Unlocking High Potential: Strategic Reverse Stock Split Opens Doors for Little-Known Company in 2023…

Now, with fewer than 600,000 shares in its float, see why now may be the best time to start your research on Smart for Life, Inc. (Nasdaq: SMFL).

LATEST NEWS

Smart for Life Announces Closing of $1.58 Million Registered Direct Offering Priced At-The-Market Under Nasdaq Rules

7 Reasons Why Smart for Life, Inc. (Nasdaq: SMFL) Could Be Poised For Significant Upside Potential in 2023

IDENTIFYING THE OPPORTUNITY

THIS UNDERAPPRECIATED STOCK IS STARTING TO GET ITS WELL-DESERVED MARKET ATTENTION

With a float of roughly 600K, a little bit of investor interest could send this soaring higher!

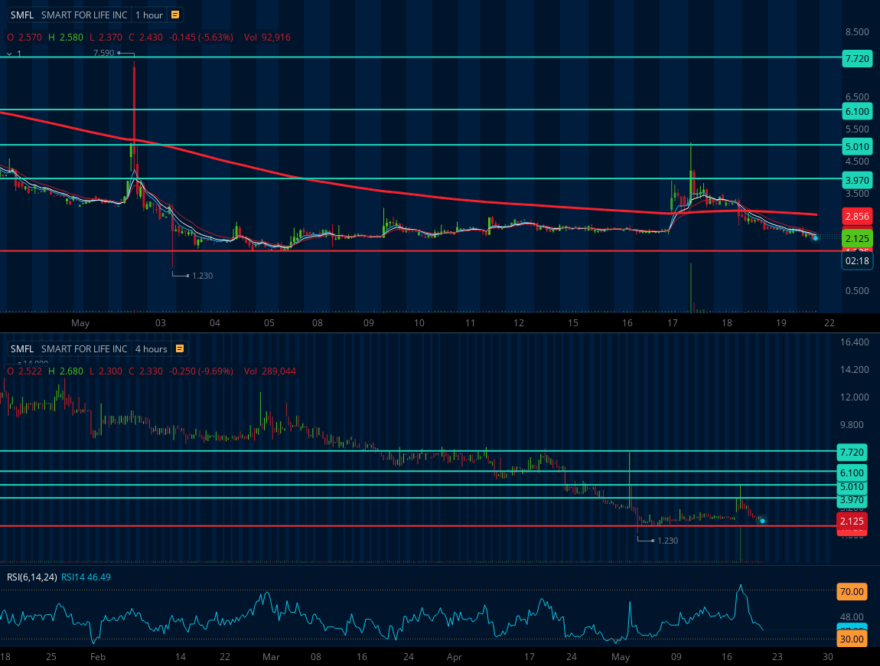

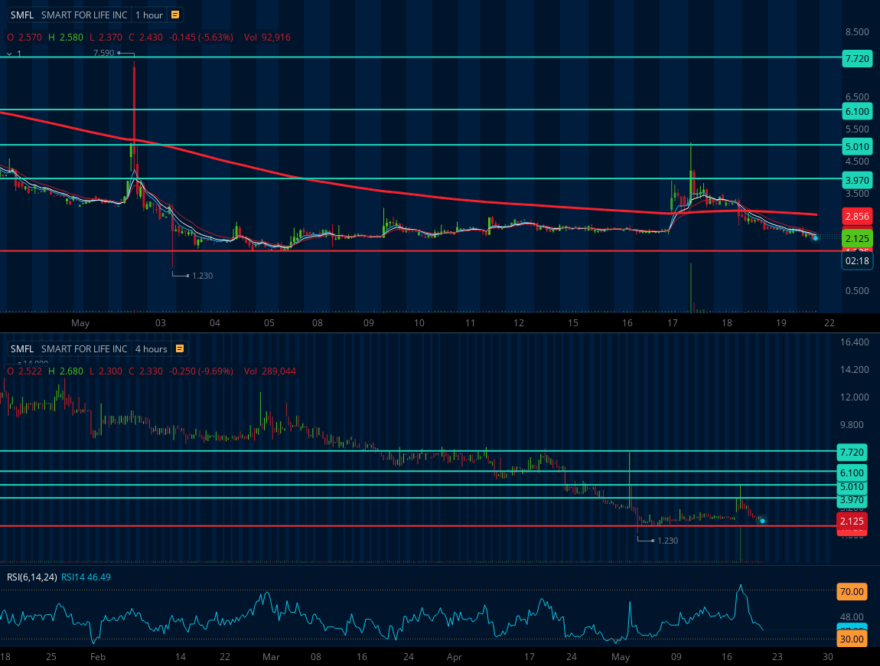

TRADE CONFIRMATION

Ideally, we would see a strong open and sustain a volume push over 20k. We are at a strong volume-based support level and should see RSI continuation going forward. We have an incredible risk-to-reward for longer-term investors.

