The Biggest Uranium Bull Run in History Begins Now

World leaders declare “All systems are go” for nuclear energy, and uranium

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

The biggest wins go to those with the best quality uranium.

That’s why one tiny Canadian uranium explorer could ride a 10-year yellow cake rally.

While the world nervously watches the see-saw of stock market values, there’s a uranium upsurge happening that could last over 10 years.

Tucked away in the Infrastructure Bill is a gift which could send stocks into the stratosphere – and one company in particular looks primed for something truly special.

House Democrats and Republicans can’t agree on much – except it seems this one thing: uranium is key to the country’s reduced-carbon energy strategy.

It’s clean, affordable, and once we hit mass adoption, could transform the way America is powered with lower bills and lower emissions.

A Decade of Potential Parabolic Returns

Analysts believe this stock sector will see huge growth leading into 2030. But not all uranium stocks are equal. Some have more capacity for growth than others, which brings us to what we think could be one of the best opportunities of them all: Basin Uranium Corporation (OTC: BURCF).

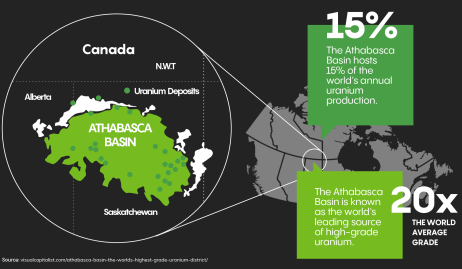

Basin Uranium has landed a project in the Athabasca Basin, a region universally regarded as the top source for high-grade uranium in the world.

And they’ve already signed an agreement with another up and coming uranium explorer, Skyharbour Resources, for one of the most exciting new sites in the area.

Past exploration on the property has been highly promising, suggesting this stock could be primed to deliver big time in the coming year.

With the economic, social and regulatory stars aligning, now is the time to get in on the ground floor for what we think could be the biggest uranium bull run in history. But if you want to get in on the act, you’ll have to act fast.

Uranium Prices Have Already Soared 69% In 18 Months

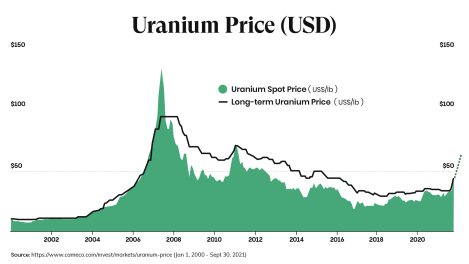

From September through November, the market went on a remarkable run which saw spot prices climb to their highest level in almost a decade.

But this is just the pre-game show. The real fireworks are expected to begin next year, with clean energy initiatives firmly taking root.

As things stand, the current uranium spot price ranges from $45-46 per pound of U308, representing a dramatic leap of more than 70% in the last 18 months.

All of which has motivated investors and hedge funds to rush into uranium stocks, accelerating prices even higher. Over just the last year:

- Denison Mines (NYSE:DNN) soared 118%

- Western Uranium & Vanadium Corp. (CSE: WUC | OTCQX: WSTRF) shot up 112%.

- Energy Fuels (NYSE:UUUU) skyrocketed 109%

- Cameco (NYSE:CCJ) climbed 77%

To many, uranium’s resurgence has been sudden. For the past decade, uranium stocks have been in the doldrums.

To many, uranium’s resurgence has been sudden. For the past decade, uranium stocks have been in the doldrums.

But things look very different today. First, safety standards have changed dramatically in recent years. Technology has evolved and safety standards have been overhauled. Today’s nuclear power is safe, reliable, consistent, and clean 2.

This brings us to the second point: The drive towards net zero requires nuclear power.

To many, uranium’s resurgence has been sudden. For the past decade, uranium stocks have been in the doldrums.

But things look very different today. First, safety standards have changed dramatically in recent years. Technology has evolved and safety standards have been overhauled. Today’s nuclear power is safe, reliable, consistent, and clean too.

This brings us to the second point: The drive towards net zero requires nuclear power.

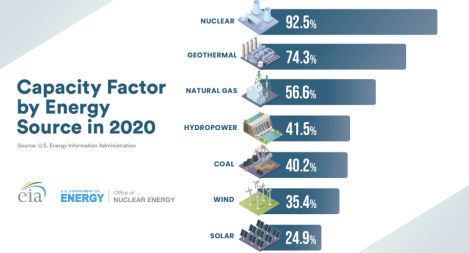

Renewable energies such as wind, solar and hydro can all play a part, but these are “swing” power sources, meaning they are dependent on weather conditions, and are far from capable of providing the capacity or consistency of power the world needs in their current state.

Uranium on the other hand is a “base load” power source. The unavoidable truth is, if the world is to transition beyond fossil fuels, it needs nuclear.

For the First Time in History, Political Agendas Align

The current administration has enthusiastically supported nuclear as a means of achieving both climate and energy plans.

Congress passed the Nuclear Energy Innovation and Modernization Act (NEIMA) in 2018 which encourages public/private partnerships to accelerate innovation in nuclear energy.

Even Republicans are pitching nuclear energy as a way forward for cleaner energy. Texas Governor Gregg Abbott has called on regulators to build more nuclear energy plants, upgrade existing plants, and penalize renewables.

Figures from across the political spectrum, like Bill Gates and Elon Musk have voiced their support.

For Elon Musk, the movement to rid the world of nuclear is misguided. “We should add more nuclear energy, or at least not shut down the nuclear power plants that we already have,” he said.

Bill Gates, meanwhile, is betting on nuclear power big time. His company, TerraPower, was selected to be part of the government’s Advanced Reactor Demonstration Program (ARDP), and aims to build a fully functional nuclear power reactor within seven years.

