Meet The Company That’s Expected To Grow Revenue About 1,500% Higher Than The Industry Average…

Here’s how Halo Collective (NEO: HALO) (OTCQB: HCANF) could take advantage of a potential $47 BILLION market cannabis opportunity!

Build your watchlist

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

5 Reasons Halo Collective Has the Potential to See Higher Highs

(NEO: HALO) (OTCQB: HCANF)

Halo Collective owns 44% of Akanda Corp., which could also give it exposure to a potential $47 billion global medical cannabis market. (2,3)

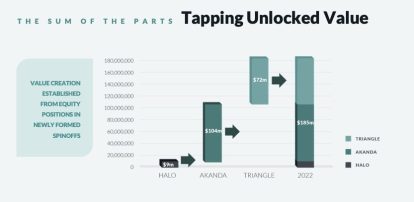

Halo Collective’s equity in its assets may be bigger than its market cap. “The financials say Halo is trading at a deep discount,” says CFO Philip van den Berg. (1)

At the moment, the company owns and operates 11 acres of cannabis cultivation in Oregon, operates centralized manufacturing, and distributes to 575+ dispensaries generating over $25M in wholesale revenues. (1)

Halo partnered with Green Matter Holdings to purchase BarX, a 1,600-acre property in Lake County, CA, with 67 acres of outdoor cultivation planned for the 2022 season. (1)

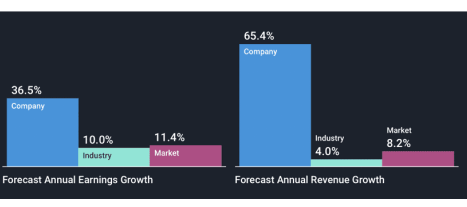

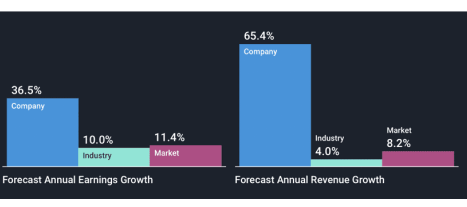

Simply Wall Street shows Halo Collective earnings could grow about 36.5% annually, as compared to the industry average of approx. 10%. Annual revenue growth is forecast to grow about 65%, as compared to approx. 4% for the industry. (4)

The U.S. cannabis industry is growing at an unprecedented pace.

In 2021, global sales hit $37.4 billion. By 2026, sales could be as high as $102 billion. (Source 5)

Cannabis is now legal in Canada. About 18 U.S. states have legalized its recreational use. About 37 U.S. states have legalized its medical use. About 91% of Americans now say cannabis should be legal. The Netherlands, Uruguay, Jamaica, Spain, etc. have all legalized its use.

Yet, even with that growth, cannabis stocks have slumped, perhaps temporarily.

Look at cannabis stock, Halo Collective (NEO: HALO) (OTCQB: HCANF), for example.

With about 44% ownership in AKAN, what could be one of the world’s largest licensed cannabis producers, Halo may now have exposure to a potential $47 billion global medical cannabis market.

Halo Collective is Akanda Corp.’s Biggest Shareholder, with a 44% Stake

In March, international medical cann-a-bis company, Akanda Corp. commenced trading on The Nasdaq Capital Market under the ticker symbol “AKAN.” (7)

After pricing four million shares at a price of about $4.00, Akanda hit a high of about $31 out of the gate. Not only was that great news for Akanda, it was also substantial for Halo Collective. (4)

After all, Halo Collective holds a 44% stake in the Akanda stock. (3)

Better, Akanda has plans to target the global medical cannabis market, which could be worth about $47 billion by 2027. That alone could give Halo Collective a unique opportunity.

Halo Collective May be Worth More than the Sum of its Parts

At the moment, Halo Collective’s equity in its assets may be bigger than its market cap.

In fact, “The financials say Halo is trading at a deep discount,” says CFO Philip van den Berg, “by spinning off Akanda and Triangle, we can unlock substantial value and benefit shareholders in the process.”

With that, the sum of the parts could unlock substantial value for shareholders.

Halo Collective is No. 1 in sales to Oregon Dispensaries – and Still Growing

At the moment, the company owns and operates 11 acres of cannabis cultivation in Oregon, operates centralized manufacturing, and distributes to 575+ dispensaries generating over $25M in wholesale revenues.

Halo Collective is Positioned to Operate One of the Largest Grows in California

Halo partnered with Green Matter Holdings to purchase BarX, a 1,600-acre property in Lake County, CA, with 67 acres of outdoor cultivation planned for the 2022 season. We have submitted for an additional 13 acres and have potential for ~400,000 lbs of annual biomass, which would make the property one of the largest licensed single-site grows in California.

Halo Collective is Expanding its Retail Footprint in the High-Volume Los Angeles Area

Halo Collective recently opened its first dispensary and plans to open two more in the Los Angeles-area under its Budega brand. With that, “California is expected to generate over $4.8B in annual revenue in 2022, of which LA generates 30% of all retail revenue in CA. Our three dispensaries give us exposure to roughly $1.5B in retail sales,” according to Halo.