TARGETS

Target #1: $3.97(+86.39%)

Target #2: $5.01 (+135.21%)

Target #3: $6.10 (+186.38%)

Bonus: $7.72 (+262.44%)

Support: $1.74

SMART FOR LIFE, INC.

(NASDAQ: SMFL)

Smart Moves: Smart for Life, Inc. (Nasdaq: SMFL) Shines with Recent Reverse Stock Split

In the world of finance, stock splits play a vital role in shaping market dynamics. Among the various types of splits, reverse stock splits stand out as an intriguing phenomenon worth exploring. Understanding the strategic maneuver of reverse stock splits can provide valuable insights into the ever-evolving landscape of the financial markets.

Reverse stock splits, unlike traditional splits that increase the number of shares, operate in the opposite direction. They involve reducing the number of outstanding shares while simultaneously boosting the share price. This calculated move aims to elevate the market price of the stock and enhance its perceived value.

Companies often employ reverse stock splits to enhance the appeal of their shares, particularly when navigating dynamic market environments. By reducing the number of outstanding shares, they effectively increase the value of each individual share, potentially attracting a broader range of shareholders.

One such example of a company that has utilized a reverse stock split to strategically position itself in a thriving market is Smart for Life, Inc. (Nasdaq: SMFL).

Smart for Life, Inc. (Nasdaq: SMFL) operates in the ever-expanding nutraceuticals market, a sector poised for significant growth. Their recent reverse stock split demonstrates their commitment to maximizing shareholder value and highlights their presence in an industry with immense potential.

Understanding the intricacies of reverse stock splits is invaluable for shareholders navigating the world of finance. By comprehending this strategic maneuver, market participants can better evaluate the potential benefits associated with reverse stock splits. Smart for Life, Inc. (Nasdaq: SMFL), operating in the dynamic nutraceuticals market, serves as a testament to the power of strategic decision-making and the opportunities that lie within emerging sectors.

Empowering Growth: Smart for Life, Inc. (Nasdaq: SMFL) Executes Reverse Stock Split

In April of 2023, Smart for Life, Inc. (Nasdaq: SMFL) announced its decision to implement a 1-for-50 reverse stock split of its common stock. Effective April 24, 2023, the reverse split aims to support the Company’s strategic initiatives as it prepares for the next generation of its acquisition financings.

With Smart for Life’s common stock continuing to trade on The Nasdaq Capital Market under the symbol “SMFL” on a split-adjusted basis, the reverse split is a step towards compliance with the minimum bid price requirement for maintaining the listing of its common stock.

Furthermore, this strategic move seeks to enhance the attractiveness of the bid price to potential stakeholders. The reverse split forms part of a larger plan to bolster future acquisition financings, including several accretive acquisitions in the Company’s current and prospective pipeline.

Darren Minton, Chief Executive Officer of Smart for Life, acknowledged the challenging market conditions faced by public companies in recent times. "This strategic restructuring aligns with our capitalization plans and positions the Company for our continued growth through accretive acquisitions." Highlighting their goals, he further added, "We are committed to achieving over $100 million in annualized revenues within the next twelve months based on anticipated acquisitions, while also aiming for $300 million in revenues by 2026."

Smart for Life, Inc. (Nasdaq: SMFL): Unveiling the High Potential of its Low Float

In the world of finance, the concept of “float” refers to the number of shares available for public trading. A low float indicates a smaller number of shares available for trading, and it is often perceived as a characteristic of interest. While larger corporations may have billions of shares in their float, a float of 10 to 20 million shares is considered relatively low.

According to Benzinga.com, Smart for Life, Inc. (Nasdaq: SMFL), a leading company in the health and wellness sector, currently has approximately 583,234 shares in its public float. This limited float is significant as stocks with lower floats tend to exhibit higher volatility.

With fewer shares available, even a slight increase in demand can result in substantial fluctuations. Given the low float of Smart for Life, Inc. (Nasdaq: SMFL), it has become an intriguing company to watch closely for those interested in its prospects.

Smart for Life, Inc. (Nasdaq: SMFL) with its limited float and dedication to the health and wellness sector, is a company that commands attention. Its potential for growth and its commitment to improving the lives of individuals make it a standout player in its industry.

SMART FOR LIFE, INC.

(NASDAQ: SMFL)

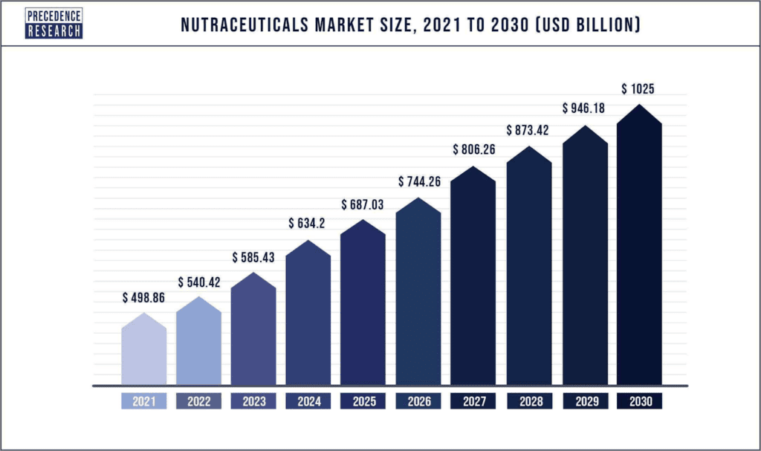

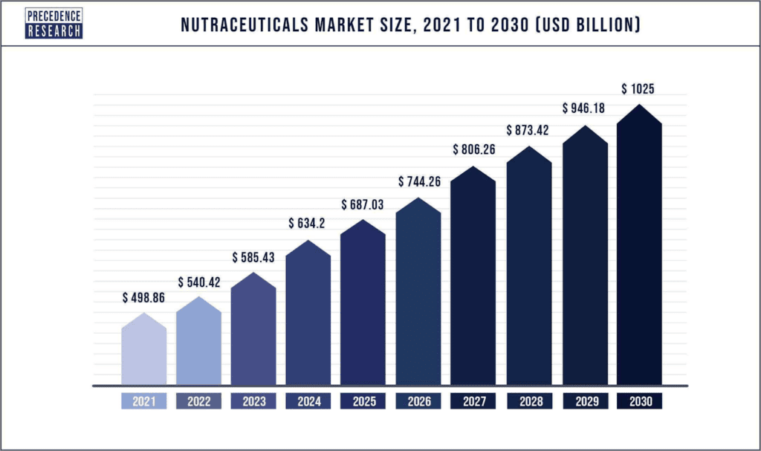

The Nutraceuticals Market: A Burgeoning Industry Set to Cross $1 Trillion

The global nutraceuticals market is on an upward trajectory, with projections estimating that it will reach a staggering $1 trillion by 2030. As a booming sector encompassing a wide array of health-promoting products, nutraceuticals have become a focal point for consumers seeking to improve their well-being through dietary supplementation.

Nutraceuticals, which can range from dietary supplements to functional foods and beverages, are designed to provide additional health benefits beyond basic nutritional value. The industry is propelled by factors such as the growing awareness of health and wellness, rising disposable incomes, increased interest in preventive healthcare, and continuous innovations in product development.

According to a report by Precedence Research, the global nutraceuticals market was valued at approximately $498.86 billion in 2021 and is expected to reach $1 trillion by 2030, growing at a compound annual growth rate (CAGR) of 8.33% during the forecast period from 2022 to 2030.

The driving forces behind the growth of the nutraceuticals market are manifold. A shift in consumer behavior toward preventive healthcare and the use of function-specific antioxidants play a key role in industry expansion. Furthermore, the market has experienced an increase in the number of fitness centers in developing regions, as well as the rise of the e-commerce industry, which has expanded the accessibility and distribution of nutraceutical products.

While the recent global pandemic posed challenges to the nutraceutical supply chain, it also created growth opportunities. As the focus shifted toward maintaining a stronger immune system, demand for supplements such as multivitamins, omega-3 fatty acids, and protein supplements surged. Consumers became increasingly interested in products that could enhance their overall health and boost their immunity in light of the global health crisis.

In terms of product segments, dietary supplements lead the market, with vitamins, minerals, and protein supplements being the most widely used. These supplements have gained popularity due to their perceived health benefits, affordability, and easy availability. Additionally, research studies have suggested that dietary supplements can improve overall health, compensate for unhealthy eating habits, and reduce the risk of chronic diseases.

The functional food segment is also gaining traction, with an emphasis on products containing carotenoids, dietary fibers, fatty acids, prebiotics, probiotics, vitamins, and minerals. Functional beverages, including energy drinks, sports drinks, and functional juices, are expected to exhibit strong growth during the forecast period.

The nutraceuticals market is geographically diverse, with North America holding the largest market share due to the presence of major manufacturers, high disposable income, and an increasing focus on physical appearance and wellness. The region is home to key players in the industry and has witnessed significant investments in research and development, leading to the introduction of innovative nutraceutical products.

As the nutraceuticals market continues to thrive, it’s essential to keep an eye on emerging players in the industry. One such company to watch is Smart for Life, Inc. (Nasdaq: SMFL). Smart for Life is a health and wellness company that offers a range of products, including dietary supplements, protein bars, and meal replacement cookies, designed to support healthy weight management and overall wellness.

With a focus on developing innovative and scientifically-backed products, Smart for Life, Inc. (Nasdaq: SMFL) is well-positioned to capitalize on the growing demand for nutraceuticals. The company’s product offerings align with the consumer interest in preventive healthcare and the desire for convenient and nutritious options to support a healthy lifestyle.

The nutraceuticals market is poised for significant growth, driven by changing consumer behavior, health awareness, technological advancements, and the quest for preventive healthcare solutions. Companies like Smart for Life, Inc. (Nasdaq: SMFL) are at the forefront of this burgeoning industry, offering products that cater to the evolving needs of health-conscious consumers.

SMART FOR LIFE, INC.

(NASDAQ: SMFL)

Smart for Life, Inc. (Nasdaq: SMFL): A Growth-Focused Player in the Nutraceutical Market.

Smart for Life, Inc. (Nasdaq: SMFL), a global holding company listed on the Nasdaq, is making significant strides in the nutraceutical industry. The company’s core activities revolve around the development, marketing, manufacturing, acquisition, operation, and sale of a wide range of nutritional products with a focus on health and wellness. Smart for Life’s growth strategy, often referred to as the “buy and build” approach, is a proactive plan that seeks to aggregate a minimum of $300 million in revenues within the next 36 months through a combination of organic growth and strategic acquisitions.

As of Q2 2023, Smart for Life, Inc. (Nasdaq: SMFL) is already generating pro forma revenues of $20 million, and this figure is expected to rise to over $100 million in annualized revenues in the next twelve months. The anticipated growth will be fueled by strategic acquisitions, as well as the development of proprietary products that align with the company’s emphasis on health and wellness.

Smart for Life, Inc. (Nasdaq: SMFL)’s acquisition strategy leverages a combination of cash, seller notes, earnouts, and stock to acquire target companies. Typically, the cash portion of a transaction ranges from 40% to 60%. This approach presents unique advantages to stakeholders of the acquired companies, offering them a substantial liquidity event and a meaningful equity position in a Nasdaq-listed public company. Moreover, the management of the acquired companies can continue in their roles, driving growth and innovation with the added benefit of access to the resources and opportunities of being part of a larger, multifaceted organization.

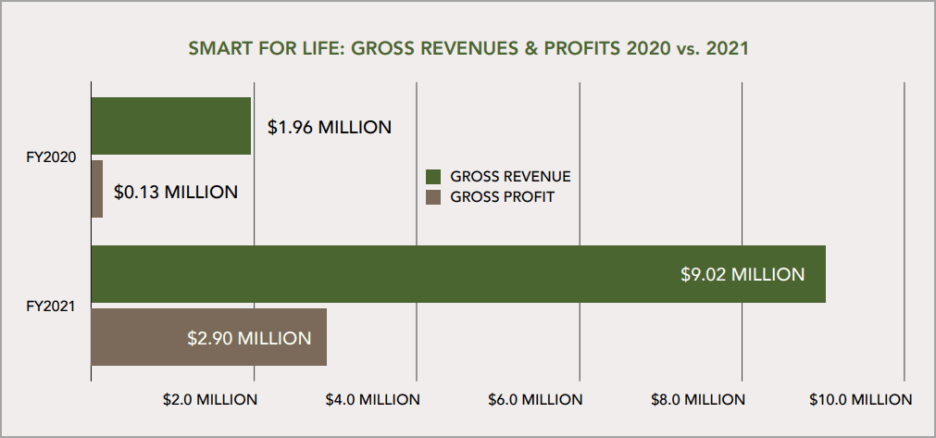

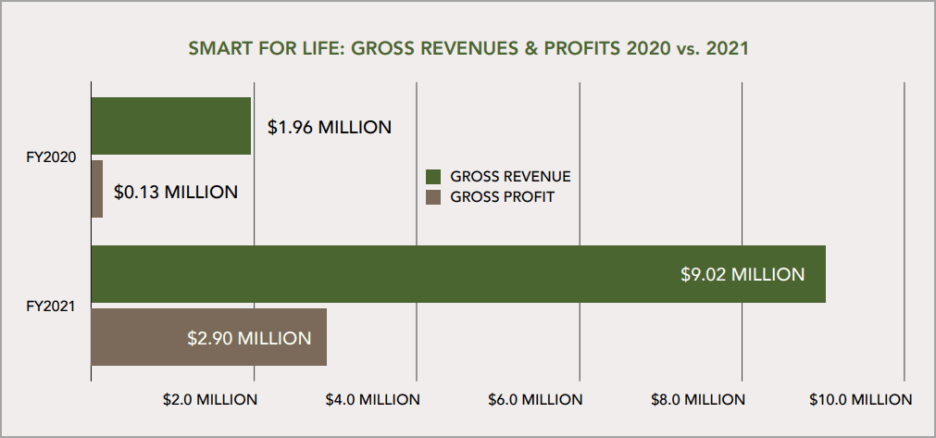

Smart for Life, Inc. (Nasdaq: SMFL) Experiences a 360% Increase in Revenue.

This growth strategy has already proven successful, as Smart for Life, Inc. (Nasdaq: SMFL) experienced a 360% increase in revenue in the fiscal year 2021. This remarkable revenue boost was driven by the closing of three acquisitions toward the end of 2021, validating the company’s ability to effectively implement its “buy and build” approach and integrate acquired companies into the Smart for Life corporate family.

The acquisitions served not only to enhance the company’s revenue but also to expand its product lines, production capabilities, distribution, and marketing capabilities. As a result, Smart for Life is further positioned for success in the competitive nutraceutical market.

Smart for Life, Inc. (Nasdaq: SMFL) is a company with a clear vision for growth and an effective strategy for achieving it. Through strategic acquisitions and the development of innovative, health-focused products, Smart for Life is poised to become a significant player in the booming nutraceutical industry. With its established revenues and major growth potential, the company is one to watch as it continues its mission to promote health and wellness on a global scale.

SMART FOR LIFE, INC.

(NASDAQ: SMFL)

Doctors Scientific Organica (DSO)’s Strong Presence on Amazon: A Key Driver of Growth

Doctors Scientific Organica (DSO), a subsidiary of Smart for Life, Inc. (Nasdaq: SMFL), has gained a reputation for its innovation in health foods and wellness products. Known for its proprietary manufacturing processes carried out at its state-of-the-art production facility in Southern Florida, DSO delivers products that prioritize taste and quality. In addition to making its products available in big box retailers such as Costco, Walmart, BJ’s, and Sam’s Club, DSO has strategically leveraged the power of online marketplaces, particularly Amazon, to expand its reach and serve a broader customer base.

Expanding Accessibility Through Amazon

Amazon, the world’s largest online retailer, has become a central part of DSO’s distribution strategy. By offering its products on Amazon, DSO has expanded its accessibility to consumers across the nation and beyond. With Amazon’s user-friendly platform, vast customer base, and robust fulfillment and delivery infrastructure, DSO has been able to seamlessly connect with health-conscious consumers seeking high-quality wellness products.

Enhancing Brand Visibility

DSO’s presence on Amazon has also contributed to enhanced brand visibility. Amazon’s powerful search and recommendation algorithms have helped DSO’s products reach consumers who may not have been previously aware of the brand. Moreover, Amazon’s customer review system allows potential buyers to read feedback from satisfied customers, further reinforcing DSO’s reputation for delivering top-quality health and wellness products.

Utilizing Amazon's Fulfillment Capabilities

By utilizing Amazon’s fulfillment capabilities, including Fulfillment by Amazon (FBA), DSO has been able to optimize its logistics and inventory management. With FBA, DSO’s products are stored in Amazon’s fulfillment centers, where they are efficiently picked, packed, and shipped directly to customers. This allows DSO to focus on product development and innovation while Amazon handles order fulfillment and customer service. Additionally, DSO’s products that are fulfilled by Amazon are eligible for Prime two-day shipping, making them even more attractive to Amazon Prime members.

Leveraging Amazon Marketing Services

DSO has strategically used Amazon Marketing Services (AMS) to further promote its products and drive sales. Through AMS, DSO can create targeted advertising campaigns to reach specific customer segments, increase product visibility, and boost conversion rates. Sponsored product listings, display ads, and brand stores are just a few of the tools available to DSO through AMS, allowing the brand to stand out in a competitive marketplace.

Capitalizing on Amazon's Global Reach

Amazon’s international presence has enabled DSO to tap into global markets and reach health-conscious consumers beyond the United States. By offering its products on Amazon’s international platforms, DSO has expanded its potential customer base and gained a foothold in key markets around the world. This global reach has opened up new opportunities for growth and brand recognition on an international scale.

Driving Innovation and Launching New Products

DSO’s successful partnership with Amazon has provided the brand with valuable insights into consumer preferences and behavior. By analyzing data from Amazon sales, DSO can identify product trends and areas of demand, enabling the brand to tailor its offerings to meet the evolving needs of consumers. Moreover, Amazon’s platform provides an ideal launchpad for introducing new products to the market. DSO can leverage Amazon’s extensive customer base and marketing tools to generate buzz and drive sales for its latest innovations in health foods and wellness products.

Enhancing Customer Experience and Building Loyalty

DSO’s commitment to customer satisfaction is reflected in its efforts to enhance the online shopping experience on Amazon. By providing detailed product descriptions, high-quality images, and educational content, DSO ensures that customers are well-informed about the benefits of its products. Furthermore, DSO’s responsive and attentive customer service, facilitated by Amazon’s customer support infrastructure, helps build trust and loyalty among consumers. Satisfied customers are more likely to leave positive reviews, recommend DSO’s products to others, and become repeat buyers.

Smart for Life, Inc. (Nasdaq: SMFL) – A Vertically Integrated Powerhouse in the Nutraceutical Sector with Exclusive Brand Licenses and Manufacturing Capabilities

At the forefront of the health and wellness industry is Smart for Life, Inc. (Nasdaq: SMFL), a vertically integrated, global holding company that boasts an impressive portfolio of thriving subsidiaries. With a unique blend of contract manufacturing, consumer brands, digital marketing services, and licensing agreements, Smart for Life is well-positioned to make a significant impact in the nutraceutical sector.

One of the key differentiators for Smart for Life, Inc. (Nasdaq: SMFL) is its ability to offer a variety of cutting-edge formulary and manufacturing capabilities, including capsules, tablets, powders, health bars, baked goods, functional foods, and other product types and delivery methods. The company’s commitment to innovation and excellence is evident in its diverse range of offerings and its dedication to empowering consumers to achieve better health and wellness.

Among the subsidiaries of Smart for Life is Ceautamed Worldwide, LLC, based in Boca Raton, Florida. Established in 2009, Ceautamed Worldwide owns the Greens First line of branded products, which are specifically marketed to the healthcare provider sector.

The company has successfully sold these vitamins and supplements through various channels, including business-to-business, direct-to-consumer, and international medical distribution.

Adding to the company’s sports nutrition segment is GSP Nutrition, which holds the exclusive license for the instantly recognizable Sports Illustrated Nutrition™ brand for certain dietary and nutritional supplements.

The product line includes whey protein powder, joint health supplements, pre and post-workout blends, omega-3 supplements, and more, with distribution in the United States and Canada. Doctors Scientific Organica (DSO) is another notable subsidiary of Smart for Life. As a leading manufacturer of health and wellness foods and supplements, DSO owns the Smart for Life retail brand.

With proprietary manufacturing processes carried out at its production facility in Southern Florida, DSO has established its reputation as an innovator in health foods. Its products are available in big box retailers such as Costco, Walmart, BJ’s, and Sam’s Club, as well as online through Amazon and the Smart for Life direct-to-consumer e-commerce site.

Bonne Santé Natural Manufacturing is a contract manufacturer of vitamins, sports nutrition, and other health supplements. Its state-of-the-art GMP and FDA-certified facility, located in Doral, Florida, provides world-class manufacturing and formulary services to clients both domestically and internationally.

Lastly, Nexus Offers is a subsidiary that provides an enhanced digital marketing platform for Smart for Life, Inc. (Nasdaq: SMFL)’s businesses, products, and service offerings.

Operating a cost-per-action/cost-per-acquisition network, Nexus leverages technology and marketing expertise to drive additional awareness and revenues for all Smart for Life brands.

Smart for Life, Inc. (Nasdaq: SMFL) Leverages BOXOUT®'s National Network to Enhance Distribution Strategy and Broaden Reach of Greens First Products

Smart for Life, Inc. (Nasdaq: SMFL) has announced a new distribution agreement with Boxout, LLC, a national distributor specializing in medical, rehabilitation, and health & wellness products. The collaboration aims to expand the distribution of the Company’s proprietary Greens First product line.

As part of the agreement, Boxout will distribute Greens First products through its established distribution channels, including medical offices, physical therapy centers, and chiropractic offices across North America. In addition to expanding distribution, both Smart for Life and Boxout plan to launch new e-commerce initiatives on various marketplace platforms.

Smart for Life’s Chief Executive Officer, Darren Minton, expressed enthusiasm about the partnership with Boxout, stating, “We are excited to expand our partnership with Boxout for distribution of our Greens First product line. Boxout is a prominent national distributor, and we believe their scalable solutions can help us cost-effectively optimize our distribution strategy.“

Minton also highlighted Boxout’s successful track record with leading brands and the potential benefits of leveraging their broad national distribution network.

Ryan Benson, CEO of Ceautamed Worldwide LLC, Smart for Life’s wholly-owned subsidiary, also emphasized the significance of the agreement, stating, “We have successfully worked with Boxout over the past several years and are excited to expand our agreement, including plans to implement new distribution channels, introduce new product lines and launch new e-commerce initiatives for the Greens First brand.“

Steven Copperman, Boxout’s Vice President, shared a similar sentiment, saying, “We have a longstanding relationship with Smart for Life and look forward to broadening the distribution of the Greens First brand through the health and wellness market.”

Boxout operates under several well-known brands, including MeyerDC®, MeyerPT®, ELIVATE®, and Milliken Medical®. With its headquarters located in Cleveland, OH, Boxout maintains distribution centers in Ohio, Florida, Texas, and California, thereby ensuring effective reach across the country.

Smart for Life, Inc. (Nasdaq: SMFL) is known for its commitment to the development, marketing, manufacturing, acquisition, operation, and sale of a broad spectrum of nutritional and related products. Through this new partnership with Boxout, the Company seeks to further enhance its presence in the health and wellness sector while providing consumers with greater access to its innovative products.

Forging the Path to Success: Meet The Expert Leadership of Smart for Life, Inc. (Nasdaq: SMFL)

The success and growth trajectory of Smart for Life, Inc. (Nasdaq: SMFL) can be attributed to its dynamic leadership team, comprised of experienced and visionary executives who bring diverse expertise to the table. At the helm of this thriving company are A.J. Cervantes, Jr., Founder and Executive Chairman; Darren Minton, CEO, and Director; and Alan Bergman, CPA, Chief Financial Officer. Together, this talented trio is driving the company’s strategic vision, spearheading mergers, and acquisitions, and navigating the complexities of the public markets. Let’s take a closer look at the backgrounds and contributions of these exceptional leaders who are shaping the future of Smart for Life.

A.J. Cervantes, Jr. - Founder & Executive Chairman

A dynamic leader with a visionary approach, A.J. Cervantes is the driving force behind Smart for Life as its Founder and Executive Chairman. With a remarkable track record spanning over 35 years, Cervantes brings a wealth of knowledge and expertise to the table. In addition to his instrumental role at Smart for Life, he serves as the Chairman of Trilogy Capital Group, LLC, a private equity firm, and is a principal shareholder of SMFL. Cervantes' expertise encompasses corporate finance, securities laws, and corporate governance, with a proven ability to catalyze the development of emerging growth companies. Having successfully navigated M&A, IPOs, APOs, and PIPEs, as well as the reorganization of middle-market companies, Cervantes is a master of strategy and execution.

Darren Minton - CEO & Director

As the CEO & Director of Smart for Life, Darren Minton is an accomplished executive with a sharp acumen in capital markets and a keen focus on M&A, corporate messaging, and growth strategies. Minton's partnership with A.J. Cervantes at Trilogy Capital Partners, a New York-based financial services company, speaks to his ability to forge fruitful collaborations. There, he served as President and played a pivotal role in international merchant banking, strategic advisory services, and financial communications. Minton's earlier career saw him honing his skills at Mesa West Capital and First Republic Bank. A proud alumnus of Stanford University, Minton holds a BA in Economics and continually leverages his knowledge to drive Smart for Life forward.

Alan Bergman, CPA - Chief Financial Officer

Alan Bergman, the Chief Financial Officer of Smart for Life, is a seasoned financial and accounting professional who brings a rich legacy of success to SMFL. Bergman's journey commenced at the prestigious Deloitte & Touche LLP in 2000, and since then, he has held key positions at notable firms including Weinberg & Company, P.A., Mallah Furman, P.A., and Greenlane Holdings, Inc. (Nasdaq: GNLN). Most recently, Bergman served as CFO at Bright Mountain Media, Inc. (OTCQB: BMTM). Beyond his corporate achievements, Bergman is also an educator, sharing his wisdom as a Professor of Accounting at Florida Atlantic University and Millennia Atlantic University. Holding a Master's in Accounting from the University of Miami, Bergman is a guiding light in financial strategy and management at Smart for Life.

Sources

- Source 1: https://www.barchart.com/stocks/quotes/SMFL/price-history/historical

- Source 2: https://smartforlifecorp.com/wp-content/uploads/2023/03/SMFL-Investor-Brief-Q2-2023.pdf

- Source 3: https://www.benzinga.com/pressreleases/23/03/g31473079/smart-for-life-enters-into-new-distribution-agreement-with-boxout-to-expand-distribution-of-greens

- Source 4: https://www.precedenceresearch.com/nutraceuticals-market

- Source 5: https://schrts.co/qMhzJPzq

- Source 6: https://www.barchart.com/stocks/quotes/SMFL/technical-analysis

- Source 7: https://smartforlifecorp.com/2023/04/02/chairmans-video-report/

- Source 8: https://greensfirst.com/

- Source 9: https://sportsillustratednutrition.com/

- Source 10: https://bonnesantemanufacturing.com/

- Source 11: https://nexusoffers.com/

- Source 12: https://finance.yahoo.com/news/smart-life-enters-distribution-agreement-123000451.html

- Source 13: https://www.boxouthealth.com/assets/video/hero_we-do.mp4

- Source 14: https://m.media-amazon.com/images/G/01/social_share/amazon_logo._CB635397845_.png

- Source 15: https://www.nasdaq.com/press-release/smart-for-life-announces-171-increase-in-amazon-sales-and-largest-prime-day-in-its

- Source 16: https://finance.yahoo.com/news/smart-life-announces-reverse-stock-164500006.html

- Source 17: https://investorplace.com/wp-content/uploads/2022/06/reverse-split-1600.png

- Source 18: https://www.femaleinvest.com/magazine/a-beginners-guide-to-reversed-stock-splits

- Source 19: https://www.businessinsider.in/stock-market/news/novo-integrated-sciences-soars-878-as-it-moves-from-over-the-counter-trading-to-nasdaq-capital-market/articleshow/81194095.cms

- Source 20: https://investmentu.com/low-float-stocks/

- Source 21: https://www.sofi.com/learn/content/understanding-low-float-stocks

- Source 22: https://www.benzinga.com/quote/SMFL/short-interest

- Source 23: https://finance.yahoo.com/news/smart-life-announces-closing-900-203000751.html

- Source 24: https://finance.yahoo.com/news/exclusive-smart-life-reaches-deal-144557473.html

- Source 25: https://finance.yahoo.com/news/smart-life-announces-closing-1-181000492.html

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media for a period beginning on 2023-05-22 and ending 2023-05-23 to publicly disseminate information about NASDAQ:SMFL via digital communications. We have been paid ten thousand dollars USD.