While nuclear power currently only accounts for 20 percent of total US electricity generation, the $1 Trillion infrastructure bill earmarked $73 billion for the expansion of nuclear power.

New plants are being planned and the US and uranium exploration activities are ramping up to record levels.

Sprott’s 41.3 Million lb. Uranium Purchase Adds Fuel To The Fire

Even the big-time mining magnates are taking notice of the money pouring into this sector.

The arrival of the Canadian-listed Sprott Physical Uranium Trust is one of the biggest game-changers. Having raised almost $1 billion dollars so far with the potential for significantly more through a US$3.5 billion at-the-market offering, they set out on a buying spree of epic proportions, snapping up 41.3 million lbs. of uranium.

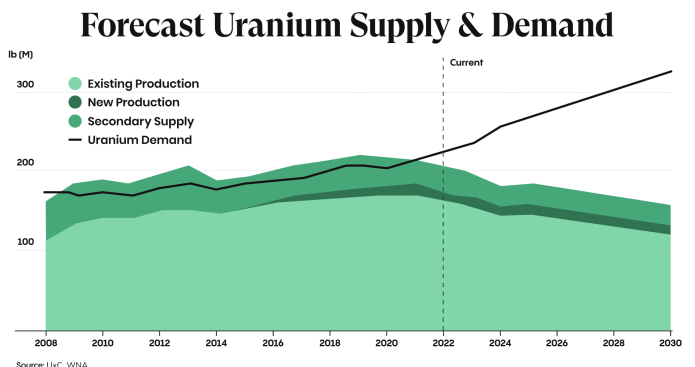

In short, demand is surging and supply is struggling to keep up.

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

Nations Compete for a Limited Supply of Uranium

It’s not only the US that is betting big on uranium:

- Russia has ambitious plans, including the world’s first floating nuclear power plant in Siberia.

The narrative couldn’t be clearer. Small wonder that the people at Basin Uranium Corporation (OTC: BURCF), sitting on a highly prospective land package in the middle of one of the richest uranium regions in the world, are so excited.

“Grade-A” Uranium At The Mann Lake Project

With its own capacity for uranium production limited, the US has begun looking to its nearby friends. Thankfully its northern neighbour has the leading sources of high-grade uranium in the world.

That’s why all eyes are turning to the Athabasca Basin in Northern Saskatchewan and Alberta. Grades are as much as 20 times higher here than anywhere else in the world.

What’s more, with 606,600 tonnes of known reserves, this region currently supplies 15% of the world’s uranium.

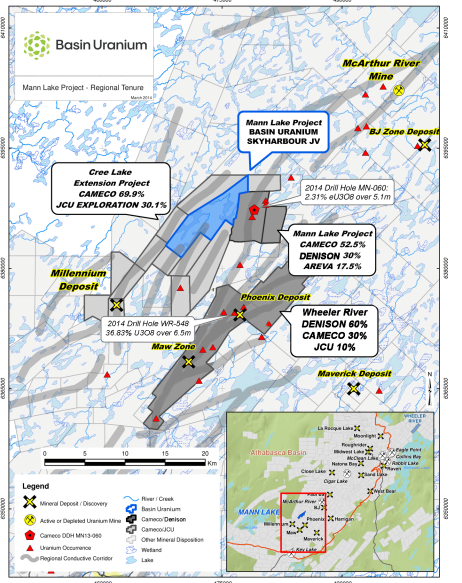

Basin Uranium has partnered with Skyharbour Resources to earn in on one of the most promising land packages in the area, Mann Lake.

This 3,472-hectare project boasts a highly strategic location, sandwiched between the McArthur River mine 25km to the northeast (host to 273.6 million lbs in proven and probable reserves), and Cameco’s Millennium uranium deposit 15 km to the southwest (host to 75.9 million lbs in proven and probable reserves).

To date this project has seen over $3 million in past exploration. In 2014, they carried out a ground-based EM survey focused on a zone where a favorable 2km long aeromagnetic low coincides with possible basement conductor trends.

Current targets focus on the main NE trending conductive corridors appear to concentrate uranium as shown at Mann Lake to the East. It is these kind of basement corridors where significant concentrations of uranium are typically found. Drilling will follow on these targets in the near term.

Mann Lake looks set to propel this relatively small exploration company into the big leagues. They believe that 2022 will be the year when the magic happens as the company will aggressively focus on exploration and development of its prime real estate in the Athabasca Basin.

What to do now…

Basin Uranium Corporation (OTC: BURCF) is in a sweet spot for investors. It has a ready market with the US and other countries looking to ramp up uranium production, and it benefits from a highly experienced team with a track record of building successful companies.

At the same time, with exploration still in its beginning stages, Basin Uranium has yet to attract the same level of speculation we’ve seen with other stocks in the same market. But as has happened many times before, once junior mining companies prove out resources, things tend to move very quickly.

You can find out more about Basin Uranium via their website. Once you’ve completed your due diligence, call your broker and put Basin Uranium Corporation (OTC: BURCF) at the top of your watchlist.

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and TD Media, LLC, Dadmin Capital LLC has been hired for a period beginning on 1/31/22 and ending 2/4/22 to publicly disseminate information about (OTC: BURCF) via digital communications. We have been paid seven thousand five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 2/14/22 and ending after five business days to publicly disseminate information about (OTC: BURCF) via digital communications. We have been paid seven thousand five hundred dollars via ACH Bank Transfer. Social Media Compensation - Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/14/22 and ending after five business days to publicly disseminate information about (OTC: BURCF) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/14/22 and ending after five business days to publicly disseminate information about (OTC: BURCF) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer.