Dragonfly Energy to be Granted U.S. Patent for Innovative Battery Pack Assembly Design Tailored for Custom Installs

10 Key Reasons Why Dragonfly Energy Holdings Corp. (NASDAQ: DFLI) is Poised for Significant Upside Potential in 2023

The Future of Green Energy Storage: Unlocking Growth Opportunities and the Benefits of Discovering Hidden Gems

The transition to a sustainable and clean energy future is underway, and green energy storage is set to play a pivotal role in this transformation. As the world embraces renewable energy sources like solar and wind power, the need for efficient and reliable energy storage systems is more pronounced than ever before.

The Outlook for Green Energy Storage

This report explores the outlook and growth opportunities in the green energy storage sector, the benefits of discovering under-the-radar companies ahead of Wall Street, and introduces Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) as an emerging player in this dynamic industry.

The global green energy storage market is poised for remarkable growth, driven by the increasing adoption of renewable energy, advancements in battery technology, and supportive government policies to combat climate change. Energy storage systems address the intermittency challenges inherent in renewable energy sources, enabling the integration of renewables into the grid and ensuring a stable supply of electricity regardless of weather conditions or time of day.

The electrification of transportation and the rapid adoption of electric vehicles (EVs) also contribute to the growing demand for energy storage solutions. Lithium-ion batteries, in particular, have emerged as the leading technology for both stationary storage applications and EVs due to their high energy density, long cycle life, and declining costs.

Growth Opportunity in the Energy Storage Sector

As the energy transition accelerates, the demand for green energy storage solutions is expected to increase exponentially, creating significant growth opportunities for companies in the sector. According to market research, the global energy storage market size is projected to reach USD $435.32 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.4% from 2022 to 2030.

The market presents opportunities for innovation in battery technology, grid integration, distributed energy resources, and microgrids. In addition, the race to secure raw materials for battery production has intensified, with a focus on establishing sustainable and responsible supply chains.

The Benefits of Discovering Little-Known Companies

For those seeking to capitalize on the growth in the green energy storage market, identifying little-known companies ahead of the rest of Wall Street can offer significant advantages. These undiscovered gems may possess innovative technologies, unique business models, and strong growth potential that is not yet reflected in their stock prices.

