LATEST NEWS

GoldMining Subsidiary, U.S. GoldMining, Announces Confirmatory Results, Including Highest Drill Intercept to Date at the Whistler Gold-Copper Project, Alaska

GoldMining Subsidiary, U.S. GoldMining, Announces Confirmatory Results, Including Highest Drill Intercept to Date at the Whistler Gold-Copper Project, Alaska

6 Reasons Why Gold Royalty Corp. (NYSE: GROY) Could Be Poised For Significant Upside Potential in 2024

IDENTIFYING THE OPPORTUNITY

INSTITUTIONAL SUPPORT IS IN PLACE AND READY TO RUN

Bullish Divergence, RSI Cross-up, and a strong area of support, what more could we ask for!

TARGETS

Target #1: $1.60 (+20.30%)

Target #2: $1.71 (+28.57%)

Target #3: $2.00 (+50.38%)

Target #4: $2.64 (+98.50%)

Target #5: $2.89 (+117.29%)

Target #6: $3.72 (+179.70%)

Support: $1.15 Range

Gold Royalty Corp.

(NYSE: GROY)

COMPANY HIGHLIGHTS AND COMPETITIVE ADVANTAGES

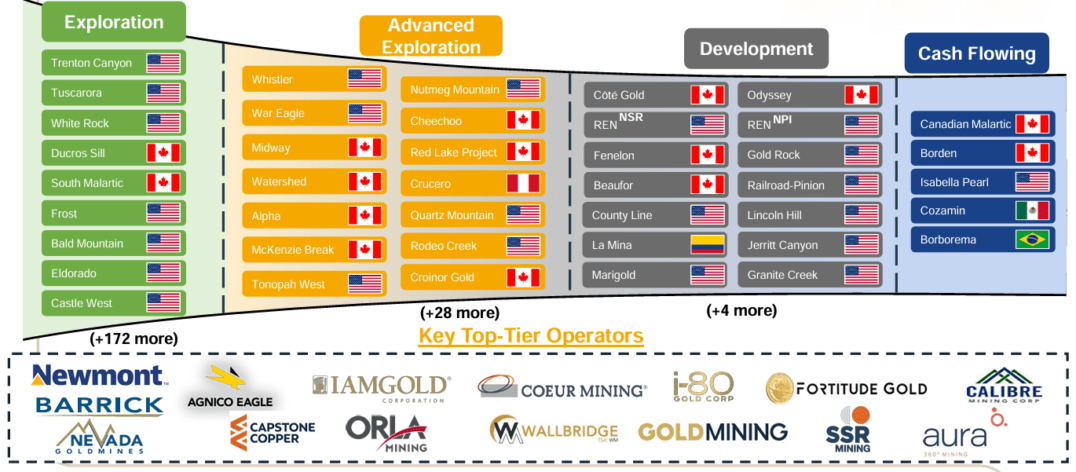

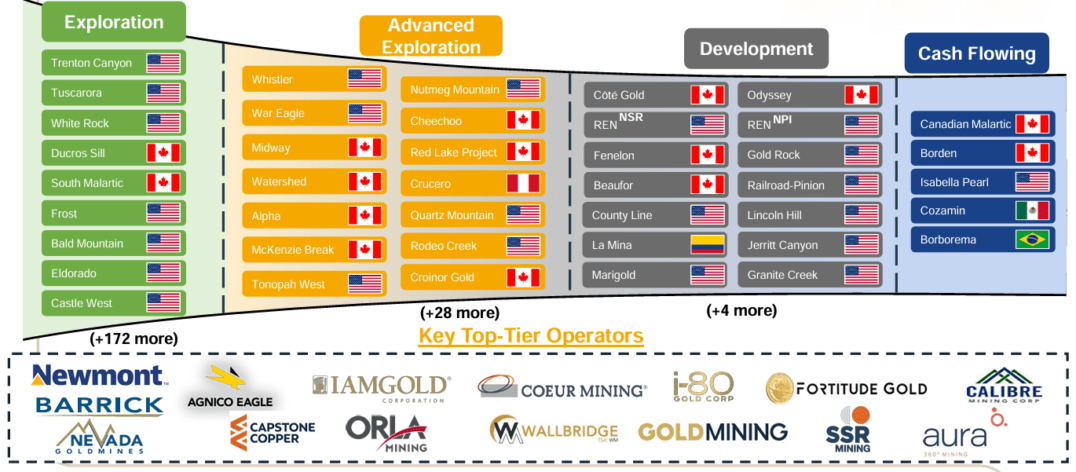

Gold Royalty Corp. (NYSE: GROY) is a mining royalty company that stands out in the investment landscape due to its diverse and strategically positioned portfolio. With a focus on precious metals, particularly gold, the company holds a collection of royalty interests in projects located in stable jurisdictions, including Canada and the USA. This diversification is a key strength, providing investors with exposure to different commodities and mitigating risks associated with individual projects.

One of the notable aspects of Gold Royalty Corp.'s investment appeal lies in the stability of its cash flow. Royalty agreements with mining operators ensure a steady stream of revenue, as the company receives a percentage of the production value from the underlying mines. This reliable income stream can be particularly attractive to investors seeking a balance between risk and return in the volatile mining sector.

