LATEST NEWS

Alaska Energy Metals Intersects 356.2 Meters Grading 0.34% Nickel Equivalent, Extending Mineralization Along Strike At The Nikolai Nickel Project, Alaska

6 Reasons Why Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) Could Be Poised For Significant Upside Potential in 2024

Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) is spearheading the development of a large-scale nickel project in central Alaska, aiming to supply the essential strategic metals required to secure America’s energy future and drive the electric vehicle revolution.

IDENTIFYING THE OPPORTUNITY

THE OPPORTUNITY IS HERE

We are seeing a major shift in trend, putting this company in the market spotlight for true appreciation...

Alaska Energy Metals

(TSX.V: AEMC)(OTCQB: AKEMF)

A Domestic Source of Nickel for Energy Transition

Investors should conduct thorough research on Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) for several compelling reasons. First and foremost, Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) is at the forefront of advancing the Nikolai project, a significant nickel and battery metal project located in central Alaska. With a potential for multi-billion-pound nickel reserves, the company is strategically positioned to contribute to America's energy transition and the electric vehicle revolution. Researching Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) allows investors to tap into the growing demand for nickel in this crucial phase of the green energy transition.

Moreover, historical drilling results indicate the presence of substantial nickel deposits along with other essential metals, reinforcing the project's potential. The company recently completed a drilling program, with expectations of establishing a maiden Inferred Resource by March 2024, providing investors with a near-term catalyst for potential growth. Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF)'s experienced management team, led by seasoned exploration geologist Greg Beischer, and its strong financial backing from Commodity Partners of Vancouver, Canada, ensure the company's capability to execute excellent exploration programs and its financial stability.

Additionally, Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) operates in Alaska, a favorable jurisdiction for mining, providing a stable regulatory environment and infrastructure that includes paved highways, gravel road access, and proximity to main rail and grid power systems. Conducting in-depth research on Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) allows investors to align their portfolios with a company that offers both strategic value and potential growth in the booming electric vehicle and green energy sector.

The NIKOLAI project

Several Near-Term Share Catalysts: An initial drilling program to be completed by Fall 2023 should result in a maiden Inferred Resource. If historic concentrations are proven the resource should exceed one billion pounds of contained nickel.

Key Metals For Electrification: Nickel is a key component of rechargeable batteries. The world is rapidly adopting electric vehicles, and thus the demand for nickel is growing quickly.

Key Management Team In Place: Mr. Beischer and the team of exploration geologists and support staff are experts at executing mineral exploration projects in Alaska.

Well-Capitalized Company: The company is well-financed and partnered with Commodity Partners to connect the company with with quality financial backers

Pro-Resource Development State: Alaska is a pro-resource development state with efficient permitting processes and mandates the development of resources.

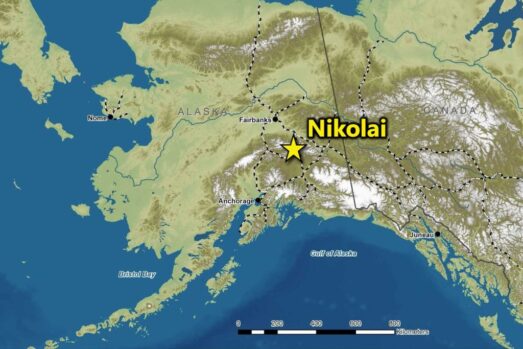

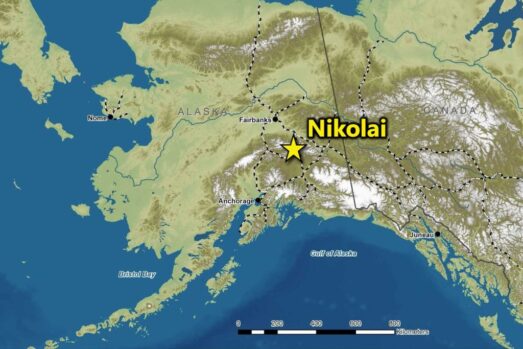

NIKOLAI'S LOCATION

The Nikolai project is located 40 km northwest of the village of Paxson, on the southern flank of the Alaska Range. The claims are proximal to paved highways and a network of gravel roads and trails afford ready access to the Canwell claim block.

The City of Fairbanks lies approximately 200 kilometers to the northwest. The city of Delta Junction lies 130 kilometers to the north of the project and has many services and amenities that support the Alaska mining community. The main Alaska power line and railway lie 100 kilometers to the west along the Denali Highway.

Sulphide Nickel and battery metal project with a multi-billion pound potential

The Nikolai project's role in the production of sulphide nickel and other battery metals presents a compelling opportunity for investors. With the ongoing energy transition and the increasing demand for nickel to support the electric vehicle revolution, this project offers the promise of becoming a substantial domestic source of nickel. Historical drilling results have provided strong indications of a significant nickel deposit and the presence of other valuable metals. By researching this project, investors can gain insight into a potentially vital resource that aligns with the global transition to cleaner and more sustainable energy sources.

The upcoming drilling program, slated for completion in the Fall of 2023, is a pivotal moment in the Nikolai project's development. The goal is to establish a maiden Inferred Resource, which, if the historical concentrations are confirmed, could surpass one billion pounds of contained nickel. This ambitious target aims to solidify the project's significance in the market. Investing the time to study this initiative is essential for investors seeking to capitalize on the growth potential associated with a large-scale domestic source of essential battery metals, including sulphide nickel, in the context of the ongoing energy transition.

The projected achievement of the maiden Inferred Resource by Spring 2024 underscores the ambitious and efficient timeline set by the Nikolai project. For investors, this represents a near-term catalyst for potential growth and offers a unique opportunity to participate in the development of a significant nickel resource with substantial multi-billion-pound potential. Researching and monitoring the project's progress can enable investors to make informed decisions and position themselves strategically in the evolving landscape of green energy and electric vehicle industries.

Located in a tier-1, pro-resource jurisdiction

Alaska's favorable regulatory environment positions it as a pro-resource development state, offering a significant advantage for companies like Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF). The state boasts an efficient permitting process, which can expedite the development of mining projects. While federal permitting for mining endeavors in Alaska can be complex and susceptible to political influence, the overarching trend is one of support for the transition to electrical energy. The federal government recognizes the urgency of securing domestic supplies of critical and strategic metals such as nickel and cobalt, aligning with the national focus on sustainability and energy independence. This makes Alaska a promising jurisdiction for mining investments, especially for companies with a focus on clean energy transition.

In addition to regulatory advantages, Alaska stands out with competitive taxation rates and high evaluations in mining jurisdiction assessments. Independent analyses have confirmed the state's appeal as a mining-friendly region, further strengthening its reputation as a strategic destination for mineral resource development. These advantages not only create a more stable and supportive environment for mining operations but also enhance the investment prospects for projects like the Nikolai project spearheaded by Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF). The combination of favorable regulations, federal support for clean energy initiatives, and a conducive taxation framework underscores the strategic importance of researching and investing in mining projects within Alaska.

Investors researching Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) and its projects should consider the broader context of Alaska's resource-rich landscape, which offers a promising backdrop for mining ventures. The state's commitment to sustainable energy and its recognition of the critical role played by metals like nickel and cobalt in the transition to electrical energy make it an appealing destination for those seeking to participate in the burgeoning green energy sector.

Led By An Alaska-based Team That Understands exploration

Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) boasts a highly experienced leadership team, spearheaded by Greg Beischer, a seasoned geologist and mining engineering technologist with a remarkable track record in the industry. With over three decades of experience, Beischer brings invaluable expertise in magmatic nickel deposit exploration to the company. His impressive career includes a notable tenure as the head of Millrock Resources, where he excelled in raising over US$50 million for exploration projects. Mr. Beischer's success was often achieved through strategic partnerships with major mining companies, showcasing his acumen for project financing and collaboration.

Furthermore, the transition of key staff from Millrock to Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) has further strengthened the company's capabilities. This migration has formed a skilled team of exploration geologists and support staff with a deep understanding of mineral exploration within the unique Alaskan terrain. Their collective expertise and experience in executing mineral exploration projects in the region make the team exceptionally well-suited to drive the success of Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) and its ambitious projects.

The presence of such a seasoned and capable management team under Greg Beischer's leadership enhances the company's ability to deliver on its exploration objectives. Investors can take confidence in the wealth of knowledge and experience at the helm, providing a strong foundation for executing successful exploration programs and advancing the company's strategic goals.

With a history of effective fundraising and a talented team with a strong focus on Alaska, Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) is well-positioned to navigate the complexities of mineral exploration in the region and drive growth in the green energy sector. Researching the expertise and track record of the leadership team is crucial for investors seeking to understand the company's potential and its ability to capitalize on opportunities in the dynamic field of battery metals and green energy.

Focused On A Metal Required For The Future

Nickel is a versatile metal with a wide range of applications, but its role in the energy sector is becoming increasingly significant. Traditionally known for its use in stainless steel production, nickel has now taken on a critical role as a cathode material in rechargeable batteries, including those powering cell phones, laptops, power tools, and electric vehicles. This transformation is driven by the global shift towards cleaner and more sustainable energy solutions. As electric vehicles gain rapid global adoption, the demand for nickel is growing swiftly, creating a surge in demand for this essential battery material.

The challenge in this context lies in ensuring a stable and secure supply of nickel to meet the surging demand. Recognizing the need for a domestic source of critical metals like nickel, the United States is actively seeking ways to bolster its supply chain and reduce dependency on foreign sources. Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF)'s project, the Nikolai project, is poised to play a pivotal role in addressing this need. The project holds significant potential to serve as a reliable domestic source of nickel, aligning perfectly with the country's goals for a sustainable energy transition.

By investing in projects like the Nikolai project, not only do investors position themselves in a sector with robust growth potential, but they also support America's drive towards energy sustainability and independence. This dual benefit makes the research and investment in Alaska Energy Metals a compelling proposition for those looking to contribute to the ongoing green energy revolution while seizing opportunities in the expanding market for battery metals.

Moreover, the need for secure domestic supplies of strategic metals like nickel has never been more apparent. As geopolitical tensions and supply chain vulnerabilities come to the forefront, it is crucial to establish a reliable domestic source of these critical materials. Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF)'s focus on meeting the growing nickel demand in a sustainable and responsible manner is a promising step towards achieving energy security and reducing dependency on external sources.

In summary, nickel's role in rechargeable batteries, especially in the electric vehicle industry, is pivotal for the global transition to clean energy. Alaska Energy Metals' Nikolai project represents an exciting prospect for both investors and the United States as it seeks to secure a stable supply of nickel to support its energy transition goals. Investing in companies like Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) not only has the potential for significant returns but also contributes to a more sustainable, independent, and secure future for the United States in the realm of critical metals.

Alaska Energy Metals

(TSX.V: AEMC)(OTCQB: AKEMF)

Unearthing Potential: Target Zones for Future Prosperity

TARGET 1

The Eureka Zone

Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) has made a significant breakthrough in the realm of mineral exploration by identifying a promising zone of mineralization within the Eureka Zone. This expansive zone, measuring 1700 meters by 600 meters by 300 meters, showcases the presence of potentially economic concentrations of multiple critical metals. Among the treasures contained within this zone are nickel, copper, cobalt, platinum, palladium, and gold, all of which play pivotal roles in the green energy and industrial sectors.

Intriguingly, Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) has postulated that this mineralization zone might hold even greater riches. The company's hypothesis suggests that higher-grade mineralization could be lurking in embayment features at the base of the Eureka Zone. These embayments are envisioned as reservoirs where heavy metals might accumulate during the fractionation and crystallization processes of the underlying ultramafic intrusion. This tantalizing possibility opens up exciting prospects for further exploration and resource assessment.

To unlock the full potential of the Eureka Zone, Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) recognizes the necessity of additional drilling. Confirming the hypothesis and conducting in-fill drilling within the identified zone are pivotal steps in the company's roadmap. The ultimate goal is to define a resource that adheres to the rigorous standards of the NI 43-101/JORC compliance, a testament to their commitment to responsible and transparent resource assessment. This undertaking not only signifies a leap forward in their exploration efforts but also promises to contribute significantly to the global supply of these vital metals, reinforcing Alaska Energy Metals' position as a key player in the energy transition.

TARGET 2

The Canwell Project

The Canwell Prospect stands as a beacon of untapped potential in the world of mineral exploration. Marked by exceptionally high-grade surface showings, this prospect has garnered attention for its significant mineralization riches. Surprisingly, limited drilling has been conducted in this promising area, and very little exploration has taken place, allowing the allure of discovery to remain largely uncharted. What further accentuates the intrigue surrounding the Canwell Prospect is the continuous exposure of new geological formations, thanks to receding glaciers, offering the tantalizing prospect of uncovering even more hidden treasures beneath the earth's surface.

A testament to the Canwell Prospect's rich mineral content lies in its historical drilling record. The highlight is the impressive CAN-01 drill intersection, where a mere 5.2 meters of exploration revealed a remarkable 1.59% Nickel Equivalent (NiEq). This result encompasses a diverse range of valuable metals, including 0.71% Nickel, 0.54% Copper, 0.017% Cobalt, 0.234 grams per ton of Gold, 0.746 grams per ton of Platinum, and 0.853 grams per ton of Palladium. This historic achievement underscores the prospect's exceptional mineral wealth and the promise it holds for future exploration efforts.

Summer 2023 marks a significant milestone in the quest to unlock the Canwell Prospect's full potential. Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) is set to embark on a comprehensive exploration program that includes rock and soil sampling, as well as ground geophysical surveys. These activities are strategically designed to position the company for a pivotal Summer 2024 drilling campaign. With a budget of $1 million earmarked for this purpose, the company is making a substantial investment in the pursuit of uncovering the Canwell Prospect's hidden riches, further solidifying their commitment to responsible and transparent resource assessment while seizing the opportunity to contribute to the growing demand for critical metals in the green energy and industrial sectors.

Alaska Energy Metals

(TSX.V: AEMC)(OTCQB: AKEMF)

THE Riches Beneath Alaska's Terrain

Project target

The Nikolai project stands as a treasure trove of mineralization, housing a rich variety of valuable metals, including nickel (Ni), copper (Cu), cobalt (Co), chromium (Cr), and platinum group elements (PGE). This impressive diversity of minerals adds a layer of complexity and opportunity to the project, showcasing its potential as a significant source of these critical materials for various industrial and green energy applications.

One of the exciting aspects of the Nikolai project is its potential to host multiple deposit types, each with its unique characteristics and economic significance. These deposit types include disseminated Ni-Cu-Co-Cr-PGE mineralization within serpentinized ultramafic rocks, reminiscent of the Crawford deposit in Canada. This form of mineralization has the potential to be a substantial source of critical metals.

Furthermore, the Nikolai project bears similarities to the massive sulfide Ni-Cu-PGE mineralization found at the Norilsk Mine in Russia. This kind of deposit is renowned for its high-grade and massive concentrations of nickel, copper, and platinum group elements, making it a valuable asset within the project.

The project's potential also extends to remobilized high-grade Ni-Cu-PGE mineralization, with analogies to known mineral deposits. Additionally, it shares commonalities with volcanogenic massive sulfide (VMS) deposits, such as the Besshi style, which encompass copper (Cu), zinc (Zn), lead (Pb), gold (Au), and silver (Ag). One of the closest analogies is the Windy Craggy deposit in Canada, showcasing the diversity of opportunities that the Nikolai project presents.

Exploring these various deposit types and analogies underscores the multi-faceted nature of the Nikolai project and the potential it holds for contributing to the global supply of these crucial metals, especially in the context of the green energy transition and the booming industrial sector.

Land status

The land status of the Nikolai project is an essential facet of its development and potential for mineral exploration. The project is strategically situated across two separate but adjacent claims blocks, each holding unique characteristics and opportunities for discovery. The first of these blocks is the Eureka claim block, which encompasses a substantial 104 State of Alaska mining claims, collectively spanning 6,734 hectares. What makes this claim block particularly noteworthy is that it is wholly owned by Alaska Energy Metals, demonstrating the company's commitment and control over this vast and mineral-rich territory.

In parallel, the Canwell claim block adds another layer of potential to the Nikolai project. Comprising 42 State of Alaska mining claims, totaling 2,720 hectares, this claim block offers an intriguing proposition. Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) holds an option to purchase 100% interest in these claims from the underlying owner. As a result, the Canwell claim block contributes to the overall expanse of the project, extending the reach and potential for significant mineral discoveries. Collectively, the Nikolai project covers an impressive 94.54 square kilometers (9,454 hectares), showcasing its substantial footprint in a region rich with mineral wealth.

The strategic combination of the Eureka and Canwell claim blocks creates a formidable asset in the company's portfolio, allowing for comprehensive exploration and the pursuit of various mineral deposit types across this extensive territory. This dynamic land status sets the stage for a promising and ambitious exploration program, positioning Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) to tap into the potential riches that lie beneath the Alaskan soil. The expansive landholdings underscore the company's dedication to responsible resource assessment and sustainable mineral exploration while contributing to the growing global demand for essential metals.

Geology and mineralization

The geology and mineralization of the Nikolai project provide a fascinating insight into the project's vast potential. Nestled within the underexplored Wrangellia Terrane of Central Alaska, the project is situated in a region known for its geological diversity and mineral riches. A defining feature of this terrane is the Nikolai Greenstone, an extensive sequence of low-grade metamorphosed Late Triassic flood basalt rocks. This geological setting serves as the foundation for a wealth of minerals, including nickel, copper, cobalt, platinum, palladium, iridium, rhodium, osmium, ruthenium, gold, silver, lead, and zinc.

The territory's geological history is marked by the intrusion of mafic and ultramafic rocks, which form the source material for the Nikolai Greenstone. These rocks, in combination with Permian and Cretaceous felsic plutons, intruded Permian volcanic and volcaniclastic rocks, creating a rich and complex mineralization environment. The Wrangellia Terrane is renowned for its potential to host economic magmatic sulfide deposits, underscoring the significance of this region for mineral exploration.

The journey of exploration at the Nikolai project is characterized by a series of significant milestones. The initial discovery in 1997 by Inco Ltd. set the stage for subsequent exploration endeavors. Subsequent drilling efforts conducted by Pure Nickel Inc. and ITOCHU Corporation between 2008 and 2013 revealed a remarkable >15km mineralized corridor known as the Eureka Zone. This corridor is characterized by disseminated Ni-Cu-PGE mineralization intricately associated with serpentinized mafic and ultramafic rocks, exemplifying the diversity of mineralization forms present in the area.

The exploration efforts also extended to other intriguing targets, including massive sulfide Ni-Cu-PGE mineralization associated with mafic dikes that intersect the ultramafic sequence. Additionally, remobilized high-grade Ni-Cu-PGE mineralization associated with Cretaceous intrusions adds another dimension to the mineralization possibilities. Furthermore, the discovery of Cu-Pb-Zn-Au-Ag mineralization in volcaniclastic rocks further broadens the scope of exploration, with the potential for volcanic massive sulfide mineralization associations. The rich and varied geological and mineralization history of the Nikolai project holds the promise of unearthing valuable resources that contribute to the green energy transition and industrial sectors.

DIGGING DEEPER

Alaska Energy Metals

(TSX.V: AEMC)(OTCQB: AKEMF)

UPCOMING EXPLORATION PROGRAM

The upcoming exploration program by Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) represents a significant step in unlocking the potential riches of the Nikolai project. In particular, the focus is on the Eureka Zone, where an impressive zone of mineralization measuring 1700 meters by 600 meters by 300 meters has been identified. This zone showcases potentially economic concentrations of critical metals, including nickel, copper, cobalt, platinum, palladium, and gold. Such a diverse array of minerals makes this zone highly valuable and strategically positioned to meet the surging demand for these metals, especially in the context of the green energy transition.

What further intrigues experts at Alaska Energy Metals (TSX.V: AEMC)(OTCQB: AKEMF) is the hypothesis that higher-grade mineralization might be concealed within the embayment features at the base of the Eureka Zone. These features are considered reservoirs where heavy metals could accumulate during the fractionation and crystallization processes of the underlying ultramafic intrusion. This exciting possibility adds an element of mystery and anticipation to the exploration efforts. Confirming this hypothesis, along with in-fill drilling on the already identified zone of mineralization, forms a critical part of the plan, with the ultimate aim of defining a resource that adheres to the rigorous NI 43-101/JORC compliance standards.

Additionally, a comprehensive data review of the Canwell claims is currently underway, laying the groundwork for the evaluation of this intriguing area. This review process is vital for assessing the potential mineral wealth contained within the Canwell claim block. Based on the findings from this review, exploration targets will be ranked, ensuring that the drilling efforts are directed towards the most promising sites. Further bolstering the prioritization process, additional geochemical and geophysical techniques may be applied to refine the selection of drilling targets. The upcoming exploration program not only holds the promise of uncovering valuable metals but also represents a critical step in Alaska Energy Metals' commitment to responsible and sustainable resource assessment in support of the growing global demand for essential minerals.

Sources

- Source 1: https://alaskaenergymetals.com/

- Source 2: https://alaskaenergymetals.com/projects/nikolai/

- Source 3: https://alaskaenergymetals.com/news/intersects-356-meters-nickel-extending-mineralization-at-nikolai/

- Source 4: https://alaskaenergymetals.com/investors/stock-info/

- Source 5: https://alaskaenergymetals.com/corporate/leadership/

- Source 6: https://alaskaenergymetals.com/news/

- Source 7: https://finance.yahoo.com/quote/AKEMF?p=AKEMF&.tsrc=fin-srch&guccounter=1

- Source 8: https://finance.yahoo.com/news/alaska-energy-metals-intersects-356-113000786.html

- Source 9: https://www.youtube.com/watch?v=K6JwgVs0JMw

- Source 10: https://alaskaenergymetals.com/wp-content/uploads/Alaska-Energy-Metals-Image-03.jpg

- Source 11: https://alaskaenergymetals.com/wp-content/uploads/Alaska-Energy-Metals-Logo-Gradient-Final-01-Web.png

- Source 12: https://alaskaenergymetals.com/wp-content/uploads/MRO-Website-Background-WebRes-5.jpg

- Source 13: https://alaskaenergymetals.com/wp-content/uploads/Alaska-Energy-Metals-Nikolai-Project-Map-01.jpg

- Source 14: https://alaskaenergymetals.com/wp-content/uploads/MRO-Website-Background-WebRes-5-1024x768.jpg

- Source 15: https://alaskaenergymetals.com/wp-content/uploads/Background24-1024x686.jpg

- Source 16: https://alaskaenergymetals.com/wp-content/uploads/Alaska-Energy-Metals-Image-01-1024x683.jpg

- Source 17: https://alaskaenergymetals.com/wp-content/uploads/AEM-Hero-Image-01.png

- Source 18: https://alaskaenergymetals.com/investors/presentations/

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and Alaska Energy Metals Corporation, Virtus Media Group LLC has been hired by Alaska Energy Metals Corporation for a period beginning on 11/13/2023 and ending 12/29/2023 to publicly disseminate information about TSX.V: AECM, OTCQB: AKEMF via digital communications. We have been paid seventy-five thousand dollars USD. Social media influencer 1. five hundred dollars USD,Social media influencer 2. five hundred dollars USD, Social media influencer 3. seven hundred fifty dollars USD, Social media influencer 4. fifteen hundred dollars USD, Social media influencer 5. five hundred dollars USD, Social media influencer 6. fifteen thousand dollars USD. Pursuant to a further agreement between Virtus Media Group LLC and Alaska Energy Metals Corporation, Virtus Media Group LLC has been hired by Alaska Energy Metals Corporation for a period beginning on 11/13/2023 and ending 12/29/2023 to publicly disseminate information about TSX.V: AECM, OTCQB: AKEMF via digital communications. We have been paid seventy-five thousand dollars USD. Social media influencer 1. five hundred dollars USD,Social media influencer 2. five hundred dollars USD, Social media influencer 3. seven hundred fifty dollars USD, Social media influencer 4. fifteen hundred dollars USD, Social media influencer 5. five hundred dollars USD, Social media influencer 6. fifteen thousand dollars USD. Pursuant to a further agreement between Virtus Media Group LLC and Alaska Energy Metals Corporation, Virtus Media Group LLC has been hired by Alaska Energy Metals Corporation for a period beginning on 01/05/2023 and ending 02/04/2023 to publicly disseminate information about TSX.V: AECM, OTCQB: AKEMF via digital communications. We have been paid seventy-five thousand dollars USD. Social media influencer 1. five hundred dollars USD,Social media influencer 2. five hundred dollars USD, Social media influencer 3. seven hundred fifty dollars USD, Social media influencer 4. fifteen hundred dollars USD, Social media influencer 5. five hundred dollars USD, Social media influencer 6. fifteen thousand dollars USD.