URANIUM ROYALTIES ARE PAYING BIG

What & Who You Should Know

Uranium Royalty Corp. (NASDAQ: UROY) is a truly pure-play on uranium, which is 20% owned by Uranium Energy Corp.

Mr. Amir Adnani is the Chairman of uranium Royalty Corp, whose other major shareholders include Altius Resources Inc., Mega Uranium Ltd., Marin Katusa, the KCR Fund, Extract Capital, Rick Rule, Sprott Global, and Commodity Capital.

Eric Sprott, Rick Rule, and Marin Katusa are among the world’s most renowned commodity investors and experts.

Another connection between Uranium Royalty Corp. and Uranium Energy Corp. is the presence of Mr. Scott Melbye, who has been the Chief Executive Officer and President of the company since October 2019.

With over 35 years of experience in the nuclear energy industry and leadership positions in various uranium mining companies and industry organizations, Mr. Melbye is responsible for uranium marketing and sales, as well as strategic growth objectives in his various roles with Uranium Royalty (US: UROY), which only has a market cap of $161M.

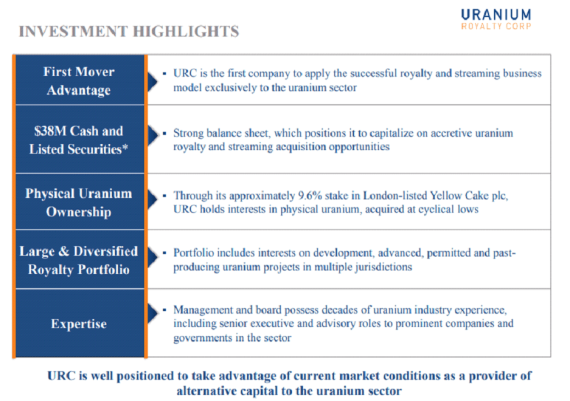

Uranium Royalty Corp. is actually the first and only company to apply the successful royalty and streaming business model exclusively to the uranium sector. Therefore, it’s important to understand what makes the royalty and streaming business model so advantageous!

The company is focused on gaining exposure to uranium prices by making strategic investments in uranium interests.

How This Business Model Works

Metal royalty and streaming companies provide funds for mines in exchange for future payoffs. The royalty entitles the holder to a fixed percentage of the revenues less certain expenses (called royalties), generated by the mines, and a stream entitled the holder to a portion of physical metals produced by the mines (streaming).

SEIZING THE OPPORTUNITY

Uranium Royalty Corp (US: UROY) takes advantage of this business framework by making strategic investments in uranium, including royalties, streams, debt, and equity in uranium companies, as well as through potential physical uranium transactions.

The company’s strategy recognizes the inherent cyclicality of valuations, based on uranium prices, including the availability of capital in different pricing environments.

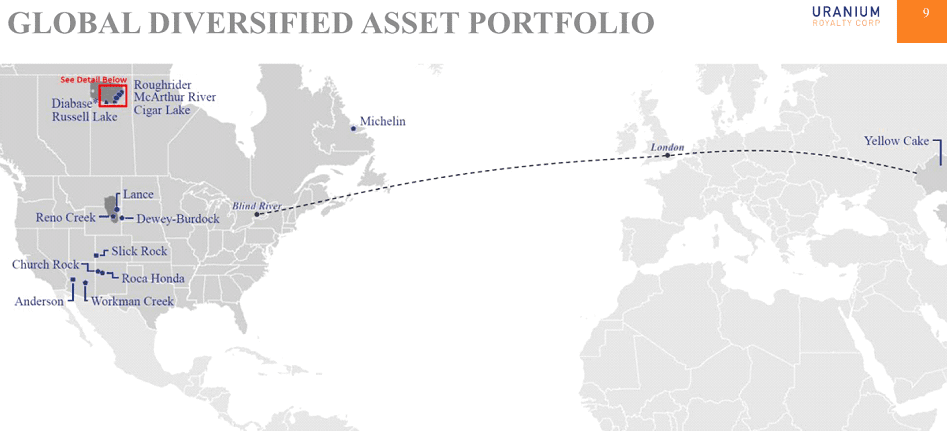

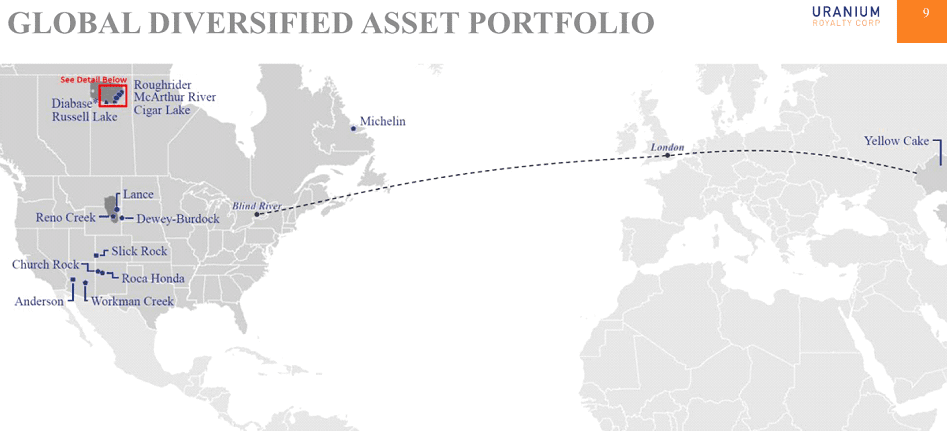

Uranium Royalty Corp.’s portfolio includes interests in development and advanced, permitted, and past-producing uranium projects in multiple jurisdictions.

Technical Analysis

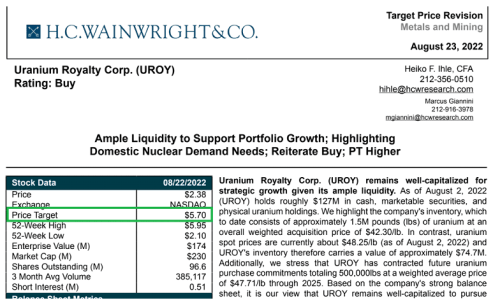

Based on the accompanying chart, we can see that the potential for this stock is extremely high. We have a very strong support level at $2.24/share and have recently broken a major resistance trendline which has been forming since September 2021. There is plenty of room for a clean run into each of the three targets, as well as the analyst target of $5.70/share.

Given the presence of strong, long-lasting confluence across multiple time frames and the strength of the recent bullish divergence into this breakout, there is a great opportunity here for both speculative traders and investors alike.

Strength in a Burgeoning Market

The analyst price target is USD $5.70 and today's price is only $2.55 (as of market close)!

With 1.5M pounds (lbs) of uranium in their inventory, and the securing of future purchase commitments of 500,000lbs at more than $5/lb higher than their acquisition cost, this company is a valuation powerhouse.

Combining this strength with the shifting geopolitical climate and the push for clean energy, the next few years should provide substantial growth for any portfolio. The Biden Administration continues to pursue Bipartisan legislative solutions in the United States House and Senate to revitalize the American domestic nuclear fuel cycle, these investments fit squarely in support of those initiatives.

On top of that, Uranium Royalty Corp. (NASDAQ: UROY) also announced that its wholly-owned subsidiary has entered into an agreement with Anfield Energy Inc. to acquire a portfolio of royalties on U.S. projects, comprised of a number of promising royalties and this is yet another indication management is executing on its mission to lead the uranium royalty industry and dominate it!

15 Million Pounds of U3O8 Anticipated From Operations Beginning in 2024

Uranium Royalty Company Corp. notified Orano Canada Inc. that it wishes to receive royalty proceeds from the recently re-started world-class McArthur River mine through delivery of physical uranium. (NASDAQ: UROY)'s royalty interest applies to Orano's 30.195% ownership interest in the McArthur River Project which currently plans to product 15M pounds of U3O8 (100% basis) per year from the operations starting next year.

Cameco has disclosed that McArthur River is the world’s LARGEST HIGH-GRADE uranium mine, with ore grades that are 100 times the global average, which means it is capable of producing 18M pounds/year, by mining only 200 to 400 tons of ore per day. Cameco has disclosed that McArthur River has a licensed capacity of 25M pounds/year.By electing to receive the royalty proceeds as physical uranium, it allows URC to control the sale of the attributed pounds in a disciplined, yet fully unhedged manner, focusing on providing the maximum value to shareholders. This is a big deal, in my view, showing how undervalued management believes the spot price to be and that it wants to grow its physical storage.

By electing to receive the royalty proceeds as physical uranium, it allows URC to control the sale of the attributed pounds in a disciplined, yet fully unhedged manner, focusing on providing the maximum value to shareholders. This is a big deal, in my view, showing how undervalued management believes the spot price to be and that it wants to grow its physical storage.

Shares are already up 13.33% in 2023

Intelligent Investments, Secure Future

In addition, the company has a strategic investment in Yellow Cake, a company that has a long-term supply agreement with Kazatomprom, the world’s largest uranium producer. This supply agreement enables Yellow Cake to purchase up to $1.07 billion (including existing purchases) of uranium from Kazatomprom over a 10-year period.

Yellow Cake has already completed its initial purchase of uranium, acquiring a significant amount of 8.1M lbs. of U3O8 for a cost of $170 million. Plus, since the initial investment, Yellow Cake has purchased an additional 0.35 million lbs. of U3O8 from Kazatomprom for $8.2 million and 1.175 million lbs. for $30.4 million.

Uranium Royalty Corp. currently has an approximate 9.6% stake in Yellow Cake. This is direct exposure to the rising uranium price and a nice addition to the company’s royalty and streaming revenues.Uranium Royalty Corp. also has the option to acquire up to $31.25 million ($2.5 million to $10 million per year) worth of uranium between January 2019 and January 2028. On top of it all, URC has an option to participate in any and all future uranium royalty and stream transactions Yellow Cake pursues on a 50:50 basis.

Uranium Royalty Corp. also has the option to acquire up to $31.25 million ($2.5 million to $10 million per year) worth of uranium between January 2019 and January 2028. On top of it all, URC has an option to participate in any and all future uranium royalty and stream transactions Yellow Cake pursues on a 50:50 basis.

Not only that, but URC and Yellow Cake have agreed to collaborate on future opportunities involving physical uranium.

Uranium Royalty (NASDAQ: UROY) Utilizes a Disciplined Approach to Manage its Fiscal Profile and Has Stable, Strong Counterparties and Operators.

THE SMART, DISCIPLINED APPROACH

Its royalty portfolio can only be described as world-class. Part of this portfolio is the Cigar Lake mine (located in Saskatchewan, Canada), whose joint venture partners are currently Cameco (50.025%), Orano Canada Inc. (37.1%), Idemitsu Canada Resources Ltd. (7.875%), and TEPCO Resources Inc. (5%)!

Cigar Lake is licensed to produce 18 million pounds of uranium per year. Historical production of 93 million pounds of uranium has been recorded since Cigar Lake went into production in 2014. In our opinion, this is one of the best uranium projects in the world today, based upon numerous valuation metrics.

The McArthur River mine is also an essential component of Uranium Royalty Corp.’s royalty portfolio. This mine is currently owned by a joint venture between Cameco (69.805%) and Orano (30.195%).

Along with the Key Lake Mill, McArthur River is licensed to produce 25 million pounds of uranium per year. In 2018, Cameco disclosed that it was put on care and maintenance. McArthur River is expected to be the first of Cameco’s operations to restart after Cigar Lake, based on market conditions.

Uranium Royalty (US: UROY) has a healthy balance sheet, which positions it to capitalize on accretive uranium royalty and streaming acquisition opportunities.

The company has $38M in cash and listed securities.

The company just recently entered into a definitive agreement to acquire the existing royalty interests on the McArthur River and Cigar Lake mines.

This acquisition represents a transformational transaction for Uranium Royalty Corp. because it provides potential near- to long-term cash-flow opportunities from existing long-life mines operated by Cameco in partnership with Orano Canada Inc., two of the world's most prominent uranium and nuclear fuel companies!

It’s a transaction that will only enhance Uranium Royalty Corp.’s already world-class production profile. The McArthur River and Cigar Lake mines rank as the two largest high-grade uranium mines in the world, with ore grade 100x the world averages as disclosed by Cameco!

Based on disclosed production capacities, the McArthur River and Cigar Lake mines have a combined capacity equal to 21% of global forecasted uranium demand for 2021. Moreover, both operations are believed to be among the lowest operating costs globally, with expected life of mine cash costs of between C$15 to C$16 per pound as disclosed by Cameco.

This is as big as it gets, in our view.

McArthur River and Cigar Lake have a combined total of 557.5 million lbs. of proven and probable mineral reserves as of December 31, 2020!

Altogether, this represents approximately 29% of the Global Reasonably Assured Recoverable Resources as stated by the International Atomic Energy Agency for the lowest-cost category!

Canada’s Athabasca Basin of Northern Saskatchewan is the premier region for high-grade conventional mining. Uranium Royalty Corp.’s growing royalty portfolio in this district, which includes a 1.97% net smelter royalty on Rio Tinto’s nearby Roughrider project, provides URC with exposure to long-life assets with existing infrastructure and exploration upside covering approximately 270,000 hectares of ground.

With major producers as operators, the company has the benefit of counterparties with proven operating track records and best in class environmental, social and corporate governance (ESG) practices.

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Virtus Media business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company's website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers' works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer's communications regarding the profiled company(s). You should assume all information in all of our communications in incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation: Pursuant to an agreement between Virtus Media LLC and West Coast media , Virtus Media has been hired for a period beginning on 2023-02-01 and ending after 2023-02-02 to publicly disseminate information about NASDAQ: UROY . We have been paid Four thousand dollars USD via ACH Bank Transfer.