The company's strategic approach to project selection involves partnering with proven and reputable mining operators. By collaborating with experienced industry players, Gold Royalty Corp. (NYSE: GROY) aims to minimize operational risks and increase the likelihood of successful project development. Several projects in its portfolio are operated by established mining companies with a track record of effective exploration and production.

Exploration upside is a key factor contributing to the growth potential of Gold Royalty Corp. (NYSE: GROY) Many of its projects are in advanced exploration or development stages, presenting opportunities for resource expansion and new discoveries. Ongoing exploration programs, coupled with positive results from drilling activities, could contribute to increased mineral reserves and, consequently, higher royalty payments.

The company's projects are strategically located in mining-friendly jurisdictions, such as Canada and the USA. This geographic positioning reduces geopolitical risks and regulatory uncertainties, creating a favorable environment for mining operations. Additionally, the presence of projects in stable jurisdictions enhances the attractiveness of Gold Royalty Corp. (NYSE: GROY) as an investment option.

As the mining industry is inherently capital-intensive, the successful closure of a $20 million IPO in 2023 positions Gold Royalty Corp. (NYSE: GROY) to fund exploration and development activities at its various projects. The infusion of capital is crucial for advancing exploration programs, conducting feasibility studies, and achieving key milestones, ultimately contributing to the company's growth trajectory.

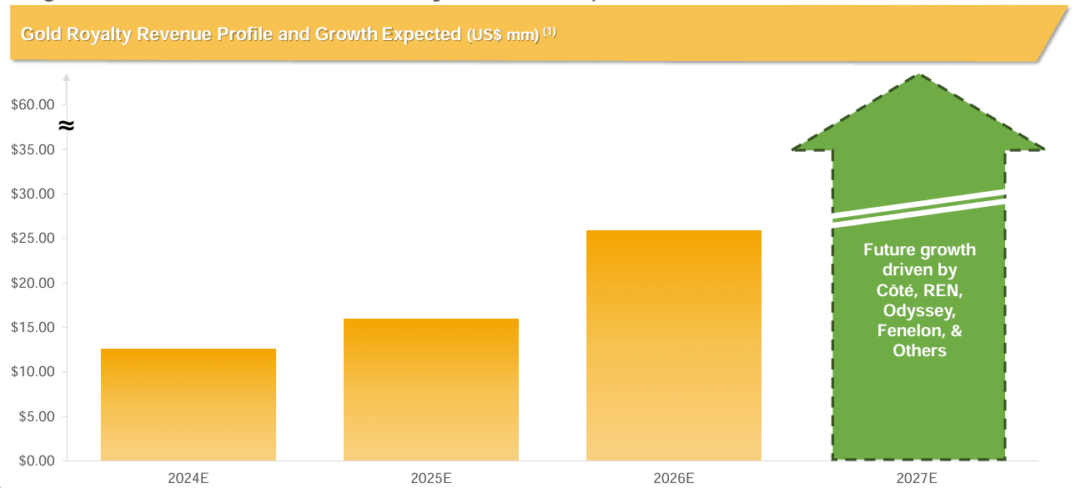

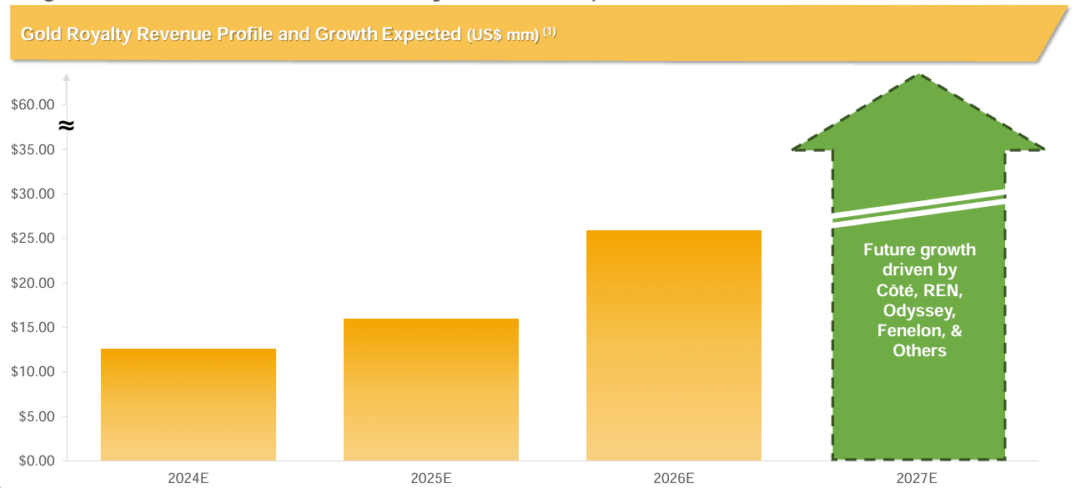

Investors in Gold Royalty Corp. (NYSE: GROY) have the potential to benefit from upcoming milestones across its portfolio. With projects reaching significant stages such as feasibility studies, production commencements, and exploration updates, the company is poised for a series of catalysts that could positively impact investor sentiment and drive future stock price appreciation.

Gold Royalty Corp. (NYSE: GROY) emerges as a compelling investment opportunity in the mining royalty sector. With a focus on stability, diversification, and strategic partnerships, the company positions itself as an attractive choice for investors seeking exposure to the lucrative yet inherently volatile world of precious metal mining.