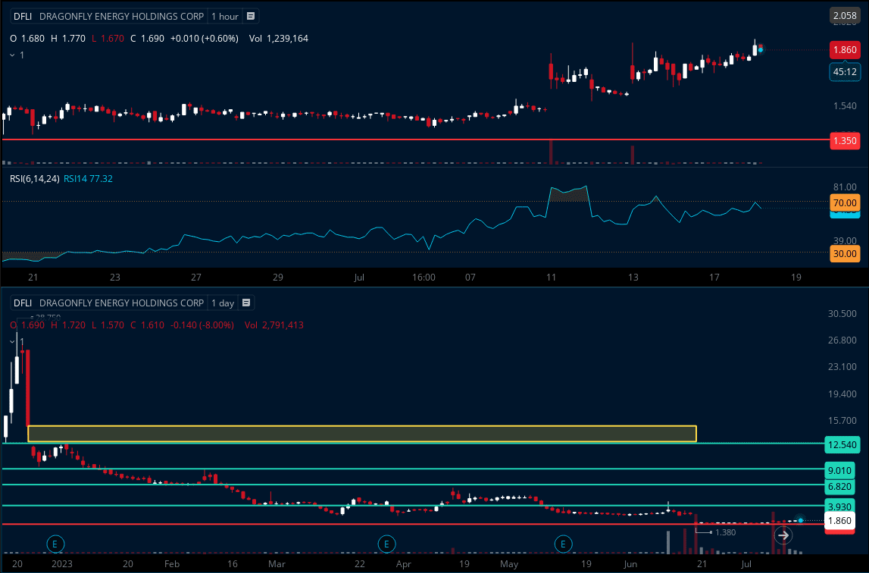

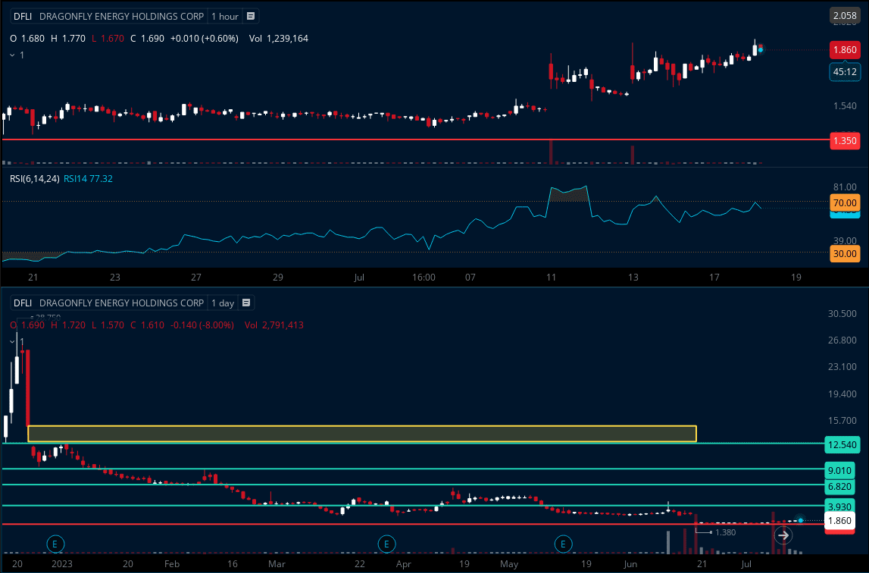

IDENTIFYING THE OPPORTUNITY

Divergence Reversal With Plenty Of Upside!

Combining this setup with the low float on DFLI means massive upside potential

TRADE CONFIRMATION

We have seen a lot of abnormal volume as we approach this point of compression.

Volume will precede the move, key indication of our push coming and an impulsive break over 2.93 is our confirmation.

TARGETS

Early entry Target: $3.93 (+111.29%)

Primary Target: $6.82 (+266.67%)

Secondary Target: $9.01 (+384.41%)

Valuation Target: $12.54 (+574.19%)

Introducing Dragonfly Energy Holdings Corp.

One such emerging company in the green energy storage space is Dragonfly Energy Holdings Corp. (Nasdaq: DFLI). Headquartered in Reno, Nevada, Dragonfly Energy is a manufacturer and supplier of deep cycle lithium-ion batteries for various applications, including RVs, marine vessels, off-grid installations, and more.

The company focuses on delivering sustainable energy storage solutions to enable a smart grid through the deployment of its solid-state cell technology. In addition to manufacturing lithium-ion batteries, Dragonfly Energy is actively engaged in the research and development of next-generation non-flammable solid-state batteries, aiming to address future energy storage needs.

Dragonfly Energy’s commitment to innovation, its robust patent portfolio, and its dedication to cleaner and more efficient battery manufacturing processes make it a compelling choice for readers seeking exposure to the booming green energy storage market.

As the world continues on its path to a cleaner and more sustainable future, green energy storage will be a critical enabler of the energy transition. The growth opportunities in this sector are vast, and readers who identify and research these innovative companies ahead of the broader market may reap significant advantages.

Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) stands out as a promising company in this space and deserves your immediate attention.

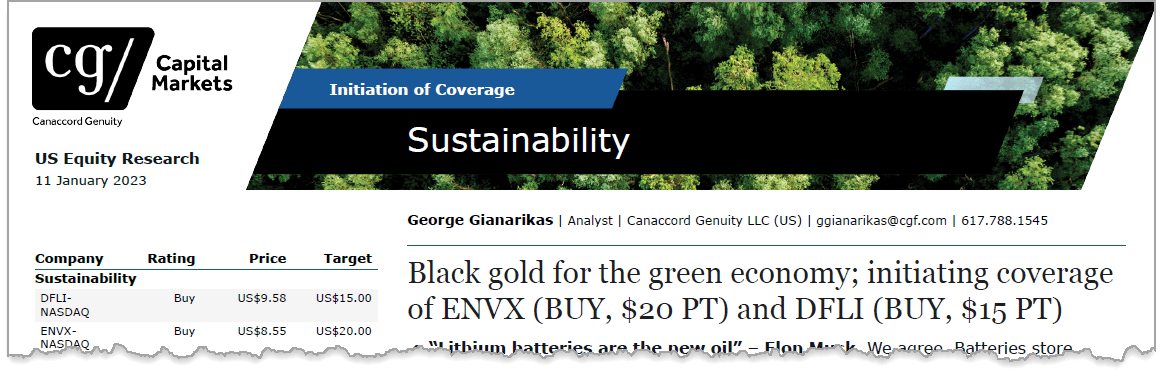

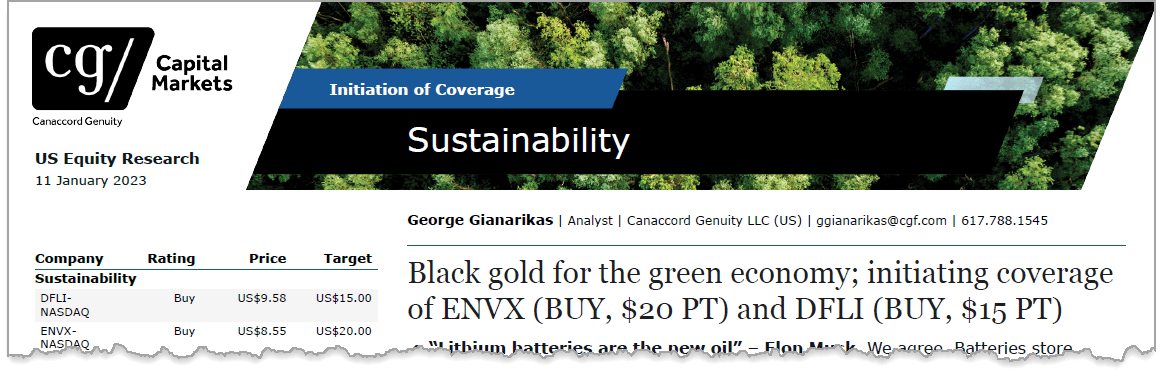

Canaccord Genuity Slaps $15 Target on Dragonfly Energy Holdings Corp.

(Nasdaq: DFLI)

Deleading the world, one segment at a time

Dragonfly is a manufacturer of non-toxic deep cycle li-ion batteries designed as a “drop-in” replacement for lead acid batteries in several markets, including recreational vehicles (RVs), marine vessels, and off-grid applications. The company uses li-ion with LFP (lithium iron phosphate) chemistry cells from outside suppliers to build its batteries. Dragonfly was founded in 2012 and came public via a SPAC merger in 2022.

The company’s products are equipped with a battery management system (BMS) and internal heating capabilities designed for cold weather temperatures. Additionally, Dragonfly is developing a “battery communication system” – designed to monitor battery system performance through real-time data and monitoring tools that are accessible via phone or tablet.

Importantly, Dragonfly is in the process of developing its chemistry-agnostic solid-state state dry electrode/electrolyte deposition technology. The company is uniquely focused on developing a solution for the energy storage market, which has different technology priorities relative to markets like EVs.

Li-ion batteries offer several relative benefits including a more sustainable option with better ROI. Dragonfly’ li-lion batteries with LFP chemistry are available as a “drop-in” replacement to lead-acid. These batteries also offer several benefits – particularly in Dragonfly’s key markets, including RVs, marine vessels, and off-grid applications – which include: 1) better power and performance, 2) longer lifespan, 3) maintenance-free, 4) cheaper “cost per usable energy” over battery lifetime, 5) faster charging time, and 6) safer.

From batteries to system integration…

In addition to eight core products, Dragonfly offers bundled solutions for its key markets (RVs, marine vessels, off-grid solar installations), as well as charging components (inverter chargers, converter charges, solar charge controllers) and a variety of accessories that simplify the installation process and ensure performance and reliability. This wide range of products allows Dragonfly to assist customers with system design and the installation process, which can result in deeper relationships with customers as their system requirements change. Management estimates that the transition to becoming a “systems integrator” is a natural path for the company as the li-ion supply chain evolves.

… to vertical integration. Dragonfly’s long-term vision is to become a vertically integrated “battery technology provider” serving multiple market verticals. To that end, in 2020, Dragonfly signed an MOU with Ioneer USA Corporation to develop a domestic battery supply chain – particularly for its solid-state cells in development.

Established partnership with an RV champion

Established partnership with an RV champion. Dragonfly’s RV OEM relationship with Thor Industries is groundbreaking. Thor, together with its subsidiaries, is the world’s largest manufacturer of RVs (~40-50% share). To date, Dragonfly has a relationship with three of 17 Thor brands: Keystone, Tiffin, and Airstream. In July 2022, Thor also made a $15M strategic investment in the company and 2) Dragonfly agreed to enter a future, mutually agreed distribution arrangement and joint IP development arrangement.

Solid-state technology development adds future optionality

Solid-state technology development adds future optionality. Dragonfly is developing solid-state batteries (SSB) and expects to launch a pilot line in 2023. CEO Dr. Phares has been working on this proprietary technology for ~10 years. Unlike other manufacturers focused on the EV market – which requires batteries with high energy density and fast charging time – Dragonfly is focused on energy storage, which has a different set of priorities. Energy storage is less focused on charging time and energy density – but more on low-cost, long-life cycle, and safety/non-flammability (achieved through using a stable and proven LFP cathode chemistry).

Initiating coverage with a bullish rating and $15 target. Using our DCF analysis, we generate a $15 price target. Dragonfly has created a strong niche leading traditional lead-acid markets into the li-ion age with its premium offering. We expect the company to continue gaining traction in RVs and penetrate additional markets – including marine – to supplement growth. Longer term, Dragonfly’s solid-state efforts add optionality to the equity as the company looks to develop into a vertically integrated leader in energy storage markets. Dragonfly must now prove it can sustain its premium pricing, penetrate new verticals, and make its solid-state offering a reality.

But Canaccord Genuity isn’t the only firm to see the potential of Dragonfly Energy Holdings Corp. (Nasdaq: DFLI)…

In fact, they weren’t even first…

One thing to consider is that Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) is a low-float stock.

Low float stocks refer to the securities that remain after a company’s stock has been issued to its controlling investors — meaning there are relatively few shares for the public to buy.

Market participants typically consider a float of 10-to-20 million shares as a low float. Some larger corporations have very high floats in the billions.

Companies with a low float frequently have a large portion of their equity held by controlling investors such as directors and employees, which leaves only a tiny percentage of the stock available for public trading.

That limited supply can cause dramatic valuation swings if demand changes quickly.

According to Finviz.com, Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) only has around 9.3 million shares in its float… And has a staggering 62% of its shares owned by insiders. This concentrated ownership suggests confidence in the company’s prospects by those with deep knowledge of its operations.

Which is why things could get very interesting and also why you need to start your research on Dragonfly Energy Holdings Corp.

Dragonfly Energy Holdings Corp. (Nasdaq: DFLI)

At the Forefront of Lithium-Ion Technology for Renewable Energy Storage

Harnessing the power of the sun, utilizing the strength of the wind, and turning the movement of water into power—renewable energy is all around us. But what happens if the water dries up, when the sun sets, and when the wind dies down? We lose power. But what if we didn’t have to? What if we could ensure that we use every ounce of that energy, whether it’s intermittent or not? The solution is storage.

Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) has been at the forefront of integrating lithium-ion technology to deliver environmentally impactful solutions for energy storage. Their batteries have powered RVs, marine vessels, industrial applications, and off-grid properties for years, and now is the time for a bigger, brighter future. As our world makes the shift, living off green energy is possible, no matter how intermittent that source is. Through manufacturing and advanced research and development, Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) is putting Americans to work and developing technology for our future.

Powering life on the water, on the road, at home, or at work, Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) is here to harness the unlimited potential of renewable energy. They’re increasing the adoption of energy sources, reducing emissions, and furthering the energy transition from being tied to the grid to being free and sustainable. As the industry leader in green energy storage, Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) is powering lives with products that are safe, reliable, and powerful—products that are revolutionary.

Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) —solving intermittency today for smarter energy storage tomorrow, and developing a cleaner, brighter future for generations to come.

The growth of Dragonfly Energy Holdings Corp. (Nasdaq: DFLI)

can largely be attributed to the company’s ability to deliver a product that met the pressing needs of a wide range of consumers. In particular, Dragonfly Energy made its mark in the recreational vehicle (RV) industry by addressing the shortcomings of traditional lead acid batteries, which were widely disliked by RV owners.

By combining a high-quality product with a rapidly growing industry like the RV market, Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) set itself on a trajectory of remarkable success.

What set Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) apart from its competitors was the company’s strategy of identifying a problem in the market and then developing a solution that was not only powerful but also safe and reliable. Through forming relationships with influential customers, industry-leading OEMs, and grassroots campaigns, Dragonfly Energy was able to raise awareness about the dangers and limitations of lead-acid batteries, thereby revolutionizing the industry.

Since 2018, Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) has sold over 175,000 of the most popular deep-cycle lithium-ion batteries on the market, leading to rapid growth of both the Dragonfly Energy and Battle Born Batteries brands. The company’s products have been well received, not only for their superior quality but also for the exceptional customer service and support provided by the company.

Dragonfly Energy’s Battle Born Batteries brand was an early mover in the transition from lead acid to lithium-ion batteries in the RV industry. These new batteries were non-toxic, lighter weight, longer-lasting, and safer than their lead-acid counterparts. As a result, they not only improved customer experiences but also enhanced and powered their lifestyles.

The company’s commitment to understanding its customers’ needs and designing products to meet those needs has been a driving factor in its success. Dragonfly Energy started small, selling just one or two batteries per day, but it now sells thousands per month. This growth has been fueled by the company’s unwavering dedication to its customers.

Dragonfly Energy Holdings Corp. (Nasdaq: DFLI)’s impact extends beyond the RV industry. Customers from various verticals and markets have sought out the company’s products to power their lives and activities. The ability to provide solutions to an increasingly diverse range of applications is a testament to Dragonfly Energy’s expertise and innovation.

For years, the RV industry was limited by outdated and dangerous technology. However, Dragonfly Energy’s introduction of lithium-ion batteries has been a game-changer, offering customers the freedom to power their lives in new and exciting ways. The company’s unique position as a battery technology company, rather than just a battery importer, allows it to take customer feedback and turn it into meaningful product development.

Dragonfly Energy’s approach to the RV industry was carefully planned. The company sought to educate early adopters about the benefits of its technology and drive business back to dealerships while simultaneously educating OEMs. This dual branding strategy positioned Dragonfly Energy on both sides of the market, resulting in widespread success and full market penetration.

As the market leader in RV batteries, Dragonfly Energy has no intention of resting on its laurels. The company plans to continue expanding, automating, and advancing its technology. This includes capturing adjacent markets and becoming a leader in the lead acid battery replacement market, which represents an enormous opportunity.

Meet the Visionary Leaders: Introducing the Management Team Behind Dragonfly Energy Holdings Corp. (Nasdaq: DFLI)

Dr. Denis Phares

Dr. Denis Phares leads with a passion for making the planet more sustainable. As the President and Chief Executive Officer of Dragonfly Energy Corp., he focuses on developing revolutionary technologies that will change the way we store and harness renewable energy. As a visionary leader, Phares has helped grow Dragonfly Energy and its consumer brand, Battle Born Batteries, into one of the leading Li-Ion products on the market while also leading a world class R&D team in the advancement of groundbreaking technologies and manufacturing processes. After establishing himself as a tenured professor of Aerospace & Mechanical Engineering at the University of Southern California, Phares left academia to found Dragonfly Energy in 2012. With three decades of extensive experience in the fields of Energy, Nanotechnology, Fluid Mechanics, and Powder Processing, Phares has positioned himself as a leading expert in Green Energy Storage and has spent the last 15 years focused on advancing lithium-ion battery technology. He holds a number of patents, some of which are key in fundamental battery cell manufacturing. Phares received a B.S. in Physics from Villanova University, an M.S. and Ph.D. in Environmental Engineering Science from California Institute of Technology, and an MBA from the University of Nevada, Reno.

John Marchetti

John Marchetti is the Chief Financial Officer of Dragonfly Energy Corp. and leads the corporate finance and investor relations of the company. Bringing over 20 years of experience in the technology and financial services industries, John Marchetti serves as a key member of the leadership team of Dragonfly Energy. Prior to joining Dragonfly Energy, Marchetti was most recently a Managing Director and senior research analyst at Stifel, focused on applied technologies, including advanced battery technologies. He previously served as the Chief Strategy Officer of Fabrinet, where Marchetti enabled growth and diversification through innovative go-to-market strategies and developed effective investor relations, as well as also served as a Senior Equity Analyst at Cowen & Co. and Morgan Stanley. As CFO of Dragonfly Energy, Marchetti focuses on the data and financials that will ultimately lead the company into future successful markets and opportunities.

Wade Seaburg

As the Chief Revenue Officer, Wade Seaburg leads Dragonfly Energy’s sales, business development and revenue growth & diversification efforts. Wade’s career and long-term success in business progression and B2B sales originated from his education at Purdue University where he earned a B.S. in Industrial Engineering and then through Eaton Corporation (ETN) where Seaburg completed their distinguished Technical Sales Training Program. Following 12 years as a Senior Account Representative within the WESCO (WCC) Distribution Manufactured Structures Division, Wade began his 5-year career as Founder and President at Structure Sales, a company focused on representing industry-leading suppliers to OEMs in the RV and Marine markets. Working as both a lead and co-inventor, Wade acquired three patents with the company. Wade began contract work with Dragonfly Energy in 2018 prior to fully joining the company as a Director of Outside Sales and Business Development in 2021, and now serving as Chief Revenue Officer of the company. During his time with Dragonfly Energy, Seaburg has helped grow the company’s OEM business and relationships exponentially, including being instrumental in successfully getting the company recognized as a "Five Rivet Supplier" with the iconic brand - Airstream RV. His work and strong B2B relationships also propelled the growth of the partnership between Dragonfly Energy and Keystone RV—where the two companies transformed the way an entire industry looked at battery power for RVs. Wade continues to prove Dragonfly’s ability to successfully serve high-volume OEM in various markets. Seaburg’s diverse skillset has led him to continually gain clear understanding of needs across industries and then to reach productive resolutions for all parties involved, including valued customers and stakeholders. As a valued leader, Wade has built a talented and experienced team around him at Dragonfly Energy as he continues to develop integral business relationships and new opportunities.

Nicole Harvey

Ms. Harvey serves as Dragonfly’s Chief Legal Officer, Compliance Officer and Corporate Secretary. In those roles she oversees corporate law, corporate governance, government relations, intellectual property, risk management, and regulatory compliance for the organization. Ms. Harvey crafted her practice as an associate at Jones Vargas, and then as the principle and managing attorney of Harvey Law Firm, a Nevada boutique. She served as senior counsel for Corix Group of Companies as well as regulatory compliance manager for Harley-Davidson Financial Services. Nicole earned a bachelor’s degree in economics from the University of Nevada, Reno, and her Juris Doctorate at Arizona State University Sandra Day O’Connor College of Law (Order of Barristers) and is licensed to practice in Nevada. She is a Certified Regulatory Compliance Manager through the American Bankers Association. Ms. Harvey is involved in her local community, having served as acting facilitator for 3 Degrees Networking, director of Disability Resources, program director of Nevada Council of the Society for Human Resources Management, committee member of Nevada System of Higher Education Chancellor’s Diversity Roundtable, and chair of Northern Nevada Human Resources Association for the Carson area. Ms. Harvey is a frequent speaker on numerous topics, including human resources and employment law, regulatory compliance, and constitutional law. She is the author of “I Hope You Die Laughing: A Beginner’s Guide to Estate Planning” and is the fourth generation of her family to call northern Nevada home. She enjoys the outdoors, the history and culture of Nevada.

Tyler Bourns

Chief Marketing Officer, Tyler Bourns, leads the creative charge at Dragonfly Energy. With over 15 years spent producing story-rich, award-winning content for global brands, Tyler has received much recognition throughout his career. Today, he draws on his deep reserves of hands-on knowledge to push the envelope of strategic marketing at Dragonfly Energy. Tyler’s segue into full-time marketing is preceded by outstanding work in content creation with a strong focus on powerful storytelling and authenticity. His experience in video production and marketing extends over 12 years with the ownership and operation of the successful and award-winning video production company Bourns Productions Inc. In 2018 he was awarded the AAF Reno Ad Person of the Year alongside the region’s most respected advertising leaders. A three-time Emmy Award Winner, he has produced and filmed thought-leading content for Panasonic, GE Energy and Terrasmart, among many others. Tyler is no stranger to an international audience; he went on to produce an extensive library of video and photo content for the legendary rock band Whitesnake. In addition, he produced, wrote and directed an internationally distributed feature film, “Desert Shadows,” starring Mitch Pillegi (X-Files, Sons of Anarchy) and produced several worldwide acclaimed short films, two of which screened at the prestigious Cannes Film Festival. His role as Director of Photography on many of these film projects has helped develop his bold and thorough eye for big ideas and strong narratives. Community service has always been important to Tyler. He served on the Under30CEO Board of Directors in Reno for two years, encouraging, collaborating and training young business leaders in the community. Tyler has also served on the Board of Directors for the Cordillera International Film Festival since its inception in 2018. This festival secured its status as a FilmFreeway Top 100 Film Festival, a rare achievement for a festival less than five years old at the time. For over 6 years, through his video production company, Bourns Productions, Tyler helped Dragonfly Energy’s Battle Born Batteries brand grow to be one of the most respected and popular Deep Cycle Lithium-ion products on the market today. In 2021, Tyler joined Dragonfly Energy full time. Drawing on his hard-earned wealth of on-the-ground insight in production, Tyler strives to apply the same narrative-driven approach to marketing that brought him both recognition and fulfillment in the world of content creation. Steered by a strategy of creative authenticity, he brings a dynamic, experience-informed leadership style to Dragonfly Energy.

Sources

- Source 1: https://www.barchart.com/stocks/quotes/DFLI/price-history/historical

- Source 2: https://energysectorreport.com/wp-content/uploads/sites/33/2023/03/Black-gold-for-the-green-economy_-initiating-coverage-of-ENVX-BUY-20-PT-and-DFLI-BUY-15-PT-1.pdf

- Source 3: https://finviz.com/quote.ashx?t=DFLI&p=d

- Source 4: https://www.sec.gov/ix?doc=/Archives/edgar/data/1847986/000110465922110688/dfli-20220630xs1.htm

- Source 5: https://dragonflyenergy.com/about-us/#team

- Source 6: https://waya.media/wp-content/uploads/sites/3/2023/01/UAE-1.jpg

- Source 7: https://www.powermag.com/new-technologies-new-sites-supporting-growth-of-energy-storage/

- Source 8: https://www.globenewswire.com/en/news-release/2022/04/06/2417212/0/en/Energy-Storage-Systems-Market-Size-to-Surpass-US-435-32-Bn-by-2030.html

- Source 9: https://dragonflyenergy.com/the-brand/

- Source 10: https://schrts.co/vQAfCsfF

- Source 11: https://www.benzinga.com/news/22/11/29782274/chardan-capital-initiates-coverage-on-dragonfly-energy-hldgs-with-buy-rating-announces-price-target

- Source 12: https://www.sofi.com/learn/content/understanding-low-float-stocks/

- Source 13: https://www.youtube.com/watch?v=0IyGdITtMqE

- Source 14: https://www.youtube.com/watch?v=-NfiWXMAEeA&t=129s

- Source 15: https://www.youtube.com/watch?v=TLrufQ_2vL0&t=232s

- Source 16: https://www.youtube.com/watch?v=QHndyhbAqtQ

- Source 17: https://www.youtube.com/watch?v=V3t7HXDzHYI

- Source 18: https://www.youtube.com/watch?v=6LELAR2vVQQ

- Source 19: https://www.youtube.com/watch?v=goO1tWFhmDE

- Source 20: https://energysectorreport.com/wp-content/uploads/sites/33/2023/03/2022.11.17_Stifel_Initiating-coverage-of-Dragonfly-Energy-with-a-Buy-rating-and-12-target-price-1.pdf

- Source 21: https://finance.yahoo.com/news/dragonfly-energy-granted-u-patent-113000077.html

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media LLC for a period beginning on 04/04/2022 and ending 04/11/2023 to publicly disseminate information about NASDAQ: NMTC via digital communications. We have been paid fifteen thousand dollars USD. Pursuant to a further agreement between Virtus Media LLC and TD Media LLC, Virtus Media has been hired for a period beginning on 06/05/22 and ending 06/09/2023. We have been paid fifteen thousand USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 07/19/2023 and ending 07/20/23. We have been paid seven thousand five hundred USD.