7 Reasons Why Li-FT (TSXV: LIFT)(OTCQX: LIFFF) Could Be Poised For Significant Upside Potential

Investing in Li-FT (TSXV: LIFT)(OTCQX: LIFFF) represents an opportunity to participate in the flourishing lithium market, driven by the electrification of vehicles and green energy technologies. With a strong portfolio of projects, sound financials, active drilling programs, and a highly experienced leadership team, Li-FT is well-positioned to thrive in the dynamic lithium industry, making it an attractive option for investors seeking exposure to the growing demand for this essential element in the green energy transition.

IDENTIFYING THE OPPORTUNITY

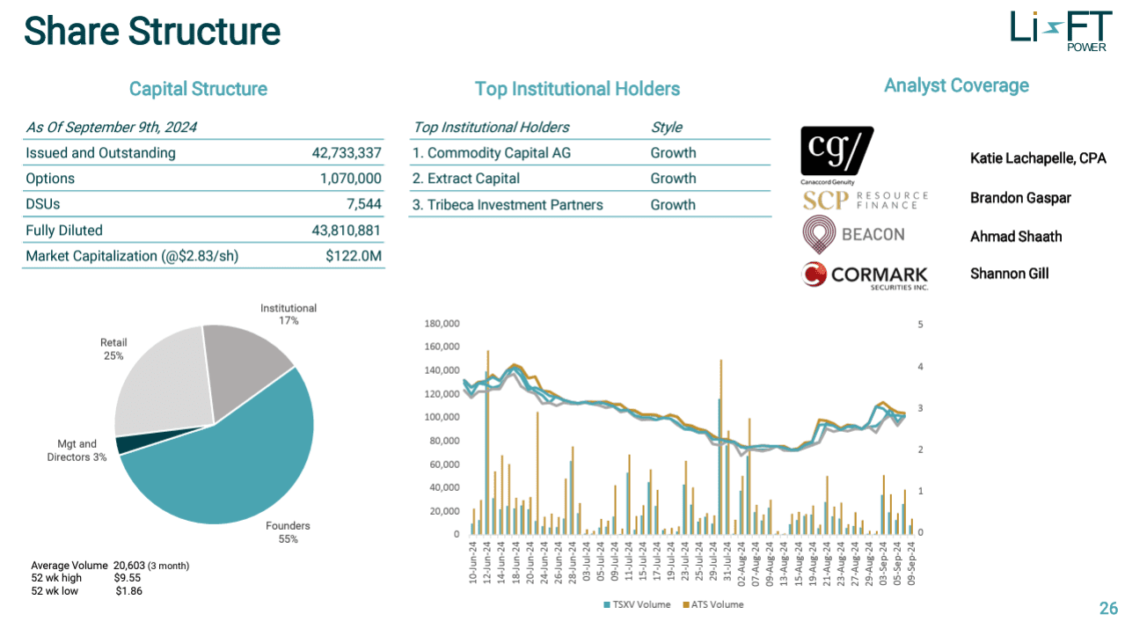

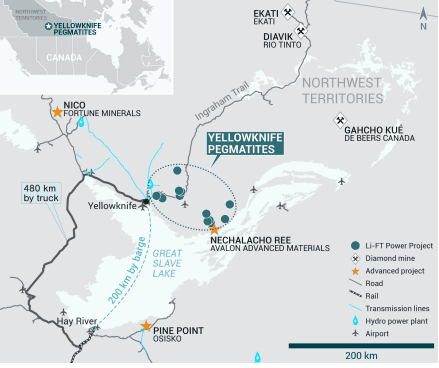

INSTITUTIONAL SUPPORT IS IN PLACE AND READY TO RUN

The price is showing aggressive pressure on the RSI and the recent MACD cross-up provides us with a key opportunity

TARGETS

Key Level #1: $3.42 (+8.57%)

Key Level #2: $3.76 (+19.37%)

Key Level #3: $4.07 (+29.21%)

Key Level #4: $4.33 (+37.46%)

Key Level #5: $4.94 (+56.83%)

Key Level #6: $5.47 (+73.65%)

Potential Support: Upper-$2.50 Range

Li-FT

(TSXV: LIFT)(OTCQX: LIFFF)

Unveiling a World-Class Portfolio of High-Potential Hard Rock Lithium Projects

The global lithium market is experiencing unprecedented growth, driven by key trends such as the electrification of vehicles and the transition to cleaner energy solutions. As the world shifts towards more sustainable modes of transportation, electric vehicles (EVs) have emerged as a central pillar of this transformation. Lithium-ion batteries are at the core of EV technology, making lithium an essential resource in the fight to reduce greenhouse gas emissions and combat climate change. This shift, supported by government incentives and increasing consumer demand for cleaner transport, has resulted in sustained demand for lithium.

Beyond transportation, the push for renewable energy sources has further accelerated the need for lithium. Large-scale energy storage systems, powered by lithium-ion batteries, play a critical role in capturing and stabilizing intermittent energy from wind and solar power. As global efforts to reduce dependence on fossil fuels continue to grow, the demand for lithium-based energy storage solutions will only increase, supporting the broader energy transition.

The consumer electronics sector also contributes significantly to the growing lithium market. Devices such as smartphones, laptops, and other electronics rely on lithium-ion batteries for their portability and energy density. As the demand for such devices expands globally, so too does the need for lithium, adding yet another dimension to the metal’s rising value.

The impact of lithium reaches even further. Industries such as aviation, shipping, and heavy machinery are exploring ways to incorporate lithium battery technology to reduce carbon emissions. This broadening scope of applications ensures that lithium will remain a key resource in the long-term transition to a sustainable, low-carbon future, positioning it as a high-growth investment opportunity for those looking to participate in the global energy revolution.

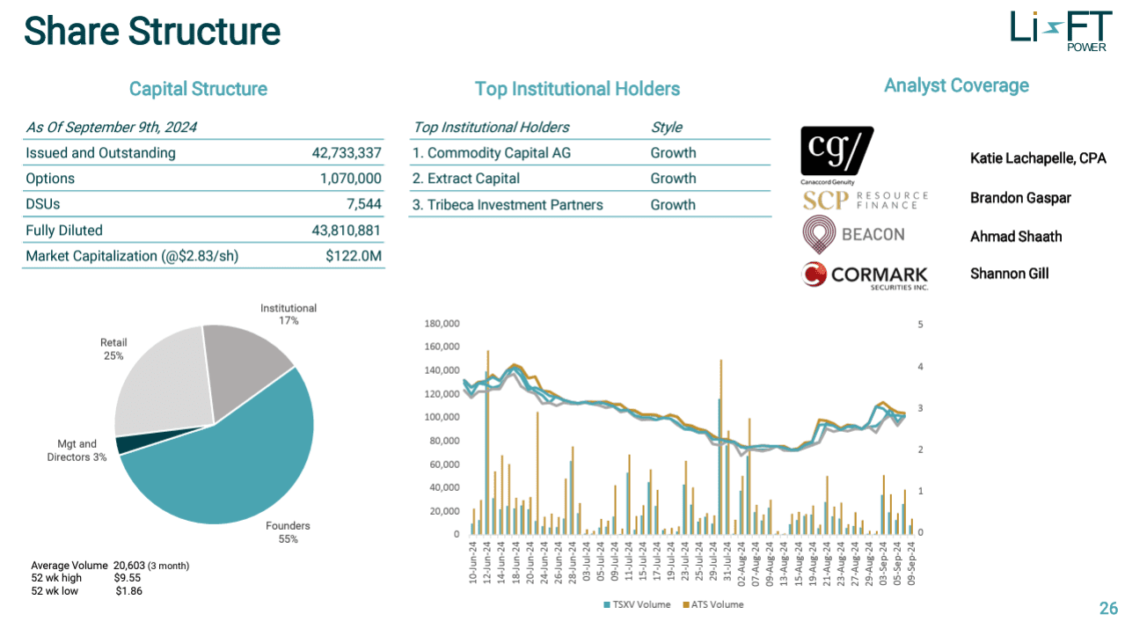

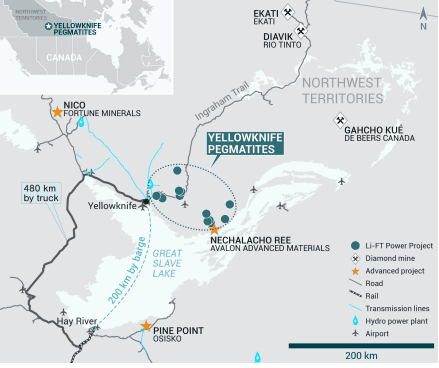

The Yellowknife project

The Yellowknife Lithium Project stands as the crown jewel of Li-FT's hard-rock lithium exploration portfolio. Located near Yellowknife in the Northwest Territories, this project has garnered significant attention due to its rich deposit of spodumene-bearing pegmatites. With 13 distinct spodumene pegmatites and lithium grades ranging from 1.0% to 1.2% Li₂O, Yellowknife presents a unique investment opportunity in the rapidly expanding lithium market.

The project is notable for its abundant outcrop exposure, offering nearly complete surface visibility of the lithium-bearing pegmatites. This visibility is a significant advantage, allowing for efficient and cost-effective exploration, reducing operational risks, and enhancing the project’s overall economic potential. With ongoing exploration work, Yellowknife continues to demonstrate exceptional lithium potential.

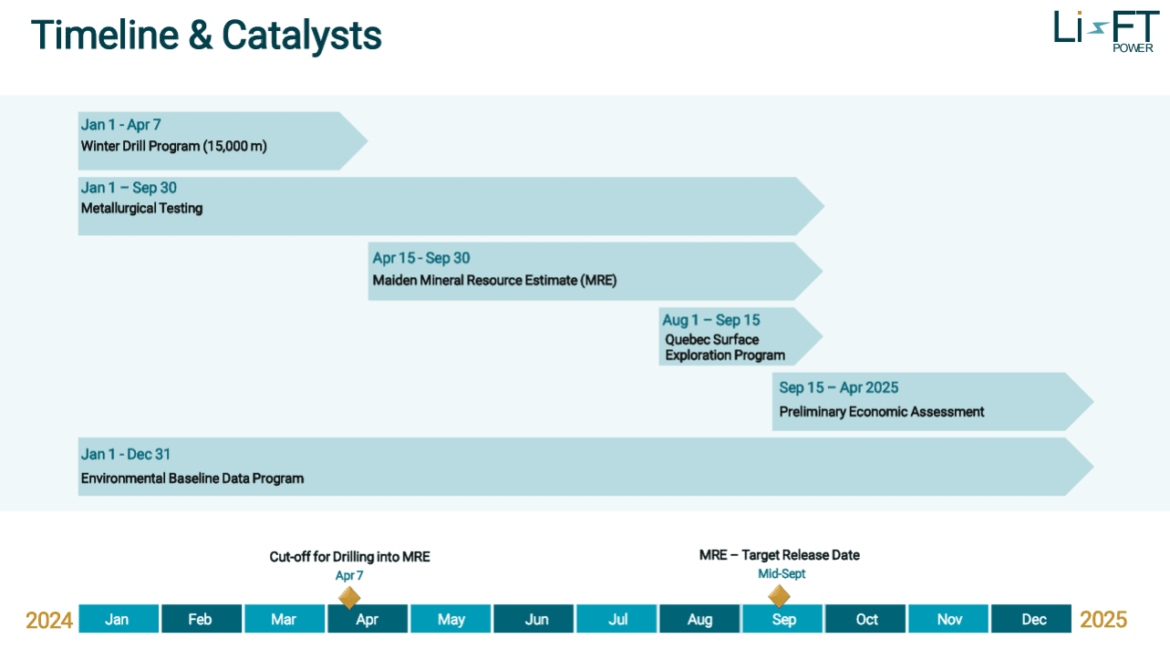

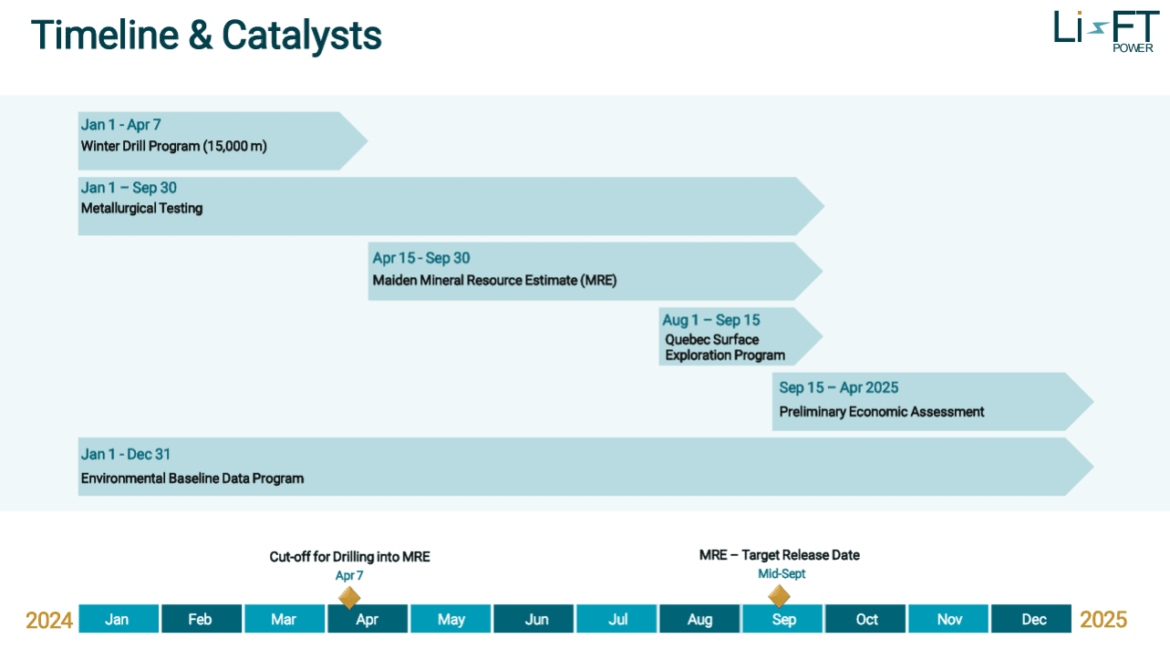

In 2024, Li-FT completed a 50,000-meter drilling campaign at Yellowknife, confirming significant lithium mineralization and positioning the project as one of the most promising lithium assets in North America. The upcoming Mineral Resource Estimate (MRE) in Q3/2024 will mark an important milestone in the project’s development, with results expected to further solidify Yellowknife’s position as a key player in the lithium space.

Strategically located near Hay River, the Yellowknife Project benefits from access to efficient shipping routes, minimizing logistical challenges. With close proximity to key mineral leases and collaboration with local Indigenous communities, the project aligns with both Li-FT’s environmental and social responsibility goals. This strong commitment to sustainability and community engagement positions Yellowknife as a standout project in the lithium industry, making it a compelling investment for those seeking exposure to the growing lithium market.

The RUPERT project

The Rupert Project is another significant asset within Li-FT's portfolio, located in a mining-friendly jurisdiction that supports streamlined exploration and development. Currently in the discovery stage, the Rupert Project represents a promising opportunity to identify new lithium resources. The ongoing diamond drilling campaign aims to delineate potential lithium deposits within the project, positioning Rupert for future growth.

By including the Rupert Project in its broader exploration strategy, Li-FT ensures a continuous flow of new targets, further diversifying its portfolio. With projects like Rupert, which are at different stages of development, Li-FT offers investors a range of opportunities, from early-stage exploration to more advanced development, catering to varying risk profiles and investment strategies.

The Rupert Project’s favorable regulatory environment and active drilling campaigns highlight Li-FT’s proactive approach to identifying and advancing new lithium resources. This project strengthens Li-FT's diverse pipeline of opportunities, positioning the company to capitalize on the growing lithium demand while offering investors a promising entry into the early stages of lithium exploration.

The CALI project

While the Cali Project remains in its early stages, it presents yet another opportunity within Li-FT’s extensive portfolio. The company holds permits for the project and has identified potential lithium targets, but there are no current plans for drilling activity at Cali. However, the project continues to be an important part of Li-FT's exploration strategy, contributing to its diversified portfolio and long-term growth prospects.

Li-FT’s focus on identifying high-potential lithium assets, even in their early exploration stages, demonstrates the company’s commitment to continuously expanding its resource base. For investors, the inclusion of the Cali Project offers a chance to participate in the early phases of a project that may contribute significantly to the company’s future success.

Overall, the Cali Project is part of Li-FT's strategy to explore and develop multiple lithium assets, ensuring a steady pipeline of opportunities. Its position within the broader portfolio showcases the company’s dedication to creating long-term value in the ever-evolving lithium market.

Li-FT

(TSXV: LIFT)(OTCQX: LIFFF)

Li-FT (TSXV: LIFT)(OTCQX: LIFFF) Has Strong Backing And Plenty Of Opportunity Ahead

As of the end of Q2 2024, Li-FT (TSXV: LIFT)(OTCQX: LIFFF) holds $6.1 million in available funds. This solid financial foundation reflects the company’s prudent fiscal management and operational discipline. For investors, Li-FT’s financial stability offers confidence in the company's ability to execute its strategic goals, advance key exploration initiatives, and drive long-term value creation in the dynamic lithium sector.

With a well-capitalized position, Li-FT is equipped to continue its exploration efforts, including its recently completed 50,000-meter drilling campaign at the Yellowknife Lithium Project. This campaign significantly enhanced the company's resource potential and paved the way for the upcoming Mineral Resource Estimate (MRE), expected in Q3 2024. Investors can trust that Li-FT is in a strong financial position to further de-risk its assets and unlock long-term growth opportunities.

In a capital-intensive industry like mining, financial agility is crucial. Li-FT’s treasury allows the company to be opportunistic in its approach, responding swiftly to evolving market conditions and exploration priorities. This flexibility ensures that Li-FT can remain at the forefront of the fast-growing lithium market.

Li-FT’s financial strength not only reduces financial risk but also provides a solid foundation for sustainable growth. Coupled with its diversified portfolio and strategic positioning in high-potential lithium projects, Li-FT is an attractive option for investors looking to capitalize on the rising global demand for lithium and support the shift to a greener energy future.

Exploration Strategy

Li-FT's exploration strategy is underpinned by several key principles:

Diversification: Li-FT maintains a diverse portfolio of lithium projects at various stages of exploration and development. This approach mitigates risk and ensures a consistent flow of opportunities across its pipeline.

Discovery Drilling: While Li-FT has completed 50,000 meters of drilling at the Yellowknife Pegmatites, the company’s ongoing focus is on discovery-stage drilling at its Quebec Greenfields projects. These efforts are designed to identify new resources and expand Li-FT’s lithium footprint.

Rigorous Evaluation: Each project undergoes a comprehensive evaluation to assess its lithium potential. This process includes surface sampling, detailed geological studies, and, where appropriate, drilling.

Environmental and Social Responsibility (ESG): Li-FT places a strong emphasis on environmental stewardship and community engagement. The company works closely with Indigenous communities, prioritizing local and Indigenous employment while adhering to rigorous environmental standards.

Commitment to Sustainability: Li-FT’s commitment to sustainability goes beyond regulatory compliance. As the company advances its projects, it remains dedicated to minimizing its environmental impact. This includes responsible land reclamation, water management, and ongoing monitoring to ensure that its exploration activities align with best environmental practices.

Community Engagement: Li-FT is committed to fostering positive, mutually beneficial relationships with local communities, particularly Indigenous groups with deep ties to the land. By working in close partnership with community leaders, Li-FT ensures that its exploration activities respect cultural values and promote economic development.

Environmental Stewardship: Throughout the exploration process, Li-FT implements rigorous environmental management practices. This includes responsibly managing land and water use, as well as taking proactive measures to minimize its environmental footprint.

A Sustainable Future: Li-FT’s long-term vision is aligned with global efforts to transition to clean energy. By responsibly developing its lithium resources, Li-FT aims to support the growing demand for renewable energy technologies and reduce reliance on fossil fuels.

World-Class Hard-Rock Lithium Potential: Li-FT’s portfolio includes some of the most promising hard-rock lithium projects in North America, including the Yellowknife Lithium Project. These projects are characterized by excellent infrastructure, abundant outcrop exposure, and high-grade pegmatites, positioning Li-FT for success in the lithium market.

Well-Financed and Agile: As of Q2 2024, Li-FT has a robust financial position with $6.1 million in funds, which enables the company to remain agile and continue advancing its exploration projects. This financial strength underpins the company’s ability to execute its plans while remaining flexible to new opportunities as they arise.

Current Drilling Status: Li-FT has completed 50,000 meters of drilling at the Yellowknife Pegmatites as of April 2024, with an upcoming MRE planned for later in the year. In addition to Yellowknife, the company is engaged in discovery drilling at its Quebec Greenfields projects, with the goal of identifying new lithium resources. There are currently no plans to drill at the Cali Project.

Pipeline of Exploration Targets: Li-FT maintains a robust pipeline of exploration targets, with an ongoing focus on projects at various stages of development. Early-stage exploration at the Rupert and Pontax projects aims to generate additional drill targets in 2024, ensuring a steady stream of new opportunities for the company and its investors.

Environmental, Social, and Governance (ESG) Commitments: Li-FT’s commitment to ESG is a cornerstone of its business model. The company has established strong relationships with local Indigenous communities and prioritizes local employment, all while operating in stable regulatory environments that support long-term project development.

Li-FT

(TSXV: LIFT)(OTCQX: LIFFF)

Li-FT's Strategic Positioning in the Dynamic Lithium Market

Global Lithium Market Dynamics

Li-FT (TSXV: LIFT)(OTCQX: LIFFF) is positioned at the forefront of the rapidly expanding global lithium market, which reached USD 7.49 billion in 2022 and is projected to grow at a strong compound annual growth rate (CAGR) of 12.3% from 2023 to 2030. This remarkable growth is driven primarily by the electrification of vehicles, with the increasing demand for electric vehicles (EVs) fueling the need for lithium-ion batteries.

As the demand for lithium continues to rise, Li-FT is strategically positioned to capitalize on this trend through its diverse portfolio of high-potential hard rock lithium projects, including the Yellowknife Lithium Project and Quebec Greenfields, ensuring the company is well-placed to meet the market’s growing needs.

DIGGING DEEP

Li-FT

(TSXV: LIFT)(OTCQX: LIFFF)

The U.S. Lithium Landscape

In the United States, Li-FT (TSXV: LIFT)(OTCQX: LIFFF) capitalizes on a nation eager to strengthen its lithium industry. Despite substantial reserves, the U.S. contributes just 1.0% to the global lithium supply. However, the country is intensifying its efforts to enhance lithium production.

Li-FT (TSXV: LIFT)(OTCQX: LIFFF)'s presence in this market aligns with the U.S. government's commitment to expedite mine permitting processes and secure the lithium supply chain.

Li-FT

(TSXV: LIFT)(OTCQX: LIFFF)

Li-FT's Leadership: Experienced and Committed

Li-FT (TSXV: LIFT)(OTCQX: LIFFF) invites you to be part of the lithium revolution, with the Yellowknife Lithium Project leading the way. As Li-FT (TSXV: LIFT)(OTCQX: LIFFF) continues to unlock the potential of hard rock lithium projects, we invite you to invest in the future of clean energy and sustainable technology. By joining us on this journey, you become a part of a company that is not only focused on financial success but also committed to environmental and social responsibility. Together, we can shape a brighter and more sustainable future powered by lithium.

Sources

- Source 1: https://www.li-ft.com/

- Source 2: https://www.li-ft.com/corporate/about-us/

- Source 3: https://www.li-ft.com/corporate/management/

- Source 4: https://www.li-ft.com/corporate/board-directors/

- Source 5: https://www.li-ft.com/corporate/advisors/

- Source 6: https://www.li-ft.com/projects/overview/

- Source 7: https://www.li-ft.com/projects/rupert/

- Source 8: https://www.li-ft.com/projects/pontax/

- Source 9: https://www.li-ft.com/projects/moyenne/

- Source 10: https://www.li-ft.com/projects/cali/

- Source 11: https://www.li-ft.com/news/

- Source 12: https://www.li-ft.com/investors/overview/

- Source 13: https://www.li-ft.com/investors/presentation/

- Source 14: https://www.li-ft.com/investors/stock-information/

- Source 15: https://www.li-ft.com/investors/financial-reports/

- Source 16: https://www.li-ft.com/investors/media/

- Source 17: https://www.li-ft.com/investors/events/

- Source 18: https://finance.yahoo.com/quote/LIFT.CN/

- Source 19: https://finance.yahoo.com/news/lift-lists-tsx-venture-exchange-070500904.html

- Source 20: https://finance.yahoo.com/news/lift-intersects-18-m-1-070500176.html

- Source 21: https://www.li-ft.com/news/lift-quadruples-the-size-of-the-cali-property-through-staking

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media Group LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media Group LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and Media Group, Virtus Media Group LLC has been hired by Media Group for a period beginning on 11/01/2023 and ending 12/15/2023 to publicly disseminate information about TSXV: LIFFF via digital communications. We have been paid fifty thousand dollars USD. Social media influencer 1. five hundred dollars, Social media influencer 2. five hundred dollars, Social media influencer 3. seven hundred fifty dollars, Social media influencer 4. one thousand five hundred dollars, Social media influencer 5. five hundred dollars, Social media influencer fifteen thousand dollars. Pursuant to a further agreement between Virtus Media Group LLC and Media Group, Virtus Media has been hired for a period beginning on 01/02/24 and ending 02/03/24. We have been paid fifty thousand USD. Social media influencer 1. five hundred dollars, Social media influencer 2. five hundred dollars, Social media influencer 3. seven hundred fifty dollars, Social media influencer 4. one thousand five hundred dollars, Social media influencer 5. five hundred dollars, Social media influencer fifteen thousand dollars. Pursuant to an agreement between Virtus Media Group LLC and New Era Publishing LLC, Virtus Media Group LLC has been hired by New Era Publishing LLC for a period beginning on 09/16/2024 and ending on 09/27/2024 to publicly disseminate information about TSXV:LIFFF via digital communications. We have been paid thirty seven thousand dollars USD. Virtus Media Group LLC agrees to pay social media influencer one thousand dollars USD and social media influencer two thousand dollars USD and social media influencer one thousand five hundred dollars USD and social media influencer one hundred fifty dollars USD and social media influencer two thousand five hundred dollars USD and social media influencer five hundred dollars USD and social media influencer two hundred fifty dollars USD and social media influencer one hundred fifty dollars USD and social media influencer five thousand dollars USD. Pursuant to an agreement between Virtus Media Group LLC and Media Group, Virtus Media Group LLC has been hired by Media Group for a period beginning on 09/16/2024 and ending 09/27/2024 to publicly disseminate information about (TSXV: LIFT|OTCQX:LIFFF) via digital communications. We have been paid thirty seven thousand dollars USD. Virtus Media Group LLC agrees to pay social media influencer three thousand dollars USD.