NSDQ: VUZI

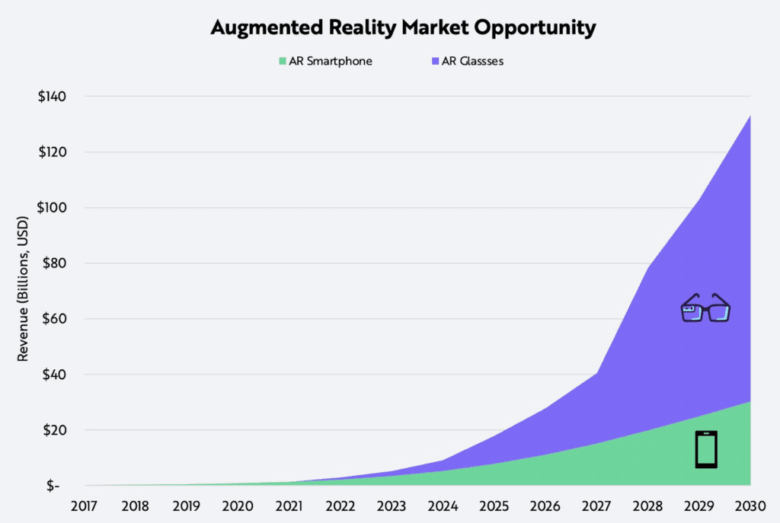

Veteran Analyst from Dawson James Securities Says This $4.00 (4/20/23) Leading Tech Stock Could Climb Over 275% to Reach $15.00 a share…

But could a potential Short-Squeeze take it even higher? Read why now could be the best time to start your research on Vuzix® Corporation (NASDAQ: VUZI)

6 Reasons Why Vuzix Corp. is Delivering on their Promise as One of the STRONGEST Names in the Metaverse:

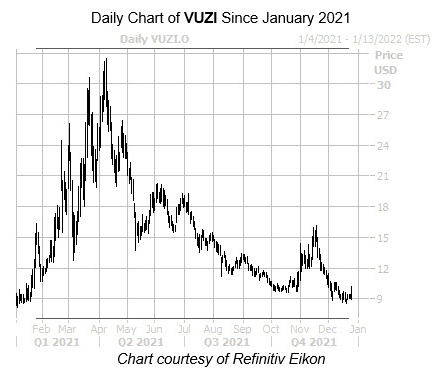

Augmented reality companies—and especially Vuzix (NSDQ:VUZI)—were some of the biggest “hidden” winners of 2021 …

Because even as trendy investments like NFTs dominated the headlines, Vuzix made a few key moves that inched the company closer and closer towards “mass adoption” potentially as early as 2022-23.

According to news from ReportLinker, the red-hot AR market is already growing at a rate of over 31% per year, on track to a whopping $88 Billion by 2026!

VentureBeat has gone as far as to say that AR, and not VR (virtual reality), will be the real heart of the new metaverse.

That news might come as a surprise to many consumers, who have been overlooking the wide variety of commercial, enterprise and manufacturing uses for AR. For most of us, Google’s failed “Google Glass” project is as close as we’ve gotten to real-world AR.

THE TRADE OPPORTUNITY

The $1 Trillion (AR) Opportunity

Every advance in computing typically faces two issues critical to adoption—convenience and engagement. Before smartphones, for example, we used cell phones to text, call, and perhaps play brickbreaker.

Today, smartphones are our primary computing devices, thanks in part to capabilities like multi-touch that are more convenient and interactive than desktop computers.

Augmented Reality (AR) heralds another digitally-enhanced real-world experience. AR layers real-time 3D computer-generated graphics onto the physical world. In 10 to 20 years, some believe that augmented reality (AR) will be key to wearable computing platforms.

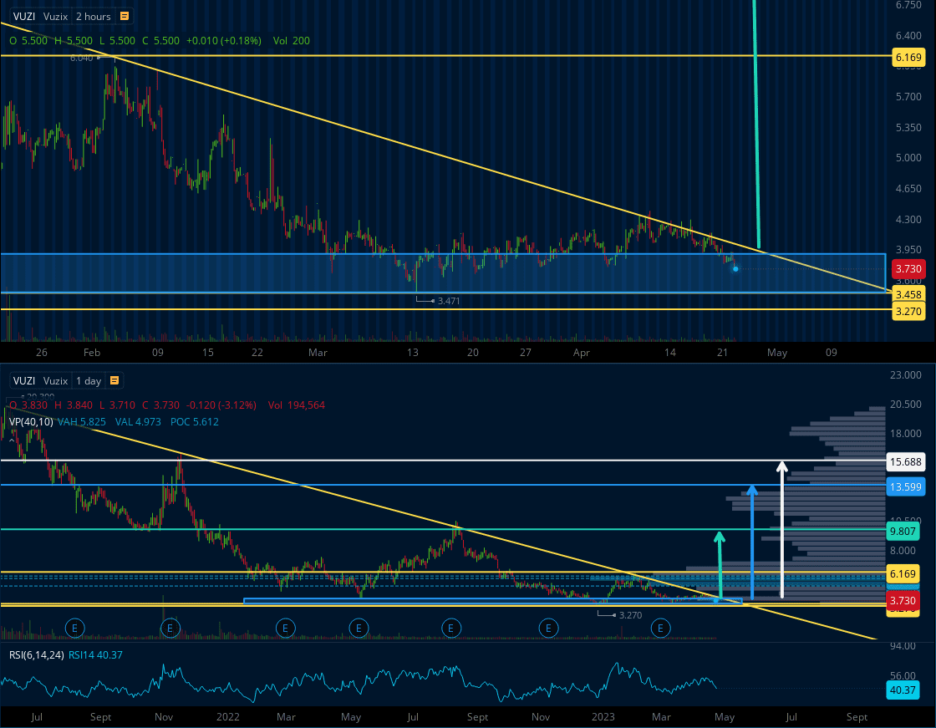

In their infancy, many consumer-facing AR experiences are native to smartphones. Use cases range from shopping to gaming. According to research compiled by ARK Invest, the AR market totaled $1.2 billion at the end of 2021—a drop in the $710 billion media market bucket.

Augmented Reality (AR) is likely to transform how we work, shop, play, and connect with the world around us. Again, according to research compiled by ARK Invest, the market capitalization associated with augmented reality could scale from $1 billion today to roughly $1 trillion by 2030.

One company that could be extremely well positioned for this opportunity is Vuzix® Corporation (NASDAQ: VUZI).

Driven By High Quality Tech

But with Vuzix (NSDQ: VUZI) glasses, professionals get a hands-free, distraction-free alternative with all the practical computing power of a modern smartphone (even including the Android 11 Operating System).

That means everything from teleconferencing to support calls, operations management and even telemedicine can now be done hands-free with easy-to-use 2-way camera support.

Augmented Reality has established itself as a powerful new tool, so powerful that even Verizon has JUST announced a new partnership with Vuzix (NSDQ: VUZI).

That means even though they’ve been a market leader for almost a decade—Vuzix could soon be at the point of becoming a household name …

Vuzix Corp. is Delivering on the Promise of Workplace AR And Leading the Market Toward an $88 Billion Future

Vuzix is a leading supplier of Smart-Glasses and AR technologies and products for the consumer and enterprise markets. The company’s products include personal display and wearable computing devices that offer users a portable high-quality viewing experience, provide solutions for mobility, wearable displays and augmented reality.

Vuzix also holds around 179 patents, patents pending, and numerous IP licenses in the Video Eyewear field. The company has also won Consumer Electronics Show (CES) awards for innovation from the years 2005 to 2020, and several other wireless technology innovation awards

All of this exposes Vuzix to an industry projected to grow at a CAGR of around 31% to approximately $88 billion by 2026, according to analysts at Gartner

AR has already begun to revolutionize life and business as we know it. But it may just be getting started.

Such technology allows us to superimpose sounds, images, text over real-world scenarios. In medical training, for instance, AR allows us to utilize 3D anatomical learning. In addition, according to Fortune, AR can be used by surgeons to alert them to potential risks or hazards during surgery. It can even be used to find patient veins!

Even Apple’s Tim Cook argues that augmented reality is “the next big thing,” adding, “I’m excited about AR. My view is that it’s the next big thing, and it will pervade our entire lives.”

But smart glasses may have the most demand and growth potential in the entire sector.

“The Smart Augmented Reality (AR) Glasses market in the U.S. is estimated at 64.2 Thousand Units in the year 2020. The country currently accounts for a 30.97% share in the global market. China, the world's second-largest economy, is forecast to reach an estimated market size of 4.4 Million Units in the year 2027 trailing a CAGR of 98.4% through 2027. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 93.8% and 89.7% respectively over the 2020-2027 period. Within Europe, Germany is forecast to grow at approximately 70.7% CAGR while Rest of European market (as defined in the study) will reach 4.4 Million Units by the year 2027.”

Report Linker

Vuzix Corp. is Primed for AR Dominance:

Over the last few weeks, the company:

- Announced it is expanding its M400 Smart Glasses market availability to approximately 54 countries.

- Received smart glasses orders from Pixee Medical to support European commercialization of AR smart glasses for orthopedic surgery.

- Upgraded its support for Zoom, Skype, and Webex.

- Received smart glasses orders from 1Minuut Innovation in response to healthcare needs in the Netherlands.

- Entered into the research of blood cells at Newcastle University.

- Had its glasses used during remote student learning at the Istanbul University Faculty of Dentistry.

- Received orders from a U.S. Defense Contractor to help develop customized Waveguide-based optic engine.

- Assisted University of Rochester Medical Center surgeons with AR glasses.

You can see more of the company’s accomplishments here: https://www.vuzix.com/News

Wall Street is Fighting over Vuzix

Shockingly, there are no FDA-approved prescription products for hemorrhoids at the moment.16

However, that could soon change with Citius’ halobetasol and lidocaine formulations.

Hemorrhoids are an uncomfortable and often recurring condition. However, despite the numerous prescription and over-the-counter (OTC) products commonly used to treat hemorrhoids, none possess the necessary safety and efficacy data generated from rigorously conducted clinical trials.

Citius believes its halobetasol-lidocaine product could one day become that go-to treatment for physicians wanting to provide patients with a therapy demonstrating safety and efficacy.16

Program Highlights20

- There are no FDA-approved prescription products on the market for hemorrhoids

- Citius’ halobetasol and lidocaine formulation could become the first FDA-approved prescription product to treat hemorrhoids in the United States

- According to IMS, over 25 million units of topical combination prescription products for are sold in the US

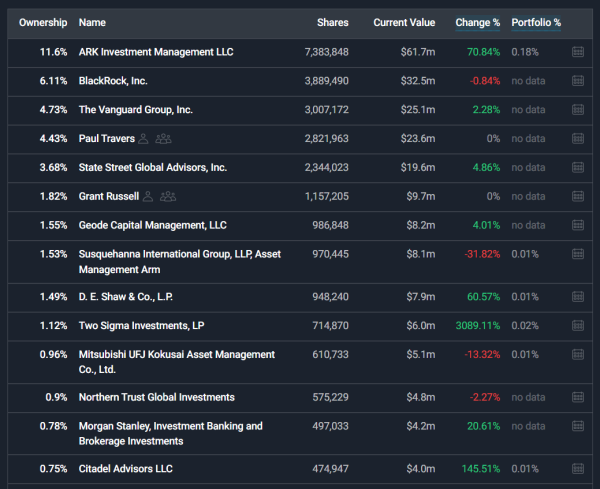

It’s obviously impossible to tell who’s been shorting the stock—but we can see who’s been taking the long side of the trade, which is a veritable “Who’s who” of major funds including Cathy Woods’ ARK Investment Group, BlackRock, Vanguard and more:

On the day the company’s Verizon deal was first announced, some 11,000 options flew across the tape—that’s six times the daily average. That’s due in part to a Schaeffer’s Volatility Index (SVI) score of 80%, which indicates investors are pricing in relatively low volatility, which in turn keeps options prices relatively low on the stock.

Strong Leadership, Strong Results

Successful companies tend to possess common traits, and one of those traits is a strong management team. Vuzix Corp. (NSDQ:VUZI) certainly has that covered well.

Paul J. Travers | CEO, President and Director

Paul Travers was the founder of Vuzix and has served as our President and Chief Executive Officer since 1997 and as a member of our board of directors since November 1997. Prior to the formation of Vuzix, Mr. Travers founded both e-Tek Labs, Inc. and Forte Technologies Inc.

He has been a driving force behind the development of our products. With more than 30 years' experience in the consumer electronics field, and 25 years' experience in the virtual reality and virtual display fields, he is a nationally recognized industry expert. He holds an Associate degree in engineering science from Canton, ATC and a Bachelor of Science degree in electrical and computer engineering from Clarkson University.

Grant Russell | CFO, Executive Vice President, Treasurer and Director

Grant Russell has served as our Chief Financial Officer and Executive Vice President since 2000 and as a member of our board of directors since April 2009. From 1997 to 2004, Mr. Russell developed and subsequently sold a successful software firm and a new concept computer store and cyber café.

In 1984, he co-founded Advanced Gravis Computer (Gravis), which, under his leadership as President, grew to become the world's largest PC and Macintosh joystick manufacturer with sales of $44 million worldwide and 220 employees. Gravis was listed on NASDAQ and the Toronto Stock Exchange.

In September 1996 it was acquired by a US-based Fortune 100 company in a successful public tender offer. Mr. Russell holds a Bachelor of Commerce degree in finance from the University of British Columbia and is both a US Certified Public Accountant and a Canadian Chartered Professional Accountant.

Shane Porzio | Vice President Engineering

Shane Porzio has been with the Company for more than ten years and has more than 13 years of experience in architecture of systems and designs for hardware and software. His previous employment was at Lockheed Martin where he served as a Hardware Engineer. Mr. Porzio has BS in Computer Engineering Technology from Rochester Institute of Technology and his MS in Computer Science from Rochester Institute of Technology.

More from The VUZI Company Website

VUZIX WAVEGUIDES, OPTICS AND DISPLAY ENGINES

Vuzix is a leader in Optics technology for near eye displays and one of the largest suppliers of smart glasses in the world. We have a reputation across the smart glasses industry for creating market-leading technology and high-quality products that are protected by 146 patents and patents pending.

Our smart glasses and component technologies are the result of extensive research, design, and development, which we then supplement through OEM partnerships with major tech companies. Our light thin and ergonomic Waveguide designs coupled with our innovative optics for display engines create some of the most desirable and adaptable products. We provide full customer ready solutions, modular sub-systems, or even full custom Waveguide with display engine designs.

WAVEGUIDES, OPTICS & DISPLAY ENGINES

Our world-class research and development have resulted in market-leading Waveguide optic technology. Our world class optics team specializes in custom solutions from full system designs to basic Waveguides for use in third party solutions.

We are experts at directing the light where it needs to be in a compact, efficient package. Vuzix is at the forefront of the smart glasses industry, providing smaller, lighter and more efficient display engines to the market. We provide high-resolution displays without obstruction.

SMART GLASSES

Smart glasses employing Waveguide-based optics have many enterprise and commercial uses such as warehousing, remote support, manufacturing, navigation, entertainment, gaming and learning. The possibilities for this technology are constantly growing and evolving with the changing demands of industry.

6 Reasons Why Vuzix Corp. is Delivering on their Promise as One of the STRONGEST Names in the Metaverse:

- Vuzix is the global leader in smartglasses and AR technology, and they have just partnered with 5G Giant Verizon for a new project yet to be announced10, while filling massive orders from Fortune 50 retailers.

- By 2021, around one-third of enterprises may deploy a multi-experience platform to support augmented reality development, say analysts at Gartner.

- The industry is expected to grow rapidly at a CAGR of over 31% to approximately $88.4 billion by 2026.

- In the near future, demand for Smart AR glasses is expected to reach about 20 million to 31 million units.

- Vuzix revenues were up approximately 156% year over year from around $1.2 million to about $2.8 million thanks to sales of the company’s smart glasses. Gross margins were also 47% in 2020.

- Vuzix is ready to steal the show at 2022’s big Consumer Electronics Show (CES), after multiple years of award-winning appearances16, generating massive buzz for their hottest new models.

Sources

Source 1: https://arpost.co/2020/09/25/augmented-reality-gartners-hype-cycle/

Source 2: https://emtemp.gcom.cloud/ngw/globalassets/en/publications/documents/top-tech-trends-2020-ebook.pdf

Source 3: https://seekingalpha.com/article/4393574-vuzix-gaining-momentum-ready-for-another-look

Source 4: https://www.analystratings.com/articles/chardan-capital-sticks-to-their-buy-rating-for-vuzix-corporation-vuzi/

Source 5: https://www.baystreet.ca/stockstowatch/8602/These-Could-be-2020s-Top-Augmented-Reality-Companies

Source 6: https://www.globenewswire.com/news-release/2020/07/13/2061334/0/en/Global-Smart-Augmented-Reality-AR-Glasses-Industry.html

Source 7: https://www.vuzix.com/News

Source 8: https://apnews.com/article/business-technology-new-york-products-and-services-intellectual-property-b543b4b1ce99c7ac2824d39c8e48cbc4

Source 9: https://seekingalpha.com/article/4393574-vuzix-gaining-momentum-ready-for-another-look

Source 10: https://www.engadget.com/verizon-vuzix-ar-partnership-211550397.html

Source 11: https://www.yahoo.com/lifestyle/augmented-reality-market-valued-usd-111700555.html

Source 12: https://venturebeat.com/2021/12/28/future-augmented-reality-will-inherit-the-earth/

Source 13: https://www.fool.com/investing/2021/04/05/why-vuzix-stock-jumped-32-in-march/

Source 14: https://www.schaeffersresearch.com/content/options/2021/12/27/options-bulls-blast-vuzix-stock-on-verizon-partnership

Source 15: https://www.prnewswire.com/news-releases/vuzix-receives-and-delivers-significant-follow-on-smart-glasses-order-to-fortune-50-global-retailer-to-support-warehousing-and-logistics-operations-301451258.html

Source 16: https://www.vuzix.com/blogs/vuzix-blog/vuzix-next-gen-smart-glasses-win-big-at-ces-2021

Disclaimer

Stock Research Today is a project of Virtus Media LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Virtus Media business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation - Pursuant to an agreement between Virtus Media LLC and TD Media LLC, Virtus Media LLC has been hired for a period beginning on 1/3/21 and ending after 2 business days to publicly disseminate information about (NASDAQ: VUZI) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Lifewater media LLC, Virtus Media has been hired for a period beginning on 2023-04-26 and ending after 2023-04-28 to publicly disseminate information about NASDAQ: VUZI. We have been paid fifteen thousand dollars USD via ACH Bank Transfer.