7 Reasons Why LiveOne Inc (NASDAQ: LVO) Could Be Poised For Significant Upside Potential in 2024

IDENTIFYING THE OPPORTUNITY

ASCENDING SUPPORT AND GROWING REVENUE

We have validated higher levels of support over time as the share price retraces back to the upside.

TARGETS

Key Level #1: $1.87 (+32.62%)

Key Level #2: $2.19 (+55.32%)

Key Level #3: $3.49 (+147.52%)

Key Level #4: $4.63 (+228.37%)

Key Level #5: $5.47 (+287.94%)

Potential Support: $1.20

LiveOne, Inc

(NASDAQ: LVO)

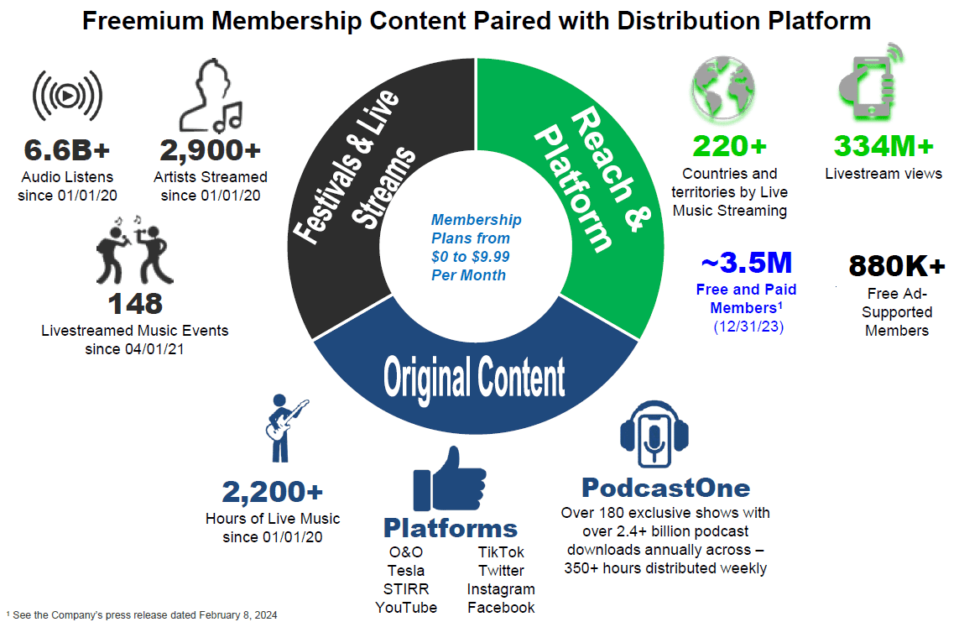

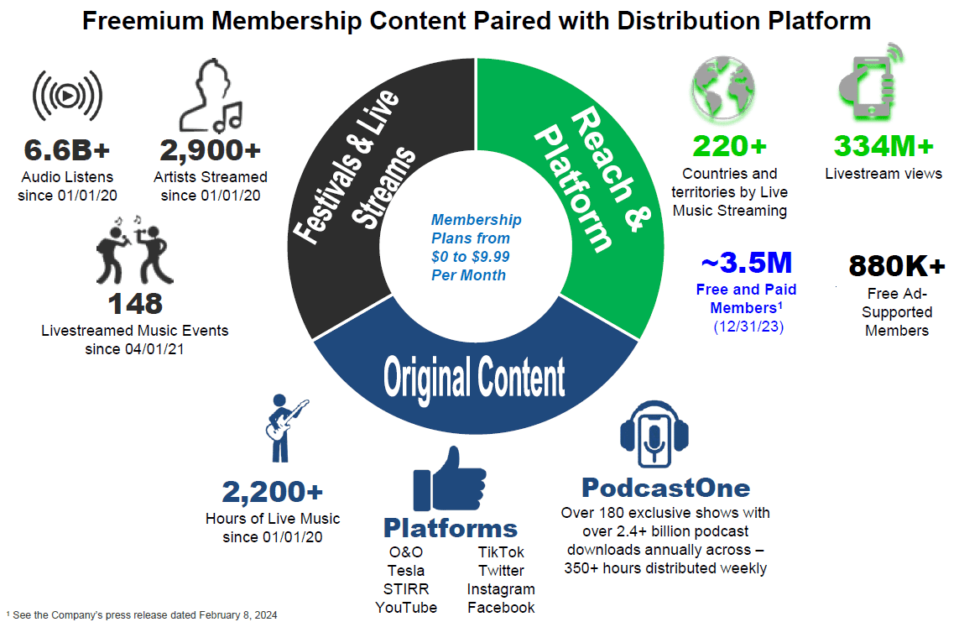

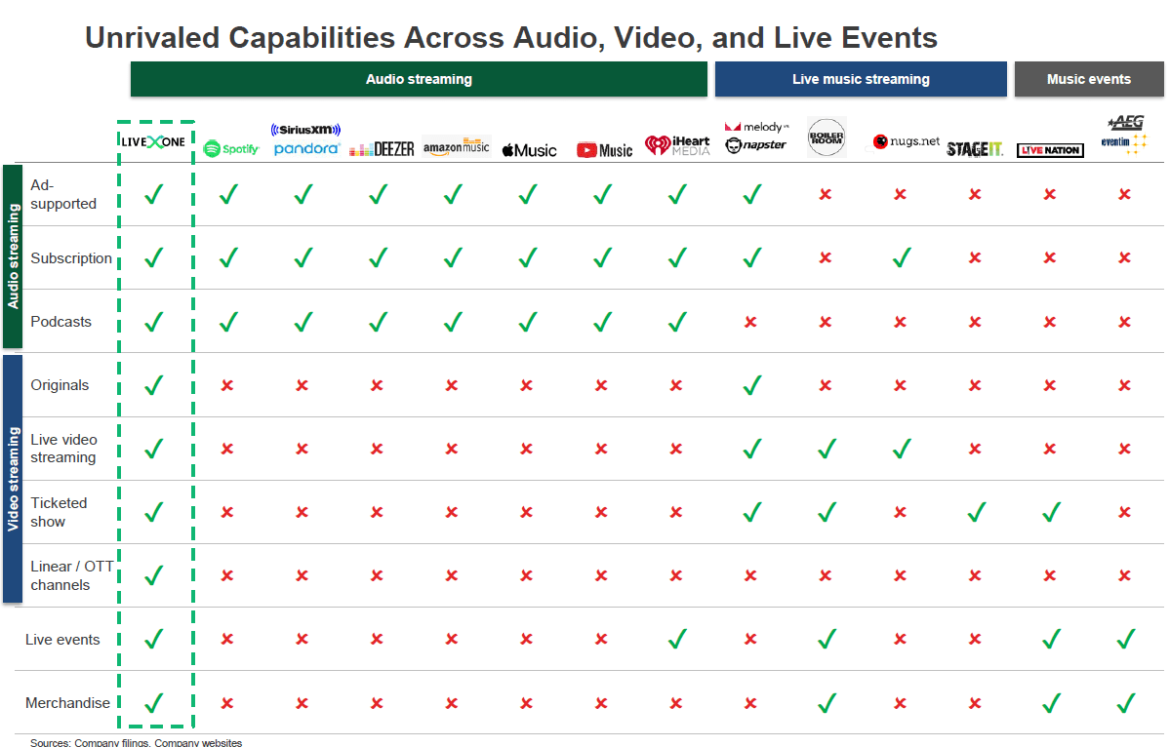

Innovative Platform Integration

STRENGTH THROUGH PERSONALIZATION & DELIVERABILITY

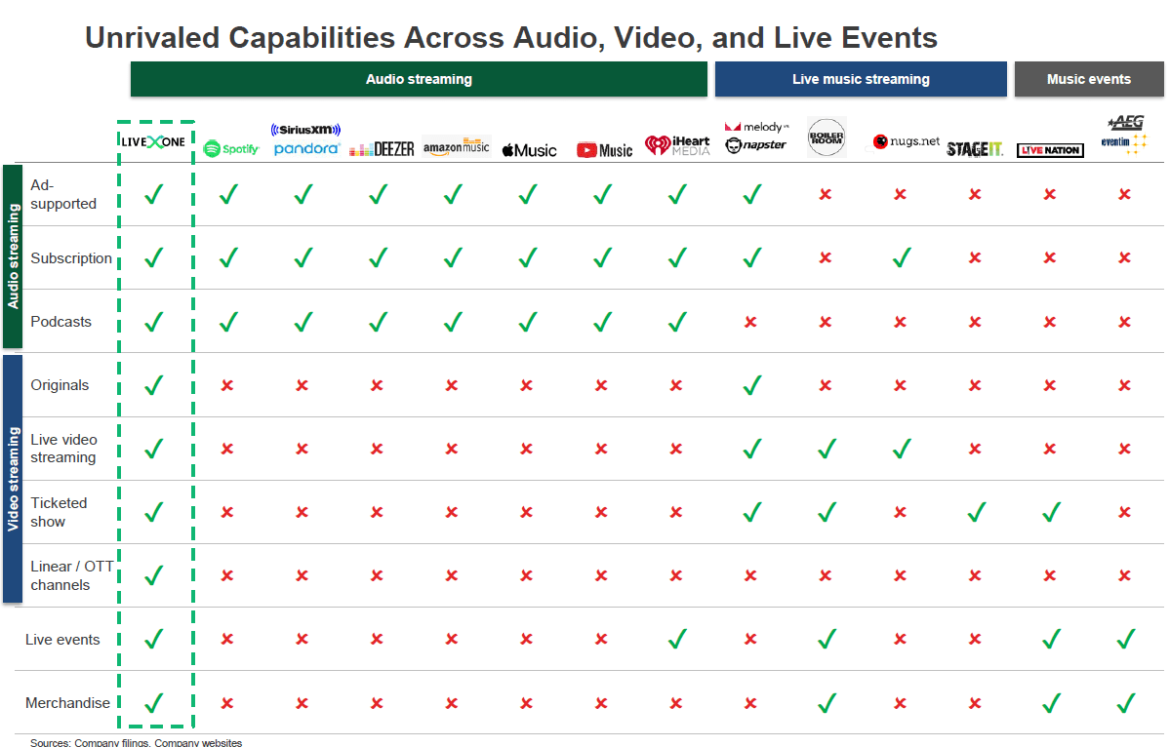

LiveOne, Inc (NASDAQ: LVO) stands at the forefront of innovation with its seamless integration of music, entertainment, and technology through a robust platform. At its core, LiveOne aims to redefine how users engage with content by providing a comprehensive ecosystem that spans memberships, live events, and virtual experiences. This integration not only enhances user convenience but also offers a unified interface where fans, brands, and artists converge to create and consume premium content worldwide.

Through its platform, LiveOne, Inc (NASDAQ: LVO) facilitates a dynamic user experience that transcends traditional boundaries. Memberships provide subscribers with exclusive access to a curated selection of music, podcasts, and live-streamed events, ensuring a personalized journey tailored to individual preferences. This approach not only cultivates a loyal subscriber base but also drives recurring revenue streams, bolstering the company's financial stability and growth prospects.

Live events represent another cornerstone of LiveOne's platform integration strategy, offering fans an immersive way to experience their favorite artists and entertainers in real-time. Whether through virtual concerts or pay-per-view events, LiveOne, Inc (NASDAQ: LVO) leverages its technological prowess to deliver high-quality audiovisual experiences that rival physical attendance, thereby expanding its reach to global audiences.

LiveOne's platform serves as a fertile ground for innovation and creativity within the entertainment industry. By harnessing cutting-edge technologies and data analytics, the company continuously refines its offerings to meet evolving consumer preferences and market trends. This agility not only ensures relevance in a competitive landscape but also positions LiveOne, Inc (NASDAQ: LVO) as a leader in pioneering new forms of entertainment consumption.

Beyond content delivery, LiveOne's platform integration extends to fostering community engagement and interaction. Through interactive features, social media integration, and virtual meet-and-greet opportunities, the platform cultivates a vibrant ecosystem where fans can connect with their favorite artists and fellow enthusiasts. This social connectivity not only enhances user satisfaction but also amplifies brand advocacy and loyalty, driving organic growth and market differentiation.

LiveOne's innovative platform integration represents more than just technological advancement—it signifies a transformative approach to how music and entertainment are consumed and experienced globally. By uniting music, entertainment, and technology into a cohesive ecosystem, LiveOne, Inc (NASDAQ: LVO) not only enriches user engagement but also paves the way for future innovations in the digital entertainment landscape.

LiveOne, Inc

(NASDAQ: LVO)