Halo Collective has Total Ownership from Farm-to-Shelf

The company also has total ownership from farm to shelf. Halo’s cultivated flower and manufactured products sell in dispensaries (primarily in the U.S.) under proprietary brands Hush™ and Winberry Farms™, and under partnership license agreements with Papa's Herb®, DNA Genetics, Fireball®, and FlowerShop.

Halo Collective is Financially Sound

According to Simply Wall Street, Halo Collective had about $161 million in cash and assets (as of 3/16/22), which exceeds its long and short-term obligations. (4)

Even better, as of 3/16/22, Simply Wall Street shows Halo Collective earnings could grow about 36.5% annually, as compared to the industry average of approx. 10%. Annual revenue growth is forecast to grow about 65%, as compared to approx. 4% for the industry. (4)

Also, just secured financing:

$65m: https://finance.yahoo.com/news/r-e-p-e-t-140000108.html

$14m: https://finance.yahoo.com/news/halo-collective-enters-unsecured-loan-200500831.html

In addition, Halo Collective just reported record third quarter results.

Revenue grew to about $8.7million, up approx. 28% year over year from about $6.8 million. (Source 8)

That included the sale of approx. 9.2 million grams of cann-a-bis products principally to dispensaries in Oregon and California, about a 620% year-over-year increase.

Organic revenue growth was approx. 9%. Adjusted gross profit was about $2.3 million, or approx. 26.5% gross margin, as compared to approx. $2.4 million, or about 35.7% gross margin, year over year. Adjusted EBITDA was approx. ($4.5 million) as compared to about ($4.4 million) in the second quarter of 2021.

“We are actively executing a four-pronged strategy consisting of growing our wholesale business in California and Oregon, launching California retail in Los Angeles, streamlining costs and monetizing equity positions in Akanda, Triangle Canna and HaloTek. Even with the strong headwinds in both California and Oregon, we believe that we have a path to profitability in 2022,” - CEO Kiran Sidhu

The Halo Collective Team

RYAN KUNKEL

Chairman

Ryan Kunkel is a leading industry expert and entrepreneur in cannabis, influencing its legal, regulatory, and operational development since the legalization of recreational cannabis use in Washington state in 2011.

He was instrumental in the raise of $50M in two private offerings, which enabled him to expand the Have a Heart footprint by creating an organizational infrastructure to maintain the dispensary storefronts at a rapid pace.

KIRAN SIDHU

CEO

CEO, Co-Founder, and Director of Halo Collective, Kiran Sidhu s a seasoned cannabis executive, serial entrepreneur and former M&A banker.

Kiran has been Director of Halo Collective since September 2018 and its CEO since 2016, developing a leading company in cann-a-bis extraction that utilizes every type of extraction and producing over 4 million grams of product since inception.

KATIE FIELD

President

Katie Field is a strategy consultant and executive with a career spanning both the private and public sectors.

Ms. Field’s resume includes notable companies and institutions such as The White House, The Brookings Institution, and Bain & Company.

PHILIP VAN DEN BERG

CFO

Philip van den Berg was a Founding Member and executive director of the European research department of Goldman Sachs in London.

Director European equities Deutsche Morgan Grenfell in London. Founding member of Olympus Capital in London. CFO and director at Golden Leaf, CFO and director at Namaste.

Sources

Source 1: Halo Collective Investor Deck

Source 2: https://www.barrons.com/articles/akanda-set-to-trade-its-shares-on-tuesday-51647295705

Source 3: https://www.theglobeandmail.com/investing/markets/stocks/OGI-Q/pressreleases/7618429/medical-cann-a-bis-ipo-akanda-corp-soared-265-on-debut/

Source 4: https://simplywall.st/stocks/us/pharmaceuticals-biotech/otc-hcan.f/halo-collective

Source 5: https://prohibitionpartners.com/2021/12/16/global-cann-a-bis-sales-hit-37-4-billion-in-2021-rising-to-102-billion-by-2026/

Source 6: https://stockcharts.com/h-sc/ui?s=HALO.NE

Source 7: https://www.barrons.com/articles/march-first-ipo-akanda-51647357812

Source 8: https://haloco.com/halo-news/halo-collective-reports-third-quarter-2021-financial-results/

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC/Virtus Media Group and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 4/04/22 and ending after 4 business days to publicly disseminate information about (NEO:HALO | OTCQB: HCANF) via digital communications. We have been paid fifteen thousand USD via ACH Bank Transfer. Social Media Compensation – Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 4/04/22 and ending after one business day to publicly disseminate information about (NEO:HALO | OTCQB: HCANF) via digital communications. We have paid this Social Media Outlet six thousand USD via ACH Bank Transfer.

Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 4/04/22 and ending after one business day to publicly disseminate information about (NEO:HALO | OTCQB: HCANF) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer.