Dan Ives WEdbush AI Revolution ETF

(NYSE: IVES)

TRACKING THE ENGINES OF CHANGE IN AN AI-DRIVEN WORLD

THE FUTURE OF ETFS

The Dan Ives Wedbush AI Revolution ETF (NYSE: IVES) offers a curated view into the global companies driving real-world artificial intelligence adoption. Developed in collaboration with tech analyst Dan Ives and managed by Wedbush, the ETF highlights organizations at the forefront of AI-powered transformation across automation, cloud computing, cybersecurity, and data infrastructure. This theme reflects the growing impact of AI technologies as they reshape business operations, consumer experiences, and the future of global innovation.

What Sets IVES apart: A Ground-Level View of the AI Shift

A New Class of Companies Powering the AI Economy

The Dan Ives Wedbush AI Revolution ETF (NYSE: IVES) is designed to track a select group of companies leading the development and deployment of real-world artificial intelligence. Curated with a focus on practical implementation over theoretical promise, the ETF highlights businesses applying AI across cloud computing, cybersecurity, automation, semiconductors, and data infrastructure. Its methodology centers on identifying firms where AI is not just a concept, but a core operational driver shaping products, services, and global connectivity.

Developed in collaboration with Wedbush’s Head of Tech Research, Dan Ives, the ETF reflects an industry-informed perspective rooted in ongoing market analysis and decades of sector expertise. With a thematic focus on companies actively integrating AI into their models and roadmaps, IVES offers a structured view of how intelligence, innovation, and scale are converging to define the next era of technology.

The Dan Ives ETF: Key Players and Market Categories

Big Names Drive This ETF forward

TECH INNOVATORS

Apple

Microsoft

Alphabet

FINANCIAL LEADERS

JPMorgan Chase

Goldman Sachs

Bank of America

ENERGY PIONERRS

Tesla

NextEra Energy

Chevron

And these are just a FEW of the big names partaking in this ETF...

The Dan Ives Wedbush AI Revolution ETF (NYSEARCA: IVES) has experienced rapid growth since its inception. Launched on June 4, 2025, the fund surpassed $100 million in assets under management (AUM) within just five trading days, reflecting strong investor interest in AI-focused investments . As of July 15, 2025, the ETF's net assets stood at approximately $339.95 million

This is Where The Genius Of The IVES ETF (NYSE: IVES) Comes In

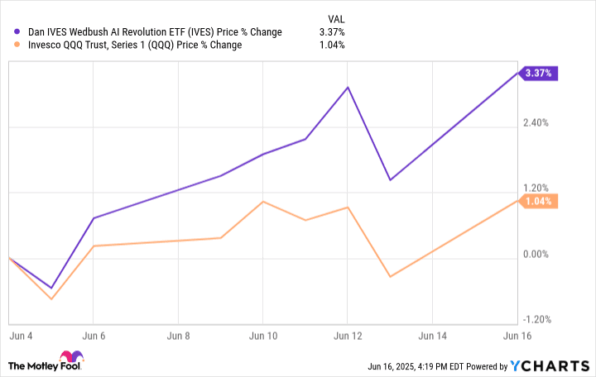

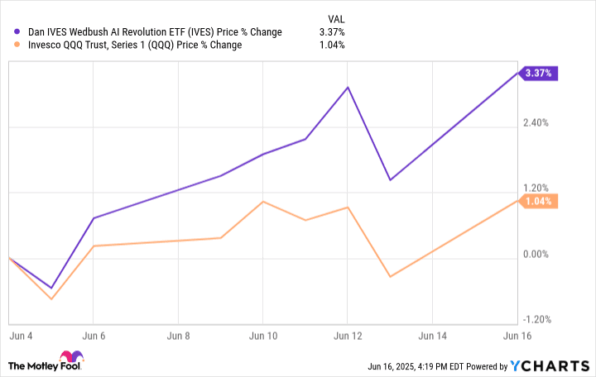

- Outperformance: The Dan Ives ETF increased by 3.74%, significantly outpacing the QQQ’s 1% gain, reflecting its superior growth potential.

- AI & Tech-Focused: With a strategic focus on AI-driven companies, it capitalizes on the rapid growth of technologies like machine learning and automation.

- Top-Tier Holdings: Includes heavyweights like Apple, Microsoft, and Alphabet, ensuring exposure to leading tech companies with robust growth trajectories.

- Future-Ready Sectors: Concentrates on cutting-edge sectors like AI, clean energy, and advanced financial technologies, which are set for long-term expansion.

- Balanced Diversification: While tech-heavy, the ETF also includes financials (e.g., JPMorgan) and energy leaders (e.g., Tesla, NextEra Energy) for a well-rounded investment approach.

- Risk Mitigation: Its diverse sector exposure reduces reliance on any single market segment, providing stability amidst volatility.

- Management Expertise: Managed by seasoned professionals with deep insights into the tech and financial sectors, ensuring a strategic investment approach.

- AI-First Strategy: Specifically targets companies leading the AI revolution, placing the ETF at the forefront of one of the world’s most transformative industries.

- Tailwind from Government Policies: The ETF benefits from government-backed initiatives, like the Inflation Reduction Act, driving investments into critical minerals and clean tech.

- Strong Institutional Backing: Supported by Wedbush, a respected financial institution, which offers credibility and expertise in managing innovative ETFs.

Dan Ives Wedbush Ai Revolution ETF

(NYSE: IVES)

WHo Is Dan IVes?

The Visionary Behind the ETF

Dan Ives is a Managing Director and Senior Equity Research Analyst at Wedbush Securities, where he has led the Global Technology Research division since 2018.With over two decades of experience, Ives has become a prominent voice in technology investing, recognized for his deep insights into sectors like artificial intelligence (AI), semiconductors, cloud computing, and electric vehicles.

His expertise has earned him frequent appearances on major financial media outlets, including CNBC, Bloomberg, and Fox News, where he shares his market perspectives and stock recommendations.

PROVEN ACCURACY AND MARKET MASTERY

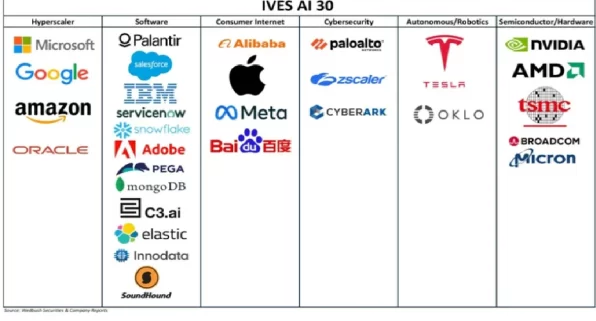

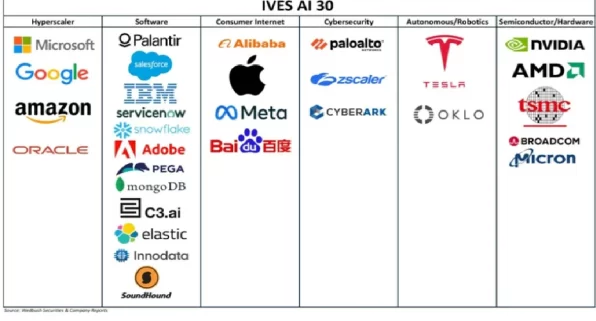

Known for his bold predictions and colorful personality, Ives has garnered a reputation as a tech bull, often likening AI chips to the "new gold and oil" due to their transformative potential.His research is highly regarded in the investment community, with his "AI 30" report identifying 30 companies at the forefront of the AI revolution. This report has served as the foundation for the Dan Ives Wedbush AI Revolution ETF (NYSE: IVES), launched in June 2025.

Dan Ives' launch of the Dan Ives Wedbush AI Revolution ETF (NYSE: IVES) reflects his vision of AI as a long-term growth trend. By leveraging his research and industry relationships, the ETF gives both retail and institutional investors targeted exposure to companies leading the AI transformation with transparent investment principles.

The IVES ETF expands Ives' influence beyond equity research, offering a direct way for investors to participate in the future of technology and innovation, while emphasizing his commitment to capitalizing on transformative market trends.

Dan Ives Wedbush Revolution AI ETF

(NYSE: IVES)

WEdbush's Leadership: Experienced and Committed

Matthew Bromberg

Chief Operating Officer & General Council

Matthew (Matt) Bromberg is the Chief Operating Officer and General Counsel at Wedbush Fund Advisers, LLC, with extensive expertise in ETFs, mutual funds, and regulatory compliance. He has a strong background in legal counsel for investment advisers, broker-dealer activities, and corporate governance, having also served as counsel to a global custodian. With a J.D. from Brooklyn Law School, Matt brings vast experience from both in-house roles and private practice, representing financial institutions on transactional and regulatory matters.

Cullen Rogers

Chief Investment OFficer

Cullen Rogers is the Chief Investment Officer at Wedbush Fund Advisers, LLC, where he oversees portfolio management, trading execution, and strategy development for ETFs. Previously, he served as CIO and Portfolio Manager at Ascendant Advisors, specializing in U.S. equities and credit strategies, and has a background in developing quantitative investment frameworks in fintech. Cullen holds a B.B.A. from the University of Texas at Austin and a FINRA Series 65, and is also CIO of Qapital Invest, LLC, an affiliate of Wedbush.

Daniel Billings

Chief Financial Officer

Daniel (Dan) Billings is the Chief Financial Officer at Wedbush Fund Advisers, LLC, with over 20 years of experience in financial services, including roles in accounting, treasury, and financial reporting. Prior to joining Wedbush, he held multiple senior positions at Jefferies, including Vice President of Treasury and Senior Vice President of High Yield Trading Controller. Dan is a CPA, holds a FINRA Series 27 license, and earned his B.S. in Accounting from Pepperdine University. He is also Executive Vice President and CFO at Wedbush Securities, an affiliate of Wedbush Fund Advisers.

Erin PReston

Chief Compliance Officer

Erin Preston is the Chief Compliance Officer at Wedbush Fund Advisers, LLC, with extensive experience in creating and managing regulatory compliance programs. Before joining Wedbush, Erin served as the Chief Compliance Officer at nabSecurities, the U.S. broker-dealer of National Australia Bank, where she oversaw compliance and regulatory risk management. She has held senior compliance and legal roles in the broker-dealer and registered investment advisory industries, specializing in the design of compliance programs for fast-paced regulatory environments. Erin holds a law degree from Elizabeth Haub School of Law, is licensed in New York and Connecticut, and holds multiple FINRA licenses and certifications, including CAMS and Advanced Certification in Risk Management. She is also Senior Vice President and Chief Compliance Officer at Wedbush Securities, an affiliate of Wedbush Fund Advisers.

Sources

- https://wedbushfunds.com/about-us/

- https://wedbushfunds.com/

- https://finance.yahoo.com/quote/IVES/

- https://finance.yahoo.com/news/dan-ives-wedbush-just-launched-140000730.html

- Billings, Dan. "Navigating Treasury and Regulatory Challenges in Financial Services." Jefferies Financial Review, 2023.

- Preston, Erin. "Compliance Strategies for Fast-Paced Regulatory Environments." Compliance and Risk Journal, 2025.

- Wedbush Securities. "Market Outlook and Investment Strategies for 2025." Wedbush Funds Report, 2025.

- Bromberg, Matthew. "Legal Challenges in ETF and Mutual Fund Compliance." Wedbush Fund Insights, 2024.

- “AI Revolution: Key Players in the ETF Landscape.” Financial Times, June 2025.

- “The Impact of AI on Global Financial Markets.” Bloomberg Technology, June 2025.

- “Dan Ives ETF Hits $100 Million in AUM After Just 5 Days.” Yahoo Finance, July 2025.

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Wedbush Securities Inc. , Virtus Media LLC has been hired by Wedbush Securities Inc for a period beginning on 00/00/2025 and ending 00/00/2025 to publicly disseminate information about NYSE: IVES via digital communications. We have been paid X dollars USD. We have been paid an additionX dollars USD. Pursuant to an agreement between Virtus Media LLC and Wedbush Securities Inc.,