFIT) of the ARF.

- Conducted a single fracture stimulated with 110 ton frac.

- Installed Electric Submersible Pump (ESP pump)

- Well production stabilized at 140 bopd of 23◦API Oil.

- Cumulative production as of July 31, 2023, was in excess of 6,000 barrels.

- Positive response confirming reservoir model and performance.

BED 1-7 Thick 40 meters ARF Formation

BED4-T100 horizontal well location

- Located adjacent to wells BED 4-2 (75,500 bbl) and BED 4-3Hz (74,000 bbl) that produced oil from ARF natural fractures, but the wells stopped producing after depleting primary fractures.

- Spud in August 2023, and commenced drilling horizontal portion of well in September 2023.

- Estimate 90 days to drill and complete.

- Well expected to be tied-in to BED-1 processing facility immediately after.

- Anticipating first oil production in Q4 2023.

- Modeling estimates initial production forecast to be between 1,000 and 1,500 bopd.

RESERVES SUMMARY HIGHLIGHTS - BED-1

TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF)'s current Field Development Plan (“FDP”), consisting of drilling 20 horizontal wells to be completed with multi-stage fracture stimulation, is focused on the east central part of the BED-1 concession area, and contains OIIP P50 Volumes of 178.3 million barrels.

RPS best estimate for Contingent Resources volumes (2C Development Pending) is 27.0 million barrels gross with 16.5 million barrels net to the Company.

Estimate recovery of approximately 15% in the East Central part of the concession

FDP CAPEX and OPEX discounted at 10% is US$104 million and $160 million for the 2C Development Pending Contingent Resources in the ARF.

RPS estimate for Contingent Resources (2C Development Pending) net present value discounted at 10% and assumed RPS Price Forecast of April 1, 2022, per barrel is US$339 million (risked at 80% chance of development) and US$423 million (un-risked).

RPS estimates the ARF OIIP P50 Volumes to be 531.5 million barrels over the BED-1 concession area. The discovered OIIP in the ARF is imaged by 3D seismic coverage, significant well control with over 30 penetrations, petrophysical analysis of available log and core data and production tests from the ARF.

DIGGING DEEP

TAG Oil Ltd.

(TSXV: TAO) (OTCQX: TAOIF)

EGYPT AND BROADER MENA REGION ACQUISITION OPPORTUNITIES

TAG Oil's ongoing evaluation of new acquisitions and joint venture opportunities, primarily within Egypt and the wider MENA region, underlines the company's strategic commitment to growth and resource diversification. By actively seeking to expand its portfolio, TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF) positions itself for sustained development and value creation. As the company explores opportunities in Egypt and MENA, it not only reinforces its presence within these regions but also taps into their promising resource potential, offering investors a gateway to diverse and dynamic markets. This strategic expansion allows TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF) to leverage its expertise and experience in the oil and gas sector, optimizing its operational footprint while contributing to economic development in the region.

The benefits of TAG Oil's proactive approach extend to both the company and the broader MENA region. For TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF), the pursuit of new acquisitions and joint ventures promises enhanced revenue streams, diversified assets, and reduced risk through a broader resource base. By strategically positioning itself within these regions, the company aims to capitalize on the wealth of untapped resources, thus strengthening its financial stability and long-term sustainability. Simultaneously, the MENA region stands to gain from TAG Oil's investments, as the company's initiatives drive economic growth, generate employment opportunities, and foster technological advancement within the local communities. By facilitating the responsible exploration and development of oil and gas resources, TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF) contributes to the energy security and economic prosperity of the region while maintaining a commitment to environmental and social responsibility. Ultimately, this symbiotic relationship reflects TAG Oil's dedication to creating value for both its shareholders and the MENA region, establishing a win-win scenario for all stakeholders involved.

TAG Oil Ltd.

(TSXV: TAO) (OTCQX: TAOIF)

TAG Oil Ltd. (TSXV: TAO)(OTCQX: TAOIF)'s management demonstrates a consistent track record of creating substantial value for shareholders, reflecting a core commitment to driving investor returns. This success story is exemplified by the achievements of key leaders, such as CEO Toby Pierce, who, during his tenure (2015 to the present), orchestrated the sale of TAG Oil's New Zealand and Australian assets, culminating in the return of a remarkable $25.6 million to shareholders in 2020. Furthermore, CEO Abby Badwi's notable role in Kuwait Energy (2017 to 2019) saw the company experience significant production growth and culminated in the sale of the company for a substantial US$830 million, illustrating his prowess in delivering shareholder value. In a similar vein, during his tenure at Bankers Petroleum (2008 to 2016) as CEO and Vice Chairman, along with COO Suneel Gupta (2004 to 2016), the duo spearheaded notable production and reserve growth in Albania, culminating in the company's sale for a commendable $790 million in 2016. Moreover, the achievements of Abby Badwi as Founder and Chairman of Verano Energy in Colombia, culminating in a $200 million sale in 2014, underscore the capacity to realize value for investors. The legacy of value creation is further exemplified by Abby Badwi's role as CEO of Rally Energy (2005 to 2007), during which he successfully amplified production and reserves in Egypt and Pakistan, ultimately concluding with the sale of the company for an impressive $890 million in 2007.

This sterling track record not only signifies TAG Oil's ability to generate value for its shareholders but also symbolizes its commitment to delivering consistent returns on investment. As the company extends its reach and explores new opportunities, investors can have confidence in its leadership's proficiency in maximizing the potential of these ventures. These accomplishments demonstrate the leadership team's capability to navigate complex markets and resource landscapes, creating a win-win situation for both TAG Oil's investors and the regions where the company operates. By consistently delivering value to shareholders, TAG Oil reinforces its position as a dependable and attractive investment prospect.

Board of Directors - Executive and Independent

Abdel (Abby) Badwi - Executive Chairman and Director, BSc

Proven oil & gas executive with over 45 years of experience of delivering outstanding returns for shareholders.

Toby Pierce - Chief Executive Officer and Director, BSc, MBA

Experienced natural resource executive with expertise in operations, capital markets, investment banking and M&A; Geologist.

Gavin Wilson - Non-Executive Director, BA

Investment Manager for Meridian Group of Companies, a private investment Company, with over 25 years of oil & gas investment experience.

Shawn Reynolds - Non-Exectuive Director, BSc, MA, MBA

Portfolio manager at Van Eck Securities focused on oil & gas covering global energy companies, and formerly an exploration geologist for Tenneco.

Keith Hill - Lead Independent Director, MBA

More than 30 years of leadership experience in the oil and gas industry; Geologist.

Thomas Hickey - Non-Executive Director, MBA

An attorney of the State of California and Solicitor of the Supreme Court of England and Wales, with over 20 years of international oil & gas sector experience.

Experienced Leadership Team - Operations and Finance

Suneel Gupta - VP & Chief Operating Officer, BSc, MSc

Senior executive in the international oil & gas industry with over 30 years experience in operations, business development and as a general manager.

Samir Abady - VP & Operations Manager, Egypt

35 years of experience in the oil & gas industry in Egypt, having supervised and managed the drilling of numerous exploration and development wells in the country.

Gamal Rezk - VP & General Manager, Egypt

24 years of oil & gas experience working with international energy companies with head-offices based overseas, and is instrumental in aligning corporate office personnel with Egypt based operations.

A member of the Chartered Professional Accountants of BC with more than 30 years of management and accounting experience

Kevin Baxter - VP & Technical Manager, Egypt

30 years of proven oil & gas management experience in developing and managing large, diverse organizations that have delivered against challenging objectives.

Sources

- Source 1: https://ca.finance.yahoo.com/news/tag-oil-present-oil-gas-123800279.html

- Source 2: https://tagoil.com/

- Source 3: https://tagoil.com/about/

- Source 4: https://tagoil.com/history/

- Source 5: https://tagoil.com/governance/

- Source 6: https://tagoil.com/hse/

- Source 7: https://tagoil.com/investors/

- Source 8: https://tagoil.com/financial-reports/

- Source 9: https://tagoil.com/leadership/

- Source 10: https://tagoil.com/insights/

- Source 11: https://tagoil.com/analyst-coverage/

- Source 12: https://tagoil.com/operations/

- Source 13: https://tagoil.com/reserves-evaluation/

- Source 14: https://tagoil.com/media/

- Source 15: https://tagoil.com/news/

- Source 16: https://tagoil.com/wp-content/uploads/2023/10/TAG-Corporate-Presentation-October-2023.pdf

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media Group LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media Group LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and Market One, Virtus Media Group LLC has been hired by Market One for a period beginning on 2023-11-06 and ending 2023-11-20 to publicly disseminate information about OTCQX: TAOIF via digital communications. We have been paid thirty thousand dollars USD. Social media influencer 1. $500,Social media influencer 2. $500, Social media influencer 3. $750, Social media influencer 4. $1500, Social media influencer 5. $500, Social media influencer $7500.