PROTECTION AGAINST MARKET UNCERTAINTY

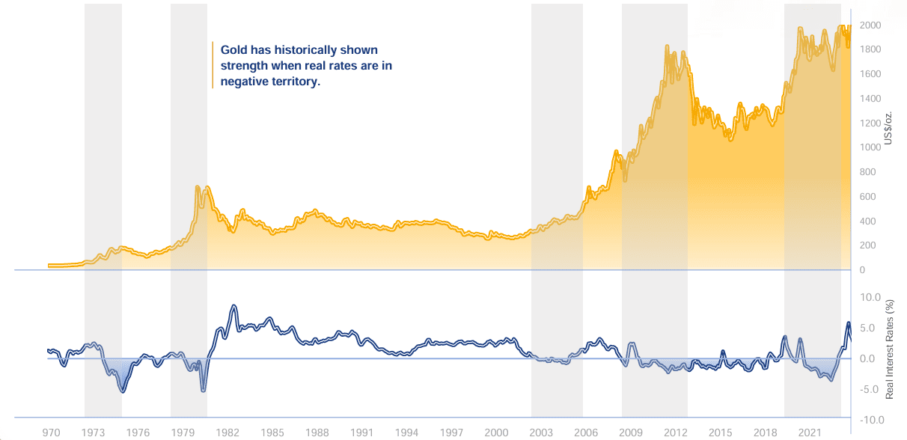

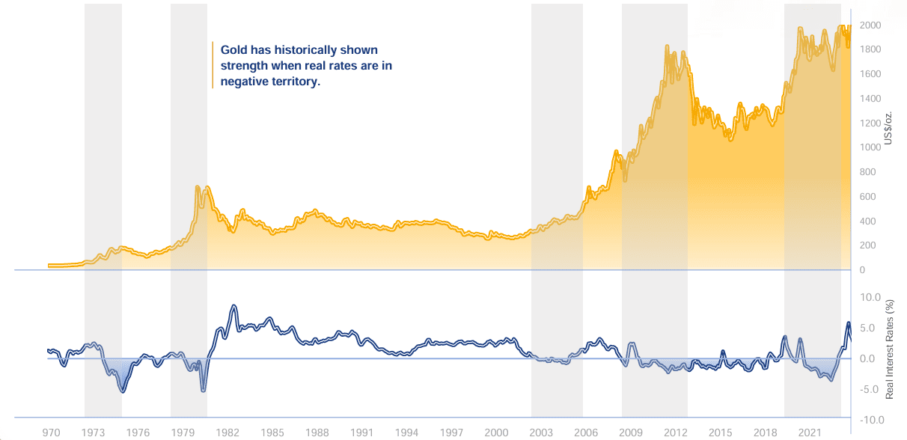

Investing in gold royalty companies, such as Gold Royalty Corp. (NYSE: GROY), can serve as a robust hedge against inflation for investors. These companies are uniquely positioned to withstand the impacts of rising inflation due to the nature of their revenue streams. Unlike traditional mining companies that may face escalating operational costs as a result of inflation, royalty companies are insulated from these pressures. The royalty model allows them to receive a predetermined percentage of the production value from mining operations, irrespective of the cost increases experienced by the operators. This insulation from cost inflation contributes to the stability of cash flows for royalty companies, providing investors with a reliable means to preserve wealth during periods of economic uncertainty.

As inflation erodes the purchasing power of fiat currencies, investors often turn to gold as a store of value. Gold royalty companies, by extension, benefit from the increased demand and higher prices for gold. In an environment where real interest rates decline due to inflation, the appeal of non-interest-bearing assets like gold tends to rise. The proceeds generated from royalty agreements, tied to gold production, see a boost as the price of gold climbs. Thus, investing in gold royalty companies becomes a strategic move for investors looking to protect their portfolios from the erosive effects of inflation while capitalizing on the inherent value of precious metals.

Gold Royalty Corp.

(NYSE: GROY)