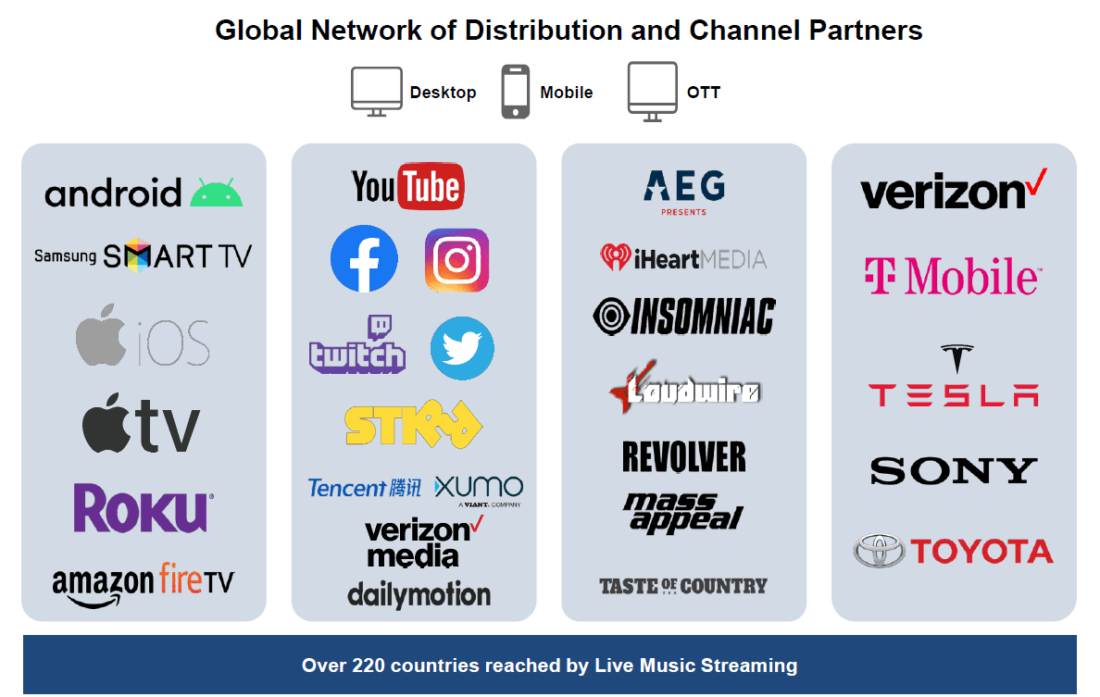

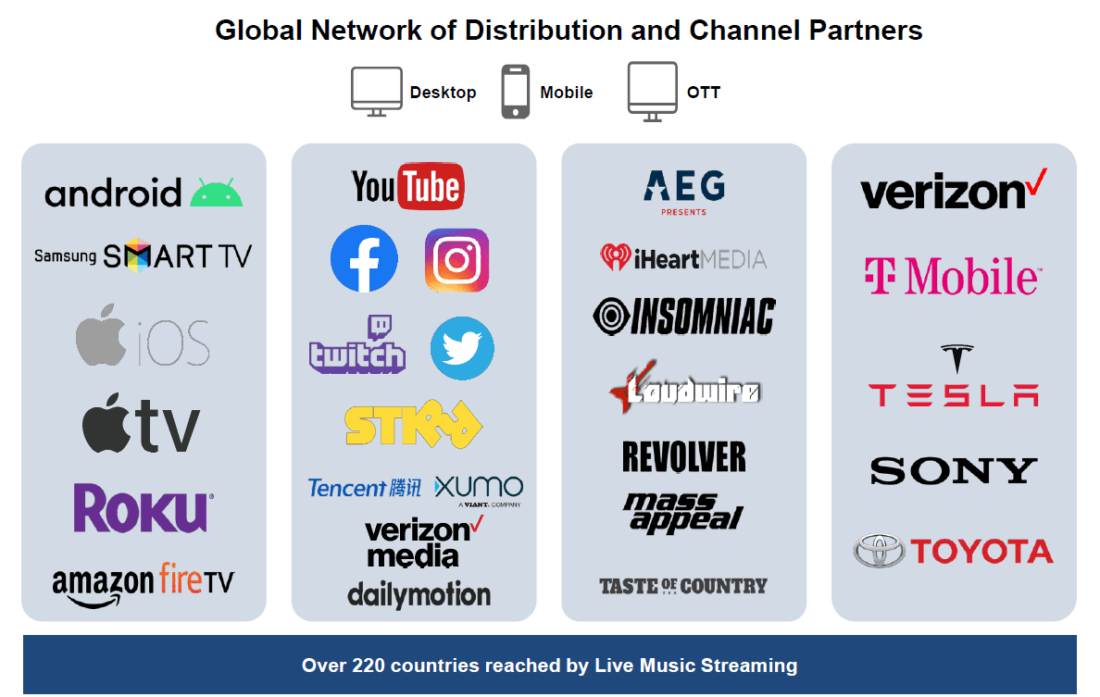

Strategically Positioned To Expand Global Acquisition, LiveOne, Inc (NASDAQ: LVO)'s Partnerships Solidify Their Ability To Strengthen Their Reach & Revenue Model

Global Market Reach

LiveOne, Inc (NASDAQ: LVO) has strategically positioned itself to maximize its audience reach through distribution across major platforms such as Roku, AppleTV, and Amazon Fire. This multi-platform approach allows LiveOne, Inc (NASDAQ: LVO) to tap into a vast and diverse global market for music and podcast streaming, reaching millions of potential users across different demographics and regions. By leveraging these widely adopted streaming platforms, LiveOne, Inc (NASDAQ: LVO) not only enhances its visibility but also ensures accessibility to a broad spectrum of audiences who are increasingly turning to digital content consumption.

The integration of LiveOne's offerings across Roku, AppleTV, and Amazon Fire represents a pivotal strategy in capturing market share within the rapidly growing digital entertainment sector. These platforms serve as gateways to a global audience hungry for diverse content experiences, ranging from music playlists and live-streamed events to exclusive podcasts and virtual engagements. By establishing a presence on these prominent platforms, LiveOne, Inc (NASDAQ: LVO) expands its market footprint and positions itself as a key player in the competitive landscape of digital media distribution.

In addition to this, LiveOne's strategic distribution partnerships extend beyond traditional streaming services to include linear over-the-top (OTT) platforms like STIRR and XUMO. This diversified distribution network not only broadens the company's audience reach but also enhances brand visibility and engagement opportunities across multiple channels. By aligning with OTT platforms that cater to specific viewer demographics and preferences, LiveOne, Inc (NASDAQ: LVO) optimizes its content delivery strategy to resonate with a wider audience base.

Beyond expanding its reach through established streaming platforms, LiveOne's distribution strategy encompasses strategic alliances and integrations with smart devices and automotive partnerships. For instance, the integration of LiveOne's services into Tesla vehicles highlights the company's innovative approach to reaching consumers in non-traditional settings. This integration not only enhances user accessibility but also solidifies LiveOne's presence within the automotive entertainment ecosystem, tapping into a captive audience of tech-savvy consumers.

LiveOne's global reach extends beyond North America to encompass international markets, where digital content consumption is rapidly growing. By localizing content and adapting to regional preferences, LiveOne, Inc (NASDAQ: LVO) effectively engages audiences in Europe, Asia, and beyond, capitalizing on the global appetite for high-quality music and entertainment experiences. This global expansion strategy not only diversifies revenue streams but also mitigates risks associated with regional market fluctuations, ensuring sustainable growth and resilience in an increasingly interconnected world.

LiveOne's strategic focus on expanding market reach through distribution across major platforms like Roku, AppleTV, and Amazon Fire underscores its commitment to maximizing audience engagement and revenue potential. By leveraging partnerships with OTT platforms, smart devices, and automotive integrations, LiveOne, Inc (NASDAQ: LVO) not only enhances accessibility but also strengthens its position as a leader in the digital entertainment industry. As the demand for on-demand music streaming, podcasts, and live events continues to rise globally, LiveOne, Inc (NASDAQ: LVO) remains poised to capitalize on these opportunities and drive future growth through strategic market expansion initiatives.

LiveOne, Inc

(NASDAQ: LVO)

Diverse Revenue Streams

LiveOne, Inc (NASDAQ: LVO) strategically diversifies its revenue streams to enhance financial resilience and capitalize on multiple monetization opportunities within the digital entertainment landscape. The company's revenue model encompasses a variety of sources, including subscriptions, pay-per-view (PPV) events, merchandise sales, and advertising. This diversified approach not only mitigates dependence on any single revenue stream but also maximizes growth potential by tapping into different consumer behaviors and market dynamics.

Subscriptions represent a fundamental pillar of LiveOne's revenue strategy, offering users access to premium content, exclusive perks, and enhanced user experiences across its platform. By providing subscription-based services, LiveOne, Inc (NASDAQ: LVO) cultivates a loyal subscriber base that generates recurring revenue, contributing to long-term financial stability and predictable cash flow. This subscription model is tailored to cater to varying consumer preferences, from ad-free music streaming to exclusive podcast content and virtual event access.

In addition to subscriptions, LiveOne, Inc (NASDAQ: LVO) generates revenue through pay-per-view (PPV) events, which enable users to purchase access to live-streamed concerts, festivals, and other exclusive content on a per-event basis. This monetization strategy not only drives immediate revenue but also leverages LiveOne's technological capabilities in delivering high-quality, interactive entertainment experiences to a global audience. PPV events capitalize on the growing demand for virtual entertainment options, particularly in light of evolving consumer preferences for digital content consumption.

Merchandise sales represent another lucrative revenue stream for LiveOne, Inc (NASDAQ: LVO), offering branded merchandise, artist collaborations, and limited-edition products to fans and collectors. By leveraging its relationships with artists, influencers, and content creators, LiveOne, Inc (NASDAQ: LVO) enhances brand affinity and consumer engagement through exclusive merchandise offerings. This revenue stream not only diversifies income sources but also strengthens the company's brand presence and fosters deeper connections with its audience base.

Advertising plays a pivotal role in LiveOne's revenue ecosystem, allowing brands to reach targeted audiences through integrated advertising solutions across its platform. By monetizing ad placements within music streams, podcasts, and live events, LiveOne, Inc (NASDAQ: LVO) leverages its extensive user data and engagement metrics to deliver tailored advertising experiences that resonate with both advertisers and consumers. This advertising revenue stream complements subscription and transactional models, further enhancing the company's overall revenue diversification strategy.

LiveOne's approach to revenue diversification extends to strategic partnerships and sponsorships, where brands collaborate with the company to sponsor events, co-create content, or integrate products within its digital ecosystem. These partnerships not only generate additional revenue streams but also foster innovation and creativity in content development and marketing initiatives. By aligning with brands that share its values and target demographics, LiveOne, Inc (NASDAQ: LVO) expands its revenue potential while enhancing the overall user experience through branded content and immersive brand activations.

LiveOne, Inc (NASDAQ: LVO) explores opportunities in digital and physical product sales, including NFTs (non-fungible tokens) and virtual goods, to capitalize on emerging trends in digital commerce and collectibles. This forward-thinking approach not only diversifies revenue streams but also positions LiveOne, Inc (NASDAQ: LVO) at the forefront of innovation within the entertainment industry, adapting to evolving consumer behaviors and market demands.

LiveOne's strategic focus on diversifying revenue streams through subscriptions, pay-per-view events, merchandise sales, and advertising underscores its resilience and growth potential in the competitive digital entertainment landscape. By leveraging multiple monetization avenues and forging strategic partnerships, LiveOne, Inc (NASDAQ: LVO) not only enhances financial stability but also drives innovation and expands its market influence, positioning itself as a leader in delivering premium content and experiences to global audiences.

THIS ALL POINTS TO THE COMPANY'S POTENTIAL FOR GROWTH AND DOMINANCE IN THE INDUSTRY

DIGGING DEEP

LiveOne, Inc

(NASDAQ: LVO)

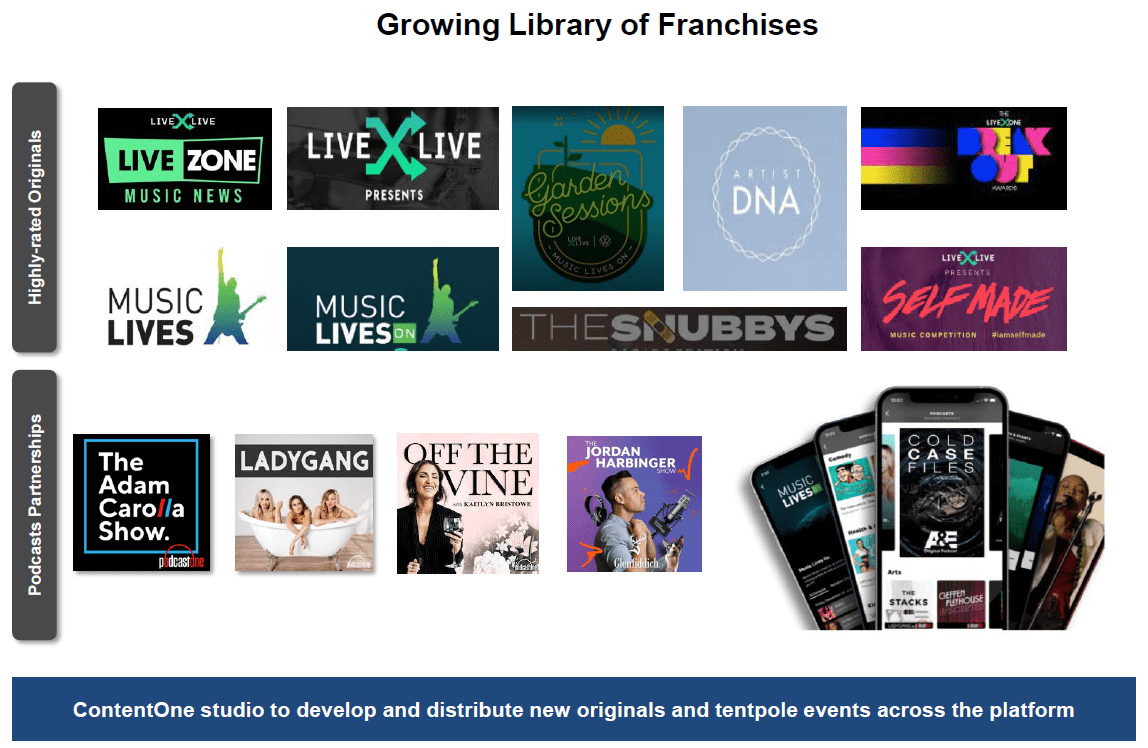

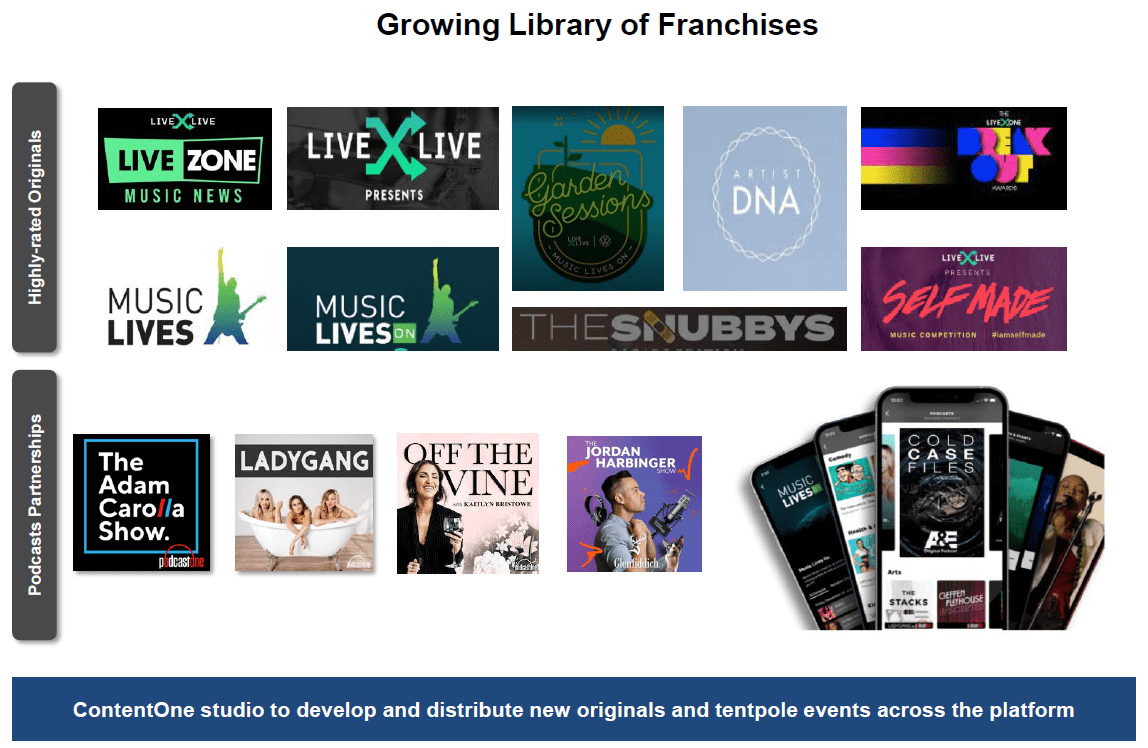

Strategic Acquisitions & Partnerships For Established Success

LiveOne, Inc (NASDAQ: LVO) strategically employs acquisitions and partnerships as key components of its growth strategy, enhancing its content offerings and market influence within the competitive digital entertainment sector. One notable acquisition is PodcastOne, a leading advertiser-supported podcast company, which has significantly bolstered LiveOne's portfolio. By integrating PodcastOne's extensive library of podcasts and strong advertiser relationships, LiveOne, Inc (NASDAQ: LVO) expands its content ecosystem, attracting a broader audience and diversifying revenue streams through podcast ad revenues and sponsored content opportunities.

Strategic partnerships also play a pivotal role in LiveOne's growth trajectory, enabling the company to collaborate with industry leaders, brands, and content creators to innovate and deliver compelling entertainment experiences. These partnerships amplify LiveOne's market reach and brand visibility, leveraging mutual strengths to drive engagement and revenue growth. For instance, partnerships with streaming platforms, tech giants, and automotive manufacturers facilitate seamless integration of LiveOne's services into diverse consumer touchpoints, from smart devices to vehicle entertainment systems, expanding accessibility and enhancing user engagement.

LiveOne's strategic acquisitions and partnerships are instrumental in fostering innovation and staying ahead of market trends. By acquiring complementary businesses and technologies, such as podcast networks and digital media platforms, LiveOne, Inc (NASDAQ: LVO) strengthens its market position and accelerates product development. These acquisitions not only expand LiveOne's content library but also enhance its capabilities in data analytics, audience targeting, and content distribution, driving operational efficiencies and competitive advantage in the digital entertainment landscape.

LiveOne's strategic approach to acquisitions and partnerships underscores its commitment to growth and market leadership in digital entertainment. By leveraging strategic acquisitions like PodcastOne and forging synergistic partnerships across the industry, LiveOne, Inc (NASDAQ: LVO) enhances its content offerings, expands market influence, and positions itself for sustained success in a rapidly evolving digital media landscape.

Strong Financial Performance

LiveOne, Inc (NASDAQ: LVO) has navigated its financial landscape with resilience, showcasing notable improvements in adjusted EBITDA despite early revenue challenges. The company's strategic focus on operational efficiency and growth initiatives has yielded positive results, positioning LiveOne, Inc (NASDAQ: LVO) for sustained financial health and expanded market influence. By leveraging its diverse revenue streams and optimizing cost structures, LiveOne, Inc (NASDAQ: LVO) has demonstrated a robust capability to enhance profitability and drive shareholder value.

In recent financial reports, LiveOne, Inc (NASDAQ: LVO) has reported substantial improvements in adjusted EBITDA, underscoring its commitment to operational excellence and financial discipline. These improvements highlight the efficacy of LiveOne's strategic initiatives in streamlining operations, optimizing resource allocation, and maximizing revenue generation across its business segments. The company's ability to adapt to market dynamics and capitalize on growth opportunities underscores its resilience and potential for long-term success in the competitive digital entertainment industry.

LiveOne's strong financial performance is indicative of its strategic investments in key growth areas, including content development, technology innovation, and market expansion. By investing in high-potential initiatives and leveraging its technological capabilities, LiveOne, Inc (NASDAQ: LVO) enhances its competitive positioning and strengthens its value proposition to stakeholders. This proactive approach not only supports revenue growth but also enhances operational efficiencies, driving sustainable profitability and shareholder confidence.

LiveOne's financial turnaround reflects its proactive measures to address initial revenue challenges through diversified revenue streams and strategic partnerships. The company's ability to forge alliances with leading industry players and capitalize on emerging trends in digital entertainment has bolstered its revenue resilience and market resilience. By staying agile and responsive to market dynamics, LiveOne, Inc (NASDAQ: LVO) continues to innovate and deliver compelling content experiences that resonate with global audiences, further solidifying its financial footing and growth trajectory.

LiveOne's strong financial performance, marked by significant improvements in adjusted EBITDA, underscores its operational resilience and growth potential in the digital entertainment sector. Through disciplined financial management, strategic investments, and a focus on enhancing shareholder value, LiveOne, Inc (NASDAQ: LVO) is well-positioned to capitalize on emerging opportunities and navigate future challenges with confidence.

LiveOne, Inc

(NASDAQ: LVO)

Innovative Marketing and Branding

LiveOne, Inc (NASDAQ: LVO) distinguishes itself in the digital entertainment industry through innovative marketing strategies that blend creativity with strategic partnerships. One notable approach involves celebrity collaborations and branded products, which not only enhance brand appeal but also drive customer engagement. By partnering with renowned artists and influencers, LiveOne, Inc (NASDAQ: LVO) leverages their social influence and fanbase to co-create exclusive content and merchandise, tapping into existing fan loyalty and expanding its reach to new audiences. These collaborations not only elevate LiveOne's brand visibility but also reinforce its position as a trendsetter in the entertainment space.

LiveOne's innovative marketing extends beyond traditional advertising to include immersive brand experiences and interactive campaigns. By embracing digital platforms and social media channels, the company cultivates a dynamic brand presence that resonates with contemporary consumers seeking authentic and personalized interactions. Through targeted campaigns that align with consumer interests and behaviors, LiveOne, Inc (NASDAQ: LVO) enhances brand affinity and drives meaningful connections with its audience, ultimately fostering long-term loyalty and advocacy.

LiveOne's commitment to innovative marketing and branding is reflected in its strategic use of data-driven insights and analytics. By harnessing consumer data and market trends, the company tailors its marketing strategies to deliver relevant content and experiences that captivate and retain customers. This data-centric approach not only optimizes marketing spend but also enables continuous refinement of messaging and campaign effectiveness, ensuring that LiveOne, Inc (NASDAQ: LVO) remains responsive to evolving consumer preferences and market dynamics.

Industry Trends and Forecast

LiveOne, Inc (NASDAQ: LVO) strategically positions itself within high-growth sectors of the digital entertainment industry, including podcasting, live streaming, and merchandise, aligning with robust global trends in digital content consumption. The rapid expansion of podcasting, with millions of listeners worldwide, underscores a shift towards on-demand audio content and personalized entertainment experiences. LiveOne, Inc (NASDAQ: LVO) leverages this trend by offering a diverse range of podcasts through its PodcastOne platform, catering to varied interests and demographics, thereby capitalizing on the growing demand for premium audio content.

Live streaming continues to gain traction as a preferred medium for real-time interaction and virtual events, driven by technological advancements and increasing internet penetration. LiveOne's expertise in live-streamed concerts, pay-per-view events, and virtual meet-and-greets positions it at the forefront of this burgeoning market segment. By enhancing viewer engagement and expanding its global audience reach through platforms like Roku and AppleTV, LiveOne, Inc (NASDAQ: LVO) capitalizes on the expanding market for digital entertainment experiences that transcend geographical boundaries.

The global licensed merchandise market presents significant growth opportunities for LiveOne, Inc (NASDAQ: LVO), particularly as consumers seek exclusive products tied to their favorite artists and influencers. By offering branded merchandise and limited-edition collections, LiveOne, Inc (NASDAQ: LVO) taps into the fan-driven economy, where fandom translates into tangible merchandise sales and increased brand loyalty. This strategic focus on merchandise complements LiveOne's content offerings, enhancing revenue diversification and strengthening its market position amid evolving consumer preferences for unique and personalized entertainment products.

Looking ahead, industry forecasts project substantial growth in digital content consumption across all sectors where LiveOne, Inc (NASDAQ: LVO) operates. With an increasing number of consumers embracing digital platforms for entertainment, education, and social engagement, LiveOne, Inc (NASDAQ: LVO) is well-positioned to capitalize on these trends by continuing to innovate, expand its content offerings, and forge strategic partnerships that amplify its market presence and revenue potential in the dynamic digital entertainment landscape.

Sources

- https://www.liveone.com/

- https://www.liveone.com/music

- https://www.liveone.com/podcasts

- https://www.liveone.com/video

- https://ir.livexlive.com/corporate-profile/default.aspx

- https://ir.livexlive.com/

- https://ir.livexlive.com/news/all/default.aspx

- https://ir.livexlive.com/news/news-details/2024/LiveOne-NASDAQ-LVO-Joined-Russell-2000-Index-June-28/default.aspx

- https://ir.livexlive.com/news/news-details/2024/PodcastOne-Nasdaq-PODC-Signs-Multi-Year-Deal-for-Wholeheartedly-Podcast-with-Fitness-Star-Kendall-Toole-and-HBO-MAX-Host-Galey-Alix/default.aspx

- https://ir.livexlive.com/news/news-details/2024/LiveOne-NASDAQ-LVO-to-Launch-AI-Search-and-Discovery-Engine-Powered-by-Seekr-Running-on-Intel-Developer-Cloud/default.aspx

- https://ir.livexlive.com/news/news-details/2024/LiveOne-Nasdaq-LVO-Updates-PodcastOne-Nasdaq-PODC-Repurchasing-Program/default.aspx

- https://ir.livexlive.com/news/news-details/2024/PodcastOnes-Nasdaq-PODC-Gals-on-the-Go-and-Skincare-Leader-fresh-Team-for-Live-Podcast-Event-at-the-Second-Annual-fresh-Beauty-Rose-Pop-Up-in-New-York/default.aspx

- https://ir.livexlive.com/news/news-details/2024/PodcastOne-PODC-to-Participate-in-the-iAccess-Alpha-Buyside-Best-Ideas-Summer-Conference-2024-on-June-25-and-26-2024/default.aspx

- https://ir.livexlive.com/news/Media-News/default.aspx

- https://ir.livexlive.com/events-and-presentations/presentations/default.aspx

- https://ir.livexlive.com/events-and-presentations/Videos/default.aspx

- https://ir.livexlive.com/governance/committee-composition/default.aspx

- https://ir.livexlive.com/governance/board-of-directors/default.aspx

- https://ir.livexlive.com/stock-information/stock-quote/default.aspx

- https://ir.livexlive.com/stock-information/analyst-coverage/default.aspx

- https://ir.livexlive.com/resources/investor-faq/default.aspx

- https://ir.livexlive.com/sec-filings/default.aspx

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17658712

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17658217

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17616934

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17604661

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17582522

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17539481

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17539318

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17494034

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17464289

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17458759

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17434432

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17429068

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17360541

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17261470

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17260014

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17250331

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17246000

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17221484

- https://ir.livexlive.com/sec-filings/sec-filings-details/default.aspx?FilingId=17220429

- https://ir.livexlive.com/corporate-profile/default.aspx

- https://finance.yahoo.com/news/liveone-nasdaq-lvo-joined-russell-120000771.html

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and JRZ Capital LLC, Virtus Media LLC has been hired by JRZ Capital LLC for a period beginning on 2024-07-15 and ending 2024-08-11 to publicly disseminate information about NASDAQ: LVO via digital communications. We have been paid fifty thousand dollars USD.