FG Nexus (Nasdaq: FGNX) is structured as a U.S. public company devoted to Ethereum accumulation, on-chain yield generation, merchant banking, asset management, reinsurance, and tokenization of real-world assets. The strategy described on its official site emphasizes accumulation of ETH, conservative staking, and growth of Ethereum per share. The firm’s platform aims to bridge traditional capital markets with blockchain infrastructure, providing access to Ethereum’s role in programmable money and settlement.

FG Nexus Inc. (NASDAQ: fgnx)

Strategy & Business Model

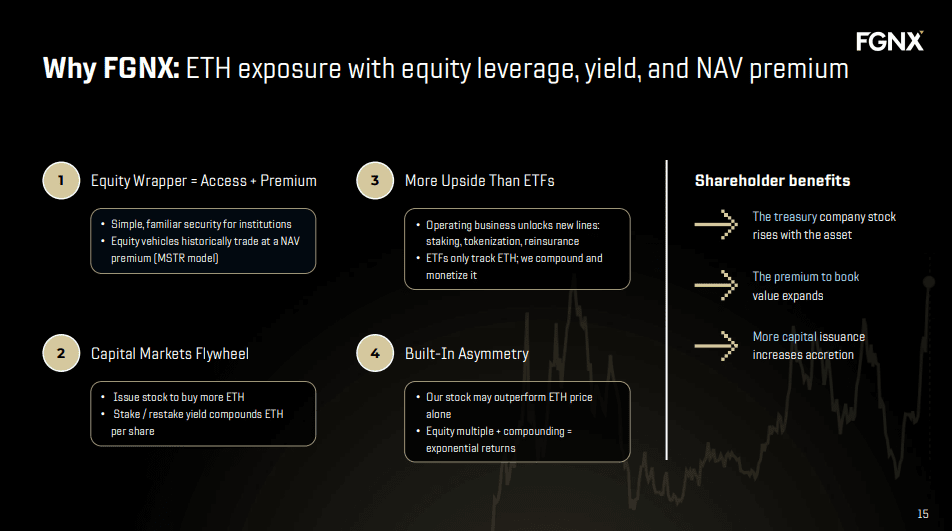

FG Nexus positions itself as a capital markets vehicle focused on Ethereum accumulation and on-chain yield generation. Its model differs from passive holdings by integrating staking, restaking, and leveraging the network’s native features.

The company expresses that Ethereum is “the most productive reserve asset of the digital economy,” citing its ability to generate native staking yield, support stablecoins, power tokenized assets, and serve as settlement infrastructure for programmable applications.

FG Nexus operates across multiple functional areas including merchant banking, asset management, reinsurance, and real-world asset tokenization. This multi-pronged approach is designed to interface traditional capital market structures with blockchain-based assets.

Recent Corporate Developments & Capital Structure

Several corporate actions have recently taken place to align the company’s structure to its strategic goals. The name was changed from Fundamental Global Inc. to FG Nexus Inc., and its charter amended to increase authorized shares substantially.

A share repurchase program of up to $200 million has been approved by the Board, offering the company the flexibility to acquire common stock under various conditions.

Also, shareholder approval was recently obtained for increasing authorized shares to 1 trillion, comprising both common and preferred stock. This is presented as enabling maximum flexibility for executing its Ethereum accumulation and capital markets-related strategy.

FG Nexus Inc. (NASDAQ: fgnx)

Operational Highlights & Metrics

As of September 18, 2025, the company holds 49,715 ETH, including acquisitions (1,087 ETH) and the impact of initial staking rewards.

Its operations include conservative staking practices and restaking to enhance yield, along with providing exposure not only to the value of ETH but also to the expansion of Ethereum’s network utility (settlement of tokenized assets, programmable applications, stablecoins) as stated in its mission.

Governance framework comprises a leadership team (including Kyle Cerminara, Maja Vujinovic, Mark Roberson, Larry Swets) and a Board of Directors with multiple committees (Audit; Compensation & Management; Nominating & Corporate Governance). Corporate governance documents (Code of Business Conduct and Ethics) are publicly available.

Introducing the Management Team of FG Nexus

(NASDAQ: FGNX)

Maja Vujinovic – CEO, Digital Assets

Maja Vujinovic has been a pioneer in financial innovation for nearly two decades. She built mobile payments and energy infrastructure across Africa and Latin America starting in 2007, recognized Bitcoin’s potential in 2010, and helped shape the crypto industry from its earliest days, including facilitating Tether’s first bank acquisition in 2013.

Prior to FG Nexus, she was Managing Partner of OGroup, an early crypto and AI fund and advisory platform working with $4B+ in family office capital. Earlier, as CIO of Emerging Tech at General Electric, she launched the company’s first blockchain pilots with JPMorgan and has been a thought leader in digital assets since.

Having lived in 16 different places and worked across five continents, Maja brings a rare geopolitical lens to the intersection of stablecoins, digital assets, and AI. She serves on the boards of Civic and Catalan.ai and is a frequent speaker at leading forums including FII Institute, Blockworks DAS, FT Digital Assets Summit, Davos, and Abundance360.

Kyle Cerminara, CFA – Co-Founder, Chairman & CEO

Kyle Cerminara is the Chairman, CEO, and Co-Founder of FG Nexus (Nasdaq: FGNX, FGNXP), where he is leading the company’s transformation into a blockchain-focused financial platform centered on an Ethereum Treasury Strategy and real-world asset tokenization. In partnership with Maja Vujinovic and her digital asset team, Kyle is positioning FG Nexus at the forefront of the convergence between traditional finance and decentralized finance.

Kyle was recognized as one of the Best of Buyside by Institutional Investor in 2006 during his time as a Portfolio Manager at T. Rowe Price and SAC Capital (now Point72), gaining deep experience across public markets before moving into entrepreneurship and merchant banking.

Kyle has also been a successful SPAC sponsor, completing multiple transactions across diverse sectors. His leadership reflects a strong track record of combining investment acumen with operational execution.

A CFA Charterholder and member of YPO, Kyle brings both professional discipline and global perspective to his ventures, while remaining deeply engaged in building innovative platforms for investors and communities alike.

Joe Moglia – Co-Founder & Executive Advisor

- Co-Founder and Chairman of Fundamental Global (FG)

- Former Chairman and CEO of TD Ameritrade and former executive at Merrill Lynch

- Grew TD Ameritrade from $700 million market cap to $20 billion+ market cap and sold to Charles Schwab

- Chair of Athletics and Former Head Football Coach at Coastal Carolina University

Sources

- https://fgnexus.io/

- https://fgnexus.io/about/

- https://fgnexus.io/investor-relations/

- https://fgnexus.io/news/

- https://fgnexus.io/fg-nexus-announces-shareholder-approval-of-historic-1-trillion-share-authorization/

- https://www.coindesk.com/press-release/2025/09/19/fg-nexus-accelerates-total-eth-holdings-to-49-715

- https://www.otcmarkets.com/filing/html?guid=cnE-kacHN5H3dth&id=18766830

- https://www.barchart.com/story/news/34689669/fg-nexus-announces-200-million-share-repurchase-program

- https://www.nasdaq.com/press-release/fundamental-global-inc-amends-its-charter-state-nevada-2025-09-05

- https://crypto-fundraising.info/projects/fg-nexus-ex-fundamental-global/

- https://finance.yahoo.com/quote/FGNX/profile

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and The Investing Authority, Virtus Media Group LLC has been hired to publicly disseminate information about NASDAQ: FGNX via digital communications beginning on 9/22/25 and ending on 10/3/25 for $100,000 USD.