PAST, PRESENT, AND FUTURE

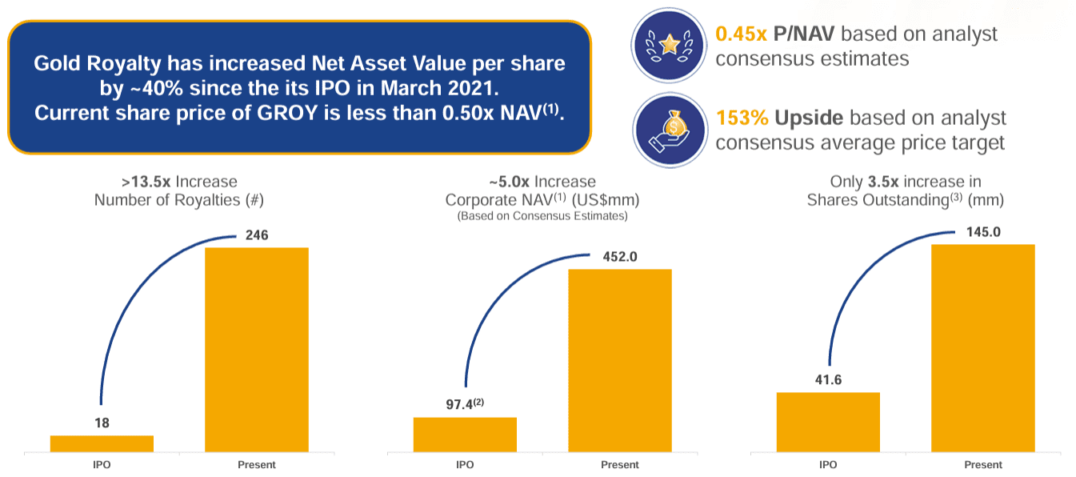

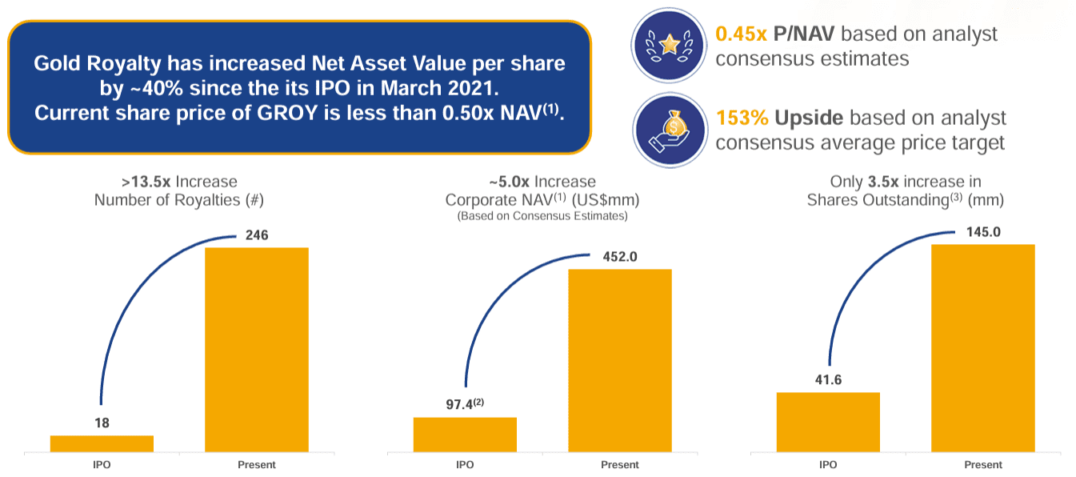

Intelligent Acquisitions Means Strong Valuation

Gold Royalty Corp. (NYSE: GROY)'s value proposition is rooted in its strategic approach to creating value through a demonstrated track record of accretive acquisitions. The company has consistently pursued opportunities to expand its royalty portfolio, enhancing its exposure to various mining projects and commodities. Through astute acquisitions, Gold Royalty has not only broadened its asset base but also increased the potential for robust, long-term revenue streams from a diversified range of mining operations. This strategy aligns with the company's commitment to delivering value to its shareholders by securing attractive royalty interests in both established and emerging mining projects.

The emphasis on accretive acquisitions underscores Gold Royalty's commitment to disciplined growth and value creation. By strategically adding high-quality royalties to its portfolio, the company positions itself to capitalize on the success and development of mining projects, translating into increased cash flows and potential for capital appreciation. Gold Royalty's value proposition, rooted in its proactive approach to acquisitions, reflects a commitment to maximizing shareholder value through a well-curated and expanding portfolio of royalties that are poised to deliver sustained returns over the long term.

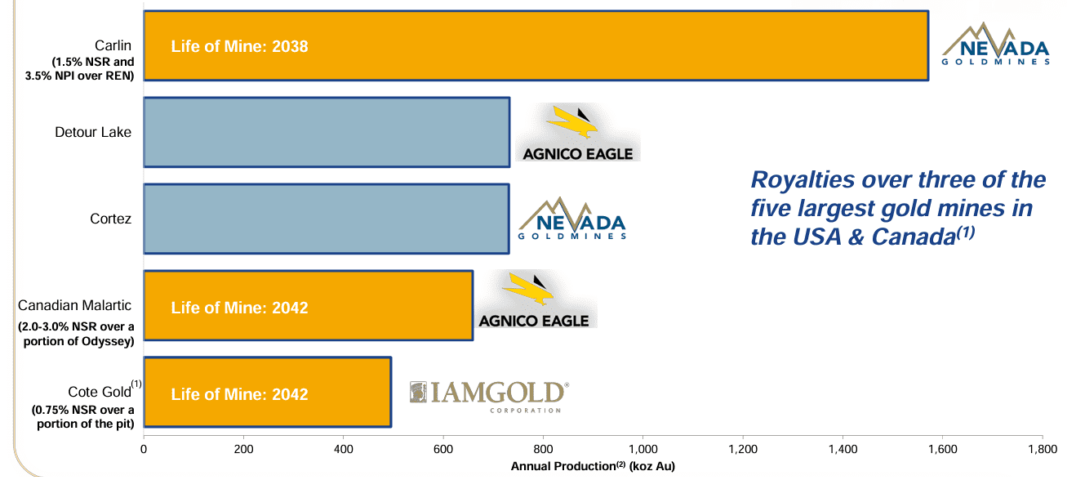

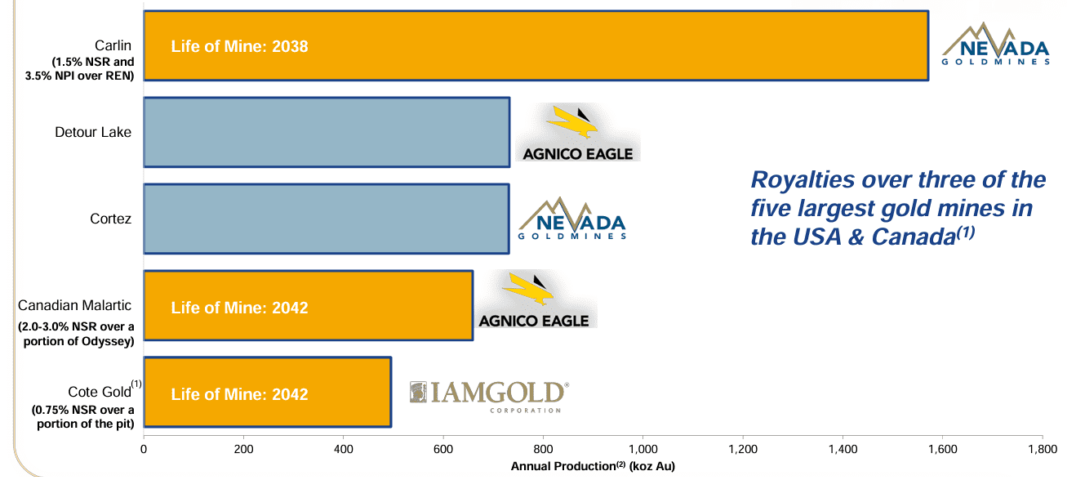

Royalties Over Three Of The Five Largest Gold Mines In The USA & Canada

Gold Royalty Corp. (NYSE: GROY)'s notable value is derived from its ownership of royalties over some of the largest gold mines in North America. These foundational assets serve as cornerstones in the company's portfolio, offering exposure to well-established and prolific mining operations. By holding royalties over these significant gold mines, Gold Royalty Corp. (NYSE: GROY) positions itself to benefit from the extensive production and resource potential of these key assets. The inclusion of such foundational royalties enhances the stability and reliability of the company's revenue streams, contributing to its overall resilience and attractiveness to investors seeking exposure to the gold sector.

These foundational, long-life assets not only provide a solid base for Gold Royalty Corp. (NYSE: GROY)'s current revenue generation but also serve as a crucial element in the company's future growth strategy. Long-term mine life, substantial mineral reserves, and consistent production levels from these key assets contribute to the overall strength and sustainability of Gold Royalty Corp. (NYSE: GROY)'s business model. The combination of foundational royalties over major gold mines and a focus on future growth positions the company strategically within the market, presenting investors with an opportunity to participate in the success and longevity of significant mining projects in North America.

A Monolithic Pipeline For Revenue & Production Growth

Gold Royalty Corp. (NYSE: GROY) is poised for significant growth with robust sources coming into production. The company strategically positions itself to capitalize on the development and commencement of various mining projects, ensuring a diversified and expanding portfolio. The anticipation of new revenue streams from these emerging projects enhances Gold Royalty Corp. (NYSE: GROY)'s potential for sustained growth and increased shareholder value. As these projects progress towards production, the company stands to benefit from the added contributions to its royalty portfolio, reinforcing its position as a key player in the gold royalty sector.

With a forward-looking approach, Gold Royalty Corp. (NYSE: GROY) focuses on securing royalties over projects with substantial growth potential. This strategy aligns with the company's goal of providing investors with exposure to rising gold markets and expanding mining operations. The emphasis on robust sources of growth underscores Gold Royalty Corp. (NYSE: GROY)'s commitment to delivering long-term value, and as these projects move forward, the company is positioned to capitalize on the increased production and resource potential, further solidifying its standing within the royalty and streaming sector.

Gold Royalty Corp.

(NYSE: GROY)

MARKET EFFICIENCY

Analyst coverage, consolidated market presence, strength in shareholder support

Gold Royalty Corp. (NYSE: GROY) boasts strong analyst coverage, a consolidated market presence, and robust shareholder support, all contributing to its overall strength in the financial markets. With comprehensive coverage from industry analysts, the company's performance and growth potential are regularly evaluated and communicated to investors. Its consolidated market presence signifies a stable and well-established position within the royalty and streaming sector. Moreover, the considerable support from shareholders underlines confidence in the company's strategies and future prospects, reflecting a positive outlook and reinforcing Gold Royalty Corp. (NYSE: GROY)'s credibility in the financial landscape.

Sources

- Source 1: https://finance.yahoo.com/quote/GROY/

- Source 2: https://finance.yahoo.com/news/goldmining-subsidiary-u-goldmining-announces-113000686.html

- Source 3: https://finance.yahoo.com/news/gold-royalty-completes-acquisition-qu-231500085.html

- Source 4: https://www.goldroyalty.com/

- Source 5: https://www.goldroyalty.com/_resources/Gold-Royalty-2023-Asset-HandBook-Final.pdf

- Source 6: https://www.goldroyalty.com/_resources/reports/Gold-Royalty-Sustainability-Report-Final.pdf

- Source 7: https://www.goldroyalty.com/company/about/

- Source 8: https://www.goldroyalty.com/company/management-and-directors/

- Source 9: https://www.goldroyalty.com/company/advisory-board/

- Source 10: https://www.goldroyalty.com/company/corporate-governance/

- Source 11: https://www.goldroyalty.com/company/corporate-directory/

- Source 12: https://www.goldroyalty.com/portfolio/overview/

- Source 13: https://www.goldroyalty.com/esg/esg-commitment/

- Source 14: https://www.goldroyalty.com/investors/presentations/

- Source 15: https://www.goldroyalty.com/investors/grc-in-the-media/

- Source 16: https://www.goldroyalty.com/investors/stock-information/

- Source 17: https://www.goldroyalty.com/investors/dividends/

- Source 18: https://www.goldroyalty.com/investors/financial-reports/

- Source 19: https://www.goldroyalty.com/investors/analyst-coverage/

- Source 20: https://www.goldroyalty.com/investors/ely-tax-election/

- Source 21: https://www.goldroyalty.com/news/news-releases/

- Source 22: https://www.goldroyalty.com/why-grc/business-strategy/

- Source 23: https://www.goldroyalty.com/why-grc/business-model/

- Source 24: https://www.goldroyalty.com/why-grc/competitive-strengths/

- Source 25: https://www.goldroyalty.com/why-grc/royalty-and-streaming-101/

- Source 26: https://www.sec.gov/edgar/browse/?CIK=1834026&owner=exclude

- Source 27: https://www.sec.gov/Archives/edgar/data/0001834026/000121390024005868/ea192097-13gqueen_gold.htm

- Source 28: https://www.sec.gov/Archives/edgar/data/0001834026/000149315223046430/formf-3.htm

- Source 29: https://www.sec.gov/Archives/edgar/data/0001834026/000149315223046430/formf-3.htm

- Source 30: https://www.sec.gov/Archives/edgar/data/0001834026/000149315223045915/form6-k.htm

- Source 31: https://www.sec.gov/ix?doc=/Archives/edgar/data/0001834026/000095017023010019/groy-20221231.htm

- Source 32: https://www.sec.gov/ix?doc=/Archives/edgar/data/0001834026/000095017022027021/groy-20220930.htm

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media Group LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media Group LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and Gold Royalty corp., Virtus Media Group LLC has been hired by Gold Royalty corp. for a period beginning on 02/05/2024 and ending 03/06/2024 to publicly disseminate information about NYSE: GROY via digital communications. We have been paid one hundred thousand dollars USD. Social media influencer 1. five hundred dollars USD, Social media influencer 2. five hundred dollars USD, Social media influencer 3. seven hundred fifty dollars USD, Social media influencer 4. fifteen hundred dollars USD, Social media influencer 5. five hundred dollars USD, Social media influencer fifteen thousand dollars USD.